Direct from BOOM Finance and Economics at the links below

Hat Tip to my colleague at BOOM Fin4ance and Economics Substack (Subscribe for Free) – also on LinkedIn and WordPress. Covid Medical News Network CMN News BOOM Blog and All Editorials (over 5 years) at BOOM Finance and Economics | Designed for Critical Thinkers — UPDATED WEEKLY (WordPress.com)

BOOM Finance and Economics seeks out the very best information from authoritative sources and strives for consistency in its quality and trustworthiness. Over 5 years, BOOM has developed a loyal readership which includes many of the world’s most senior economists, central bankers, their senior advisers, fund managers, and academics. If you want a real edge in understanding the complex world of finance and economics, subscribe to BOOM on Substack or as a Follower on LinkedIn.

BOOM EDITORIAL THIS WEEK

To reiterate, none of these events ever come to fruition. But that does not stop the predictions. They continue in abundance. After all, they are useful in selling newsletters, books, conferences, “educational” cruises, and podcasts. The authors of these doom-laden predictions almost always promulgate the idea of “sound money” (commodity-backed). And, not surprisingly, these merchants of economic doom are almost always backed by the gold industry.

In BOOM’s view, so-called “sound money” is an intellectually bankrupt concept but somehow it is very appealing to uninformed citizens who think that nation-states should manage their budgetary affairs similarly to a prudent household. In other words, they think that a nation’s government should arrange for the accumulation of precious savings (profit) to effect the payment of outstanding debts.

BOOM says that nation-states do not go cap-in-hand to a commercial bank seeking loans to fund their deficits; they issue bonds. And that is a very different form of “debt” compared to a bank loan. Also, nation-states (generally) do not die and (generally) do not default on their bond contracts.

Sovereign default can occur but it’s quite rare. Nation-states do not become unemployed and they do not become sick or incapacitated by injury or illness. In financial terms, they are (generally) regarded as immortal beings. This is very different from a human household which must borrow from banks, be prudent, and aim to pay off its debts.

However, rather than endlessly discussing the so-called “inevitable” collapse of the US Dollar, BOOM prefers to look at why it continues to display strength. Some observers argue that the foreign policy objectives and actions of the United States, since the Bretton Woods Agreement in July 1944, illustrate a virtuous circle that strengthens international acceptance of the US Dollar and increases offshore volumes of the US Dollar, known as ‘Eurodollars’.

This argument seeks to explain all the wars in which the USA has been engaged, since the end of WW2, as being perpetrated for the benefit of US currency hegemony.

BRETTON WOODS HOTEL in NEW HAMPSHIRE – WHERE US DOLLAR DOMINANCE WAS ESTABLISHED

BOOM presents the following in the spirit of discussion and discovery, as a possible aid to understanding US Dollar global dominance and strength since 1944. The virtuous circle hypothesis is explained thus:

- The US contributes significantly to Geopolitical chaos and uncertainty; which…

- Strengthens the US Dollar (compared to other national currencies) which…

- Increases spending on US weapons to be paid for with US Dollars which…

- Increases demand for US Dollars offshore and allows the US to interfere with…

- Domestic policies of other nations cause more geopolitical chaos which…

- Strengthens the US Dollar (compared to other national currencies)

Readers will see that this is a “virtuous circle” for the United States. A virtuous circle is a term that describes the positive feedback loop of desirable events (in this case, for continued US dollar demand and strength).

Some argue that this is a deliberate strategy conducted by a cynical US Department of State. Others say that the US is simply dragged reluctantly into geopolitical chaos because of its military dominance. Both these hypotheses are feasible.

This “virtuous” circle (or non-virtuous to some) is strengthened by the creation of offshore US dollars by ‘Tax Haven Banks’ when they issue US dollar-denominated loans to corporate borrowers. Those loans are most often used to purchase assets in nations other than the USA and are assets used as collateral to secure the loans.

The United States government has nothing to do with the creation of these offshore US dollars which reside on foreign bank ledgers. They are called Eurodollars wherever they appear on bank ledgers. For example, US dollars that appear on Japanese bank ledgers, South African bank ledgers, or Cayman Islands bank ledgers are still called “Eurodollars”.

