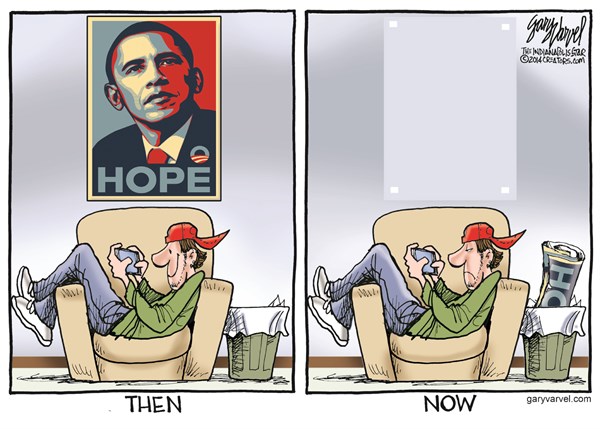

MILLENNIAL HOPE

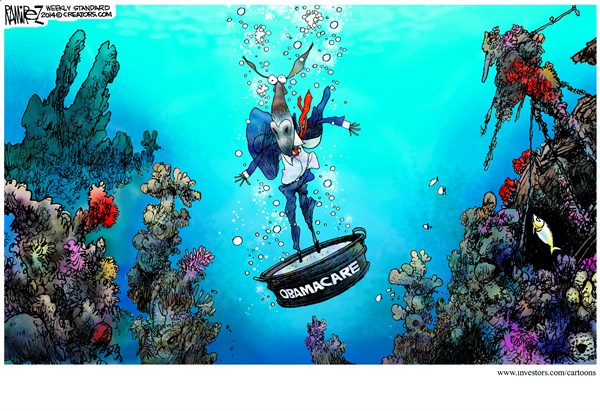

CEMENT SHOES

Via Cagle Post

Inside the NSA’s Secret Efforts to Hunt and Hack System Administrators

Guest Post from Glenn Greenwald’s The Intercept

Across the world, people who work as system administrators keep computer networks in order – and this has turned them into unwitting targets of the National Security Agency for simply doing their jobs. According to a secret document provided by NSA whistleblower Edward Snowden, the agency tracks down the private email and Facebook accounts of system administrators (or sys admins, as they are often called), before hacking their computers to gain access to the networks they control.

The document consists of several posts – one of them is titled “I hunt sys admins” – that were published in 2012 on an internal discussion board hosted on the agency’s classified servers. They were written by an NSA official involved in the agency’s effort to break into foreign network routers, the devices that connect computer networks and transport data across the Internet. By infiltrating the computers of system administrators who work for foreign phone and Internet companies, the NSA can gain access to the calls and emails that flow over their networks.

The classified posts reveal how the NSA official aspired to create a database that would function as an international hit list of sys admins to potentially target. Yet the document makes clear that the admins are not suspected of any criminal activity – they are targeted only because they control access to networks the agency wants to infiltrate. “Who better to target than the person that already has the ‘keys to the kingdom’?” one of the posts says.

The NSA wants more than just passwords. The document includes a list of other data that can be harvested from computers belonging to sys admins, including network maps, customer lists, business correspondence and, the author jokes, “pictures of cats in funny poses with amusing captions.” The posts, boastful and casual in tone, contain hacker jargon (pwn, skillz, zomg, internetz) and are punctuated with expressions of mischief. “Current mood: devious,” reads one, while another signs off, “Current mood: scheming.”

The author of the posts, whose name is being withheld by The Intercept, is a network specialist in the agency’s Signals Intelligence Directorate, according to other NSA documents. The same author wrote secret presentations related to the NSA’s controversial program to identify users of the Tor browser – a privacy-enhancing tool that allows people to browse the Internet anonymously. The network specialist, who served as a private contractor prior to joining the NSA, shows little respect for hackers who do not work for the government. One post expresses disdain for the quality of presentations at Blackhat and Defcon, the computer world’s premier security and hacker conferences:

It is unclear how precise the NSA’s hacking attacks are or how the agency ensures that it excludes Americans from the intrusions. The author explains in one post that the NSA scours the Internet to find people it deems “probable” administrators, suggesting a lack of certainty in the process and implying that the wrong person could be targeted. It is illegal for the NSA to deliberately target Americans for surveillance without explicit prior authorization. But the employee’s posts make no mention of any measures that might be taken to prevent hacking the computers of Americans who work as sys admins for foreign networks. Without such measures, Americans who work on such networks could potentially fall victim to an NSA infiltration attempt.

The NSA declined to answer questions about its efforts to hack system administrators or explain how it ensures Americans are not mistakenly targeted. Agency spokeswoman Vanee’ Vines said in an email statement: “A key part of the protections that apply to both U.S. persons and citizens of other countries is the mandate that information be in support of a valid foreign intelligence requirement, and comply with U.S. Attorney General-approved procedures to protect privacy rights.”

As The Intercept revealed last week, clandestine hacking has become central to the NSA’s mission in the past decade. The agency is working to aggressively scale its ability to break into computers to perform what it calls “computer network exploitation,” or CNE: the collection of intelligence from covertly infiltrated computer systems. Hacking into the computers of sys admins is particularly controversial because unlike conventional targets – people who are regarded as threats – sys admins are not suspected of any wrongdoing.

In a post calling sys admins “a means to an end,” the NSA employee writes, “Up front, sys admins generally are not my end target. My end target is the extremist/terrorist or government official that happens to be using the network some admin takes care of.”

The first step, according to the posts, is to collect IP addresses that are believed to be linked to a network’s sys admin. An IP address is a series of numbers allocated to every computer that connects to the Internet. Using this identifier, the NSA can then run an IP address through the vast amount of signals intelligence data, or SIGINT, that it collects every day, trying to match the IP address to personal accounts.

“What we’d really like is a personal webmail or Facebook account to target,” one of the posts explains, presumably because, whereas IP addresses can be shared by multiple people, “alternative selectors” like a webmail or Facebook account can be linked to a particular target. You can “dumpster-dive for alternate selectors in the big SIGINT trash can” the author suggests. Or “pull out your wicked Google-fu” (slang for efficient Googling) to search for any “official and non-official e-mails” that the targets may have posted online.

Once the agency believes it has identified a sys admin’s personal accounts, according to the posts, it can target them with its so-called QUANTUM hacking techniques. The Snowden files reveal that the QUANTUM methods have been used to secretly inject surveillance malware into a Facebook page by sending malicious NSA data packets that appear to originate from a genuine Facebook server. This method tricks a target’s computer into accepting the malicious packets, allowing the NSA to infect the targeted computer with a malware “implant” and gain unfettered access to the data stored on its hard drive.

