Authored by Mark Jeftovic via DollarCollapse.com,

One of the things I frequently point at in the incessantly tiresome debate between the precious metals and cryptocurrency communities is that while each asset offers its own advantages, cryptos afford a level of optionality for capital mobility that simply doesn’t exist for precious metals.

At least until fairly recently.

Gold is heavy – a one kilo bar is slightly smaller than an iPhone. When you see those scenes in “heist” movies where the crooks are lobbing gold bars around, you know they’re using spray painted styrofoam. A real gold brick would just drop straight to the floor, probably crushing the guy’s foot into mush.

I don’t think so. (Plus you’d need a forklift to move that box).

So no matter how superior one might think gold is as a store of value and a monetary metal – if you have anything beyond a small physical amount in your possession and you need to move locations in a hurry, you have a big problem.

Even traveling with coins or small bars can be an issue if you have to get out of a heavily militarized zone or an area where civil order has broken down. It’s difficult to conceal, and a magnate for trouble if you’re flashing any around to buy passage or refuge.

With cryptos, you can literally hide your wealth in your mind. It’s called a “brain wallet“: you memorize the seed phrase for your private keys (12 or 24 words), and from there on out you can focus on the task at hand – getting yourself and your family out of whatever “hot zone” you’re in.

Whether its a war torn fiefdom in the (so-called) Third World, or a near-future People’s Republic of Canada after the Prime Minister seizes your bank account for running a natural gas furnace in the winter, with a brain wallet you just need to get out of dodge, and then you can reestablish yourself, and a chunk of your wealth, from a safe distance.

Online Vaulted Gold Is Not a Viable Defense From Capital Controls

One option that has come to the fore that gives people the ability to hold gold at a distance, is vaulted gold. These are non-bank custodial vaults – often contracting with the likes of Brinks or other companies – that hold precious metals on behalf of their clients. Bullionvault – domiciled in London, UK, is among the largest of these, with $4.1 billion USD under custody on behalf of over 100,000 clients.

Goldmoney is another one, founded by James Turk – later acquired by Bitgold and now publicly traded on the Toronto Stock Exchange (TSX:XAU). The original Bitgold value-prop was to provide Bitcoin-to-gold convertability – where one could deposit BTC, covert into gold – and even redeem the precious metals. I did this a couple times in 2018 and it was a byzantine nightmare of delays – all regulatory. They eventually suspended the Bitcoin aspect of the operations and reverted to being a straight up gold and silver vaulting platform under the original Goldmoney brand. (In the interests of disclosure, I hold Goldmoney shares).

There is also the US based GoldSilverVault which offers fully segregated holdings – I’ve had a few conversations with its founder and CEO Bob Coleman about the ins-and-outs of all this and he is beyond a doubt, one of the most knowledgeable in the industry.

For a good overview on vaulted gold options, you can check out TrustableGold, although it’s a more Euro-centric (they don’t cover some of the US options like GoldSilverVault).

Vaulted gold provides a good way to store some of your wealth away in an offshore jurisdiction, and you have a decent level of liquidity. Once your account is set up, you can move from fiat to precious metals – and between precious metals… and even between vaults (e.g Singapore, London, Toronto, etc) easily. It’s frictionless, from a user perspective.

But there are limitations and caveats to having gold stored within these platforms. Here are the big weaknesses of vaulted gold platforms:

- You cannot spend gold between accounts or users – this used to be a feature of the early Digital Gold Currencies like e-gold, pecunix and the original Goldmoney (before its current incarnation). That’s what actually sunk the former and the latter had to move away from being a transaction platform to a straight store-of-value platform – for regulatory reasons (there’s that word again).

- You can only cash out to the same bank account you funded through – as with any centralized exchange or financial platform, setting up your account involves undergoing KYC (Know Your Customer), uploading government issued photo ID, proof-of-residence and finally linking your bank account. Once you’ve done so, you can only fund through your linked accounts, you can only cash out through those accounts.If you’re holding some of your wealth in an online vault like this, and in a crisis you find yourself as a refugee, in exile or otherwise nomadic – you cannot easily redeem your vaulted holdings out into some other bank account in another jurisdiction. You’re going to have to jump through a lot of hoops – and it will take time.