To examine the hypothesis of the virtuous/non-virtuous circle, it is instructive to look at the List of Wars involving the United States since 1945. In this respect perhaps WW2 never ended. BOOM presents this summary list from Wikipedia.

- Korean War (1950–1953) Korean Peninsula

- Vietnam War (1955–1964, 1965–1973, 1974–1975) North and South Vietnam

- Laotian Civil War (1959–1975) Laos

- Permesta Rebellion (1958-1961) Indonesia

- Lebanon crisis (1958) Lebanon

- Bay of Pigs Invasion (1961) Cuba

- Dominican Civil War (1965–1966) Dominican Republic

- Korean DMZ Conflict (1966–1969) Korean Peninsula

- Cambodian Civil War (1967–1975) Cambodia

- Multinational intervention in Lebanon (1982–1984) Lebanon

- United States invasion of Grenada (1983) The Island of Grenada

- Bombing of Libya (1986) Libya

- Tanker War (1987–1988) Persian War — Part of the Iran–Iraq War

- United States invasion of Panama (1989–1990) Panama

- Gulf War (1990–1991) Iraq, Kuwait, Saudi Arabia, and Israel

- Iraqi No-Fly Zone Enforcement Operations (1991–2003) Iraq

- First U.S. Intervention in the Somali Civil War (1992–1995) Somalia

- Part of the Somali civil war (1991–present)

- Bosnian War and Croatian War (1992–1995) Bosnia and Herzegovina and Croatia – Part of the Yugoslav Wars

- Intervention in Haiti (1994–1995) Haiti

- Kosovo War (1998–1999) Serbia

- War in Afghanistan (20 Years) (2001–2021) Afghanistan

- US intervention in Yemen (2002–present) Yemen

- Iraq War (2003–2011) Iraq

- US intervention in the War in North-West Pakistan (2004–2018) Pakistan

- Second US Intervention in the Somali Civil War (2007–present) Somalia and North Eastern Kenya

- Operation Ocean Shield (2009–2016) Indian Ocean

- International intervention in Libya (2011) Libya

- Operation Observant Compass (2011–2017) Uganda

- US military intervention in Niger (10 Years) (2013–present) Niger

- US-led intervention in Iraq (2014–2021) Iraq

- US intervention in the Syrian civil war (2014–present) Syria

- US intervention in Libya (2015–2019) Libya

- Operation Prosperity Guardian (2023–present) Red Sea, Gulf of Aden and Yemen

This extensive list of major wars is one in which the United States has played a key role since 1945 and further lists US wars since the Declaration of Independence in 1776. You will be surprised but don’t forget that the Brits have been engineering conflicts in these and many other covert operations for decades.

BOOM suggests careful study after reading this editorial. Especially noteworthy is the 19th century when the US was at war almost continuously. 58 wars in total are listed for the 19th century alone.

This period is often held up by “sound money” exponents as being wonderfully prosperous for the people of the United States because of the so-called Era of Free Banking from 1836 to 1862 (when there was no central bank). History, however, reveals that there was no outbreak of happiness and peaceful prosperity.

The “sound money” dreamers simply ignore the carnage from the almost endless warfare, economic mayhem, and massive monetary upheavals. The ‘Era of Free Banking’ was certainly no picnic.

Then there is a timeline of US Covert Operations. Most covert action by the United States is carried out by the Central Intelligence Agency (the CIA), founded soon after WW2, which has a paramilitary branch. However, members of the military’s special forces units also take part in these activities.

Then we must also consider clandestine operations (which are apart from covert operations). These can be discovered by reading a report titled, “Covert Action and Clandestine Activities of the Intelligence Community: Framework for Congressional Oversight In Brief.” That report was produced in 2019 by the Congressional Research Service and is certainly worth researching.

It refers to “seventeen diverse elements” (17) of the so-called “Intelligence Community” and states “by their very nature, these and other intelligence programs and activities are classified and shielded from the public”. Covert action is defined in statute (50 U.S.C. §3093(e)) as “an activity or activities of the United States Government to influence political, economic, or military conditions abroad, where it is intended that the role of the United States Government will not be apparent or acknowledged publicly.”

“Congress does not have the authority to approve or disapprove covert actions, it can have (and has had) influence on the President’s decision”.