“Just pull those selectors, queue them up for QUANTUM, and proceed with the pwnage,” the author of the posts writes. (“Pwnage,” short for “pure ownage,” is gamer-speak for defeating opponents.) The author adds, triumphantly, “Yay! /throws confetti in the air.”

In one case, these tactics were used by the NSA’s British counterpart, Government Communications Headquarters, or GCHQ, to infiltrate the Belgian telecommunications company Belgacom. As Der Speigel revealed last year, Belgacom’s network engineers were targeted by GCHQ in a QUANTUM mission named “Operation Socialist” – with the British agency hacking into the company’s systems in an effort to monitor smartphones.

While targeting innocent sys admins may be surprising on its own, the “hunt sys admins” document reveals how the NSA network specialist secretly discussed building a “master list” of sys admins across the world, which would enable an attack to be initiated on one of them the moment their network was thought to be used by a person of interest. One post outlines how this process would make it easier for the NSA’s specialist hacking unit, Tailored Access Operations (TAO), to infiltrate networks and begin collecting, or “tasking,” data:

Aside from offering up thoughts on covert hacking tactics, the author of these posts also provides a glimpse into internal employee complaints at the NSA. The posts describe how the agency’s spies gripe about having “dismal infrastructure” and a “Big Data Problem” because of the massive volume of information being collected by NSA surveillance systems. For the author, however, the vast data troves are actually something to be enthusiastic about.

“Our ability to pull bits out of random places of the Internet, bring them back to the mother-base to evaluate and build intelligence off of is just plain awesome!” the author writes. “One of the coolest things about it is how much data we have at our fingertips.”

Micah Lee contributed to this report.

———

Documents published with this article:

QUOTE OF THE DAY

“Robbery, rape, and slaughter they falsely call empire; and where they create a desert, they call it peace.”

Tacitus, Calgacus’ Speech from Agricola

RON PAUL: “PRIVACY IS DEAD AND GONE”

THIS IS JOURNALISM????

Do you need more proof that the corporate MSM and the faux journalist shills work in conjunction with the corrupt slimy politicians to produce a show for the American people? Everything is scripted. Welcome to the Truman Show.

Outside the Box: Gavekal on Russia and Japan

Outside the Box: Gavekal on Russia and Japan

By John Mauldin

I look at dozens of sources a day on global macroeconomics, but one source I go to every day is my good friends at Gavekal. The Gavekal partnership – father Charles Gave, son Louis-Vincent Gave, and noted economist and journalist Anatole Kaletsky – spans three continents: Charles is based in Paris, Anatole is in London, Louis has set up shop in Hong Kong, and the firm also has an office in the US. And they have an extensive team of outstanding analysts.

Gavekal’s publishes global macro articles for its clients on an almost daily basis, and for today’s Outside the Box they have allowed me to share two of them with you. First, Louis Gave gives us a very insightful analysis of Russia’s permanent interests and makes a very interesting case connecting Middle East oil and Crimea.

The author of the second piece is Gavekal Asia Research Director Joyce Poon, who has been rising on my must-read list because she consistently thinks differently and more deeply than most conventional analysts. Her analysis here on Japan is very intriguing, convincing, and counterintuitive to standard economic theory. But, you’ll note, the end result is to still short the yen.

Incidentally, Anatole Kaletsky will speak at our Strategic Investment Conference this year, as he has for the past several years. This is a must-attend conference.

There has been a great response to the exclusive-to-Mauldin-Economics video interview by Jim Bruce of Janet Yellen when she was the president of the San Francisco Fed. He interviewed her in the course of producing the gonzo documentary on the Federal Reserve, Money for Nothing. The original interview was quite wide-ranging – over two hours – and Jim has edited the interview to just over 10 minutes of the most pertinent and interesting pieces segments. Given that today is the day Yellen chairs her first Fed meeting, I think it might be interesting to see what her views are on the role of the Federal Reserve.

What’s fascinating to me are the risks inherent in so many of her beliefs:

- That the Fed can reduce “the pain that people feel when they want to have jobs” by stimulating financial markets with ultra-low rates

- That the Fed will be able to control inflation no matter how profligate Washington gets

- That the Fed wasn’t irresponsible in deliberately fueling the housing bubble, and shouldn’t raise rates to puncture a bubble because it might impact the economy.

These are the views that are going to be driving Fed policy and shaping the monetary environment in which we all invest. I think it’s worth your time to consider. You can watch the interview here.

As you receive this I am on a plane to Buenos Aires, where I will spend the day before flying on to Salta and then driving three hours up through a beautiful canyon to Cafayate. Sometime early in the week I will make a 4- to 5-hour trek over the roughest terrain I’ve ever driven on, back to see my old friend Bill Bonner at his hacienda at 10,000 feet in the Andes. He retreats there for two months every year, where he continues to write and pursue his avocation of building things with his own hands. In theory there is internet, but in practice I was completely cut off for a few days when I was there last year. Withdrawal was acute, but I survived. I might even need to stay a few days longer with just my books to see if the reflexive tics go away.

As soon as I get back to the resort at La Estancia, I will once again be connected to the world and will be able to write my weekly letter as usual. With everything happening so fast these days, it almost seems like I should be writing to you three times a week. But that is why we have the other writers like Grant Williams and our Outside the Box contributors to supplement my humble weekly missives.

Have a great week, and follow me on Twitter as I try to post from Argentina and from South Africa in a few weeks.

Your getting ready to feast at almost daily asados analyst,

John Mauldin, Editor

Outside the Box[email protected]

Stay Ahead of the Latest Tech News and Investing Trends…

Click here to sign up for Patrick Cox’s free daily tech news digest.

Each day, you get the three tech news stories with the biggest potential impact.

Russia’s Permanent Interests

By Louis-Vincent Gave

Nineteenth century statesman Lord Palmerston famously said that “nations have no permanent friends or allies, they only have permanent interests.” As anyone who has ever opened a history book knows, Russia’s permanent interest has always been access to warm-water seaports. So perhaps we can just reduce the current showdown over Crimea to this very simple truth: there is no way Russia will ever let go of Sevastopol again. And aside from the historical importance of Crimea (Russia did fight France, England and Turkey 160 years ago to claim its stake on the Crimean peninsula), there are two potential reasons for Russia to risk everything in order to hold on to a warm seaport. Let us call the first explanation “reasoned paranoia,” the other “devilish Machiavellianism.”

