Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at: BOOM Finance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at: BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

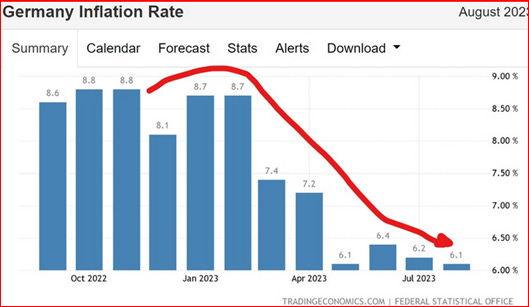

ADVANCED ECONOMIES IN EUROPE ARE SLOWING AS EXPECTED. Globally, demand for consumer goods has slowed but especially in Europe and the United Kingdom where 500 million people reside. Consumers there are worried about their (uncertain) cost of energy, their job security, the war in Ukraine and last but not least, their poor political leadership at national level. They are also worried about the poor leadership of the EU and NATO. Thus, consumers have steadily closed their wallets. The tendency for CPI prices to rise has slowed (called dis-inflation), and in some nations we are seeing consumer prices actually decline (deflation).

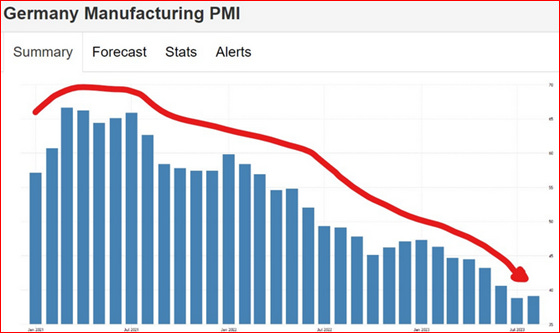

In Germany, the economic powerhouse of Europe, industrial production has been flat overall for 2 years. July figures show that it’s down 2.1% from July 2022. Capacity Utilisation has been slowly falling since July 2021. This means that industrial potential is rising because there is falling demand for the products that can theoretically be produced. In other words, production plants are increasingly falling silent. It is not panic stations yet but the slow, steady decline in capacity utilisation is indeed worrying. And Germany’s Manufacturing PMI — Purchasing Managers’ Index – has been in a rather steep decline for over 2 years.

PEOPLES BANK VERSUS THE US FEDERAL RESERVE – BOOM has often referred to the disciplined, tight control that the People’s Bank of China (PBOC) holds over its financial sector and its money supply. In contrast, BOOM has been critical of western monetary systems which are way too reliant upon the emergence of fresh new borrowers to appear at commercial banks searching (or begging) for loans.

To explain that further, readers must understand that Credit Money in the West, created when commercial banks make loans, is the chief source of fresh new money origination in this system. And most of that loan money requires a link to collateral assets as security for the bank (usually in the form of a house or other real property). In fact, in most advanced western economies, the Ratio of Credit Money at origin versus Cash Money is now at the ridiculous level of Credit Money 97 – 98%: Cash Money 2 – 3%. Such a ratio is fraught with risk to the real economy at large.

A move to a “cashless society” would make everything worse, much worse. In fact, Western economies must move the other way and incentivise the use of Cash. Increased Cash volumes would help stabilise the ship as Cash is non-interest bearing and can be issued by the Treasury upon increased demand. Cash is a stabiliser, a buffer to excessive Credit money creation. Governments could even pay their bills with Cash especially their wages bills. This would improve the Velocity of Money immediately in the real economy and render it less fragile.

The central bankers of the West understand this and have openly dallied with their concept of electronic cash – otherwise known as CBDC – Central Bank Digital Currencies. BOOM is definitely not a fan of this concept for many reasons. Such a proposal is fraught with risk and uncertainty. In fact, most central banks cannot issue currency by law into the real economy and with good reason. They can only buy and sell assets to balance the balance sheets of the financial sector commercial banks. Thus, any proposal for a central bank to issue electronic cash into the real economy would meet stiff resistance from politicians who understand money issuance. And the central bank clients (the commercial banks) would also object vehemently. Then the people may also reject it out of hand, being suspicious of unelected “independent” central bankers fiddling directly with their money.

In fact, in China, this has been the case. As BOOM reported two months ago, the Chinese experiment with a CBDC (Central Bank Digital Currency) seems to be failing. Despite what you read in the West, the E-Yuan has not been adopted by many citizens. As reported by Reuters, the central bank governor, Yi Gang, recently said that total transactions settled with the E-Yuan (e-CNY) amounted to just 1.8 Trillion Yuan since August last year. Expressed in US Dollars, this is equivalent to only US$257bn in just under 12 months. The Annual GDP of China is about $US18,000bn. So, this is roughly equivalent to 1.4% of total GDP transactions. He also said that e-CNY in circulation accounted for only 0.16% of China’s ‘M0 money supply’, or cash in circulation.