The term clandestine describes a methodology “for a range of activities wherein both the role of the United States and the activity itself are secret. Clandestine activities can involve traditional intelligence or unconventional military assets. Like covert action, their impact can be strategic even though a specific activity may be tactical in scope. Their secret character suggests the potential harm to sources and methods in the event of an unauthorized or unanticipated public disclosure.”

The US controls around 1,000 bases in at least 80 countries worldwide and spends more on its military than the next 10 countries combined.

The US maintains hundreds, if not thousands, of military bases inside and outside of their borders. At least 800 such bases are maintained in 70 nations. The US is not directly involved in the current war in Ukraine but known as a ‘proxy war’.

However, it is arguable that the war in Ukraine, or “Special Military Operation” (SMO) as Russia describes it, has been a success for the US Dollar Empire and the US Military Complex. Pressure has been brought to bear on many nations in Western Europe to double their annual military expenditures from 1% of GDP to 2%. And, of course, much of that extra expenditure on weapons must be settled with US Dollars.

Here is the US Dollar strength over the last 15 years – as measured by the US Dollar Index ETF (UUP), listed on the New York Stock Exchange. Does it look weak? Or strong? BOOM thinks the answer is clear.

The US dollar Index is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of US trade partners’ currencies. The Index goes up when the US dollar gains “strength” (value) when compared to other currencies.

The index is designed, maintained, and published by ICE (Intercontinental Exchange, Inc.), with the name “US Dollar Index” as a registered trademark. It is a weighted geometric mean of the dollar’s value relative to the following select currencies:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY), 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF), 3.6% weight

The hypothesis of deliberate global geo-political destabilisation in support of US dollar strength is not proven by these military facts. The virtuous/non-virtuous circle theory remains conjectural.

However, ask the question, “Is all of this military activity, intended to create a defence of the US homeland? Or is it intended to create global instability?

Another question arises. “What other nation has embarked upon such all-encompassing external military action since World War Two?

BOOM ascertains that the USSR embarked upon a misguided invasion of Afghanistan that lasted for 10 years from 1979-89. The USSR collapsed and disappeared soon afterward. The Russian Federation now has just nine external military bases all in former states of the USSR, but excluding their ‘Special Military Operation’ in Ukraine.

China has two bases, one in Djibouti and one in Tajikistan, plus a handful of bases on islands in the South China Sea. China invaded Tibet way back in 1950. The military threat to the US homeland seems grossly exaggerated based on these facts.

UNITED STATES — A GIANT SOCIALIST NATION? — USSA?

Could the giant Wurlitzer of US government expenditure on military bases and weapons be a huge socialist-inspired expenditure program aimed at maintaining employment and industries dedicated to the task? A never-ending monetary stimulus program? Or is it aimed at maintaining US dollar dominance globally? These questions must be asked but remain unanswered.

OWNERSHIP OF THE FEDERAL RESERVE

This is another controversial issue about the Federal Reserve, the central bank of the United States. BOOM hears that this is “secretly owned by one family”, “secretly owned by several rich foreign families”, or “owned by a small group of foreign banks”. There are many variations on the theme which (always) implies that the people of the USA are somehow controlled financially by powerful, foreign entities.

BOOM acknowledges the potentially harmful and suspicious involvement of the banking system with representative governments in almost all nations. This is certainly a matter for serious consideration and discussion. This book makes it quite clear who rules the world HERE

If citizens knew how badly their political representatives understand (or fail to understand) the world of banking and finance, they would become very concerned. However, it is rare to find any deep examination of central bank ownership. So let’s dive deep and see what can be found easily.

The Federal Reserve (America’s central bank) is privately owned by a group of commercial and investment banks. That is a fact. There is much obfuscation of this but it is easy to find the truth. The Federal Reserve website describes its ownership thus — “Some observers mistakenly consider the Federal Reserve to be a private entity because the Reserve Banks are organised similarly to private corporations. For instance, each of the 12 Reserve Banks operates within its particular geographic area, or District, of the United States, and each is separately incorporated and has its board of directors. Commercial banks that are members of the Federal Reserve System hold stock in their District’s Reserve Bank.”

And Wikipedia’s explanation — “The US Government does not own shares in the Federal Reserve System or its component banks but does receive all of the system’s annual profits after a statutory dividend of 6% on their capital investment is paid to member banks and a capital account surplus is maintained.”