Reasoned paranoia

Put yourself in Russian shoes for a brief instant: over the past two centuries, Russia has had to fight back invasions from France (led by Napoleon in 1812), an alliance including France, England and Turkey (Crimean War in the 1850s), and Germany in both world wars. Why does this matter? Because when one looks at a map of the world today, there really is only one empire that continues to gobble up territory all along its borders, insists on a common set of values with little discussion (removal of death penalty, acceptance of alternative lifestyles and multi- culturalism…), centralizes economic and political decisions away from local populations, etc. And that empire may be based in Brussels, but it is fundamentally run by Germans and Frenchmen (Belgians have a hard enough time running their own country). More importantly, that empire is coming ever closer to Russia’s borders.

Of course, the European Union’s enlargement on its own could be presented as primarily an economic enterprise, designed mainly to raise living standards in central and eastern Europe, and even to increase the potential of Russia’s neighbors as trading partners. However, this is not how most of the EU leaders themselves view the exercise; instead the EU project is defined as being first political, then economic. Worse yet in Russian eyes, the combination of the EU and NATO expansion, which is what we have broadly seen (with US recently sending fighter jets to Poland and a Baltic state) is a very different proposition, for there is nothing economic about NATO enlargement!

For Russia, how can the EU-NATO continuous eastward expansion not be seen as an unstoppable politico-military juggernaut, advancing relentlessly towards Russia’s borders and swallowing up all intervening countries, with the unique and critical exception of Russia itself? From Moscow, this eastward expansion can become hard to distinguish from previous encroachments by French and German leaders whose intentions may have been less benign than those of the present Western leaders, but whose supposedly “civilizing” missions were just as strong. Throw on top of that the debate/bashing of Russia over gay rights, the less than favorable coverage of its very expensive Olympic party, the glorification in the Western media of Pussy Riot, the confiscation of Russian assets in Cyprus … and one can see why Russia may feel a little paranoid today when it comes to the EU. The Russians can probably relate to Joseph Heller’s line from Catch-22: “Just because you’re paranoid doesn’t mean they aren’t after you.”

Devilish Machiavellianism

Moving away from Russia’s paranoia and returning to Russia’s permanent interests, we should probably remind ourselves of the following when looking at recent developments: 1) Vladimir Putin is an ex-KGB officer and deeply nationalistic, 2) Putin is very aware of Russia’s long-term interests, 3) when the oil price is high, Russia is strong; when the oil price is weak, Russia is weak.

It is perhaps this latter point that matters the most for, away from newspapers headlines and the daily grind of most of our readers, World War IV has already started in earnest (if we assume that the Cold War was World War III). And the reason few of us have noticed that World War IV has started is that this war pits the Sunnis against the Shias, and most of our readers are neither. Of course, the reason we should care (beyond the harrowing tales of human suffering coming in the conflicted areas), and the reason that Russia has a particular bone in this fight, is obvious enough: oil.

Indeed, in the Sunni-Shia fight that we see today in Syria, Lebanon, Iraq and elsewhere, the Sunnis control the purse strings (thanks mostly to the Saudi and Kuwaiti oil fields) while the Shias control the population. And this is where things get potentially interesting for Russia. Indeed, a quick look at a map of the Middle East shows that a) the Saudi oil fields are sitting primarily in areas populated by the minority Shias, who have seen very little, if any, of the benefits of the exploitation of oil and b) the same can be said of Bahrain, where the population is majority Shia.

Now of course, Iran has for decades tried to infiltrate/destabilize Shia Bahrain and the Shia parts of Saudi Arabia, though so far, the Saudis (thanks in part to US military technology) have done a very decent job of holding their own backyard. But could this change over the coming years? Could the civil war currently tearing apart large sections of the Middle East get worse?

At the very least, Putin has to plan for such a possibility which, let’s face it, would very much play to Russia’s long-term interests. Indeed, a greater clash between Iran and Saudi Arabia would probably see oil rise to US$200/barrel. Europe, as well as China and Japan, would become even more dependent on Russian energy exports. In both financial terms and geo-political terms, this would be a terrific outcome for Russia.

It would be such a good outcome that the temptation to keep things going (through weapon sales) would be overwhelming. This is all the more so since the Sunnis in the Middle East have really been no friends to the Russians, financing the rebellions in Chechnya, Dagestan, etc. So having the opportunity to say “payback’s a bitch” must be tempting for Putin who, from Assad to the Iranians, is clearly throwing Russia’s lot in with the Shias. Of course, for Russia to be relevant, and hope to influence the Sunni-Shia conflict, Russia needs to have the ability to sell, and deliver weapons. And for that, one needs ships and a port. Ergo, the importance of Sevastopol, and the importance of Russia’s Syrian port (Tartus, sitting pretty much across from Cyprus).

The questions raised

The above brings us to the current Western perception of the Ukrainian crisis. Most of the people we speak to see the crisis as troublesome because it may lead to restlessness amongst the Russian minorities scattered across Eastern Europe and Central Asia, and tempt further border encroachments across a region that remains highly unstable. This is of course a perfectly valid fear, though it must be noted that, throughout history, there have been few constants to the inhabitants of the Kremlin (or of the Winter Palace before then). But nonetheless, one could count on Russia’s elite to:

a) Care deeply about maintaining access to warm-water seaports and

b) Care little for the welfare of the average Russian

So, it therefore seems likely that the fact that Russia is eager to redraw the borders around Crimea has more to do with the former than the latter. And that the Crimean incident does not mean that Putin will try and absorb Russian minorities into a “Greater Russia” wherever those minorities may be. The bigger question is that having secured Russia’s access to Sevastopol, and Tartus, will Russia use these ports to influence the Shia-Sunni conflict directly, and the oil price indirectly?

After all, with oil production in the US re-accelerating, with Iran potentially foregoing its membership in the “Axis of Evil,” with GDP growth slowing dramatically in emerging markets, with either Libya or Iraq potentially coming back on stream at some point in the future, with Japan set to restart its nukes … the logical destination for oil prices would be to follow most other commodities and head lower. But that would not be in the Russian interest for the one lesson Putin most certainly drew from the late 1990s was that a high oil price equates to a strong Russia, and vice-versa.

And so, with President Obama attempting to redefine the US role in the region away from being the Sunnis’ protector, and mend fences with Shias, Russia may be seeing an opportunity to influence events in the Middle East more than she has done in the past. In that regard, the Crimean annexation may announce the next wave of Sunni-Shia conflict in the Middle East, and the next wave of orders for French-manufactured weapons (as the US has broadly started to disengage itself, France has been the only G8 country basically stepping up to fight in the Saudi corner … a stance that should soon be rewarded with a €2.7bn contract for Crotale missiles produced by Thales and a €2.4bn contract for Airbus to undertake Saudi’s border surveillance). And, finally, the Crimean annexation may announce the next gap higher in oil prices.