These appear to be the cold hard facts concerning the Chinese Central Bank Digital Currency (CBDC) experiment as reported by the head of the Peoples Bank of China.

BOOM admires very few economic commentators on the planet but, occasionally (rarely), he sees wisdom. Such wisdom came recently in an interview given by Paul Gambles, head of MBMG Group in Thailand. In the interview Paul said,

“So far, the Peoples Bank of China has been very graduated, very incremental and very controlled. When we compare the PBOC (People’s Bank of China) policy to The Fed (US Federal Reserve), the PBOC is like a high-performance luxury saloon car gradually accelerating away when the traffic lights turn green, with a sense of always being in control, whereas The Fed is more like a pimped-up boy racer, flooring it, pedal to the metal, completely out of control. We’re more worried that the Fed is going to drive the US economy and markets off the road and crash and burn horribly. With the PBOC, we don’t see any signs of alarm. In the West the big worry remains stagflation. In China we have the opposite. Growth may be weaker but there is positive economic growth while we also have negative CPI inflation. This has never been achieved before. If this continues, it could be a lesson to other policymakers how to operate policy in a sustainable way.”

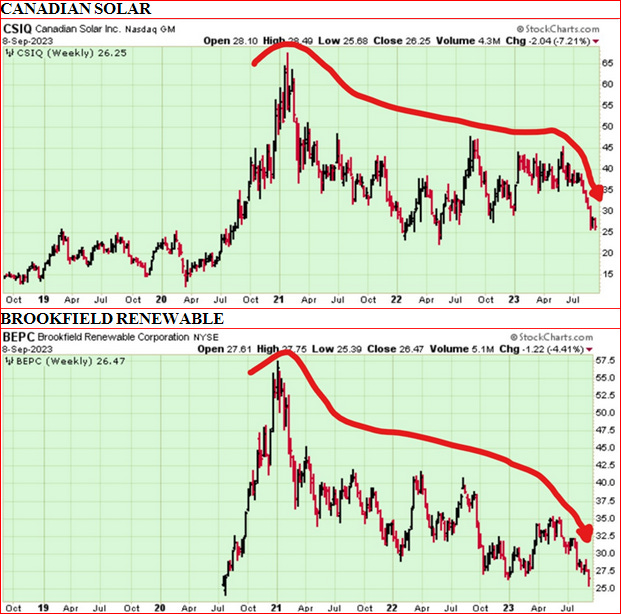

INVESTORS DOUBT RENEWABLE ENERGY — REVIEW OF SHARES – The shares of Orsted (Code: DOGEF) which BOOM looked at last week – the ‘Green Energy Giant of Denmark’ — are down another 15% in last week’s trading on the OTC market in the US. The chart tells all about investors’ lack of enthusiasm for the stock.

This week, seeking perspective, BOOM looked at the share price charts for a range of top renewable energy companies to see if Orsted was an outlier in the sector. BOOM only looked at companies which have annual revenues above US$3bn. The renewables companies include Orsted, Nextra Energy, Vestas Wind, Jinko Solar, Canadian Solar, Brookfield Renewable, Daqo Energy, and Algonquin Power.

There is a remarkable similarity in the charts with investor enthusiasm often peaking at the end of 2020. Since then, they all fall in price in steady downtrends. And most are falling at a faster rate lately.

The exception is the energy giant in the US, General Electric. Its recent share price trajectory is the exact opposite of all the other companies. General Electric revenue for the quarter ending June 30, 2023 was $16.7bn, an 18.21% increase year-over-year. General Electric revenue for the twelve months ending June 30, 2023 was $80.94bn, a 23.24% increase year-over-year.

An independent analysis of General Electric Revenues by Segment shows that Renewable Energy accounts for only 21% of its total revenue. So GE cannot be called a “renewables company”. That appears to explain why its share price performance is the opposite of the “renewables” dominant energy companies in the list.

