Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

And then there’s Justin Trudeau who stabbed his nation in the heart when he locked some citizens out of their bank accounts during the Truckers protests. That is perhaps the ultimate financial sin that any government can commit against individual citizens, and unwise in the extreme.

In previous editorials, BOOM has detailed the dramatic loss of trust that Canadians now feel for their institutions of government, central banking, finance, and technology. However, sadly, there are many other examples. Joe Biden is one. Benjamin Netanyahu is another and so is Anthony Albanese, the new Prime Minister of Australia.

The advanced economies are mostly being led by fools who adopt the narratives and policies handed to them by unelected, unrepresentative, foreign non-government organisations such as the ‘Un’-United Nations, the Non-World, Non-Economic, Non-Forum WEF (the so-called, private World Economic Forum); the World Not for Health Organisation (WHO), Non-Think Tanks and Non-Charitable Non-Philanthropies funded by a conga line of secretive billionaires. Secret Non-Intelligence organisations also seek to disproportionately influence government policies and national discourse.

The mainstream media dutifully plays its role as a paid-for megaphone of distorted narratives. Integrity is sadly lacking everywhere. The problem is that governments prefer to be influenced by these corporatist organisations. They call them “stakeholders”, which is a word invented for hiding disproportionate, non-democratic influence. They do not listen to The People. Corruption in government and poor policies are the result.

The politicians dress up this merger of corporate and state fascism with fancy terms such as “Public Private Partnerships”, “Corporate Partnerships”, and “Advisory Groups”. They hope that no one notices. Then they seek employment with those corporate “stakeholders” after they have left office.

For example, Scott Morrison, the former Prime Minister of Australia has recently left politics for a job in the United States “defence industry”. Media reports have said he will “take up a role” with a “leading Washington think tank” as an adviser to the ‘Centre for a New American Security’. CNAS is described by Wikipedia as specialising in United States national security issues, including terrorism, irregular warfare, the future of the U.S. military, the emergence of Asia as a global power centre, war games pitting the U.S. against the People’s Republic of China, and the national security implications of natural resource consumption, among others. The CNAS website explains its modus operandi.

“We have a track record of attracting the best and brightest scholars and practitioners to lead our research programs, and our board members, founders, leaders, scholars, and interns have held or gone on to prominent positions in the U.S. government, at the departments of Defense and State, the White House, and the Central Intelligence Agency as well as in Congress and the private sector.” Of course, CNAS is a 501(c)3 tax-exempt non-profit organisation. Its major sponsors include:

Northrop Grumman Systems Corporation, Open Philanthropy (Dustin Moskovitz/Facebook founder), U.S. Department of Defense, Secretary of the Air Force Concepts Development and Management (SAF/CDM), Office of Commercial and Economic Analysis (OCEA), and the Schwab Charitable Fund.

Other funding sources include Google.org, James Murdoch, Korea Foundation, Open Society Foundations (George Soros), Amazon Web Services (AWS), Inc., Carnegie Corporation of New York, Goldman Sachs Group, JPMorgan Chase & Co. (JPMC), KKR & Co. Inc., Lockheed Martin Corporation (LMCO), Meta Platforms Inc., (Facebook), Microsoft Corporation, BAE Systems, Inc., Booz Allen Hamilton Holding Corporation, BP America, Inc., Chevron Corporation, Emergent BioSolutions Inc., European Union (via the German Marshall Fund of the United States), Government of Australia – Department of Defense, Strategic Policy Division, Intel Corporation, The Boeing Company, U.S. Department of Defense, Office of the Secretary of Defense, Office of Net Assessment (ONA), U.S. Department of Defense, U.S. European Command, Russia Strategic Initiative (via Huntington Ingalls Industries (HII), Inc.), U.S. Department of Energy, National Nuclear Security Administration, Savannah River National Laboratory (via Longenecker & Associates, ExxonMobil Corporation, General Dynamics Corporation (GD), Mitsubishi Corporation (Americas), NEC Corporation of America, Norwegian Ministry of Defence, Softbank Group International, Sumitomo Corporation of Americas, Temasek International (USA) LLC, American Rheinmetall Defence, Inc., Embassy of Finland to the United States of America, Finnish Ministry of Foreign Affairs and many more.

Readers will get the drift. Today, BOOM is turning the spotlight onto the economies of Israel, Argentina, Japan, and the United Kingdom. All four are showing signs of economic and societal breakdown which could easily accelerate into an unstoppable cascade of failure. If this were to happen, the consequences could rapidly become unimaginable for their comfortably numb populations. Poverty is a hard pathway to wisdom.

