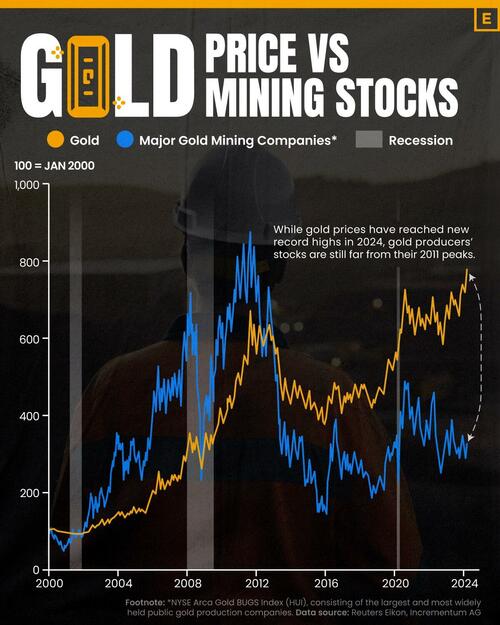

Although the price of gold has reached new record highs in 2024, gold miners are still far from their 2011 peaks.

In this graphic, Visual Capitalist’s Bruno Venditti illustrates the evolution of gold prices since 2000 compared to the NYSE Arca Gold BUGS Index (HUI), which consists of the largest and most widely held public gold production companies. The data was compiled by Incrementum AG.

Mining Stocks Lag Far Behind

In April 2024, gold reached a new record high as Federal Reserve Chair Jerome Powell signaled policymakers may delay interest rate cuts until clearer signs of declining inflation materialize.

Additionally, with elections occurring in more than 60 countries in 2024 and ongoing conflicts in Ukraine and Gaza, central banks are continuing to buy gold to strengthen their reserves, creating momentum for the metal.

Traditionally known as a hedge against inflation and a safe haven during times of political and economic uncertainty, gold has climbed over 11% so far this year.

According to Business Insider, gold miners experienced their best performance in a year in March 2024. During that month, the gold mining sector outperformed all other U.S. industries, surpassing even the performance of semiconductor stocks.

Still, physical gold has outperformed shares of gold-mining companies over the past three years by one of the largest margins in decades.

| Year | Gold Price | NYSE Arca Gold BUGS Index (HUI) |

|---|---|---|

| 2023 | $2,062.92 | $243.31 |

| 2022 | $1,824.32 | $229.75 |

| 2021 | $1,828.60 | $258.87 |

| 2020 | $1,895.10 | $299.64 |

| 2019 | $1,523.00 | $241.94 |

| 2018 | $1,281.65 | $160.58 |

| 2017 | $1,296.50 | $192.31 |

| 2016 | $1,151.70 | $182.31 |

| 2015 | $1,060.20 | $111.18 |

| 2014 | $1,199.25 | $164.03 |

| 2013 | $1,201.50 | $197.70 |

| 2012 | $1,664.00 | $444.22 |

| 2011 | $1,574.50 | $498.73 |

| 2010 | $1,410.25 | $573.32 |

| 2009 | $1,104.00 | $429.91 |

| 2008 | $865.00 | $302.41 |

| 2007 | $836.50 | $409.37 |

| 2006 | $635.70 | $338.24 |

| 2005 | $513.00 | $276.90 |

| 2004 | $438.00 | $215.33 |

| 2003 | $417.25 | $242.93 |

| 2002 | $342.75 | $145.12 |

| 2001 | $276.50 | $65.20 |

| 2000 | $272.65 | $40.97 |

Among the largest companies on the NYSE Arca Gold BUGS Index, Colorado-based Newmont has experienced a 24% drop in its share price over the past year. Similarly, Canadian Barrick Gold also saw a decline of 6.5% over the past 12 months.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

A great wealth transfer is underway: How the West lost control of the gold market

Pricing power in a market long dominated by Western institutional money is moving East and the implications are profound

The gold price has risen to a series of new all-time highs of late, a development that has received only cursory attention in the mainstream financial media. But as is the case with so much else these days, there is much more going on than meets the eye. In fact, the rise in the dollar price of gold is almost the least interesting aspect to this story…

So coming into focus is a picture of Western institutional investors responding like Pavlov’s dogs to rising interest rates and ditching gold in favor of higher yielding assets such as bonds, stocks, money market funds – you name it. And normally, like clockwork, this would have driven the price down.

But it didn’t. And the two main reasons are the voracious appetite for physical gold on display from central banks and extremely strong private-sector demand for physical gold from China. It is difficult to know exactly which central banks are buying and how much they’re buying because these purchases take place in the opaque over-the-counter market. Central banks report their gold purchases to the IMF, but, as the Financial Times has pointed out, global flows of the metal suggest that the real level of buying by official financial institutions – especially in China and Russia – has far exceeded what has been reported…

Where does this all lead?

Let’s now zoom out a little bit and try to put this into some kind of perspective. The first obvious point here is that gold pricing is increasingly being determined by demand for physical gold rather than mere speculation. Let’s be clear: the People’s Bank of China is not loading up on 25:1 leveraged gold futures contracts with cash settlement. Neither is Russia. They’re backing trucks laden with the real thing into the vaults. And in fact we have seen net exports from wholesale markets in London and Switzerland – i.e. representing Western institutional gold. That gold has been moving East…

Another aspect to this is that as BRICS countries increasingly trade in local currencies, a neutral reserve asset is needed to settle trade imbalances. In lieu of a BRICS currency, which may or not be forthcoming in the near future, Luke Gromen believes this role is already starting to be performed by physical gold. If this is the case, it marks the return of gold to a place of prominence in the financial system, both as a store of value and a means of settlement. This, too, represents a hugely important step.

https://swentr.site/business/595122-west-losing-gold-east/