Guest Post by Bryan Lutz, Editor at Dollarcollapse.com

Ever since Nixon took the US Dollar off the gold standard in 1971, gold has acting accordingly. There are three relationships that traders, investors, and I suppose many gurus out there have been able to rely on to predict gold’s future pricing. Now, gold is breaking three of the most prominent indicators.

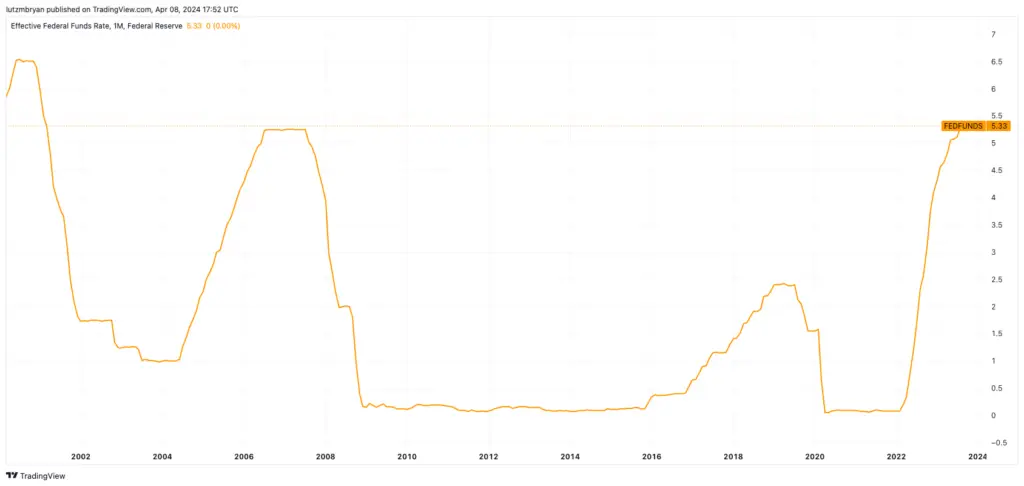

1. Federal Fund Interest Rates

When the Federal Reserve raises interest rates, it pushes the value of the US dollar up. The effect drives the price of gold down.

So there’s an inverse relationship between the price of gold and the Federal Fund Interest rates.

You can see how this works below:

Gold

Federal Fund Rates

From 2004 to 2007, interest rates rose, slowly flatlining the price of gold. Then when interest rates dropped, and were held at 0% for years, the price of gold went up.

Then again, when the interest rate dropped in 2019, you see the price of gold move from below $1200 to over $2000.

If you zoom into the early 2000’s, there are more examples, but that happens every time. Whenever the Fed lowers interest rates, gold rises relatively quickly.

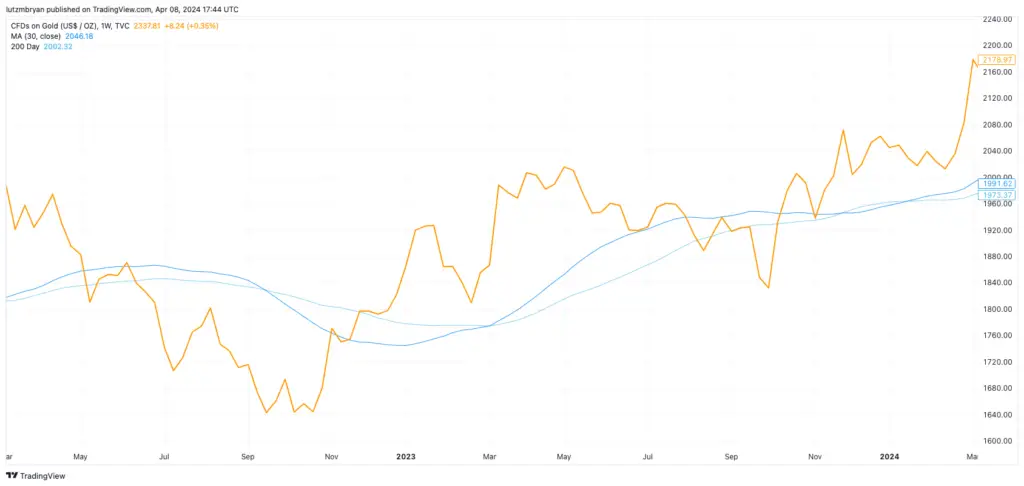

Except something is different today. In the past two months, gold has broken out past $2200 to almost $2300. Yet, there’s no change in Federal Fund interest rates.

Gold

Federal Fund Rates

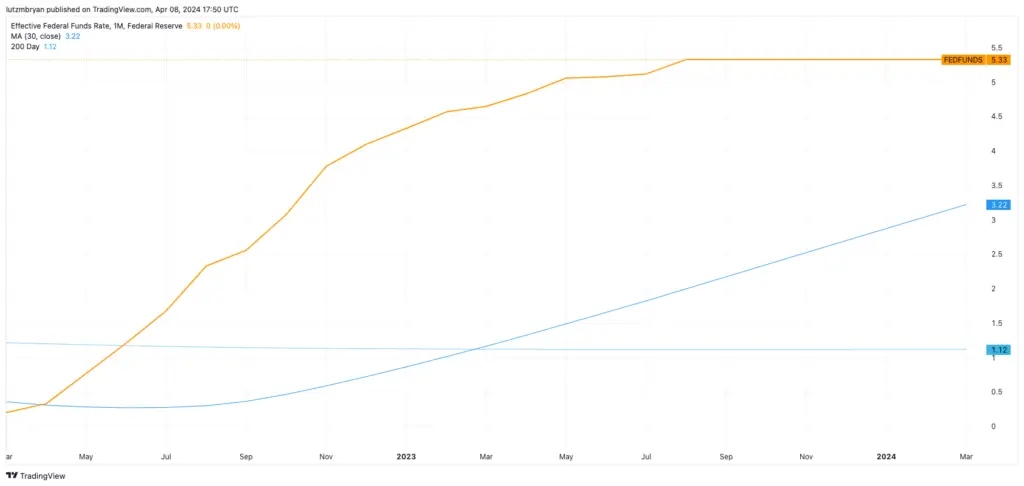

2. Bond Yields

Here’s another example of how gold is breaking out and defying conventional behavior.