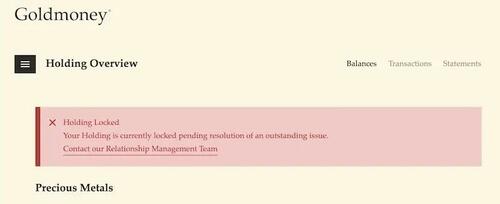

- The vaulted gold platforms are centralized and require trust – you deposit your money, they hold your gold and you basically have to trust them to do that and to give you access to it when you want it, which is typically when you need it the most.As someone who over on the crypto side never leaves anything on the exchange, I had an unpleasant reminder of the “not your keys = not your coins” mantra when I recently logged into my Goldmoney account…I hadn’t logged into my account in years and it got straightened out in short order – but the entire point of these vaults is they’re supposed to be a place where you can safely custody some previous metals and then forget about it. For years on end. But in this era of increasingly high demands on providers for regular KYC audits on their client base – you can almost guarantee that if you’ve simply left your deposits for any length of time, they’ll probably be locked up the next time you want to access them.

Vaulted gold is still a viable solution for diversification – from both an asset and geographical standpoint, provided the system is operating and the rule of law has not been mangled by ever increasingly despotic governments.

Not good.

But in the event of nationalizations or catastrophic system collapse – your gold will likely either be stuck inside the vault for the duration of the crisis or you will be barred from accessing your holdings because the only financial egress point (the bank accounts linked to your profile) has been seized or frozen.

Gold-backed cryptocurrencies: The Best of Both Worlds

It is still early in the gold-backed crypto space. This site’s founder, John Rubino covered these early initiatives in 2018, and there were a fair number of comments there pointing out still more options (one unique approach was a DAO – Decentralized Autonomous Organization – that owned a gold mine in Ethiopia, alas the project now seems defunct).

While we are not there yet – the projects and companies pioneering this space today are closer than ever. As noted in our new gold-backed crypto monitor section, the impediments to trustless store-of-value of precious metals and perfectly frictionless capital mobility are not technological, they’re regulatory.

We’re going to make it our business to follow the ones we feel have a shot at achieving escape velocity.

One of the front-runners in my mind is Lode.one. On a call with the Lode team earlier this month I was impressed at how their business continuity plans included provisions for their smart contracts to function independently of themselves, even if the Lode organization ceased to exist:

The smart contracts were running on a blockchain (in this case Avalanche – AVAX), – they are open source and published on their Github – and they would continue to collect custodial fees from the holdings and use those to pay their vaulting contracts – completely automated in the event that an asteroid hit them.

Holders of the AUG and AUX tokens could then redeem their holdings even after the business ceased to exist. It may sound very cyberpunk, but it is the state of the technology today.

Eventually I expect technological advancement to overcome the regulatory headwinds for several reasons:

- My base scenario for today’s polycrisis (what I came to call “The Jackpot” back in 2020), is a secular decline in centralized governance structures like nation states

- Geopolitical jurisdictions desperate for capital inflows will begin to compete for citizens a la “The Sovereign Individual” thesis

- World War Three will be more about populations vs governments than nations vs nations – so the ones that survive will be those who adapt themselves to the highly networked world ultra-mobile capital.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Just use fucking gold, for crizakes . . .

YEP!…If you don’t HOLD it…You Don’t OWN it!

Just a simple FACT folks!…GET-IT???

REAL GOLD for real people in a real world. . That’s why I said what I said below.

You have to hold your own wealth, forget banks, cryptos, stock markets.

LOVE “THINKERS”!!!!

Especially “Common Sense” thinkers!!!

REMEMBER: ITS WAS ALWAYS YOURS FROM YOUR BIRTH, IN THE FIRST PLACE!!!

“YOU ARE THE REAL-DEAL”…THEY “OWE YOU”…GET-IT???

DON’T LET THEM “REVALUE” WHAT YOU ARE WORTH”…YOU WERE ALWAYS “PRICELESS”…GET-THAT YET???

Cryptos have always pimped off Gold. Notice how crypto coins in these articles are always gold in colour?

Thank you!

“Gold backed” = “fake as shit and worthless as Hell”

Imagine that. You got a thumbs up.

I’ll leave that discussion to the idiots who actually place importance on such utter shit.

UNpossible in reality.

I dont get when I read these articles why no one mentions the state of Utah and there change in legal tender allowing for intrastate commerce using gold and silver. You cann also use the gold and load it up to a debit card and use it. The united precious association has been around for a while. If we just allow for gold and silver to compete with the dollar, we win. Article 1 sec 10 explains state can use gold and silver all they want. .

