Guest Post by Nick Giambruno

MicroStrategy Chairman Michael Saylor recently said, “The window to front-run institutional demand for Bitcoin is closing.”

He’s absolutely correct.

BlackRock, Fidelity, Schwab, Citadel Securities, and other large institutions are making big moves into Bitcoin.

With nearly $10 trillion in assets under management, BlackRock is the world’s largest asset manager.

Larry Fink, the CEO of BlackRock, had a remarkable turnaround regarding his views of Bitcoin.

After years of dismissing and denigrating it, Fink recently called Bitcoin “an international asset” to hedge against currency debasement that could “digitize gold” and “revolutionize finance.”

BlackRock has filed for a spot Bitcoin ETF.

BlackRock has an ETF approval track record of 575-1, so it is probably a matter of time before their spot Bitcoin ETF is approved and potentially others. That would open the floodgates for certain large pools of capital—like traditional retirement accounts—that would be otherwise unable to buy Bitcoin.

Let me be clear. I am no fan of Fink, BlackRock, and the nefarious agendas they push.

Frankly, I’d like to see BlackRock go bankrupt and Fink clean toilets to earn a living.

However, it’s important to remember that Bitcoin is an apolitical, open, permissionless monetary network available to anyone and controlled by none. Nobody can be prevented from using Bitcoin.

Bitcoin is for everyone, including people you don’t like.

Some worry that BlackRock could change Bitcoin somehow, but that is unfounded.

Remember, nobody can change Bitcoin’s protocol—not even Elon Musk, Jeff Bezos, the Chinese government, the US government, or any of these powerful entities combined.

Even if Satoshi Nakamoto—Bitcoin’s anonymous cypherpunk creator—returned after disappearing in 2011, he could not alter Bitcoin.

The Blocksize Wars, which culminated in 2017, is proof.

That’s when an overwhelming majority of the Bitcoin miners (primarily based in China)—and other prominent insiders and large companies—tried to get together and change Bitcoin’s protocol to increase the block size.

Even though they represented most Bitcoin miners, some of the most powerful insiders, prominent influencers, and large corporations, their attempted hostile takeover was an abysmal and embarrassing failure.

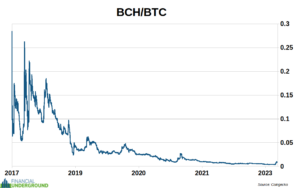

Instead of forcing a destructive change in Bitcoin—as they desired—they just created an increasingly worthless knock-off known as Bitcoin Cash.

Recently, the market cap of Bitcoin Cash (BCH) was less than 1% of the real Bitcoin’s (BTC) and is trending towards 0%.

I wouldn’t worry too much about BlackRock trying to make an “ESG Bitcoin” or otherwise changing it.

Even if they were foolish enough to do so, I doubt it would be more successful than Bitcoin Cash.

Another worry about BlackRock is that they will manipulate the Bitcoin price by creating more claims on it than what actually exists.

They could sell some fake paper Bitcoin, but it would fail spectacularly and be self-destructive.

Suppose someone like BlackRock wants to manipulate the price of an asset by creating more claims on it than what actually exists.

Taking physical delivery of the underlying asset would be one way to reveal the fraud.

If there are more claims than actually exist, asking for physical delivery will reveal it because the delivery will fail.

Think of taking physical delivery like calling the manipulator’s bluff.

It’s challenging to take delivery of physical commodities traded on large exchanges, which opens the door to creating more claims than actually exist. It’s not easy to call their bluffs.

However, with Bitcoin, taking delivery is as simple as sending an email.

If anyone is idiotic enough to create more claims to Bitcoin than actually exist, revealing the fraud will be much easier than with other assets.

If BlackRock or some other entity tries this stunt, consider it a gift. You’ll be able to accumulate more Bitcoin at artificially lower prices until their Ponzi Scheme inevitably blows up.

Here’s the bottom line.

BlackRock’s colossal shift on Bitcoin indicates that big institutions could soon flood in.

It’s a powerful potential tailwind for Bitcoin.

I think we could be on the cusp of Bitcoin’s next upside explosion.

That’s why I’ve just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes.

Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I stopped dabbling in Bitcoin when the institutional investors jumped in. They took control of it like they take control of everything else. I completely lost interest in anything to do with Bitcoin.

Bitcoin = Finite supply of nothing

Block Chain + Binary Code = Please hack me

Accurate.

I stopped dabbling in Bitcoin before I ever got started.

Schwarzstein is a Jew ponzi scheme.

Ooooooooo. Pretty golden bitcoin image.

Why gold in color? Why not some other color? Why represent it as a physical thing when it is not physical at all?

WHY ARE YOU MISLEADING US?

I never invest in things I don’t understand. And I sure as Hell don’t “understand Bitcoin”.

“Potter’s not selling – Potter’s buying!”

“If BlackRock or some other entity tries this stunt ( creating paper claims above what exists), consider it a gift. You’ll be able to accumulate more Bitcoin at artificially lower prices until their Ponzi Scheme inevitably blows up.”

They will, you bettcha, it will blow up, You bettcha, and when it does your money is in their pockets, as usual. This is a feature not a Bug.

Blackrock is as trustworthy as a personal check in the mail.

I’ll side with history. I do not need anything that was birthed during the recent and still continuing “Age of lies, fakery, and mass delusion “. This certainly includes Bitcoin, vaccines, genetic manipulation of any kind, climate hysteria, fake/unnatural foods, anything suggested or required by any government. That’s just the short list.

Those car things will never replace a good horse. That internet thing is a fad. giant box stores will never replace good old mom-and-pop stores. Amazon? people will never buy something without holding it in their hands first. the dollar will always be the reserve currency of the world. Trump will drain the swamp.

Just buy some Bitcoin and put it in a cold wallet. It’s a long-term investment. Right now prices have dropped and the next halving is supposed to bring higher prices. Blackrock and an ETF will also light prices on fire. In a few months, it could easily double in price. I like silver but think diversifying is a good idea.

Everyone will have a flying cars ten years from now. Pets.com is a fantastic investment opportunity. Everybody will buy clothes and shoes only online. Nobody will ever drain the swamp. Just buy some Tulipcoins and put it in your locker besides the tulip bulbs, the South Sea company stocks, and your Enron certificates.

Dude, the proof of the BTC pudding this right there in front of you. Along with thousands of clones and even central banks getting in on the action. The price is volatile because it is an almost unregulated market and always subject to govt evil etc etc, but FFS something you could buy 10 years ago for under a hundred bucks is now worth 30k. It can be liquidated and transferred in seconds. I just don’t get the hate against it. A young guy who worked for me years ago was always telling me about BTC. He persuaded me to buy $1000 worth. That was the best investment I’ve ever made in my life.

Stop hating on BTC!