In short, buying a straddle option position on oil makes a lot of sense. On the one hand, if the Saudis and the US want to punish Russia for its destabilizing actions, then the way to do it will be to join forces (even if Saudi-US relations are at a nadir right now) and crush the oil price. Alternatively, if the US leadership remains haphazard and continues to broadly disengage from the greater Middle East, then Russia will advance, provide weapons and intelligence to the Shias, and the unfolding Sunni- Shia war will accelerate, potentially leading to a gap higher in oil prices. One scenario is very bullish for risk assets, the other is very bearish! Investors who believe that the US State Department has the situation under control should plan for the former. Investors who fear that Putin’s Machiavellianism will carry the day should plan for the latter (e.g., buy out-of-the-money calls on oil, French defense stocks, Russian oil stocks).

Japan’s Self-Defeating Mercantilism

By Joyce Poon

In the 16 months since Japanese Prime Minister Shinzo Abe launched his bold plan to reflate Japan’s shrinking economy the yen has depreciated by 22% against the dollar, 28% against the euro and 24% against the renminbi. The hope was to stimulate trade and push the current account decisively into the black. Yet the reverse has occurred. Japan’s external position has worsened due to anemic export growth and a spiraling energy import bill: in January it recorded a record monthly trade deficit of ¥2.8trn ($27.4bn). Having eked out a 0.7% current account surplus in 2013, Japan may this year swing into deficit for the first time since 1980. So why is the medicine not working?

The standard response revolves around timing issues: the so called J-curve effect usually means that the boost to exports after a currency devaluation lags the rise in the value of imports by about 12-18 months. In addition, consumers may be busily buying goods ahead of April’s scheduled sales tax increase, temporarily jacking up imports. On a more structural note, there is also the suspicion that exports are not benefitting from the cheaper yen partly because so much production has been pushed offshore.

This may all be true, but there is more to the story than the trade data. After all, a big devaluation has a ricochet effect across the broad economy that changes the outlook for producers, consumers, the government and providers of capital. The transmission mechanism can be thought as working in the following way. Consumers are immediately hit with an implicit “tax” as imported goods cost more, while export-oriented firms get an effective subsidy. In the capital markets, the effect is to lower the value of domestic bonds in foreign currency terms, with the result that yields rise. This means that the cost to the government of financing its deficit rises, forcing a reduction in government spending. As a result of these effects, resources are shifted from the household and government sectors and into the corporate sector. The effect of this resource reallocation should be to boost productivity, which in turn initiates a virtuous circle of rising incomes and ultimately higher consumption.

Unfortunately, Japan defies this textbook paradigm because in addition to devaluing, it is also engaging in massive quantitative easing. This keeps bond yields low, enabling the government to keep financing its deficit at low cost. There is thus no incentive for the government to cut spending— and in fact the consumption tax hike will be offset by even more spending. Furthermore, low bond yields suppress the financial income of household savers.

The end result of all this is that the government bears none of the burden of the adjustment and the household sector bears all of it, through higher import costs and lower financial income. With the household sector’s spending power thus crimped, companies have no incentive to invest in domestically-focused production. Instead, all their investment will be geared toward exports—mercantilism on steroids.

A mercantilist policy can feel like it is working during periods when strong global growth allows excess exports to be absorbed without ruinous price falls. Between 2001 and 2006 the yen devalued by almost 40% on a real effective exchange rate basis and Japan’s current account improved sharply. Japan may not have won back its global competitiveness (its share of the global export pie fell by 1.5 percentage points in the period), but strong external conditions did allow exports to grow 9% a year in dollar terms.

Today, Japanese exporters do not face such benign conditions and any successful mercantilist boost can only come from eating the lunch of rivals.

Since all the leading economies favor policies that support production over consumption, the world is getting more goods than it can absorb. The result is ongoing price declines, which have the effect of deferring the ultimate global recovery.

What this means is that Japan’s ultra-mercantilism is self defeating. In a global environment of weak demand and disinflation any volume increase in its exports will have to be paid for through price reductions. To be sure, in the short term the trade balance is likely to improve somewhat as a result of the J-curve effect taking hold. But in the longer term Japan looks to be entering a cycle where it must run harder just to stand still.

There are a few ways this could all end happily. Japan might embrace a structural reform agenda that boosts productivity, raises wages and pushes up domestic demand. Alternatively, world growth could surprise on the upside, creating a rerun of 2001-06. Energy prices could collapse, closing Japan’s trade deficit and reducing the incentives for mercantilist policy. But we are not holding our breath on any of these possibilities.

Instead, Japan’s most likely path is that the yen keeps falling, the BoJ keeps printing money, and the dollar value of exports stagnates as devaluation and price cuts offset any volume increases. And so, paradoxically, the current account will continue to deteriorate into permanent deficit, despite ultra-mercantilism. At this point the game will have changed in Japan and Abenomics will have manifestly failed to deliver on its stated objectives.

Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.

It’s your opportunity to get the news John Mauldin thinks matters most to your finances.

© 2013 Mauldin Economics. All Rights Reserved.

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to [email protected] to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin’s e-letter, please click here: http://www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Outside the Box and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin’s other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA, SIPC, through which securities may be offered . MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at http://www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor’s services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop.

Should We Really Put Gold in an IRA?

Should We Really Put Gold in an IRA?

By Hard Assets Alliance Team

Jeff Clark, Editor of BIG GOLD

“Gold is one of the dumbest things to put in your IRA,” said the slick TV commentator, with his $200 haircut, perfect white teeth, and superior attitude. “Everyone knows income-producing vehicles are best for an IRA.”

I tried to ignore the prepackaged message from someone who sounded like he hadn’t given any more thought to the topic than what he’d read somewhere. His advice was misleading and incomplete, and I wondered how many viewers might weaken their portfolios by acting on his sound bite.

On one hand, he’s right: the tax-advantaged nature of an IRA makes income-generating assets ideal, especially when you factor in compounding. Gold generates no income.

And there’s another drawback to putting gold in an IRA, one the slick TV journalist probably never even thought of: you lose confidentiality. Gold is one of the last assets in modern society that still offers this advantage—and you’d have to give it up if you stick it in an IRA.

So on a cursory level, one might nod along with the empty suit on TV and conclude that gold should be excluded from a retirement account. But these concerns are only reasons not to hold all your precious metals in an IRA, or have your retirement account be comprised entirely of gold. Indeed, the reasons to put some gold in an IRA have grown—in fact, it might be a major strategic mistake not to have a gold IRA…

A Gold IRA Is a Strategic Portfolio Move

There are solid, core reasons why every investor should have some gold in an IRA. See which of these factors apply to you…

Your IRA is one of your biggest—or only—investment accounts. If an IRA is where most of your investment funds are housed, it may be your only chance to add physical metal to your portfolio.

