Guest Post by Nick Giambruno

Bitcoin confuses many people, including prominent investment professionals.

Recently, I debunked the top ten most pervasive misunderstandings.

Today, I’ll continue by debunking another five.

Misconception #11—Bitcoin Is Vulnerable to Nuclear War and Utility Outages

Even if the US and Russia engaged in an all-out nuclear war, destroying most of the Northern Hemisphere, Bitcoin wouldn’t miss a beat in the Southern Hemisphere.

To even have a chance to stop Bitcoin, every government in the world would have to successfully coordinate simultaneously to shut down the entire Internet everywhere and then keep it off.

Even in that improbable scenario, the Bitcoin network can be communicated over radio signals and mesh networks. At the same time, small portable solar panels can power the computers running the network if the regular grid is unavailable.

Further, a network of satellites is constantly beaming the Bitcoin network down to Earth.

In short, all aspects of Bitcoin are genuinely decentralized and robust.

Barring an inescapable, global return to the Stone Age, Bitcoin appears unstoppable.

Misconception #12—Bitcoin 2.0 or a “Better Bitcoin”

As a practical matter, anyone can try to make a “better Bitcoin” whenever they want.

All you have to do is take the open-source code—available to anyone—and make your desired changes.

But that doesn’t mean anyone will follow your lead or value your new cryptocurrency.

For example, I can easily make a new Bitcoin that adds some bells and whistles and tout it using the latest buzzword. Let’s call it Bitcoin 2.0.

But that doesn’t mean I can inherit the superior monetary properties of the original Bitcoin, which depends on its supply’s credibility, which depends on its extreme resistance to change, which I’ve just undermined by adding some bells and whistles and thus demonstrating that someone can change it.

That’s why the market is unlikely to assign any value to Bitcoin 2.0.

Here’s another way to think of it.

Imagine someone wanting to change the rules of chess so pawns could move backward. Let’s call it Chess 2.0.

Of course, anyone could do so anytime, but that doesn’t mean Chess 2.0 will gain traction.

Remember, anyone can make a cryptocurrency in minutes.

That’s the easy part.

Making one that nobody controls is the hard part.

Simply put, no other cryptocurrency comes even close to challenging Bitcoin’s immutability, decentralization, resistance to debasement, liquidity, economic incentives, network effects, and, most importantly, the credibility of its supply.

But suppose a new cryptocurrency came along that was a genuine competitor to Bitcoin.

To disrupt Bitcoin’s established dominance as a monetary network, it would have to be not just a little bit better, but orders of magnitude better.

According to renowned author Jeff Booth, a new competitor to an established network must be at least 10x better to convince enough people to leave the existing one and join the new network.

There have been dubious claims of a “better Bitcoin” for many years, usually from people who simply don’t understand Bitcoin or disreputable altcoin promoters.

I am not inclined to believe such claims until there is solid evidence that something could potentially have much better monetary properties than Bitcoin.

So far, nothing has come close.

Misconception #13—The SEC Will Go After Bitcoin

Given their statements, it’s clear that the Securities and Exchange Commission (SEC) views almost all cryptocurrencies as unregistered securities, making them vulnerable to enforcement actions.

That has led many to incorrectly believe that the SEC will go after Bitcoin.

The reality is that Bitcoin is the only cryptocurrency unambiguously NOT a security.

The US government has been clear that it views Bitcoin—and only Bitcoin—as a commodity under the purview of the Commodity Futures Trading Commission (CFTC) and the Commodity Exchange Act.

Bitcoin is a commodity because it is an asset without an issuer.

Similarly, gold, silver, copper, wheat, corn, and other commodities have producers, but they do not have issuers.

Every other cryptocurrency other than Bitcoin has an issuer. They also have identifiable founders, central foundations, marketing teams, and insiders who can exercise undue control.

On the other hand, Bitcoin has none of these things—just as copper or nickel has no marketing department or founder.

The SEC couldn’t go after Bitcoin even if it wanted to because there’s nobody to go after. There’s no Bitcoin headquarters. Bitcoin has no CEO, no marketing department, and no employees.

But presuming the SEC could go after Bitcoin, they won’t because even they admit Bitcoin is not a security and thus not under their purview.

Misconception #14—Breaking Bitcoin’s Cryptography

Bitcoin’s cryptography is not a risk today.

If Bitcoin’s cryptography were at risk of being broken, it would also be an existential problem for every bank, brokerage, central bank, email provider, and every aspect of modern digital life.

I would put this risk in the same category as an alien invasion—something theoretically possible but irrelevant to investment decisions today.

But let’s suppose a hypothetical problem of quantum computing—or some new technology—posing a threat to Bitcoin’s cryptography.

A hypothetical solution exists.