The lesson is that poor-quality leadership, incompetence, and mismanagement have consequences.

Early in the twentieth century, Argentina had one of the ten highest per capita GDP levels globally. It was on a par with Canada and Australia, rich in resources, and with a great future. From 1880 to 1905, the economy grew dramatically, averaging around 8% annually.

During the first three decades of the 20th century, Argentina outgrew Canada and Australia in population, total income, and per capita income. By 1913, Argentina was among the world’s ten wealthiest nations.

However, after the global stock market Crash of 1929, the nation was taken over by the military and a long economic decline began. Since independence from Spain in 1816, the country has defaulted on its debt nine times with currency devaluation and collapse being a recurring theme.

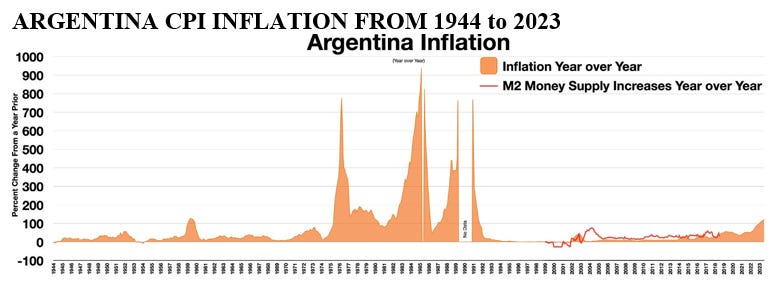

From 1945 to 1955, the government of Juan Perón nationalised the central bank, the railways, and other strategic industries. Inflation became a chronic problem, averaging 26% annually from 1944 to 1974. Today, it is hard to imagine what it must be like to live in Argentina. The annual CPI inflation rate in Argentina increased to 254% in January this year. In December, it was 211%. This chart illustrates the roller coaster ride of CPI inflation since 1944.

The New York Post last week praised his management with the headline “Javier Milei’s Argentine Success is Paving the Way for Freedom and Prosperity”. That’s a brave prediction indeed, given Argentina’s history. It’s reminiscent of what happened when the USSR collapsed in 1990. BOOM expects a decade of economic turmoil before the dust settles.

Foreign robber barons and their Argentinian agents will emerge to take control of Argentina’s productive assets. There will be a rise of another set of oligarchs fuelled by foreign capital as happened in the USSR. This process is already happening.

In January, Argentina’s poverty rate shot up to 57.4%, the highest rate in two decades, as revealed in a recent study by the Catholic University of Argentina. About 27 million people out of Argentina’s 46 million population are poor and 15% of those (4 million) are living in “destitution,” meaning they cannot adequately cover their food needs, according to the study released last week. Poverty is expected to rise above 60% in March.

If over 20% of those become “destitute” under Milei’s new “shock therapy”, then perhaps five million people may be starving soon in a nation renowned for its agricultural production. Five million people starving in a land with the potential for abundant food production is more than shocking, it’s a farce of criminal bad management.

BOOM expects a flood of economic migrants to soon leave and find a better future elsewhere. And most of those will be energetic, resourceful, middle-class people, not the destitute. Such an exodus, were it to happen, would cause persistent economic contraction over and above what is happening already under Milei. The cost of food in Argentina increased by 296% in January 2024 compared with the same month in 2023. Food inflation in Argentina has averaged 68.8% from 2017-24.

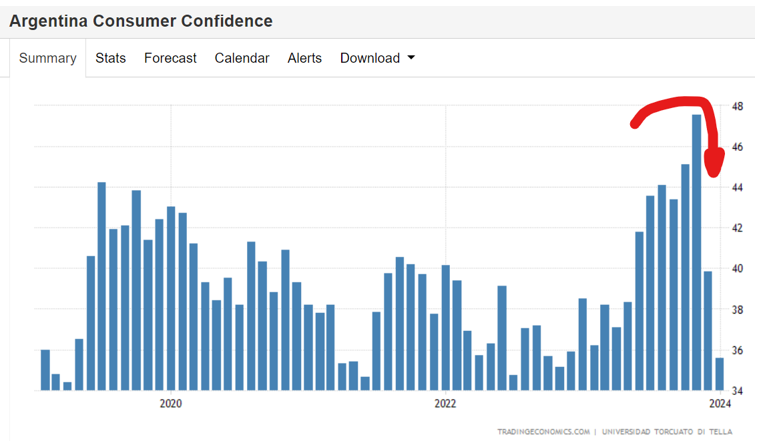

Consumer confidence is plunging, as expected, due to general despair in these dire circumstances. This chart shows the latest data for January. BOOM expects updates will soon show a further dramatic collapse, in this measure of economic health, as 2024 unfolds.

