I wrote this on January 3. It was my outlook for 2011. Whenever I think I’m too pessimistic about the world, I go back and read old articles. This article is less than 4 months old and the situation has gotten much worse, much faster than I anticipated. The economy has slowed dramatically, even with the payroll tax cut and Ben’s QE2. I now think the 2nd half of 2011 will be outright recession. Again, my own words prove than I’m actually an optimist compared to what really happens. Think about that the next time you get depressed by one of my articles.

As I began to think about what might happen in 2011, the classic Joseph Heller novel Catch 22 kept entering my mind. Am I sane for thinking such a thing, or am I so insane that asking this question proves that I’m too rational to even think such a thing? In the novel, the “Catch 22” is that “anyone who wants to get out of combat duty isn’t really crazy”. Hence, pilots who request a fitness evaluation are sane, and therefore must fly in combat. At the same time, if an evaluation is not requested by the pilot, he will never receive one (i.e. they can never be found “insane”), meaning he must also fly in combat. Therefore, Catch-22 ensures that no pilot can ever be grounded for being insane – even if he were. The absurdity is captured in this passage:

There was only one catch and that was Catch-22, which specified that a concern for one’s own safety in the face of dangers that were real and immediate was the process of a rational mind. Orr was crazy and could be grounded. All he had to do was ask; and as soon as he did, he would no longer be crazy and would have to fly more missions. Orr would be crazy to fly more missions and sane if he didn’t, but if he was sane, he had to fly them. If he flew them, he was crazy and didn’t have to; but if he didn’t want to, he was sane and had to. Yossarian was moved very deeply by the absolute simplicity of this clause of Catch-22 and let out a respectful whistle. “That’s some catch, that Catch-22,” he observed. “It’s the best there is,” Doc Daneeka agreed. – Catch 22 – Joseph Heller

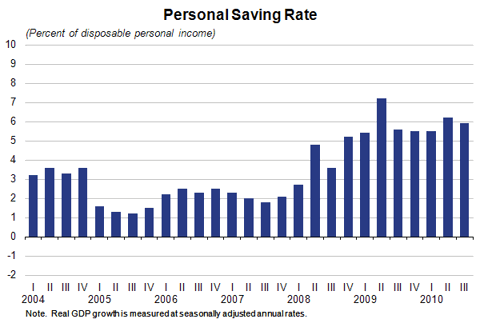

The United States and its leaders are stuck in their own Catch 22. They need the economy to improve in order to generate jobs, but the economy can only improve if people have jobs. They need the economy to recover in order to improve our deficit situation, but if the economy really recovers long term interest rates will increase, further depressing the housing market and increasing the interest expense burden for the US, therefore increasing the deficit. A recovering economy would result in more production and consumption, which would result in more oil consumption driving the price above $100 per barrel, therefore depressing the economy. Americans must save for their retirements as 10,000 Baby Boomers turn 65 every day, but if the savings rate goes back to 10%, the economy will collapse due to lack of consumption. Consumer expenditures account for 71% of GDP and need to revert back to 65% for the US to have a balanced sustainable economy, but a reduction in consumer spending will push the US back into recession, reducing tax revenues and increasing deficits. You can see why Catch 22 is the theme for 2011.

It seems the consensus for 2011 is that the economy will grow 3% to 4%, two million new jobs will be created, corporate profits will rise, and the stock market will rise another 10% to 15%. Sounds pretty good. The problem with this storyline is that it is based on a 2010 that gave the appearance of recovery, but was a hoax propped up by trillions in borrowed funds. On January 1, 2010 the National Debt of the United States rested at $12.3 trillion. On December 31, 2010 the National Debt checked in at $13.9 trillion, an increase of $1.6 trillion.

The Federal Reserve Balance Sheet totaled $2.28 trillion on January 1, 2010. Today, it stands at $2.46 trillion, an increase of $180 billion.

Over this same time frame, the Real GDP of the U.S. has increased approximately $350 billion, and is still below the level reached in the 4th Quarter of 2007. U.S. politicians and Ben Bernanke spent almost $1.8 trillion, or 13% of GDP, in one year to create a miniscule 2.7% increase in GDP. This is reported as a recovery by the mainstream corporate media mouthpieces. On September 18, 2008 the American financial system came within hours of a total meltdown, caused by Wall Street mega-banks and their bought off political cronies in Washington DC. The National Debt on that day stood at $9.7 trillion. The US Government has borrowed $4.2 since that date, a 43% increase in the National Debt in 27 months. The Federal Reserve balance sheet totaled $963 billion in September 2008 and Bernanke has expanded it by $1.5 trillion, a 155% increase in 27 months. Most of the increase was due to the purchase of toxic mortgage backed securities from their Wall Street masters.