It would be possible to upgrade Bitcoin’s cryptography by gaining the consensus of the full nodes to make it resistant to quantum computing or whatever new technology is an existential threat to it.

Misconception #15—Bitcoin Is Too Volatile To Be Money

It’s essential first to clarify that while the Bitcoin price is volatile, the Bitcoin protocol is the most stable, predictable, and reliable thing I know of in finance.

Ever since Bitcoin’s inception in 2009, the 21 million total supply has not changed, the network has never stopped, miners have continued to create a new block every 10 minutes on average, and anyone has always been able to use Bitcoin to send value to anyone, anywhere, without needing a third party.

In short, despite everything that has happened since 2009, the Bitcoin network hasn’t missed a beat.

That said, monetization doesn’t happen overnight, and it’s inherently a volatile process for the Bitcoin price.

While gold is an established money, Bitcoin is an emerging one.

It took gold centuries to achieve monetization. Bitcoin has a good chance of undergoing monetization in a much shorter period—and it’s already well on its way.

Something doesn’t go from having no value to being significant global money without volatility in its price. For example, Bitcoin went from having no value in 2009 to over $67,000 in 2021 to around $41,600 as of writing.

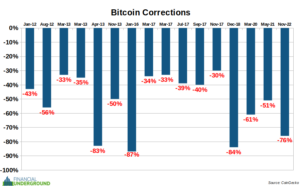

It is not uncommon for Bitcoin to have significant corrections of 50% or more, which has happened eight times. Further, there have been three occasions where Bitcoin has declined 80% or more.

Here is a chart showing Bitcoin’s biggest corrections over the years to put its volatility into perspective.

If you zoom out and look at the Big Picture, the volatility of the Bitcoin price has mainly been to the upside over the long term.

It’s a series of higher highs and higher lows.

Stomaching Bitcoin’s volatility is the price we must pay to earn outsized gains as it undergoes the process of monetization.

It will be a wild ride—like a violent roller coaster—but I believe it will reward patient investors.

There are a couple of ways to help tame the volatility of Bitcoin’s price.

First, instead of buying your desired amount of Bitcoin in one large transaction, use dollar cost averaging (DCA) to spread it out over time.

For example, suppose you’d like to invest $10,000 into Bitcoin. Instead of buying $10,000 at once, make a purchase of around $192 each week for a year.

DCA significantly reduces the risk of buying too much at the top of a cycle and not buying at the bottom.

That’s how DCA can turn Bitcoin’s volatility in your favor.

Second, plan on holding for at least four years—through one halving cycle.

There has rarely been a period in which the Bitcoin price was lower than it was four years ago. But, of course, past performance does not indicate future results.

Third, whenever you see volatility in the Bitcoin price, ask yourself two things:

1) Does Bitcoin still have superior monetary properties (total resistance to debasement and extreme portability)?

2) Is Bitcoin still unstoppable?

If the answer to those two questions is “Yes,” I would not be worried.

As adoption grows and Bitcoin becomes more established as money, the volatility should smooth out—but probably at a much higher price.

That’s why you want to buy Bitcoin—and the best Bitcoin stocks—before the rest of the world figures out its superior monetary properties.

I’ve just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes.

Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Satoshi Nakamoto luvs blue horseshoe

Due to my age (mid-70s), and general lack of tech-savvy, I will never buy (or sell) crypto.

So, speaking as a fairly neutral observer, it really does sound like Bitcoin needs a 24/7/365 sales campaign to keep prospective buyers interested.

Pass.

The market cap is now over $800 billion, so don’t worry about lack of interest. And have you noticed that the dollar you love to hold in a bank where it is a genuine digit and belongs to the bank as we will see when the collapse comes is being replaced slowly around the world? You want some safety, you need to diversify away from what the gov’t wants you to do. But you know that.

This article is such a non sequitor I dont know where to start, so here is one example:

“The SEC couldn’t go after Bitcoin even if it wanted to because there’s nobody to go after. ”

They don’t have to. They will just arrest you for using an illegal currency.

Author doesn’t seem to get it but in a Police State they can make all crypto other than CB crypto illegal. They can also confiscate precious metals but if I have a choice I like physical option better than digital anything.

Davos will prevent us having anything unapproved to purchase, anyway, by whatever existing currencies – including much barter.

How will the gov’t get your Bitcoin? If one country outlaws it another will benefit as “money” flows to where its treated best.

ME at the grocery store: OK, Just trying to figure out how to radio transmit my Bitcoin into your payment system, wait while I try to transmit it……oh never mind. I don’t have cash and there is no way to pay, sorry.

