Guest Post by Mark Nestmann

Earlier this month, the Federal Register published its quarterly list of former US citizens and permanent residents who have “expatriated,” i.e., given up their US citizenship or permanent residence. The published data comes from the IRS, which has tracked expatriation trends since 1998.

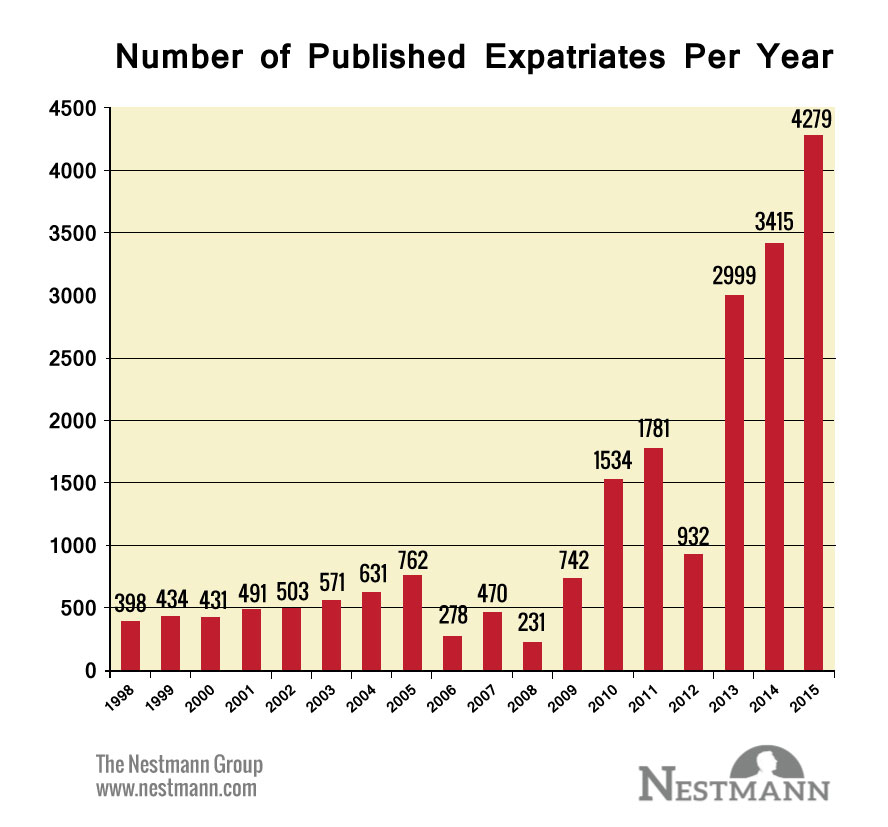

The number of people bidding adieu to the red, white, and blue for the fourth quarter of 2015 came to 1,058. For all of 2015, the total came to 4,279. This was an all-time record, beating the former record set in 2014 (3,415 expatriates) by 25%.

Here’s a chart of expatriation trends since 1998, after a law took effect in 1996 requiring the IRS to publish this data quarterly in the Federal Register.

What could lead someone to take the admittedly radical step of severing official ties to Uncle Sam? The mainstream media report the culprit is tax. Tax is a factor, but hardly the only one. But it’s certainly a place to start.

US citizens and permanent residents must pay US tax on their worldwide income, even if they live permanently outside the country. The US is one of only two countries with this policy. The other is the one-party dictatorship of Eritrea. (Ironically, until 2013, the State Department’s annual report on human rights throughout the world condemned Eritrea for this policy.)

As the old adage goes, “Do as I say, not as I do,” or more simply, “Might makes right.”

But worldwide taxes are just the beginning of problems facing US citizens or permanent residents living abroad. A case in point is the overwhelming compliance burden US taxpayers face. The information reporting regime they face is complex, overlapping, and constantly evolving. Even minor violations are subject to draconian penalties.

Take for instance, the onerous FinCEN Form 114, the “Report of Foreign Bank and Financial Accounts.” Fail to file this form and you could face a five- year prison term and a fine of $500,000 or more. True, sanctions typically are much less severe, but many other mandatory disclosure forms exist, all of them easy to miss, and all with significant penalties for non-compliance.

Don’t forget, too, that if you owe more than $50,000 in taxes or tax-related penalties, the State Department can revoke your passport. (For that reason, I expect another big surge in expatriations in 2016.)

Then there’s the issue of US laws such as the infamous FATCA, the Foreign Account Tax Compliance Act. These laws force foreign financial institutions to enforce US tax and reporting rules. In the case of FATCA, if these institutions fail to do so, they face a 30% withholding tax on many types of US source income and other capital transfers. In many cases, it’s easier to “fire” US clients than deal with this risk.

My own experience with expatriated clients backs this up.

- One who had lived in Switzerland for more than 40 years gave up her US citizenship only after all of the banks she dealt with there closed her accounts. They didn’t want to deal with all the reporting requirements the US demands if they accept US account-holders.

