Before the Fed was created, people didn't say "adjusted for inflation" much. pic.twitter.com/Ey3VJrHBpa

— Rudy Havenstein, wearing a jetpack near LAX. (@RudyHavenstein) August 19, 2020

Tag: End The Fed

“Irresponsible” Fed Policy Poses This Dual Threat to Retirement Savings

From Birch Gold Group

The health of retirement accounts could soon take a big blow, thanks to a combination of rising price inflation and recent monetary policy issued by the Federal Reserve.

First, let’s shine a light on the Fed monetary policy…

According to an article on the Financial Times, long-term savers will likely reach desperation in the near future, thanks to near-zero 10-year bond rates:

Continue reading ““Irresponsible” Fed Policy Poses This Dual Threat to Retirement Savings”

David Stockman: The Biggest Threat to Your Prosperity and What You Can Do

If you want to understand America’s dangerously deepening travails, you have to start at the Federal Reserve’s Eccles Building.

After a 30-year rolling coup d’etat, its occupants have imposed a regime of destructive falsification on America’s financial, economic, political, and social life.

It has become the heart of mushrooming darkness taking prosperity, liberty, and democracy down for the count.

Continue reading “David Stockman: The Biggest Threat to Your Prosperity and What You Can Do”

Will the Federal Reserve Cause the Next Riots?

Guest Post by Ron Paul

Federal Reserve Chair Jerome Powell and San Francisco Fed President Mary Daly both recently denied that the Federal Reserve’s policies create economic inequality. Unfortunately for Powell, Daly, and other Fed promoters, a cursory look at the Fed’s operations shows that the central bank is the leading cause of economic inequality.

Continue reading “Will the Federal Reserve Cause the Next Riots?”

The Federal Reserve is Getting Desperate

Guest Post by Ron Paul

In a sign that the Federal Reserve is growing increasingly desperate to jump-start the economy, the Fed’s Secondary Market Credit Facility has begun purchasing individual corporate bonds. The Secondary Market Credit Facility was created by Congress as part of a coronavirus stimulus bill to purchase as much as 750 billion dollars of corporate credit. Until last week, the Secondary Market Credit Facility had limited its purchases to exchange-traded funds, which are bundled groups of stocks or bonds.

HOW SOCIETIES GET DESTROYED

Oh, and what really crushed the bottom 50% and accelerated the top 1% in the last 10 years?

What changed?

Low rates and QE.Fed induced asset price inflation. So screw Powell for denying the Fed has anything to do with wealth inequality.

He's lying.— Sven Henrich (@NorthmanTrader) June 2, 2020

The Federal Reserve: More Lethal than Coronavirus

Guest Post by Ron Paul

Last week the Federal Reserve announced it will keep interest rates at or near zero until the economy recovers from the government-imposed shutdown. Following this announcement, Federal Reserve Chairman Jerome Powell urged Congress and the Trump administration to put aside any concerns about the deficit and spend whatever it takes to stimulate the economy and combat coronavirus.

The Federal Reserve previously announced it would make unlimited purchases of Treasury securities, thus encouraging Congress and the president to increase spending and debt. With some members of Congress talking about another multi-trillion-dollar stimulus bill, and with President Trump proposing a two trillion dollars infrastructure plan as a way to get Americans back to work, it is obvious, and not surprising, that Congress and President Trump gleefully agree with Powell’s advice.

Continue reading “The Federal Reserve: More Lethal than Coronavirus”

Broken System

Guest Post by Sven Henrich

The Fed poisons everything, and I mean everything. From markets, the economy, and I will even go as far as politics. Sounds far fetched? Let me make my case below. But as much as the Fed poisons everything this crisis here again reveals a larger issue: The system is completely broken, it can’t sustain itself without the Fed’s ever more monumental interventions. These interventions are absolutely necessary or the system collapses under its own broken facade. And this conflict, a Fed poisoning the economy’s growth prospects on the one hand, and its needed presence and actions to keep the broken system afloat on the other, has the economy and society on a mission to circle a perpetual drain.

So how does the Fed poison everything?

Let’s start with the Fed actual process of working towards its stated mission: Full employment and price stability.

How does it do that? Well, for the last 20 years mainly by extremely low interest rates and balance sheet expansion sprinkled with an enormous amount of jawboning. The principle effect: Asset price inflation.

Third Major Transfer From The Middle Class To The Wealthy In 20 Years

Authored by Mike Shedlock via MishTalk,

The Fed is robbing the middle class once again…

For the third time in 20 years, the Fed has targeted the middle class for the benefit of the wealthy.