And — “The Federal Reserve Act created a system of private and public entities. There were to be at least eight and no more than twelve private regional Federal Reserve banks.”

“Democratic Congressman Carter Glass and Senator Robert L. Owen crafted a compromise plan in which private banks would control twelve regional Federal Reserve Banks, but a controlling interest in the system was placed in a central board filled with presidential appointees.

Note this on the website for the Federal Reserve Bank of New York — regarding its Directors ….… Reference: https://www.newyorkfed.org/aboutthefed/org_nydirectors

About the Board of Directors. Under Section 4 of the Federal Reserve Act, each Federal Reserve Bank, including the Federal Reserve Bank of New York, operates under the supervision of a Board of Directors, in addition to the general supervision of the Board of Governors in Washington, DC. The Bank’s Board of Directors has nine members, all chosen from outside the Reserve Bank, who are divided into three equal classes—designated A, B and C.

Class A directors are required to be representatives of the member banks in the District and for the most part, they have been officers or directors of member banks or their holding companies.

Class B and Class C directors are required to represent the public “with due but not exclusive consideration to the interests of agriculture, commerce, industry, services, labor, and consumers.”

“Furthermore, all directors, like all Reserve Bank employees, are generally precluded from participating in any matter in which they have a financial interest. These constraints are designed to minimize the risk of an actual or perceived conflict of interest at the board level.”

Class A Director Facts

Elected by member banks

Elected to represent stockholding, “member” banks

Class B Director Facts

Elected by member banks

Elected to represent the public

Class C Director Facts

Appointed by the Federal Reserve Board

Chosen to represent the public

(Note the presence of the President of the Rockefeller Foundation as a Class C Director of the New York Federal Reserve)

It is not complicated. But you have to read between the lines. The US Federal Reserve structure allows private banks to influence without appearing to do so. And it allows the US Government to influence without appearing to do so. There are direct benefits and indirect benefits for each participant. The US Government makes the senior appointments (a direct benefit). However, they will (obviously) listen to any recommendations in that regard from the banking sector (an indirect benefit).

Contrary to popular opinion, most central banks almost always are banned from issuing currency into their real economy (where goods and services are provided). They may distribute the national currency as Notes and Coins via commercial banks but that is different from being the “Issuer”.

The idea that “central banks are printing too much money” is false. They control the cost of money directly but not the volume of money and they cannot control borrower demand directly. Direct volume controls are only allowed in China (!).

There are some exceptions to this e.g. the Bank of Russia which still has the power to issue currency into the real economy (a carry-over from their communist times when the central bank issued ALL of the currency in the USSR economy). However, the modern Bank of Russia now will never use that power unless facing force majeure. In such a case, it is similar to a QE program as in other central banks.

The People’s Bank of China is the central bank of China. They operate a Potemkin Village system of “private commercial banks”. It is carefully managed (in BOOM’s opinion, the best-managed monetary system on Earth). They infuse fresh new money into the money supply by having State Owned Enterprises (SOEs) borrow strictly defined volumes from the Commercial Banks.

They also monitor the loan books of their informal Shadow Banking system carefully and use it to keep the money supply flowing while restricting the formal Commercial Banks lending (when necessary). Volume and cost controls are used in those circumstances. The Chinese rely on bank loans to finance their economy much more than bond issuance.

This allows China to expand the money supply purposely because bond issuance does not contribute to the supply of fresh new money (while bank loans do). This gives them a major advantage over Western economies where bond issuance by governments, corporations, and municipals does not increase the supply of fresh new money.

There is no formal, direct connection between the US Federal Reserve and other national central banks such as the Reserve Bank of Australia, the Bank of Japan, and the Bank of Canada unless they engage in Currency Swap arrangements. This reference explains those. https://som.yale.edu/story/2023/central-bank-swap-lines-primer

OTHER NATIONAL CENTRAL BANKS. Please note that the word “assets” in the banking sector is quite different from the usual use of the word in the real economy. An “asset” in banking is often about a loan that has been agreed with a borrower.