You want to diversify into a non-financial asset. Think about it: if your retirement account consists of just stocks and bonds, then all of your IRA investments are in paper assets. In today’s world, that’s the pinnacle of risk.

Tax-advantaged growth. As with any asset, gains can compound tax-deferred inside an IRA (or tax-free in a Roth). The additional advantage with precious metals is that you can shift the allocation and not trigger a taxable event—for example, if you wanted to lighten up on gold to buy some silver.

Retirement inflation hedge. To have no inflation hedge in a retirement portfolio seems especially shortsighted in today’s monetary environment. Remember, regardless of what the “profit” column shows on your statement each year, those gains have to be adjusted for inflation—you’re eventually going to spend some of that money, after all. A dividend mutual fund yielding 2%, for example, nets you nothing after accounting for the current rate of inflation. And the further away you are from withdrawing the funds, the longer inflation is eating away at your account value. The answer is to utilize one of the best inflation hedges known to man.

If you share our concern about the consequences of global fiscal and monetary excesses, holding some physical precious metals inside a retirement vehicle is a prudent move. The Hard Assets Alliance provides that service. As you’ll see below, the Hard Assets Alliance just opened the door to international storage for IRA holders.

But first, why should we use the Hard Assets Alliance and not one of the other programs you might see advertised? Well, for the same reason we no longer start our cars with a crankshaft…

The Horse-and-Buggy Industry of the 21st Century

The process to set up a gold IRA has traditionally been slow and cumbersome. US law requires that IRA assets be held at a trust company to ensure proper tax reporting and recordkeeping. However, most gold dealers are not trust companies. For them to offer physical gold IRAs, they must partner with a trust company that’s willing to hold physical gold.

So when a gold dealer offers to purchase gold within an IRA, the process for the investor looks like this:

- Open an account with a gold dealer

- Open a separate IRA account with a trust firm (usually done via snail mail)

- Fund your account with the trust

- Request a purchase of metals from your chosen vendor

- Wait for funds to transfer and your order to settle

This procedure takes 30-45 days—it still takes a month, even if you already have an IRA or a relationship with a dealer. Further, dealers typically charge high fees when purchasing gold for an IRA. And when you want to sell or take a distribution, get ready for more paperwork, verification checks, and shipping fees, all of which take another 2-3 weeks.

This “manual” process has led to lengthy delays, unexpected costs, and never-ending frustrations. Check out some of the common complaints IRA holders have had with this antiquated system…

- IRA transfers can take up to 30 days to execute, depending on the follow-up procedures of the custodian.

- Deposit confirmations are not always sent to the client in a timely manner and are not automated.

- Clients cannot lock in an order until the custodian verifies the cash balance with the dealer, exposing them to market risk.

- The purchasing process typically takes 8-10 business days to settle.

- Metals must be shipped to the custodian’s vaulting facility, and the IRA holder is responsible for those costs.

- Deliveries to the vaulting location may not be tracked by the custodian, nor are the deliveries compared to the order invoice for accuracy of delivery. This has been a growing concern by investors.

- Limited storage options. Most custodians only offer one or two storage locations, and most of those are in Delaware.

- The sell process is costly, cumbersome, and time consuming.

- Poor customer service is one of the biggest complaints. When the client has questions about his IRA or order, the dealer refers him back to the custodian—and the custodian refers him back to the dealer! The client is often passed around without ever getting his questions answered.

This doesn’t sound fun. Fortunately, the Hard Assets Alliance has completely changed how business is done with gold IRAs…

The New “Gold” Standard in IRAs

HAA’s program has streamlined the entire gold/IRA process and greatly reduces the time and hassle to open an account. In most cases, you can do everything online. It’s a breakthrough service, and we want to highlight it now, before the April 15 deadline, so you can still make a 2013 contribution.

The Hard Assets Alliance IRA reduces both time and hassle. The online platform lets you electronically create an IRA account and a trust account simultaneously. Entrust, a well-known custodian, provides the trust account, and it receives your application in real time. In most cases, it takes only 10-15 minutes to open a traditional or Roth IRA account; SEP and SIMPLE accounts take about one to two weeks to process, and Entrust will work with you to facilitate transfers. The process is straightforward and user-friendly.

Further, there are no additional fees to purchase or sell precious metals within a Hard Assets Alliance IRA. And like all Hard Assets Alliance products, all buying and selling can be done online.

As far as we know, this is the only fully automated online IRA trading system to offer physical precious metals.

The process is straightforward. You open an IRA account at the Hard Assets Alliance, and your application is automatically sent to Entrust. The submittal process takes about five minutes, and once approved, you can fund your account. An additional form is required for SEP and SIMPLE accounts. You can also fund your account by transferring a full or partial existing 401k into a Hard Assets Alliance IRA.

If you’re already a Hard Assets Alliance customer, you can create a separate IRA account using your existing username and password, and toggle between accounts.

The Hard Assets Alliance portal will notify you electronically once you’re approved (typically within two business days), and then you can fund your account. All funds go directly to Entrust since it’s the custodian. Upon receipt, it notifies the Hard Assets Alliance of your deposit, and your funds are available to purchase metal the next business day. It also takes care of all reporting, including tax statements.

The Hard Assets Alliance makes buying (and selling) easy; it’s all done online at your convenience, and comes with industry-low commissions since your order is bid out to a network of dealers. Further, only IRA-permissible bars and coins are displayed for purchase. The rules can get a tad complicated—that’s been another hazard: buy the wrong form of gold for a retirement vehicle, and you risk invalidating the entire IRA, triggering an unwelcome taxable event. No worries with the Hard Assets Alliance.

And Now You Can Store Your IRA Gold in Zurich

Until now, foreign gold storage for IRAs, while available for US investors, has been a tedious process, with the setup requiring a good deal of time, paperwork, and expense. However, the Hard Assets Alliance just announced that its vault in Zurich, Switzerland can be used to store Gold Eagles (only) in an IRA with the same ease and convenience of a US IRA. This gives us an international storage option for our gold—and in one of the strongest jurisdictions to boot.

This is a breakthrough offering in the industry—one you won’t find elsewhere. The minimum for this vault is $10,000 (the Hard Assets Alliance only requires $5,000 for US storage). If you don’t meet the minimum, open an account and fund it over time with a monthly direct deposit. By opening your account now, it can be ready to go when you are.

The reasons to put some gold in an IRA are mounting. And with the Hard Assets Alliance, we can avoid the VHS-tape versions of the industry and jump straight to Blu-ray. I encourage you not to put off making this strategic move for your retirement account.