Continue reading “Third Major Transfer From The Middle Class To The Wealthy In 20 Years”

How to Think About the Fed Now

Guest Post by Jeff Geist

The Great Crash of 2020 was not caused by a virus. It was precipitated by the virus, and made worse by the crazed decisions of governments around the world to shut down business and travel. But it was caused by economic fragility. The supposed greatest economy in US history actually was a walking sick man, made comfortable with painkillers, and looking far better than he felt—yet ultimately fragile and infirm. The coronavirus pandemic simply exposed the underlying sickness of the US economy. If anything, the crash was overdue.

FEDERAL RESERVE HQ

Congrats Fed. Your insanity has no longer just make you a laughing stock within the financial industry, but with the everyday American. The confidence game is up. pic.twitter.com/KZmpdOprKY

— Quoth the Raven (@QTRResearch) April 19, 2020

THE ROAD TO PERDITION IS PAVED WITH EVIL INTENTIONS – A FINAL RECKONING

In Part 1 of this article I pointed out how we have allowed ourselves to be cowed by authoritarian “experts” who have proven to be nothing but incompetent and wrong every step of the way, while the financiers have used the crisis once again to pillage the citizens as they did in 2008/2009.

The absurdity of shutting down this country based on academic death models that make economist and climatologist models look highly accurate in comparison, can be seen in the ludicrousness of the following chart. And realize we did this on purpose because of a virus that will kill .018% of the U.S. population. And most of those deaths will occur in several highly dense urban enclaves, with the rest of the country barely affected.

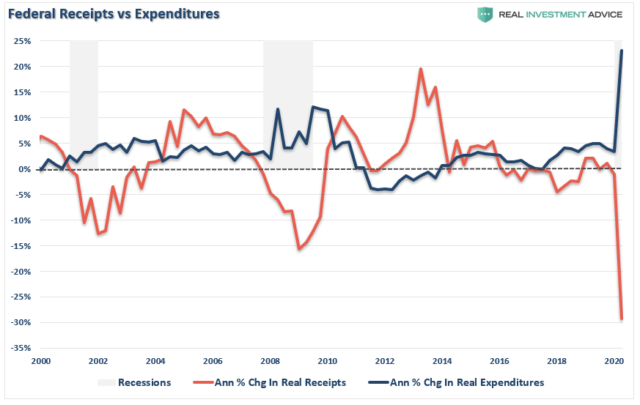

By shutting down the country the government has crushed virtually every business in the country and putting tens of millions out of work, with resulting crash in tax revenues at the Federal, State and Local level. At the same time, Trump and everyone in Congress have become Bernie Sanders socialists, except most of it is corporate socialism. The deficit was already on track to top $1.2 trillion, but with the $2.2 trillion stimulus package, and more to come, the deficit this year and next will approach $3 trillion.

“It has been more profitable for us to bind together in the wrong direction than to be alone in the right one. Those who have followed the assertive idiot rather than the introspective wise person have passed us some of their genes. This is apparent from a social pathology: psychopaths rally followers.” ― Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable

Continue reading “THE ROAD TO PERDITION IS PAVED WITH EVIL INTENTIONS – A FINAL RECKONING”

Will Coronavirus End the Fed?

Guest Post by Ron Paul

September 17, 2019 was a significant day in American economic history. On that day, the New York Federal Reserve began emergency cash infusions into the repurchasing (repo) market. This is the market banks use to make short-term loans to each other. The New York Fed acted after interest rates in the repo market rose to almost 10 percent, well above the Fed’s target rate.

The New York Fed claimed its intervention was a temporary measure, but it has not stopped pumping money into the repo market since September. Also, the Federal Reserve has been expanding its balance sheet since September. Investment advisor Michael Pento called the balance sheet expansion quantitative easing (QE) “on steroids.”

The Fed Can’t Fix What’s Broken

Authored by Lance Roberts via RealInvestmentAdvice.com,

The Federal Reserve is poised to spray trillions of dollars into the U.S. economy once a massive aid package to fight the coronavirus and its aftershocks is signed into law. These actions are unprecedented, going beyond anything it did during the 2008 financial crisis in a sign of the extraordinary challenge facing the nation.” – Bloomberg

Currently, the Federal Reserve is in a fight to offset an economic shock bigger than the financial crisis, and they are engaging every possible monetary tool within their arsenal to achieve that goal. The Fed is no longer just a “last resort” for the financial institutions, but now are the lender for the broader economy.

There is just one problem.

FED POLICY

How the Fed Created an Uncontrollable “Monster” for the Markets

From Birch Gold Group

Like Victor Frankenstein, the Fed may have created its own monster. It’s been called many things, such as Quantitative Easing (QE), QE Lite, QE/Not QE, “Organic” Balance Sheet Growth, and more.

But no matter what you choose to call it, the bottom line is this:

The Fed is growing its official balance sheet at a frantic pace to provide liquidity to various banking operations, including the repo markets.

In fact, the balance sheet has grown about $400 billion since August, as reflected in the uptick at the far right of this chart:

Continue reading “How the Fed Created an Uncontrollable “Monster” for the Markets”