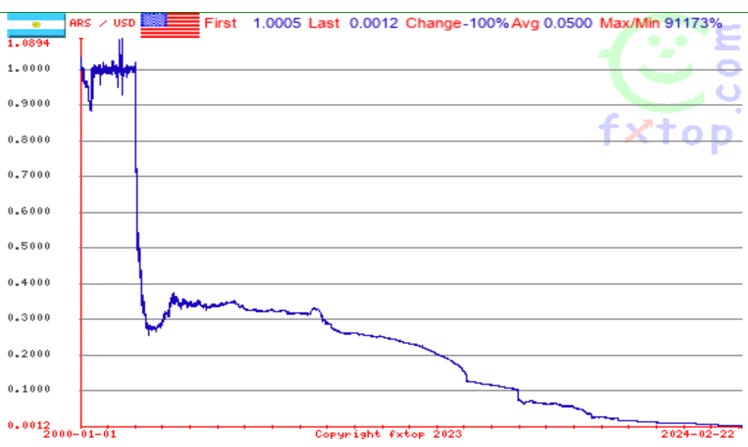

CURRENCY COLLAPSE IN ARGENTINA. Javier Milei was elected as President on 3rd December last year. On December 13th, only three months ago, Argentinians could buy a US Dollar for 366 pesos. The Argentinian peso collapsed, from parity with the US Dollar 23 years ago, to US$ 0.0012c.

In other words, one dollar now is 837 pesos. Four years ago, in January 2020, the US Dollar was 60 pesos. This means that in four years, the purchasing power of an Argentinian peso has collapsed over 10-fold. For those holding US Dollar savings, it is a bonanza but for those holding the national peso currency, it’s a disaster.

This always happens during hyperinflation events, as one currency is abandoned whilst the other one skyrockets in purchasing power. A small group of citizens become super rich while the majority are rendered destitute. Asset prices will soon collapse due to a lack of borrowers/purchasers. Commercial bank failures will then follow as sure as night follows day. Their loan books will be in tatters. Severe social unrest is the inevitable next step and then violence will erupt.

None of this needed to happen. No government should ever allow free circulation and acceptance of a foreign currency; it is committing treason against ‘The People’. This has been happening in Argentina for decades. The People have been robbed by their political class.

Corruption at the highest levels of government, mixed with dreams and promises of a socialist nirvana, has effectively destroyed the nation. Gross mismanagement of the money supply is at the very heart of this tragedy. The chart shows the dramatic fall of the peso against the US Dollar since the year 2000.

The new President must ban US Dollar circulation but he intends to do the opposite. He plans to abandon the peso and adopt the US Dollar as the national currency. He is also planning to close the nation’s central bank. If he were to do both, he would effectively hand over monetary control to the US Federal Reserve (America’s central bank).

BOOM has not yet heard of either announcement because the number of people suffering destitution and starvation would rapidly exceed the predicted five million and might explode higher. An urgent airlift of food supplies would be necessary to feed the people and Argentina is a distant location. Such an airlift would have to be put in place for many months, possibly years.

Last Friday, Milei made this statement, reported by Reuters: “The IMF (International Monetary Fund) is very satisfied with what we’re doing.” Milei said this after a meeting with the IMF’s Gita Gopinath. Gopinath said in a statement that the Milei administration’s “initial actions are starting to bear fruit, although the path ahead remains challenging.” “Consistent and well-communicated monetary and (foreign-exchange) policy will be necessary to continue to bring down inflation durably, rebuild reserves, and strengthen credibility,” Gopinath said.

Gopinath previously served as chief economist at the IMF in Washington DC 2019-22. Before joining the IMF, she had a two-decade-long career as an academic, including at the economics department of Harvard University, and earlier as an assistant professor at the University of Chicago Booth School of Business (2001–05). Gopinath has been the co-director of the international finance and macroeconomics program at the National Bureau of Economic Research, a visiting scholar at the Federal Reserve Bank of Boston, and a member of the economic advisory panel at the Federal Reserve Bank of New York.

Therefore, BOOM assumes Gopinath (52), has never had a job in the real economy, having spent her entire working career in academia and government offices.

Javier Milei (53) has also never worked in the real economy (where goods and services are produced). At school, he was nicknamed ‘el Loco’ (“The Crazy One”) for his outbursts and aggressive rhetoric. Milei has been a professor of macroeconomics, the economics of growth, microeconomics, and mathematics for economists.

