CoreLogic reported this morning that home prices fell 1.8% in the last month and have now declined for 6 straight months. This means that home prices are falling at an annualized rate of 21%. The post bubble low will be breached next month. Yesterday the MSM was excited by the fact that mortgage delinquencies declined again. The rate had peaked in January 2010 and has been steadily declining.

Now this is the part that requires some thinking. So anyone reading this post that works for CNBC, Seeking Alpha, or any other MSM outlet can go back to your mindless propaganda mode and exit stage left. The hundreds of billions in tax dollars thrown at housing in 2009 and early 2010 for home buyer tax credits and mortgage modification programs temporarily stopped prices from falling. Shockingly, when prices stopped falling, mortage delinquencies started to decline. OK. Got that?

The government’s efforts to prop up the housing market have failed miserably. The hundreds of billions were pissed down the toilet. The prop has been removed and home prices will fall to the level they were always going to fall to. Supply and demand determine price. Prices are now in freefall again. Guess what? In the next few months, mortgage delinquency rates will begin to rise again. Even Larry Kudlow could see this if he knew how to add 2 + 2.

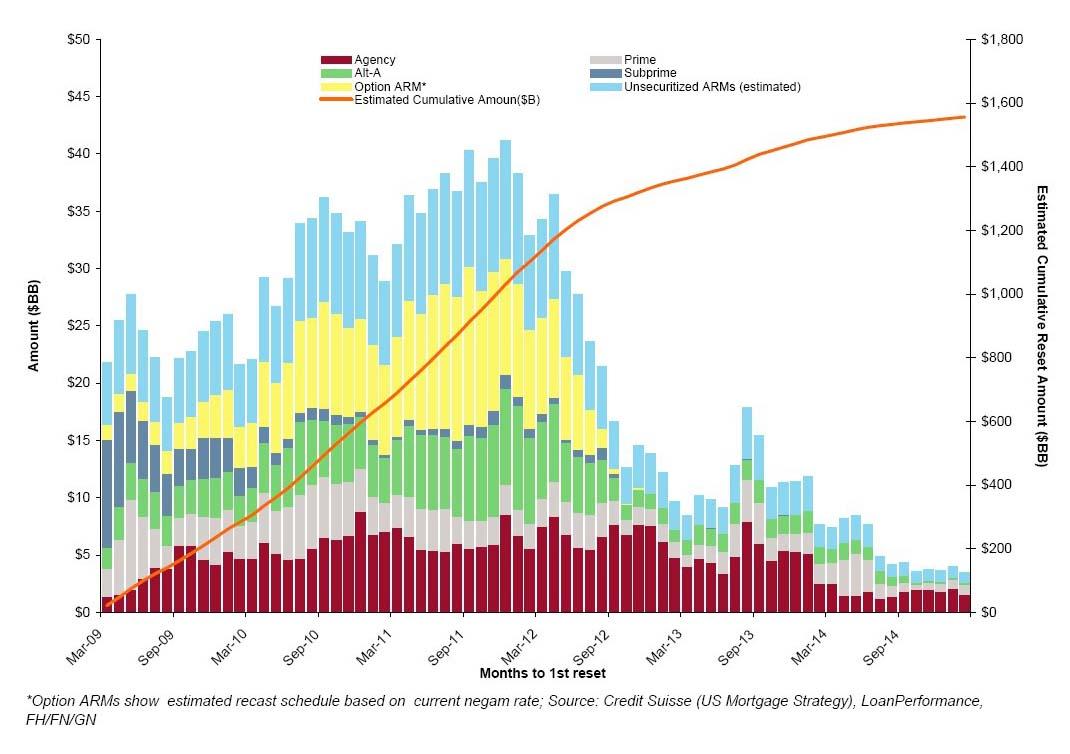

As an added benefit, we are about to enter the huge reset stage for Alt-A fraudulent mortgages. These resets are occurring just as mortgage rates are hitting the highest levels in a year. This will give an added kicker to the foreclosure tsunami on the way.

So, you can listen to your favorite real estate broker who tells you it is the best time to buy, or you can add 2 + 2 and get 4.

According to LPS, 8.83% of mortgages are delinquent (down from 9.02% in November), and another 4.15% are in the foreclosure process (up from 4.08% in November) for a total of 12.98%. It breaks down as:

• 2.56 million loans less than 90 days delinquent.

• 2.12 million loans 90+ days delinquent.

• 2.2 million loans in foreclosure process.

For a total of 6.87 million loans delinquent or in foreclosure.

Llpoh

I’d be curious some time to hear your story about how you got involved in your business with your partner. It sounds like you have had a fascinating life.