Guest Post by Mark Nestmann

Earlier this month, the Federal Register published its quarterly list of former US citizens and permanent residents who have “expatriated,” i.e., given up their US citizenship or permanent residence. The published data comes from the IRS, which has tracked expatriation trends since 1998.

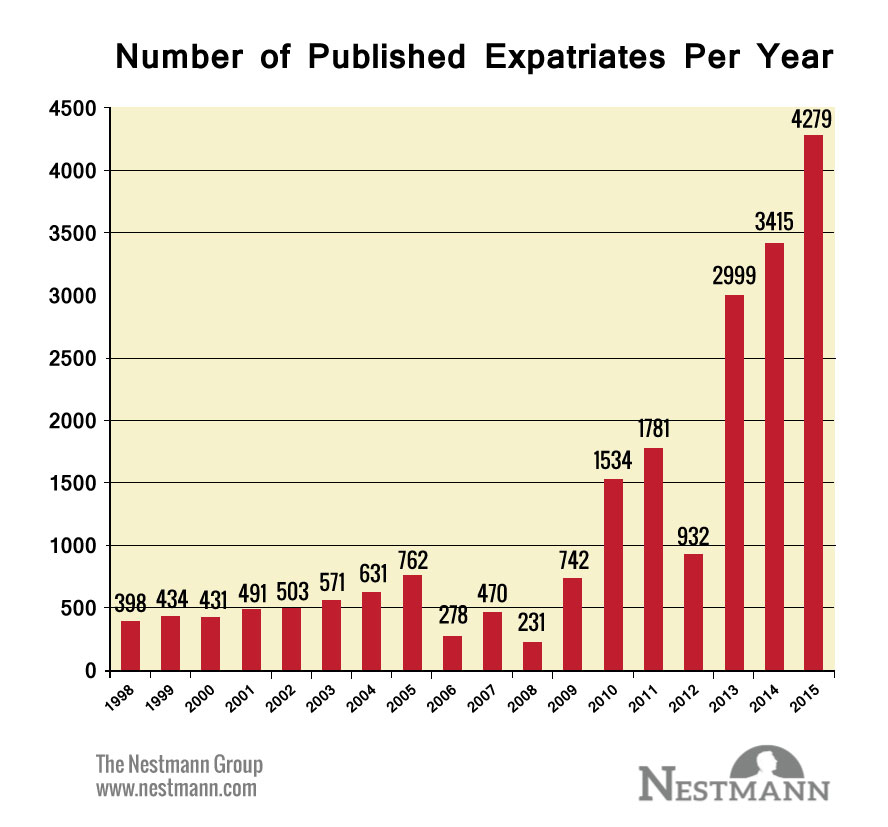

The number of people bidding adieu to the red, white, and blue for the fourth quarter of 2015 came to 1,058. For all of 2015, the total came to 4,279. This was an all-time record, beating the former record set in 2014 (3,415 expatriates) by 25%.

Here’s a chart of expatriation trends since 1998, after a law took effect in 1996 requiring the IRS to publish this data quarterly in the Federal Register.

What could lead someone to take the admittedly radical step of severing official ties to Uncle Sam? The mainstream media report the culprit is tax. Tax is a factor, but hardly the only one. But it’s certainly a place to start.

US citizens and permanent residents must pay US tax on their worldwide income, even if they live permanently outside the country. The US is one of only two countries with this policy. The other is the one-party dictatorship of Eritrea. (Ironically, until 2013, the State Department’s annual report on human rights throughout the world condemned Eritrea for this policy.)

As the old adage goes, “Do as I say, not as I do,” or more simply, “Might makes right.”

Continue reading “Is this only for “tax cheats” and “moochers”?”