On Friday, shortly after Powell failed to hammer the hawkish case in his “fireside” chat with stocks eager to take out 2023 highs, we said that Powell has a big problem on his hands not so much because if the market was indeed correct about imminent easing that only assures that inflation will come back with a vengeance and Powell would indeed be the “second coming” of a former Fed Chair – only Burns not Vlcker – but because the kneejerk surge higher in gold (and digital gold) meant that the once again deathwatch for the dollar – and fiat in general – had resumed.

Well, with futures having opened for trading on Sunday night, what we joked about on Friday, namely that Powell – having seemingly once again lost control of the hawkish narrative – may be leaking emergency rate hikes though Nick Timiraos on Dec 12, ahead of the December FOMC (now that the Fed is in blackout mode)…

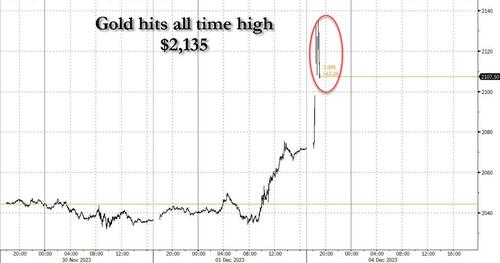

… is all too real because suddenly everything that is non printable is soaring, starting with gold, which has exploded as much as $60, spiking to a new all time high of $2,135…

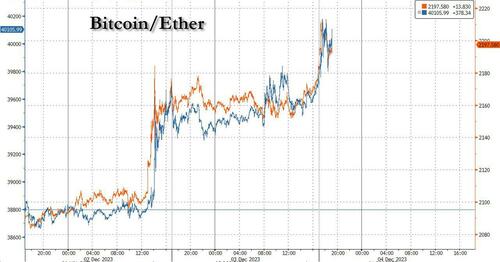

… while bitcoin, and the entire crypto sector following closely, spiking above $40,000 for the first time since May 2022.

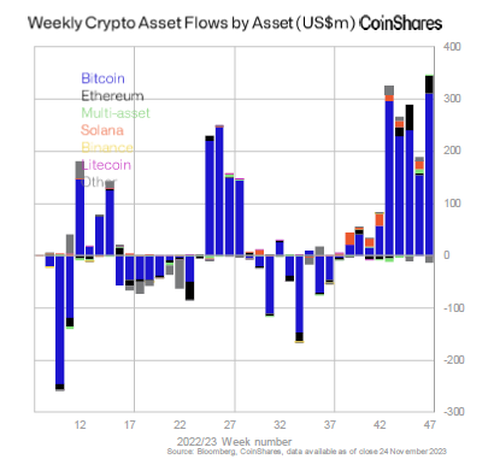

The bitcoin move was to be expected after what we reported yesterday, namely that cryptos had just seen their largest inflows in two years… and Friday’s comments by Powell only guaranteed even more capital would flow into the largely illiquid asset class.

“Bitcoin continues to be supported by optimism around SEC approval for an ETF and Fed rate cuts in 2024,” Tony Sycamore, a market analyst at IG Australia Pty, wrote in a note. Technical chart patterns point to $42,330 as the next level to watch for, he added.

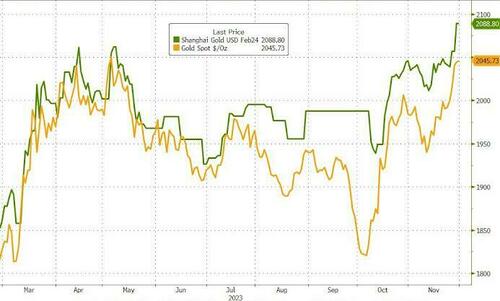

As for gold, everything is suddenly going in its favor, and not only the violent resumption of the Israel-Hamas war (which now includes attacks on US warships in the Gulf)…

… as well as the relentless buying out of China which we discussed last week in “Behind The Mysterious Explosion In Gold Prices: China’s “Massive Accumulation Of Gold” which noted the staggering divergence between Shanghai and London gold prices, a clear proxy for outsized demand for physical gold on the mainland…

… but also years of market reflexes which prompt algos to buy gold any time the Fed is set to ease, something which markets assigned 80% odds on Friday could happen as soon as March.

And so, going back to square one, Powell is once again boxed in: either he pushes back on the market’s sudden dovish euphoria which could well send dollar sparling lower, and in turn send commodities exploding higher guaranteeing that all the worst aspects of Burns Fed make a triumphant return, or he does nothing, and we see gold go parabolic.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

There are times coming soon where a can of beans will be worth more than silver, and a reliable weapon will have greater value than gold.

A can of beans and a couple of bears can be a formidable weapon.

Premiums are still reasonable on Eagles, still time to back up the truck.

Totally reasonable $110 markup for 1 oz. Eagle!

I think I’d go with a Maple Leaf for $60 markup, thanks.

I wouldn’t trust EITHER of those Governments not to sell me gold coated tungsten.

Try the same with 1/4 or 1/10 oz coins, if they’re not already unobtanium.

Damned if they do and damned if they don’t. They are losing control.

Interest rates were sky high in the 70’s because the fed, that was back when the dollar still had 20 cents purchasing power. Was everything barreling out of control?

The Bitcoin suckers are being led to slaughter, it’s going to be ugly and ditto for vaporizing the Fed stuffed stock market which only indicates that the goy will believe anything they are told. Indicators are fake, the Fed can levitate this steaming turd for a lot longer if they choose to and never count out their ability to tax and inflate you into moar poverty while the .001% get a bigger bloat on.

They are in FULL control, that is our problem.

As long as the Fed can rathole $$$$, they can keep the inflation train on the tracks, Mary.

Fed dovish till after the election. Then we will see

And a HUGE, honkin daily reversal right now. Gold will need quite a few weeks before the trend continues.

I have prepared to best of reasonable ability and over the years added metals as a small part of a bigger basket.

I would be happy to not see metals jump a suddenly high amount though I own them as that means things are getting very much worse,be glad to have me metals just hover around current value.

Au and Ag in your possesion have no counter party risk. If you don’t hold it, you don’t own it. That applies to everything.

Bitcoin may be the path to true wealth compared to gold but my concern is the ability of man/nature to shut down the internet…gold in your hand it won’t matter.

You don’t need internet for gold or silver. It’s been real money for several thousand years.