The economic and social future of 45 million Argentinians is now in the hands of two academics with essentially no significant experience in the real economy and is unlikely to end well. The people of Argentina will bear the long-term consequences while Javier Milei and Gita Gopinath will disappear and be given “roles” in a “think tank”, funded by “stakeholders”, probably in Washington DC.

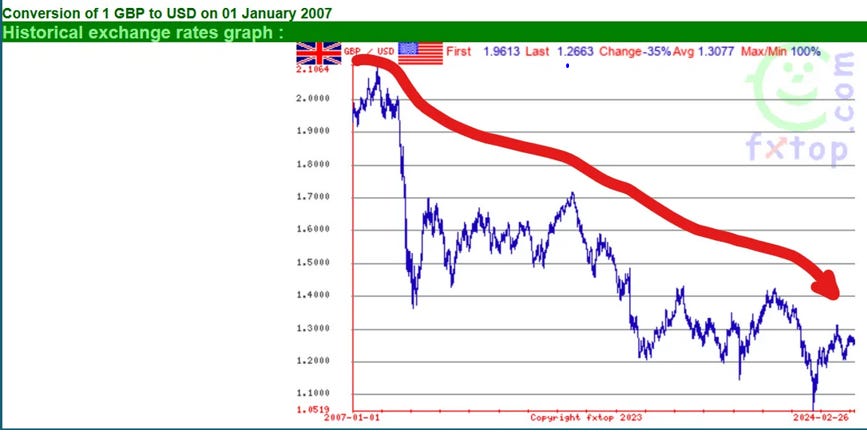

The British stock market, for example, the GB100 stock index is desperately trying to hold at levels achieved in 2017. The long-term view is even worse. It has risen by only 7% since the end of last century.

ISRAEL’S ECONOMY CONTRACTED BY 20% — ANOTHER ECONOMIC DISASTER. Israel’s Central Bureau of Statistics has revealed that the country’s GDP slumped by a seasonally adjusted 19.4% in the final three months of 2023. This is the first quarterly fall in Israel’s economy in two years.

The war in Gaza has caused severe disruption to Israel’s economy leading to a sudden crash in manufacturing, consumption, and construction. Investment in Israel has collapsed. Government spending has skyrocketed by 88.1% due to increased military spending.

The IMF stated that any steps towards seizing Russia’s frozen reserves should be backed by “sufficient legal support” (whatever that means).

“The US and the EU have blocked an estimated US$300bn in assets belonging to the Russian central bank since the beginning of the Ukraine conflict in 2022. Of that amount, 196.6 billion Euros ($211bn) is being held by the Belgium-based clearinghouse Euroclear, which last year accumulated nearly €4.4bn in interest on the funds.”

Earlier this week, the European Council took steps toward the potential seizure of that interest income. Later, the US State Department revealed that Washington continues to be “in active conversations with our allies and partners, including the G7” on potential ways to seize the Russian assets.

BOOM sees this as piracy – plain and simple. The IMF joined in the discussion, trying to bring some sanity to the table, “The decision of what to do with Russia’s frozen assets rests solely with the countries that are holding these assets and the negotiations among them”.

Thanks for reading BOOM Finance and Economics. Subscribe to BOOM Finance and Economics on Substack linked below. BOOM has developed a loyal readership over five years (on other platforms) which includes many of the world’s most senior economists, central bankers, fund managers, and academics. Dr Gerry Brady 2024

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

- The Financial Jigsaw Part 2 – Chapter 4 – Personal Transformation – Saturday, March 2, 2024

- BOOM Weekly Global Review – Tuesday, March 5, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that web site or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities nor investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

“Unwise”? I think not…under orders from the globalist satanic Cabal is the real reason for their country destructive decisions….

JAVIER MILEI – ARGENTINA’S SLIMY WEF KLEPTOCRAT

WHAT’S THE COMMISSION ON 16 BILLION U.S. DOLLARS JAVIER?

A GLOBALIST SUICIDE PUPPET IS BLOWING UP IN ARGENTINA – Video from Dec 15/23

With all due respect, I posit that for anyone who does not live in Argentina and/or is not bilingual, the situation in the country is not easily analyzed. As it happens, I’ve lived in the country for the past 20 years, am bilingual, a thorough reader of a wide spectrum of the national press, a participant in the LLA (NOT to be equated with Pres. Milei) movement and the grandfather of three native-born Argentines with an Argentine mother. Without going into details (available upon request, heh heh), I will only say that things here are never quite what they seem. García Márquez’s “magical realism” Colombia ain’t got nothin’ on this place.