Real GDP in the 3rd quarter of 2008 was $13.2 trillion. Real GDP in the 3rd quarter of 2010 was $13.3 trillion.

Think about these facts for one minute. Your leaders have borrowed $5.7 trillion from future unborn generations and have increased GDP by $100 billion. The financial crisis, caused by excessive debt creation by Wall Street and ridiculously low interest rates set by the Federal Reserve, 30 years in the making, erupted in 2008. The response to a crisis caused by too much debt and interest rates manipulated too low was to create an immense amount of additional debt and reduce interest rates to zero. The patient has terminal cancer and the doctors have injected the patient with more cancer cells and a massive dose of morphine. The knowledge about how we achieved the 2010 “recovery” is essential to understanding what could happen in 2011.

Confidence Game

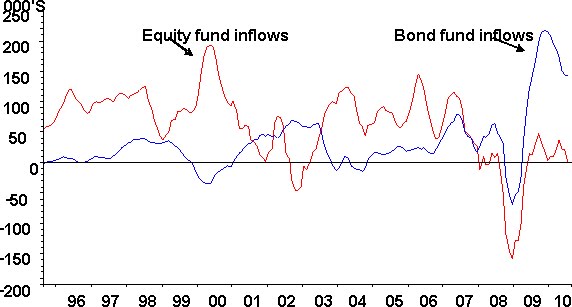

Ben Bernanke, Timothy Geithner, Barack Obama, the Wall Street banks, and the corporate mainstream media are playing a giant confidence game. It is a desperate gamble. The plan has been to convince the population of the US that the economy is in full recovery mode. By convincing the masses that things are recovering, they will begin to spend and buy stocks. If they spend, companies will gain confidence and start hiring workers. More jobs will create increasing confidence, reinforcing the recovery story, and leading to the stock market soaring to new heights. As the market rises, the average Joe will be drawn into the market and it will go higher. Tax revenues will rise as corporate profits, wages and capital gains increase. This will reduce the deficit. This is the plan and it appears to be working so far. But, Catch 22 will kick in during 2011.

Retail sales are up 6.5% over 2009 as consumers have been convinced to whip out one of their 15 credit cards and buy some more iPads, Flat screen TVs, Ugg boots and Tiffany diamond pendants. Consumer non-revolving debt for autos, student loans, boats and mobile homes is at an all-time high as the government run financing arms of GMAC and Sallie Mae have issued loans to anyone that can fog a mirror with their breath. Total consumer credit card debt has been flat for 2010 as banks have written it off as fast as consumers can charge it. The savings rate has begun to fall again as Americans are being convinced to live today and not worry about tomorrow. Of course, the current savings rate of 5.9% would be 2% if the government was not dishing out billions in transfer payments. Wages have declined by $127 billion from the 3rd Quarter of 2008, while government transfer payments for unemployment and other social programs have increased by $441 billion, all borrowed.

Both the government and its citizens are living the old adage:

Everybody wants to get to heaven, but no one wants to practice what is required to get there.

The government politicians and bureaucrats promise to cut unsustainable spending as soon as the economy recovers. The economy has been recovering for the last 6 quarters, according to GDP figures, but there are absolutely no government efforts to cut spending. This is proof that politicians always lie. It will never be the right time to cut spending. Another faux crisis will be used as a reason to continue unfunded spending increases. Having consumer spending account for 70% of GDP is unbalanced and unsustainable. Everyone knows that consumer spending needs to revert back to 65% of GDP and the Savings Rate needs to rise to 8% or higher in order to ensure the long-term fiscal health of the country. Savings and investment are what sustain countries over time. Borrowing and spending is a recipe for failure and bankruptcy. The facts are that consumer expenditures as a percentage of GDP have actually risen since 2007 and Congress and Obama just cut payroll taxes in an effort to encourage Americans to spend even more borrowed money. Catch 22 is alive and well.