Andrew, I agree, but not in the crypto ones and zeros free for all space. Also, you can’t allow it to become a stock market trade instrument.

The so-called “Stock Market” is NOT what it “Appears to Be” Folks…Its all about “Slavery”…Do RESEARCH Folks!

They are just as EVIL as the “Bankoholics”, only they call their fraud “Future Value” stocks…Understand THAT meaning???

Just HOLD Your PM’s and “METER” you Pm’s into the banks…ONLY.

Anything of value a government can track,it can seize.Uncle can track your purchase of gold coins. Plain 14 or 18 ct. gold wedding bands would be a safer bet.

Once Klaus Schwab has us eating bugz, living in one person tiny pods, spending our CBDCs, and contemplating the elimination of the orgasm. Anyone holding gold much less crypto currencies will have their social credit scores revoked affecting their ability to travel in their fifteen minute city and their ability to purchase Bill Gates’ delicious highly industrial processed fake meat. And, as a punishment the perpetrator will be required to undergo extensive medical therapy with vaccine booster shots and psychotropic prescription drugs until they get their mind right.

Well Flatulence , your scenario depends on my compliance…not happening…

Added weight without added value. You’d be better off toting around a sack of silver.

Also…tracking is one thing. Seizing is quite another. I would consider ANY such attempt as an Act of War against me personally.

Uncle can track my purchase of Lead also…Uncle hasn’t made any moves for either, now has he…

I’ll go with gold-backed Unicorn farts.

TALK ABOUT “DEEP BS”?!?

YIKES!!!!

Who ever buys into this a “MORON”!…Invisible Gold???

Gold that will ONLY be available to the “Gullible” who will be REQUIRED to think like the “Cabal crowd” to get access to THEIR money???

ANYTHING, That requires you to use THEIR “Electric grid” can be SHUT DOWN…UNDERSTAND Folks???

The fact that you’re desperate for attention is coming in loud and clear. You’ve PROCLAIMED IT BOLDLY!!!

Nice for a transfer of location, but get the physical back in hand immediately when you get there. No power, no crypto. No internet, no crypto….and THEY know that.

Indeed they do Mr. Liberty.

Man, what a sales pitch. Now, just have to get all of my money out of that other casino located on Wall Street so I can invest it in BitGold.

Very soon now, Wall Street is going to disappear up its own ass. It’ll be quite the magic show!

As Bix Weir notes, precious metals must be in your physical possession.

It’s even simpler. You can make brain wallets with any memorable phrase you wish. It does not need to be 12 or 24 random words. For instance you could use the opening verses of Genesis. (Not a good idea, because good hackers will be trying Bible verses!) Or maybe you could use the full names of your children and grandchildren in order of birth. Longer is better, and an additional numeric or special character doesn’t hurt either. But make it a phrase you won’t forget. Maybe the first line of that song that was playing when you met your wife.

https://www.bitaddress.org/

I see Sam Bankman Fried hasn’t been wasting his time in lockup.

Last I heard he was walking free. They squeezing him in stages?

I was correct thinking the article would fall on deaf ears here.

If you’re here to promote fiat, you might as well seek your entertainment elsewhere.

OH! I almost forgot PM’s!

Of course they are “Heavy” (Duh!)

Duh!!!

This was WHY the Ancient Chinese created “Paper receipts” call MONEY by the learned “Westerners”.

The “Westerners” brainstormed the concept of “fractional Reserved” value…UNDERSTAND folks???

They “Played Off” the Chinese idea of “Representing FALSE Value” of the “Paper Money”.

That created the “Checking” system, and every other FAKE Value system since THIS happened.

Now there is a “DEBIT” system (Not bad)…Only there is a “Attempt” to use this as a “CONTROL GRID SYSTEM” now called “Cryptocurrencies” (FART Money)?!? (Laugh!!!)

ENTER AI into this!!!

UNDERSTAND “HUMANITY”???

YOU ARE “PRICELESS BEINGS” OF ALL “CREATION”…THE “REAL GOD’S”!!!

NOT THE VATICAN!!!

Well, Kenny the Chinese may have invented the scam but the Khazarian Jews perfected it…

I’ll take the one kilo bar of gold for $60,000 Alex…