- Another client received a letter from the bank that had issued a mortgage for her home in Germany. The letter threatened to cancel her mortgage unless she could prove she was no longer a US citizen. Rather than face a huge balloon payment, she gave up her citizenship.

- A Canadian client contacted me after receiving a bill from the IRS for $20,000. He never owed any US tax because taxes in Canada are higher than in the USA but he still got screwed. A Canadian educational savings plan account he’d set up for his daughter was the problem. Under Canadian law, gains in the account are tax deferred – but not under US law. That led to a big tax bill – and his decision to expatriate.

The fact is, more than 8 million Americans now live abroad. Many of them can no longer hold bank accounts, qualify for a mortgage, or set up a tax-deferred account for retirement or their children’s education. Their only real option is to give up US citizenship, even though most of them don’t want to.

But don’t try telling Joe Six-Pack at a Donald Trump campaign rally that these folks are victims of unfair and oppressive government policies. Here are some of the comments posted on social media in response to the most recent announcement of expatriation statistics:

- Let them go anytime they want. Just don’t ever let them back in. And make sure they are paid up in all back taxes.

- Give up your US citizenship for money? Good riddance! Don’t let the door hit you on the butt on your way out. And stay out.

- Most of those people aren’t contributing anything to America. Good riddance.

- It’s moochers that are renouncing; mostly tax cheats.

- I view these people as quitters!!

Is expatriation for you? Clearly, the decision to turn in your US passport or green card is an important one. It requires you to acquire a second passport, if you don’t already have one. It also requires that you live permanently outside the United States, if you don’t already. Further, if your net worth exceeds $2 million or your average income tax liability for the five years preceding your expatiation exceeds $161,000 or you can’t demonstrate tax compliance for those same five years, you might need to pay a stiff exit tax.

And finally, if Senators Bob Casey (D-PA) and Chuck Schumer (D-NY) have their way, such wealthy expatriates will be banned from ever returning to the United States. Congress didn’t get around to enacting this law the last four years, but you can count on its reintroduction. Expatriates don’t get a lot of sympathy on Capitol Hill – or on Main Street, USA.

Once the land of opportunity, now the land of subjugation.

They’re easily being replaced a thousand or more times over by illegals and H1b’s.

My brother and his wife are American expats. He’s mentioned renouncing his citizenry for all of these same reasons, and he really doesn’t make that much money abroad, its just so much cheaper to live outside the US.

When you start doing the research, one of the more amusing things you discover is how other countries in the world create large hurdles for Americans to overcome in order to move and gain citizenship in their countries.

Other nations don’t want Americans unless they are filthy rich or highly educated.

Some of the things my government comes up with are disgusting and this is one of them. If someone lives in another country and gains nothing from this country, they shouldn’t owe anything and shouldn’t have to fill out more than one form showing it.

Guess this is our version of the Berlin Wall.

That’s only 20,000 people in 20 years. Anon nails it. More Mexicans come here every two weeks

The reason they are being tracked and most likely targeted is that they usually take a lot of money with them that the govt. can no longer pilfer. I assume they expect more and more to do the same with the economy of theft revving up, thus they will want to clamp down on this to keep the money here, and thus available to the PTB, elite, psychopathic bastards, whatever you want to call these vermin. One common expat probably takes out more money that a thousand illegal alien invaders. And then the invaders just send any under the table untaxed cash they make right back the fuck out anyway.

If i spoke Spanish I’d probably consider Columbia, countryside, organic farm.

I am born American and will die and American.

I may die an American in revolt against a government who seeks to destroy our freedoms, redefining the Constitution and enslaving the people, but I will die an American.

I have a deep seated and dreadful feeling that the collapse will happen before I’m dead. If so, I will stand with our local militia, Constitutionally armed and fight to the death for the freedoms that same Constitution guaranteed.

Far better that than being slowly deprived of freedom of speech, right to bear arms and freedom of religion (even though I’m an atheist) in that I would die in defense of your right to worship in whatever way you choose.

Free speech is free speech and Political Correctness is a ball of smelly crap.

MA

I believe in allowing dual citizenship, as most countries do. The good ol’ USA does not allow the practice, but there are a surprising number of American citizens who hold another passport anyway.

Citizenship can be an over-rated, over-valued concept, especially when the government pursues its own entrenched self-interests at the expense of the people who supposedly ‘own’ it.

@Bob,

Dual citizenship is definitel permitted by USA. See https://en.wikipedia.org/wiki/United_States_nationality_law#Dual_citizenship.

I would assume it is even actively encouraged — it permits the tax pool to grow per the taxation cited above + FATCA and FBAR.

Bob,

The USA does allow dual citizenship, and even allows such individuals

to hold positions in high level gov administrative roles.

People with money and assets ………… yeah, let’s ban them forever.

Free Shit Mexicans without a pot to piss in ………… come on in !!!!

Makes sense to me.

I am an American and have some assets out the country. I would prefer to keep everything in the US, if it were safe. But it clearly isn’t. The Federal government is out of control.