The first half of 2011 is guaranteed to give the appearance of recovery. The lame-duck Congress “compromise” will pump hundreds of billions of borrowed dollars into the economy. The continuation of unemployment benefits for 99 weeks (supposedly to help employment) and the 2% payroll tax cut will goose consumer spending. Ben Bernanke and his QE2 stimulus for poor Wall Street bankers is pumping $75 billion per month ($3 to $4 billion per day) directly into the stock market. Since Ben gave Wall Street the all clear signal in late August, the NASDAQ has soared 25%. Despite the fact that there are 362,000 less Americans employed than were employed in August 2010, the mainstream media will continue to tout the jobs recovery. The goal of all these efforts is to boost confidence and spending. Everything being done by those in power has the seeds of its own destruction built in. The Catch 22 will assert itself in the 2nd half of 2011.

Housing Catch 22

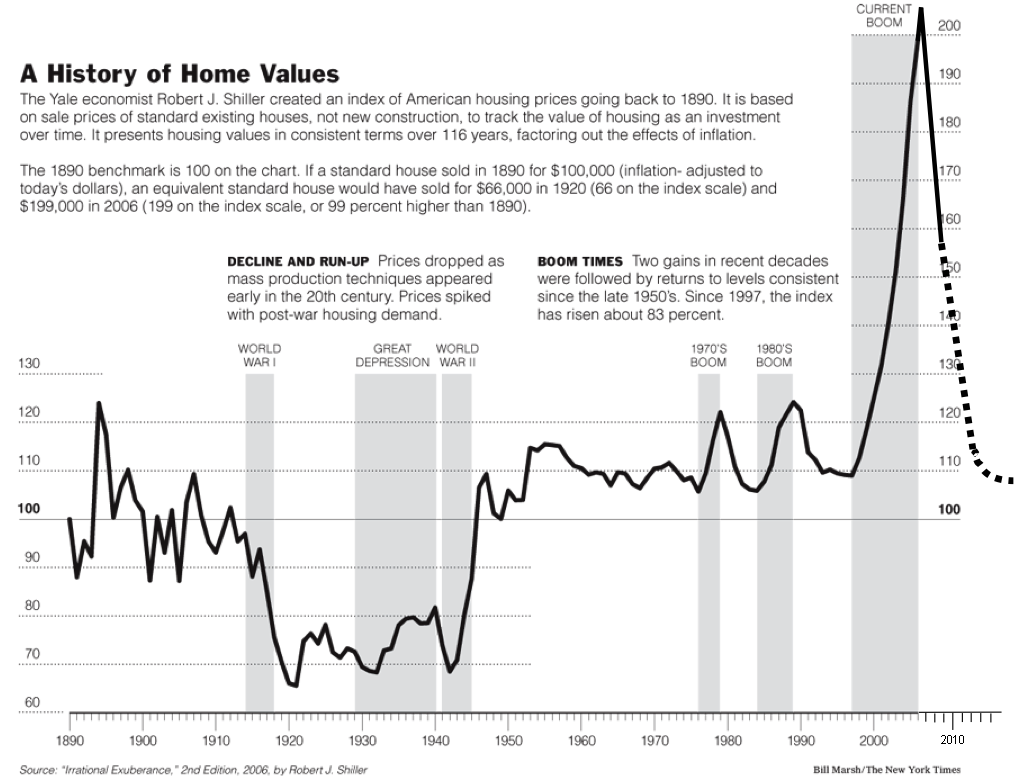

Ben Bernanke, an Ivy League PhD who should understand the concept of standard deviation, missed a 3 standard deviation bubble in housing as ironically pointed out by a recent Dallas Federal Reserve report.