Disclaimer

The Hard Assets Alliance website and the SmartMetals Investor are published by Hard Assets Alliance, LLC. Information contained in such publications is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The information contained in such publications is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. The information in such publications may become outdated, and there is no obligation to update any such information.

Any Hard Assets Alliance publication or website and its content and images, as well as all copyright, trademark, and other rights therein, are owned by Hard Assets Alliance, LLC. No portion of any Hard Assets Alliance publication or website may be extracted or reproduced without permission of Hard Assets Alliance, LLC. Nothing contained herein shall be construed as conferring any license or right under any copyright, trademark, or other right of Hard Assets Alliance, LLC. Unauthorized use, reproduction, or rebroadcast of any content of any Hard Assets Alliance publication or website is prohibited and shall be considered an infringement and/or misappropriation of the proprietary rights of Hard Assets Alliance, LLC.

Hard Assets Alliance, LLC reserves the right to cancel any subscription at any time. Cancellation of a subscription may result from any unauthorized use or reproduction or rebroadcast of any Hard Assets Alliance publication or website, any infringement or misappropriation of Hard Assets Alliance, LLC’s proprietary rights, or any other reason determined in the sole discretion of Hard Assets Alliance, LLC.

Affiliate Notice: Hard Assets Alliance has affiliate agreements in place that may include fee sharing. If you have a website or newsletter and would like to be considered for inclusion in the Hard Assets Alliance affiliate program, please contact us. Likewise, from time to time Hard Assets Alliance may engage in affiliate programs offered by other companies, though corporate policy firmly dictates that such agreements will have no influence on any product or service recommendations, nor alter the pricing that would otherwise be available in absence of such an agreement. As always, it is important that you do your own due diligence before transacting any business with any firm, for any product or service.

© 2014 Hard Assets Alliance, LLC.

Yes, You Are Being Manipulated by Your Government

Yes, You Are Being Manipulated by Your Government

The truth that government agents are influencing people online has been visible for some time to those who were looking. For example, in 2011, we got proof that military contractors and the US Air Force were doing this. (See here and here.) There were other facts as well, including the publicly-stated wishes of Cass Sunstein.

Most people didn’t see those stories, of course, and those who mentioned them were thought to be crazy. “If it was true, we’d have heard about it!”

In early February, however, we got serious proof, courtesy of Edward Snowden and Glen Greenwald. Honestly, I expected this to be a big story, like many of the previous Snowden leaks. Instead, the story went almost nowhere. The “news” simply refused to cover it. And while the story did run on a few websites, I don’t know of it running in any major newspaper or on any TV news, except perhaps RT, the Russian 24/7 English-language news channel. (NBC did run a prior and less troubling story.)

But, we have the slides, and we now know what the NSA and its British partner, GCHQ, are doing to us.

The Manipulations You Pay For

Let’s start with this direct quote from the GCHQ on two tactics of their JTRIG (Joint Threat Research Intelligence Group) program:

(1) to inject all sorts of false material onto the Internet in order to destroy the reputation of its targets; and

(2) to use social sciences and other techniques to manipulate online discourse and activism to generate outcomes it considers desirable.

Here’s their slide for training agents how to discredit people:

These are their tactics for discrediting companies:

Here’s just one more, listing the tricks they use to manipulate people:

So…

So, this is where we are. All the Anglosphere governments are – RIGHT NOW – building systems to manipulate us 24/7.

Please understand that it is far, far easier and cheaper for computers to do this work than to have actual humans at keyboards. And thousands of amoral engineers and psychologists are currently selling us out for mere paychecks, by programming computers to do just that.

If there is one message that I’d like to get across on this subject, it is this:

Your rulers are immoral, rapacious, and unrestrained. They are building a hell for you and your children right now.

I’m sorry if that seems strong, but speaking the truth leaves me no option.

Big Brother did not come with elections and clear choices; it came riding on the usual human weaknesses: fear, greed, and servility.

Paul Rosenberg

[Editor’s Note: Paul Rosenberg is the outside-the-Matrix author of FreemansPerspective.com, a site dedicated to economic freedom, personal independence and privacy. He is also the author of The Great Calendar, a report that breaks down our complex world into an easy-to-understand model. Click here to get your free copy.]

Planet ‘Murka

Planet Fitness’s Judgement Free Zone is bullsh!t. No judgement allowed unless of course they are the ones doing the judging. You’re too strong, training too hard, too fit, breathing too heavy. God forbid a fit person doing an intense workout is in your vicinity and may breathe heavily; can’t have someone making you feel guilty for being a fat, slazy slob while you walk on the treadmill for 5 mins thinking you just “earned” a baker’s dozen worth of donuts.

When I read about “Planet Fitness” I find it hard not to laugh. It is gym for people that are mediocre at best, looking to perpetuate their mediocrity while persecuting and mocking people who might be seeking improvement or excellence because it makes the sloths feel inadequate. Switch the word gymn with country and you’ve got a pretty good description of the US(S)A. It has to be the stupidest gymn in the US. Not coincidently it is also the the fastest growing.

Reminds me of another post a friend forwarded me on “Thin Privilege and Fat Logic”. If you are interested it can be found HERE.

Gym tells woman to cover up because her toned body ‘intimidated’ others

The Planet Fitness gym in Richmond, California is standing behind their dress code policy after one member claimed that she was told to put a shirt over her intimidatingly toned body.

As reported by KTVU Channel 2, Tiffany Austin was recovering from a car accident and getting back in shape with her first workout at the gym. However, her time exercising was cut short when a Planet Fitness employee stopped her. Austin explained, “She says, you know, ‘Excuse me, we’ve had some complaints. You’re intimidating people with your toned body. So can you put on a shirt?’”

Ms. Austin was wearing a spaghetti strap tank top and capri pants with her midriff exposed, and she doesn’t think her attire was out of line. “I don’t feel like it’s anything crazy, but I mean you tell me if it’s burning your eyes,” Austin said with a laugh. Reportedly she was only told that the gym dress code prohibited wearing string tank tops. The Planet Fitness customer agreed to wear one of the shirts the gym provides patrons for free, but while she waited for the tee, another employee approached her with objections to her clothing. Feeling harassed and intimidated herself, Austin decided to get her money back and cancel her membership at the gym advertised as the “Judgement Free Zone” whose policy bans “gymtimidation.” McCall Gosselin, Planet Fitness spokesperson, said that criticizing Austin for being toned, “…is not in line with the Planet Fitness policy whatsoever.”