** I laughed over the transmit Bitcoin with radio waves……. right.

Auntie always finds images of a Bitcoin “coin” amusant. It’s almost an hallucination as Bitcoin only exists in that mysterious blockchain somewhere over-the-technotronic-fake and Gay rainbow in The Cloud, wherever the fuck that is.

The cloud, and indeed much of the internet, exist largely in Amazon server farms. It also exists on/in other servers and still functions mostly by wire but also via cell towers. If half or more that physical infrastructure goes down, data goes missing and there’s absolutely no way for the remaining infrastructure to keep all data on the internet intact. And why TF would the southern hemisphere be exempt from ever going down?

Author doesn’t understand how the internet (or the world) works but I’m going to trust him on the rest of the mystery that is blockchain?

I don’t think so.

Wow, there is so much misinformation here, I don’t want even to attempt to clear it up.

I know right, Bigfoot. They are really grasping at the “stupid” straws, which absolutely hits me as insulting. The mouth breathers will believe anything.

It is amusing, AA. Just like when the street cleaners in New York protested wagons holding water barrels with holes in them used to clean the horse shit off the thoroughfares. The signs were great: “Down with the labor saving devices!”

keeping shilling.

Horse shit is good fertilizer. Washing it into the sea is stupid.

The irony is rich; People who bitch about a fiat system go out of their way to continuously push a fiat currency and call anyone who doesn’t buy it stupid.

B I N G O …

And one more thing … looking at the ‘corrections’ graph above — imagine the shitstorm in the US — throughout the world, even — if the dollar ‘corrected’ as violently as bitcoin has.

Imagine the shitstorm in Germany, Argentina, France, Rome and every other country that has had hyperinflation and ruination of the people. All of because the “money” was fiat and governments are what they are. Why not try something new that gov’t doesn’t control? Is that so bad?

its that stupid.

Hmm. let’s see the fiat currency is the dollar. Bitcoin is something new and certainly not anything like a fiat currency. So, yeah, people bitch about the dollar that can be printed at will and is to the point of failure, which is just ahead, and yet people don’t want to try anything else lest it fail. The craziness.

Lie #1 – “It’s a shiny, real, golden coin just like is shown in the picture!”

What it really is: 1011101010110101110101011010101011010101010100010101110101011010110101011010101010101010101010101001010010010101101110110101010101010101101111011010001010110101010010101100100101100100110101010101010111101010101111010010101010001011111000101010101011110101100100010111101010

Really extremely well stated, Richmond. Outstanding, sir or ma’am.

Just like your digits on your bank account statement. Ones ands zeros, the Yankee Dollah. Are you fooled or what!

So the people who print all the fiat and own all the banks can’t just buy up most of the bitcoin and control it?

No.

Shush. WHat’s the matter with you. And with CBDC looming large:

“You vil own notting und be heppy.”

No, there are OG btc whales with 100 thousand plus coins (day one you could mine with a home pc 10,000 btc every 24hrs) but Wallstreet is coming in and will most likely gain control of the price action. There are btc futures and options which they can currently use to somewhat help them try to manipulate the price and battle the OG whales, but I believe once they get their ETF they will fully control the price. They will be able to combine married put options along with hiding spot short positions in the ETFs and they can even loan out unlimited shares ( re hypothication) if they get these btc etfs passed

unless they can keep btc price down indefinitely they may run price up so high no sane regular individual will even be able to afford 1 or even a fraction of 1,

Wow, the shit runs deep here. Bitcoin is divisible by what is called a “satoshi.” One hundred million satoshi equals one Bitcoin.

I thought it was divisible by anything. Didn’t realize what that meant. I listen to a guy who was talking about how he was getting ‘sats’ for this and that.

So the dude is being manipulated by like 4% of a penny. Disappointing.

When they finished buying it to the control point the cost would be ruinous and then it would be worthless as no one would use it. Fucking crazy people around here.

Fanboy much…

Bitcoin is entirely traceable, meaning every transaction in the chain. The government will be able to trace every person who ever transacted in said bitcoin. That doesn’t sound anywhere near as anonymous as cash does to me.

And if the elites have their way, we’ll all be freezing to death in the dark without any electricity if their net-zero dreams come to fruition. No electricity, means no bitcoin. After covid, if you don’t believe the elites will go to any means necessary to eliminate the carbon that is us plebians, you’re a fool.

I’ll stick to cash, food and drink, land, brass and precious metals. Throughout history, no matter the turmoil, all of these tended to continue to be negotiable instruments, or at least useful for barter.

Yeah like the German Marc was still valuable so long as you had a wheelbarrow and a need for a loaf of bread. “Hold that cash,” they said! “More is on the way!”

I don’t carry a phone around, not sure how I can mesh with jack shit. About the time I want a side of beef or truckload of potatoes or whatever, off the radar, the last thing I would do is introduce electronics.