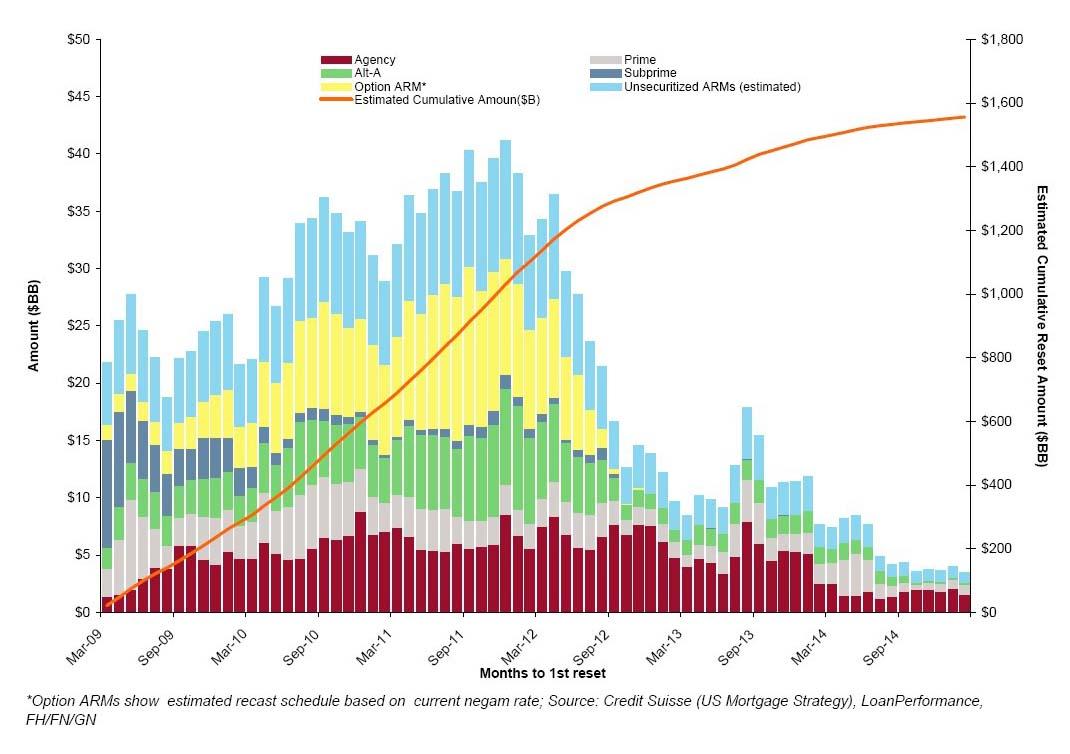

Home prices still need to fall 23%, just to revert to its long-term mean. That is a fact that even Bernanke should be able to grasp (maybe not). Anyone who argues that housing has bottomed and will resume growth either has an agenda (NAR) or is a clueless dope (Bernanke). A new perfect storm is brewing for housing in 2011 and will not subside until late 2012. You may have thought those bad mortgages had been all written off. You would be wrong. There will be in excess of $200 billion of adjustable rate mortgages that reset between 2011 and 2012, with in excess of $125 billion being the dreaded Alt-A mortgages. This is a recipe for millions of new foreclosures.

![[SNLCreditSuisse.jpg]](https://3.bp.blogspot.com/_pMscxxELHEg/S41iYJmDurI/AAAAAAAAHpo/DfLns3uE_J8/s1600/SNLCreditSuisse.jpg)

According to the Dallas Fed, in addition to the 3.9 million homes on the market, there is a shadow inventory of 6 million homes that will be coming on the market due to foreclosure. About 3.6 million housing units, representing 2.7% of the total housing stock, are vacant and being held off the market. These are not occasional-use homes visited by people whose usual residence is elsewhere but units that are vacant year-round. Presumably, many are among the 6 million distressed properties that are listed as at least 60 days delinquent, in foreclosure or foreclosed in banks’ inventories.

The coup de grace for the housing market will be Ben Bernake’s ode to Catch 22. In his November 4 OP-ED piece he had this to say about his $600 billion QE2:

“Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance.” – Housing sage Ben Bernanke

On the day Bernanke wrote these immortal words 30 Year Mortgage rates were 4.2%. Today, two months later, they stand at 5.0%. This should be a real boon to refinancing and the avalanche of mortgage resets coming down the pike. It seems that money printing and a debt financed “recovery” leads to higher long-term interest rates. The more convincing the recovery, the higher interest rates will go. The higher interest rates go, the further the housing market will drop. The further housing prices drop, the number of underwater homeowners will grow to 30%. This will lead to more foreclosures. Approximately 50% of all the assets on banks books are backed by real estate. Billions in bank losses are in the pipeline. Do you see the Catch 22 in Bernanke’s master plan? The Dallas Fed sees it:

This unease highlights the housing market’s fragility and suggests there may be no pain-free path to the eventual righting of the market. No perfect solution to the housing crisis exists. The latest price declines will undoubtedly cause more economic dislocation. As the crisis enters its fifth year, uncertainty is as prevalent as ever and continues to hinder a more robust economic recovery. Given that time has not proven beneficial in rendering pricing clarity, allowing the market to clear may be the path of least distress. – Dallas Fed

Quantitative Easing Catch 22

Ben Bernanke’s quantitative easing (dropping dollars from helicopters) is riddled with Catch-22 implications. Bernanke revealed his plan in his 2002 speech about deflation:

“The U.S. government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost.”