Planet Fitness in Richmond, CA (KTVU)

According to their website, Planet Fitness’ philosophy of a Judgement Free Zone, “means members can relax, get in shape, and have fun without being subjected to the hard-core, look-at-me attitude that exists in too many gyms.” It’s a policy that is attractive to many Americans. With over 5million members, Chris Rondeau, the co-founder and chief executive, says the gym chain is the fastest growing in the U.S. “It’s unfair to like, show off your body and that’s what they don’t want,” said a gym-goer to KTVU. Yahoo! Odd News made a call to the Richmond, California Planet Fitness and was told that while the dress code is not available on the gym’s website, signs within the gym explain the policy.

Director of the Athletic Studies Center at UC Berkeley, Derek Van Rheenen, told the station, “In a lot of ways I actually think what Planet Fitness is doing is a positive thing. I think they obviously need to iron out some of these issues. But you know, sport in the United States is by nature discriminatory. It is selective. It is elitist.”

The Planet Fitness website (Planet Fitness)

Planet Fitness does have its detractors who say that some of their policies go too far. In November 2006 Albert Argibay was removed by police from the Planet Fitness in Wappingers Falls, NY. Reportedly, Argibay had broken the gym’s rule of no grunting, though he says that he was just breathing heavily. The no grunting policy may be what Planet Fitness is most known for. The gym sounds its “lunk alarm,” a siren and flashing lights, whenever a gym-goer is found displaying lunk-like behavior. Posters are said to define a lunk as “one who grunts, drops weights, or judges.”

Albert Argibay (Susan Stava/The New York Times)

With membership rates that start at just $10 per month, and monthly pizza nights and bagel breakfasts, the gym chain is likely to keep attracting their target demographic of occasional exercisers.

RAND PAUL GETS STANDING OVATION AT LEFT-WING CAL BERKELEY

BERKELEY, Calif.—Sen. Rand Paul delivered a blistering critique of America’s spy agencies on Wednesday, likening the surveillance state to the “dystopian nightmares” of literature and arguing that a growing number of his colleagues on Capitol Hill now fear an intelligence apparatus that is “drunk with power.”

“If you have a cell phone, you are under surveillance,” Paul warned an auditorium of more than 350 at the University of California (Berkeley), adding, “I believe what you do on your cell phone is none of their damned business.”

He demanded stronger oversight, calling for a new, bipartisan select committee to monitor the nation’s intelligence agencies. “It should watch the watchers,” he said.

Paul said the National Security Agency and the Central Intelligence Agency have run amok. The intelligence world, he said, had wrongly interpreted that “equal protection means Americans should be spied upon equally.”

“I oppose this abuse of power with every ounce of energy I have,” Paul declared.

“I find it ironic that the first African-American president has, without compunction, allowed this vast exercise of raw power from the NSA,” Paul said. “Certainly, J. Edgar Hoover’s illegal spying on Martin Luther King and others in the civil-rights movement should give us all pause.”

MADOFF: SCHUMER WOULD COME TO HIS OFFICE TO COLLECT “CONTRIBUTIONS”

Good article about Madoff in Politico called: Bernie Madoff speaks: Politics, remorse and Wall Street

Here are a few juicy tidbits:

- Madoff described in detail the “never ending” fund raising solicitations from politicians, and was harshly critical of President Barack Obama, even though he said he voted for him in 2008. The politician he said he admires the most is Sen. Ron Wyden, the Oregon Democrat.

- He warned that he is sure there are other “bad players like myself” getting away with another massive Ponzi scheme. And he offered one piece of advice to investors: Stay away from the stock market.

- Madoff and his wife Ruth made several hundreds of thousands of dollars in political donations since the 1990s, according to Federal Election Commission records. The recipients were mostly Democrats, and the roster included Sen. Chuck Schumer, ex-New Jersey Gov. Jon Corzine, Rep. Joseph Crowley, Sen. Jeff Merkley and Hillary Clinton during her Senate bid.

- Madoff said Schumer, whom he described as a “personable guy,” would ask him for money a couple of times a year. “They would come up [to Madoff’s office] just to say hello and collect the money,” he said. Approached in a Senate hallway last week, Schumer seemed willing to talk to a reporter — until the subject of Madoff came up. “I’m not commenting,” the New York Democrat said as he walked away. “I am not commenting.”

- Even though he’s donated to Clinton, Madoff doesn’t think she would make a good president. “I certainly wasn’t impressed with her as secretary of state,” he says. “Our foreign policy is a mess.” Madoff voted for Obama in 2008, but now says he is “terribly disappointed” in the president and would not have voted for him a second time. “His policies are too socialist.”

Read more: http://www.politico.com/story/2014/03/bernie-madoff-interview-104838.html#ixzz2wWMySMQt

Busted! – U.S. Tech Giants Knew Of NSA Spying Says Agency’s Senior Lawyer

Submitted by Michael Krieger of Liberty Blitzkrieg blog,

This is why I’ve been so confused and frustrated by the repeated reports of the behavior of the US government. When our engineers work tirelessly to improve security, we imagine we’re protecting you against criminals, not our own government.

The US government should be the champion for the internet, not a threat. They need to be much more transparent about what they’re doing, or otherwise people will believe the worst.

I’ve called President Obama to express my frustration over the damage the government is creating for all of our future. Unfortunately, it seems like it will take a very long time for true full reform.

So it’s up to us — all of us — to build the internet we want. Together, we can build a space that is greater and a more important part of the world than anything we have today, but is also safe and secure. I‘m committed to seeing this happen, and you can count on Facebook to do our part.

– Facebook CEO, Mark Zuckerberg in a post last week

Last week, Mark Zuckerberg made headlines by posting about how he called President Barack Obama to express outrage and shock about the government’s spying activities. Of course, anyone familiar with Facebook and what is going on generally between private tech behemoths and U.S. intelligence agencies knew right away that his statement was one gigantic heap of stinking bullshit. Well now we have the proof.

Earlier today, the senior lawyer for the NSA made it completely clear that U.S. tech companies were fully aware of all the spying going on, including the PRISM program (on that note read my recent post: The Most Evil and Disturbing NSA Spy Practices To-Date Have Just Been Revealed).

So stop the acting all of you Silicon Valley CEOs. We know you are fully on board with extraordinary violations of your fellow citizens’ civil liberties. We know full well that you have been too cowardly to stand up for the values this country was founded on. We know you and your companies are compromised. Stop pretending, stop bullshitting. You’ve done enough harm.

From The Guardian:

The senior lawyer for the National Security Agency stated unequivocally on Wednesday that US technology companies were fully aware of the surveillance agency’s widespread collection of data, contradicting month of angry denials from the firms.

Rajesh De, the NSA general counsel, said all communications content and associated metadata harvested by the NSA under a 2008 surveillance law occurred with the knowledge of the companies – both for the internet collection program known as Prism and for the so-called “upstream” collection of communications moving across the internet.