No one says you can’t use silver coins and also Bitcoin for what’s appropriate. Like when you leave the country that is on fire. You won’t be carrying metals. They’ll take ’em at the border, what you can carry. Metal is heavy.

lol going through a border crossing

Misconception #11—Bitcoin Is Vulnerable to Nuclear War and Utility Outages

OK.

But the point is invalid.

If the utility system is down HERE, where I am, and I have no internet access, Bitcoin is functionally worthless to me.

When I need it most.

The same reasoning goes with ATMs.

The bank’s ATMs might be fine in Florida, but if they don’t work HERE, where I am, they are worthless to me.

“But don’t worry, your money is safe!”

If I can’t access it, it’s worthless.

I don’t keep money in a bank for the same reason.

If it’s not in your hand, you don’t own it.

Your logic is impeccable. When the power is out, we are fucked. Nothing will get delivered and it won’t matter how much cash paper you got on hand.

We lived without ‘power’ until a century ago. If you can only survive by having things delivered to you, then magic internet money probably sounds awesome.

If the grid goes down, no one will have time to worry about Bitcoin.

Folding cash may be used for a time, maybe quite a while, as it is in relatively short supply.

Gold/silver coins would be used for barter.

But basically everyone would spend most of their time trying to merely survive.

Bitcoin would be a memory within a month.

The chances of a global power outage are MUCH higher than anyone imagines. The sun can take them out any old time, along with basically every electronic device.

X-20 flare…I would sweat. X-50+ and there is NO doubt.

I’ve been in crypto for a very long time. At one point it seemed like a relatively good alternative to centralized currency, many Patriots and sovereigns made millions of USD.

But I for one have always been skeptical and looked at it more as a Trojan horse. I believe the plan has always been to get everyone into btc and crash it either by destroying 51% of the network (51% network attack cyber attack) or by pure market manipulation, or some type of emp grid down event.

Then trillions of fiat will be wiped away in seconds. It’s possible even 1st gen CB /gov cbdc get wiped out too in a grid down or cyber attack, leading the way to the final one world digital currency beast system and mark of the beast.

The NSA back in the mid to late 90s had a crude white paper on DLT(digital ledger technology) currency

#11

Bitcoin will always work

i.e. it is impossible to shut down the internet

i.e. it is impossible to shut down the electrical grid generation and/or transmission system 😂 🤣

OK, that does it.

Nick Giambruno receives the coveted ‘full retard’ COTW award.

Let’s lighten up. Nick has boat payments to make.

Bitcoin is bullshit . Another tool to get you all hook like credit cards did to digital money. Money has worth and can be used even if shtf occurs. Digital can be shut down, confiscated , hacked. This is just another cashless society baitvand switch. Make your money and get out of bitcoins.

Yes, it is only worth something if you can get rid of it for real cash or something of real value.

Ha ha, good one. “Real cash” is “real value.”

And put it into what? What investment opportunity has the potential of bitcoin? The financial system has a long way to go before it collapses into nothing. The chicken littles have been crying out that it’s all going to end next week for centuries. Telling people to buy silver coins or gold bars is very bad investment advice. They have been about the worst investment you could make for the last 40 years. Everyone should put some money into bitcoin because it has huge upside potential and limited downside.

“put it into”

says alot about a persons mindset

Hodlers can exchange bitcoin with each other to pay debts, but for any other use it has to be converted to another fiat means of exchange. That means fees, a paper trail, and regulation. It’s not the SEC, they are already too corrupt to make a difference. It will be the IRS, Justice Department, and US Treasury that will go after your exchanges. And exchange platforms will be hackable.

Too true. Let’s all drop on all fours and wait for the man to have his way with us. Did you know that Home erectus was around for one and a half million years? At about 750, OOO years. H.e. learned to use fire. Otherwise, at the end of this time he was using the same tools the entire time. So really, the lesson is if you want to hang around, don’t do anything rash like invent a new kind of transaction. Too many fuckin’ problems to solve. Best to fire up the grill and have a beer and let the raiders have what they want.

I see you believe in the Darwinian theory…buy Bitcoin and win an award.

Homo erectus is still around, and even many of them can use magnetic strips and rfid and take pictures of qr codes and sheiiiit.

I’d rather not be part of their system.

Maybe the author could explain why Central Banks and nation states are buying tons of gold…and not Bitcoin?

They already have or are planning to issue their own CBDCs. Though some are also buying BTC. US govt is already one of the largest hodlers of BTC through confiscation.

Your question touches on one of the reasons driving the current price increase. BTC ETFs which will be approved in the new year will open the door for BTC to become a mainstream investment vehicle and part of portfolios held by pension funds etc. Major financial institutions will scramble to take a position, but many can’t act until the ETF makes it an official