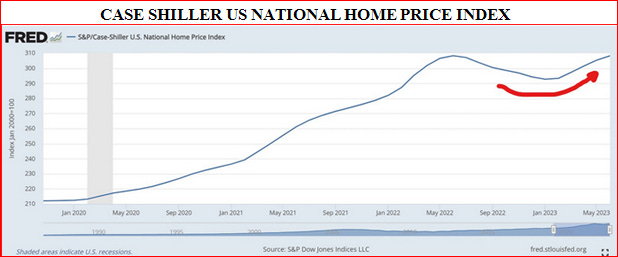

US HOME PRICES KEEP RISING – On April 16, BOOM wrote — “This suggests that US house prices may soon begin to rise in price”. At the time, nobody was making such statements. However, the Case Schiller National Home Price Index is following BOOM’s forecast. It has risen by 5.3% since January – from 292.71 to 308.35 in June.

The 20-City Home Price Index has risen from 296.96 in January to 314.86 in June, a 6% rise. The 10-City Index has risen from 309.21 to 328.63. That is a 6.28% rise. Prices cannot continue to rise at such rates. A pull back is expected in the next series of the data.

BOOM’s QUANTITATIVE BOOSTING EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

In economics, things work until they don’t. Make your own conclusions, do your own research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — that is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch this short 15-minute video and learn as Professor Richard Werner brilliantly explains how global banking systems really work. Most economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Per video… Modern Banking began in England …. ha ha ha ..and what else…Church reform which unleashed the hell of usury upon the entire world. Thank you Judeo-Satanism controlled Britain, you been poison to the entire world.

Philip II: (1527-1598)

William Thomas Walsh

“It did not occur to the kings that if the money-lenders ever got

power enough, if they ever got from under the public-spirited

repression of the Church, they would destroy their own masters.

Kings were not generally as far-sighted as money-changers, and

much less so than priests. This is not to deny that clerics sometimes

condoned usury and profited by it, or that some kings repressed it.

Human affairs are never so simple as that. But there was a line of

cleavage: the Church on one side hostile to usury, the kings

compelled to make use of it on the other.

As the moral influence of the Church was weakened in the

political and economic spheres, in consequence of a series of

calamities for which she was not to blame—the Black Death, the

papal exile at Avignon, the Great Schism, the return of paganism

with the Renaissance—usury began to accumulate wealth and to

organize its influence. With canny insight it threw its influence, by

and large, against the power of Church and State, supporting now

one, now the other, until, by a see-saw process, it succeeded in

weakening both.

It early identified itself with the forces of heresy in religion and

liberalism in politics, until Protestantism at last gave money-lending a certificate of respectability, until a Lord Bacon could write a serious defense of it, and Harrison (in Holinshed) must chronicle the capitulation of the new Protestant England to “usury, a trade brought in by the Jews, but now perfectly practised almost by every

Christian, and so commonly that he is accompted but for a fool that

doth lend his money for nothing.”5 ”

https://libgen.is/book/index.php?md5=1889B28539B7506D637C3D5605BFD2A0

Brilliant Flash, thank you for a simple précis of history and all too true! Understanding that the Anglo-Saxons are even worse than the Khazarians helps us understand why we are here today.

There is no defence against an omnipotent global power which has now been achieved by the Globalists. However, we must not lose the faith that ultimate power is held in the ‘The People’ because the elites only rule by our consent and if we chose to withdraw it – they are powerless, regardless of the spoils they have accumulated.

Saudi and Russian curtailment of oil production is pushing oil higher. That will raise inflation or at least end its decline. US housing prices have started to decline – at least a little bit, since many would-be buyers can’t afford 6.5% – 8% interest rates. Where home prices go from here is unclear and probably depends on Fed actions.

The Fed cannot save anyone from what is happening. It has blown the bubble as large as it can be blown, and now it is going to pop.

When economies get to this point, government’s save themselves by asset confiscation. When the bottom drops out of the equity, bond, and housing markets, every asset that is financed will be lost, and acquired by the Government, Banks, and the Fed, who will use those assets to recapitalize themselves. It is basically the same thing they did in the Great Depression.

People who are in debt will lose everything.

You are on target Jdog, as always. The People will lose everything and be happy owning nothing. Thus it is ordained and has always been so. But this time I think the elites are on a losing wicket. When the robbers have stolen everything the peasants have noting to lose. That’s when the pitchforks come out and this is what terrifies the elites! Have a laugh:

Wolf Richter has some info on this Iska:

And I mentioned it this last week: “Render to Caesar that which is Caesar’s” makes excellent sense as authoritarianism increases. Obeying egalitarian laws is an implied civic duty and a strategy for avoiding needless trouble. However when the laws become overtly oppressive, and contrary to natural justice ‘Common Law’, a proportion of the general public will always resist. Anthony Wedgwood Benn was clear in 1981 when he asserted that, “Conscience is above the law.”