Asked during at a Wednesday hearing of the US government’s institutional privacy watchdog if collection under the law, known as Section 702 or the Fisa Amendments Act, occurred with the “full knowledge and assistance of any company from which information is obtained,” De replied: “Yes.”

When the Guardian and the Washington Post broke the Prism story in June, thanks to documents leaked by whistleblower Edward Snowden, nearly all the companies listed as participating in the program – Yahoo, Apple, Google, Microsoft, Facebook and AOL –claimed they did not know about a surveillance practice described as giving NSA vast access to their customers’ data. Some, like Apple, said they had “never heard” the term Prism.

The disclosure of Prism resulted in a cataclysm in technology circles, with tech giants launching extensive PR campaigns to reassure their customers of data security and successfully pressing the Obama administration to allow them greater leeway to disclose the volume and type of data requests served to them by the government.

The NSA’s Wednesday comments contradicting the tech companies about the firms’ knowledge of Prism risk entrenching tensions with the firms NSA relies on for an effort that Robert Litt, general counsel for the director of national intelligence, told the board was “one of the most valuable collection tools that we have.”

Move along serfs, move along.

Full article here.

OBAMACARE PREMIUMS TO DOUBLE OR TRIPLE NEXT YEAR

Article via The Hill

O-Care premiums to skyrocket

By Elise Viebeck

Health industry officials say ObamaCare-related premiums will double in some parts of the country, countering claims recently made by the administration.

The expected rate hikes will be announced in the coming months amid an intense election year, when control of the Senate is up for grabs. The sticker shock would likely bolster the GOP’s prospects in November and hamper ObamaCare insurance enrollment efforts in 2015.

The industry complaints come less than a week after Health and Human Services (HHS) Secretary Kathleen Sebelius sought to downplay concerns about rising premiums in the healthcare sector. She told lawmakers rates would increase in 2015 but grow more slowly than in the past.“The increases are far less significant than what they were prior to the Affordable Care Act,” the secretary said in testimony before the House Ways and Means Committee.

Her comment baffled insurance officials, who said it runs counter to the industry’s consensus about next year.

“It’s pretty shortsighted because I think everybody knows that the way the exchange has rolled out … is going to lead to higher costs,” said one senior insurance executive who requested anonymity.

The insurance official, who hails from a populous swing state, said his company expects to triple its rates next year on the ObamaCare exchange.

The hikes are expected to vary substantially by region, state and carrier.

Areas of the country with older, sicker or smaller populations are likely to be hit hardest, while others might not see substantial increases at all.

Several major companies have been bullish on the healthcare law as a growth opportunity. With investors, especially, the firms downplay the consequences of more older, sicker enrollees in the risk pool.

Much will depend on how firms are coping with the healthcare law’s raft of new fees and regulatory restrictions, according to another industry official.

Some insurers initially underpriced their policies to begin with, expecting to raise rates in the second year.

Others, especially in larger states, will continue to hold rates low in order to remain competitive.

After this story was published, the administration pointed to some independent analyses that have cast doubt on whether the current mix of enrollees will lead to premium hikes.ObamaCare also includes several programs designed to ease the transition and stave off premium increases. Reinsurance, for example, will send payments to insurers to help shoulder the cost of covering sick patients.

But insurance officials are quick to emphasize that any spikes would be a consequence of delays and changes in ObamaCare’s rollout.

They point out that the administration, after a massive public outcry, eased their policies to allow people to keep their old health plans. That kept some healthy people in place, instead of making them jump into the new exchanges.

Federal health officials have also limited the amount of money the government can spend to help insurers cover the cost of new, sick patients.

Perhaps most important, insurers have been disappointed that young people only make up about one-quarter of the enrollees in plans through the insurance exchanges, according to public figures that were released earlier this year. That ratio might change in the weeks ahead because the administration anticipates many more people in their 20s and 30s will sign up close to the March 31 enrollment deadline. Many insurers, however, don’t share that optimism.

These factors will have the unintended consequence of raising rates, sources said.

“We’re exasperated,” said the senior insurance official. “All of these major delays on very significant portions of the law are going to change what it’s going to cost.”

“My gut tells me that, for some people, these increases will be significant,” said Bill Hoagland, a former executive at Cigna and current senior vice president at the Bipartisan Policy Center.

Hoagland said Sebelius was seeking to “soften up the American public” to the likelihood that premiums will rise, despite promises to the contrary.

Republicans frequently highlight President Obama’s promise on the campaign trail to enact a healthcare law that would “cut the cost of a typical family’s premium by up to $2,500 a year.”

“They’re going to have to backpedal on that,” said Hoagland, who called Sebelius’s comment a “pre-emptive strike.”

“This was her way of getting out in front of it,” he added.

HHS didn’t comment for this article.

Insurers will begin the process this spring by filing their rate proposals with state officials.

Insurance commissioners will then release the rates sometime this summer, usually when they’re approved. Insurers could also leak their rates earlier as a political statement.

In some states, commissioners have the authority to deny certain rate increases, which could help prevent the most drastic hikes.

Either way, there will be a slew of bad headlines for the Obama administration just months before the election.

“It’s pretty bad timing,” said one insurance official.

Other health experts say predictions about premiums are premature.

David Cutler, who has been called an architect of Obama-Care, said, “Health premiums increase every year, so the odds are very good that they will increase next year as well. None of that is news. The question is whether it will be a lot or a little. That depends in part on how big the insurers think the exchanges will be.”

Jon Gruber, who also helped design the Affordable Care Act, said, “The bottom line is that we just don’t know. Premiums were rising 7 to 10 percent a year before the law. So the question is whether we will see a continuation of that sort of single digit increase, as Sebelius said, or whether it will be larger.”

The White House and its allies have launched a full-court press to encourage healthy millennials to purchase coverage on the marketplaces.

HHS announced this week that sign-ups have exceeded 5 million, a marked increase since March 1.

White House press secretary Jay Carney on Tuesday claimed the administration has picked up the pace considerably, saying months ago reporters would have laughed if he “had said there would be 5 million enrollees by March 18.”

It remains unclear how many of those enrollees lost their insurance last year because of the law’s mandates. Critics have also raised questions about how the administration is counting people who signed up for insurance plans.

Political operatives will be watching premium increases this summer, most notably in states where there are contested Senate races.

In Iowa, which hosts the first presidential caucus in the nation and has a competitive Senate race this year, rates are expected to rise 100 percent on the exchange and by double digits on the larger, employer-based market, according to a recent article in the Business Record.

Sheila Timmons contributed.

Read more: http://thehill.com/blogs/healthwatch/health-reform-implementation/201136-obamacare-premiums-are-about-to-skyrocket#ixzz2wVSebMm1

Follow us: @thehill on Twitter | TheHill on Facebook