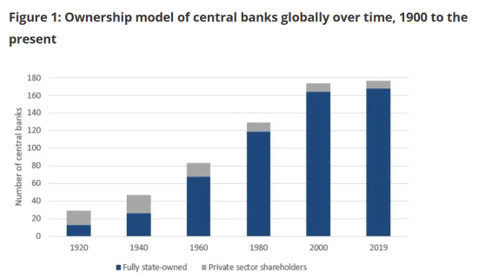

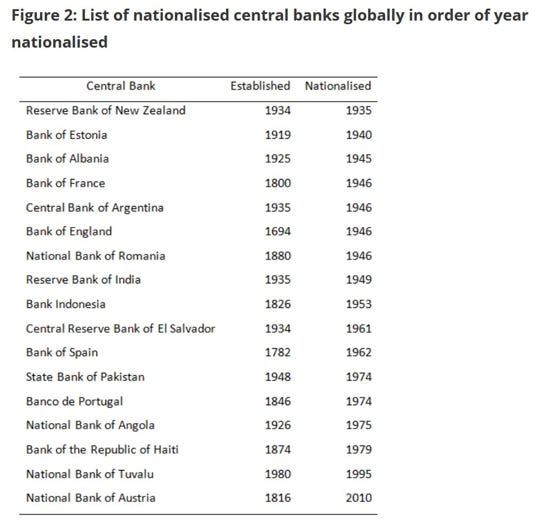

Unlike the US Federal Reserve, the vast majority of national central banks are owned by their national governments. Most cannot issue currency and are restricted to trading in assets. The owners of central banks, mostly governments, generally receive a share of central banks’ profits and are most often responsible for making executive appointments. However, the day-to-day control of the central bank is delegated to the central bank’s senior management and policy committees. This is similar to how large commercial corporations are owned and operated.

Some central banks are joint private/public in their ownership structure. Shares can be purchased in some of the major central banks e.g. the Swiss National Bank, Bank of Japan, and Banca d’Italia. Their shares are listed on their national stock market where shares can be bought by a click of a mouse. Smaller central banks have mixed ownership structures e.g. Belgium, San Marino, Turkey, Greece, and South Africa.

For example, the Bank of Japan has a Market Capitalisation of US$29bn, pays no dividends, and has been a poor investment over the last 23 years.

The following images are sourced from Bank Underground:

The central banks of Japan, San Marino, and Turkey have some private sector shareholders but the majority shareholder is the national government. In Belgium and Switzerland, around half of the shares are held by the government. The American, Italian, and South African governments have no formal ownership stake in their central banks.

THE BANK FOR INTERNATIONAL SETTLEMENTS

Then there is the BIS, the Bank for International Settlements, based in Basel, Switzerland, established in 1930 and brilliantly described in The Tower of Basel by the author Adam Lebor.

“Tower of Basel is the first investigative history of the world’s most secretive global financial institution. Based on extensive archival research in Switzerland, Britain, and the United States.”

“Created by the governors of the Bank of England and the Reichsbank in 1930, and protected by an international treaty, the BIS and its assets are legally beyond the reach of any government or jurisdiction. The bank is untouchable. Swiss authorities have no jurisdiction over the bank or its premises. The BIS has just 140 customers but made tax-free profits of 1.17 billion in 2011-2012.

Since its creation, the bank has been at the heart of global events but has often gone unnoticed. Under Thomas McKittrick, the bank’s American president from 1940-1946, the BIS was open for business throughout the Second World War. The BIS accepted looted Nazi gold, conducted foreign exchange deals for the Reichsbank, and was used by both the Allies and the Axis powers as a secret contact point to keep the channels of international finance open.”

Thanks for reading BOOM Finance and Economics. Subscribe to BOOM Finance and Economics on Substack linked below. BOOM has developed a loyal readership over five years (on other platforms) which includes many of the world’s most senior economists, central bankers, fund managers, and academics. Dr Gerry Brady 2024

BOOM’s QUANTITATIVE BOOSTING FOR THE PEOPLES MONEY EXPLAINED: https://boomfinanceandeconomics.wordpress.com/2019/12/15/boom-as-at-15th-december-2019/ AND BOOM’s Perfect Economy: https://boomfinanceandeconomics.wordpress.com/2020/01/18/boom-as-at-19th-january-2020/

COMING NEXT:

- Letter from Great Britain – Budget Special – Saturday, March 9, 2024

- BOOM Weekly Global Review – Tuesday, March 12, 2024

In economics, things work until they don’t. Make your conclusions and do research. BOOM does not offer investment advice.