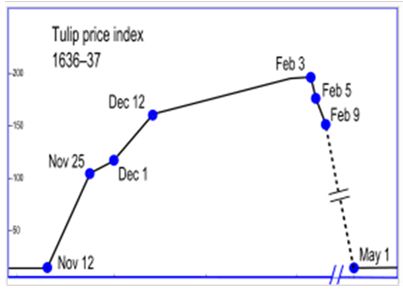

The expectations of most when reading Ben’s words were that his helicopters would drop the dollars across America. What he has done is load up his helicopters with trillions of dollars and circled above Wall Street for two years continuously dropping his load. Bernanke’s quantitative easing, which will triple the Fed’s balance sheet by June of 2011, began in earnest in early 2009. The price for a gallon on gasoline was $1.62. Today, it is $3.05, an 88% increase in two years. Gold was $814 an ounce. Today, it is $1,421 an ounce, a 61% increase in two years. In the last year, the prices for copper, silver, cotton, wheat, corn, coffee and other commodities have risen in price by 30% to 90%.

Quantitative easing has been sold to the public as a way to avoid the terrible ravages of deflation. The fact is there are less jobs, lower wages, lower home prices, zero returns on bank deposits, higher fuel costs, higher food costs, higher real estate taxes, higher medical insurance premiums and huge jaw dropping bonuses for the bankers on Wall Street. Somehow the government has spun this toxic mix into a CPI which has resulted in fixed income senior citizens getting no increases in their pitiful Social Security payments for two years. You can judge where Ben’s Helicopters have dropped the $2 trillion. Quantitative easing has benefited only Wall Street bankers and the 1% wealthiest Americans. The $1.4 trillion of toxic mortgage backed securities on The Fed’s balance sheet are worth less than $700 billion. How will they unload this toxic waste? The Treasuries they have bought drop in value as interest rates rise. Quantitative easing’s Catch 22 is that it can never be unwound without destroying the Fed and the US economy.

The USD dollar index was at 89 in early 2009. Today, it stands at 79, an 11% decline, which is phenomenal considering that Europe has imploded over this same time frame. Bernanke’s master plan is for the USD to fall and ease the burden of our $14 trillion in debt. He just wants it to fall slowly. Foreigners know what he is doing and are stealthily getting out of their USD positions. This explains much of the rise in gold, silver and commodities. The rise in oil to $91 a barrel will not be a top. The Catch-22 of a declining dollar is that prices of all imported goods go up. If the dollar falls another 10%, the price of oil will rise above $120 a barrel and push the economy back into recession. Then there is the little issue of at what level of printing and debasing the currency does the rest of the world lose its remaining confidence in Ben and the USD.

A few other “minor” issues for 2011 include:

- The imminent collapse of the European Union as Greece, Ireland, Portugal and Spain are effectively bankrupt. Spain is the size of the other three countries combined and has a 20% unemployment rate. The Germans are losing patience with these spendthrift countries. Debt does matter.

- State and local governments were able to put off hard choices for another year, as Washington DC handed out hundreds of billions in pork. California will have a $19 billion budget deficit; Illinois will have a $17 billion budget deficit; New Jersey will have a $10.5 billion budget deficit; New York will have a $9 billion budget deficit. A US Congress filled with Tea Party newcomers will refuse to bailout these spendthrift states. Substantial government employee layoffs are a lock.

- There is a growing probability that China will experience a hard landing as their own quantitative easing has resulted in inflation surging to a 28 month high of 5.1%, with food inflation skyrocketing to 11.7%. Poor families spend up to half of their income on food. Rapidly rising prices severely burden poor people and can spark civil unrest if too many of them can’t afford food.

- The Tea Party members of Congress are likely to cause as much trouble for Republicans as Democrats. If they decide to make a stand on raising the debt ceiling early in 2011, all hell could break loose in the debt and stock markets.

The government’s confidence game is destined to fail due to Catch-22. Will the consensus forecast of a growing economy, rising corporate profits, 10% to 15% stock market gains, 2 million new jobs, and a housing recovery come true in 2011? No it will not. By mid-year confidence in Ben’s master plan will wane. He is trapped in the paradox of Catch-22. When you start hearing about QE3 you’ll know that the gig is up. If Bernanke is foolish enough to propose QE3 you can expect gold, silver and oil to go parabolic. Enjoy 2011. I don’t think Ben Bernanke will.

“That’s some catch, that Catch-22.” -Yossarian