The conventional relationship between gold and the 10-year treasury bond is this:

When yields go up, gold goes down.

And that’s because there’s an opportunity cost to holding gold when a person can make more money from bonds. So people drop gold and go for yields…

Except not this year, ever since October of last year, 10-year treasury bond yields and gold have generally been rising together.

Gold

10-Year Treasury Bonds

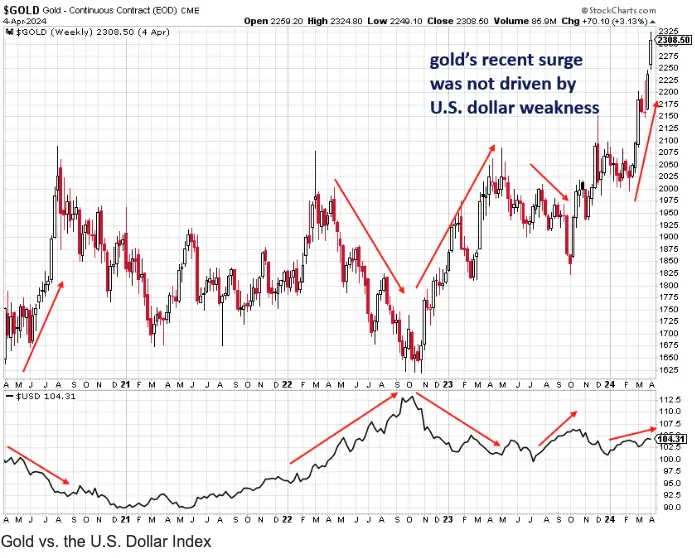

3. Dollar Strength

The last example, is the strength of the US Dollar. Gold and Treasury yields are both influenced by the US Dollar. When the dollar rises in value, it can make gold more expensive in other currencies, which reduces demand for gold lowering its price. Then a stronger dollar can also mean increased prices for US Bonds, lowering yields.

That being said, a strong dollar historically lowers the price of gold. Not since the beginning of March…

Since the start of March, the strength of the dollar slowly rose. Yet, the price of gold continues to make leaps and bounds.

(source: Jesse Colombo, BullionStar)

In conclusion, the recent behavior of gold prices, defying long-established correlations with Federal Fund interest rates, bond yields, and the strength of the US dollar, signals a significant shift in the financial landscape. These anomalies suggest that traditional indicators, once reliable predictors of gold’s movement, may no longer be as dependable in the current economic environment.

What do we have to thank for this?

1. America’s sovereign debt crisis.

2. A long history of the weaponization of the dollar leading to geopolitical tension.

3. The market is possibly over-speculating.

In any event, all three breaks in conventional behavior show the strength of gold in the market. And, that gold most likely has much higher to go.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I hereby declare Gold has launched right f’ing now. Armstrong’s $2,500 by Monday?

I just see it as a hedge against property seizure.

Certainly a better hedge than fiat.

Those charts are screaming.

A great wealth transfer: How China is changing global gold market dynamics

The global gold market is witnessing a significant transformation as the control and pricing power, long held by Western institutional investors, begins to migrate East. This shift is reshaping the landscape of the precious metal’s trade and holds deep implications for the global economy…

According to a Russia Today report, the traditional trends in the gold market are now breaking down, as demand for physical gold, particularly from Eastern central banks and private sectors in countries like China, begins to outpace the speculative paper gold market prevalent in the West. This growing demand for physical gold is reducing the influence of Western institutional investors over gold prices, indicating a shift in the market’s center of gravity towards the East.

https://timesofindia.indiatimes.com/world/china/a-great-wealth-transfer-how-china-is-changing-global-gold-market-dynamics/articleshow/109201685.cms

I’ve been listening to Peter Schiff a bit the last couple months. Like him or not, he’s made some valid points: the Fed has not killed inflation with its rate hikes. They probably should have raised MOrE to stop consumer spending. Also, Congress is creating inflation with its historic and insane deficit spending. Unless they cut spending radically, we’ll be forced to monetize the debt, which will make inflation shoot up much higher. So the historic relationship of interest rates to gold are broken. The Fed could pull a Bank of Japan and buy all the newly issued debt. That would keep rates low while inflation goes out of control. That will push gold higher – especially since other countries – China and the Arabs principally- are trying to de-dollarize after seeing Russia’s US and EU bond holdings frozen and – soon – stolen.

The Dollar’s value is guaranteed by the full faith and credit of the United States. These assholes are willing to throw away what little reputation we have left for one last Pukraine grift by stealing Russian citizens US deposits. This is mad man behavior.

It just broke above $2,400

Metals may be in the beginning of a panic phase. $3,000 very quickly. Silver finally catching fire.

Crazy moves with some ammo suppliers. If you see a real sale, jump on it.