But IMHO it will end badly.

German construction industry ‘faces abyss’ – property mogul

Rising costs and red tape have been hurting the sector, Vonovia has warned

Germany’s crucial construction sector has been on the brink of collapse, putting in jeopardy the overall economy. The Economist reported that last week, citing housing giant Vonovia.

The report says the sector makes up 12% of the country’s GDP and employs a million construction workers.

“We are sending our construction industry into the abyss,” the chief executive of Vonovia, Rolf Buch, was quoted as saying…

The Economist wrote that soaring energy prices and high building material costs as a result of supply-chain disruptions have been crippling the construction industry. Meanwhile, higher interest rates have increased the cost of debt that many German builders rely on to get projects off the ground, it noted. All of this has resulted in construction firms and property developers going bust, with 437 building companies filing for insolvency in the first four months of this year, representing an increase of 20% year-on-year.

“It is not a functioning market,” head of think-tank Ifo Clemens Fuest said, pointing to remorseless red tape, namely the introduction of ‘rent brake’ as well as strict environmental regulations.

https://www.rt.com/business/582750-german-construction-industry-faces-abyss/

Thank you B_MC – well found and confirms BOOM’s points. If I had the space I would quote your excellent work. But we are under multiple attacks and it’s a challenge to put a Letter of 3,000 words together these days!

Zelensky Threatens To Terrorize Europe

Zelenski goes on to threaten, in rather unthankful fashion, those countries which have delivered aid to Ukraine but may want to cut their losses:

I have seen such threats from low ranking individuals of the fascist Bandera fringe. They spoke of terrorism they would unleash in the West should it end its support for Ukraine. That the Ukrainian president now reinforces such threats shows how deeply he immersed himself in that mindset.

https://www.moonofalabama.org/2023/09/zelensky-threatens-to-terrorize-europe.html

So true B_MC- the war is already lost – coming this week: UKRAINE SITREP UPDATE – September 15, 2023

Russian Special Military Operations

More on Saturday!

Best

AP

It appears we are heading into a world wide economic calamity. With US banks sitting on way too much bad investments in 30yr treasuries that have lost substantial value, and depositors pulling deposits to reinvest in money markets and short paper, it is looking like the majority of banks are now zombies and will go insolvent before long.

The US Government is spending money like the world is ending, and interest on the debt is quickly approaching the biggest expense. Corporations are anticipating a liquidly shortage, and borrowing any money they can, further driving up rates. When the crash comes, money will disappear on a scale no one now can even imagine.

Europe has the same problems with their banks, but are also being monkey hammered by energy and food costs.

Germany and the UK are being sacrificed on the alter of the false religion of Ukraine, with most of the rest of Europe not far behind. At some point, the people of Europe are going to realize that their leaders have committed treason against them, but by that time it will be much too late.

China also has fundamental economic problems that even their giant manufacturing economy will not be able to save from a serious downturn.

When the storm comes, and goes, and the dust settles, most people will be destitute.

If you have not already begun to stockpile for disaster, better get going, it is going to be a very bad winter…..

The winter will be like 1977, the summer like the 30s, and the economy like 1929. Those will be like the good old days once the GSM super volcano and the big one hit.

“It is difficult to make predictions, especially about the future” – Yogi Berra

LOL -:0

A big volcano and a big earthquake are highly probable in every GSM.

Many thanks Jdog for referencing the coming crisis (engineered). I just hope to get away from UK before TSHTF. And then I will be living a simple life in the sun!

Peace comes in many forms.

Blessings

AP

We can’t build houses and shelter for illegals as fast as democrats are bringing them into America; we won’t be able to produce food, fuel, welfare etc as fast as they need it next year; the democrats are turning US blue cities into third world shit-holes as fast as they can. Why? Why are insouciant Americans allowing this to happen?

Correction to earlier comment: the TV reporter goofed when he said the Aug CPI was 3.7%; he meant to say the Aug Year over year was 3.7%.

Yep – planned default methinks rhs jr – but the stats are fudged anyway.

They are doing the same in UK and EU rhs jr and the only thing I can think of the elites’ need to collapse western economies – no other conclusion makes sense. Just like 2019 when the Repo crisis threatened collapse:

https://austrianpeter.substack.com/p/a-perfect-storm-the-money-crisis?s=w

And Prof. Richard Werner has something to say at where we are today:

Very interesting unexpected consequences. Giving money to banker’s wives and blacks helps them briefly but is like giving everybody a dose of poison.