CLICK HERE FOR PODCASTS: OUR BRAVE NEW ECONOMIC WORLD

BANKS DON’T TAKE DEPOSITS, THEY BORROW YOUR MONEY: LOANS CREATE DEPOSITS — this is how almost all new money is created in the economy (by commercial banks making loans). https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy. Watch the short 15-minute video and see Professor Richard Werner brilliantly explaining how global banking systems work.

In 2014, Richard Werner provided the first empirical evidence that banks create credit out of thin air. They do this whenever they issue a loan or, more specifically, purchase a promissory note. This is a walk-through of exactly how they do it.

Many economists are unaware of this and even ignore the banking & finance sectors in their econometric models.

DISCLAIMER: All content is presented for educational and/or entertainment purposes only. Under no circumstances should it be mistaken for professional investment advice, nor is it at all intended to be taken as such. The commentary and other contents simply reflect the opinion of the authors alone on the current and future status of the markets and various economies. It is subject to error and change without notice. The presence of a link to a website does not indicate approval or endorsement of that website or any services, products, or opinions that may be offered by them.

Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any neither securities investments. Do NOT ever purchase any security or investment without doing your own and sufficient research. Neither BOOM Finance and Economics.com nor any of its principals or contributors are under any obligation to update or keep current the information contained herein. The principals and related parties may at times have positions in the securities or investments referred to and may make purchases or sales of these securities and investments while this site is live. The analysis contained is based on both technical and fundamental research.

Although the information contained is derived from sources that are believed to be reliable, they cannot be guaranteed.

Disclosure: We accept no advertising or compensation, and have no material connection to any products, brands, topics or companies mentioned anywhere on the site.

Fair Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of economic and social significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

They control the cost of money directly but not the volume of money

Skimmed the very long and filled with irrelevant info “doth protest too much” article and found the above gem as an example of how silly it is. The Fed enables limitless money creation in a stupid bank-and-Treasury shell game which fools exactly no one. Or maybe it fools the OP and no one else.

Clicking $Trillions into banks’ “reserve accounts” and then paying them interest on those accounts isn’t also controlling volume of money? In what alternate universe?

OP does correctly state that USD strength is due to military intervention. “Use our currency or we will fucking kill you”. But this cannot go on forever, and Biden is doing his damndest to end it.

WHEN IT IS WELL KNOW THAT “ALL BANKS” ARE PRACTICING FRAUDULENTLY…HOW IS IT THAT PEOPLE STILL “OWE THEM” ANYTHING FOLKS???

LIKE YOU SAID…THEY USE THE “THREAT OF VIOLENCE” TO ENFORCE THEIR GOALS!

REMEMBER THE “TINY DOT” SCENARIO FOLKS???

Pipe down, faggot. Try believing in yourself enough to not scream in boldface capslock. If you have nothing to say, keep quiet. If yes, then simply say your piece. Truth will out: no need to shout.

This is a long article that demonstrates what? The author’s concept of “dollar strength” has relevance only as regards other fiat currencies. As the article illustrates, the Dollar Index is a weighted index: 57% of the weight is the EuroFX. Indexes can be notoriously misleading. Had the author focused on is the dollar’s purchasing power we would have a completely different conclusion about what is happening in the world of currencies.

In case it wasn’t already very clear:

Dear Leader of any Cuntry,

Use our money and buy some of our stuff or we will export “democracy” to your country.

Sincerely,

Uncle Scam

They love to mock us/U.S.

Everything they do is hidden in plain sight…

I am surrounded by people about to get financially wiped out…been warning some for years and others for decades.

Some have listened…most have not.

The Shit in TSHTF will soon be tossed into the blades…we will be nowhere near the SPLAT!

Typical a banker arguing that a time when wages went up, and costs down, the only century in history when that occurred, is equivelent to todays central bank economic dystopia era. Debt is debt, no matter how it is accumulated. Debt turns people into slaves, as this debt laden era is doing. Bankers hate the gold standard because it limits the money they can make. Beneath the authors despicable runimations it is apparent he deplores the natural discipline a gold standard imposes.