Our self proclaimed “expert” on the Great Depression, Ben Bernanke, seems to be feeling the pressure. His theories worked so well when he modeled them in his posh corner office at Princeton. He could saunter down the hallway and get his buddy Krugman to confirm his belief that the Federal Reserve was just too darn restrictive between 1929 and 1932, resulting in the first Great Depression. I wonder if there will be a future Federal Reserve Chairman, 80 years from now, studying how the worst Federal Reserve Chairman in history (not an easy feat) created the Greatest Depression that finally put an end to the Great American Military Empire. Bernanke spent half of his speech earlier this week trying to convince himself and the rest of the world that his extremist monetary policy of keeping interest rates at 0% for the last two years, printing money at an astounding rate, and purposely trying to devalue the US currency, had absolutely nothing to do with the surge in oil and food prices in the last year. Based on his scribbling since November of last year, it seems that Ben is trying to win his own Nobel Prize – for fiction.

His argument was that simple supply and demand has accounted for all of the price increases that have spread revolution across the world. His argument centered around growth in emerging markets that have driven demand for oil and commodities higher, resulting in higher prices. As usual, a dollop of truth is overwhelmed by the Big Lie. Here is Bernanke’s outlook for inflation:

“Let me turn to the outlook for inflation. As you all know, over the past year, prices for many commodities have risen sharply, resulting in significantly higher consumer prices for gasoline and other energy products and, to a somewhat lesser extent, for food. Overall inflation measures reflect these price increases: For example, over the six months through April, the price index for personal consumption expenditures has risen at an annual rate of about 3.5%, compared with an average of less than 1% over the preceding two years. Although the recent increase in inflation is a concern, the appropriate diagnosis and policy response depend on whether the rise in inflation is likely to persist. So far at least, there is not much evidence that inflation is becoming broad-based or ingrained in our economy; indeed, increases in the price of a single product–gasoline–account for the bulk of the recent increase in consumer price inflation. An important implication is that if the prices of energy and other commodities stabilize in ranges near current levels, as futures markets and many forecasters predict, the upward impetus to overall price inflation will wane and the recent increase in inflation will prove transitory.”

So our Federal Reserve Chairman, with a supposedly Mensa level IQ, declares that prices have risen due to demand from emerging markets. He also declares that US economic growth will pick up in the 2nd half of this year. He then declares that inflation will only prove transitory as energy and food prices will stop rising. I know I’m not a Princeton economics professor, but if US demand increases due to a recovering economy, along with continued high demand in emerging markets, wouldn’t the demand curve for oil and commodities move to the right, resulting in even higher prices?

Ben Bernanke wants it both ways. He is trapped in a web of his own making and he will lie, obfuscate, hold press conferences, write editorials, seek interviews on 60 Minutes, and sacrifice the US dollar in order to prove that his economic theories are sound. They are not sound. They are reckless, crazy, and will eventually destroy the US economic system. You cannot solve a crisis caused by excessive debt by creating twice as much debt. The man must be judged by his words, actions and results.

November 4, 2010

With the U.S. economy faltering last summer, Ben Bernanke decided to launch a desperate attempt to re-inflate the stock market bubble. The S&P 500 had peaked at 1,217 in April 2010 and had fallen 16% by July. This was unacceptable to Bernanke’s chief clientele – Wall Street and the richest 1% in the country. At Jackson Hole in August he gave a wink and nod to his peeps, letting them know he had their backs. It was safe to gamble again. He’d ante up the $600 billion needed to revive Wall Street. It worked wonders. By April 2011, the S&P 500 had risen to 1,361, a 33% increase. Mission accomplished on a Bush-like scale.

Past Federal Reserve Chairmen have kept silent about their thoughts and plans. Not Bernanke. He writes editorials, appears regularly on 60 Minutes, and now holds press conferences. Does it seem like he is trying too hard trying to convince the public that he has not lost control of the situation? QE2 was officially launched on November 4, 2010 with his Op-Ed in the Washington Post. He described the situation, what he was going to do, and what he was going to accomplish. Let’s assess his success.

“The Federal Reserve’s objectives – its dual mandate, set by Congress – are to promote a high level of employment and low, stable inflation. Unfortunately, the job market remains quite weak; the national unemployment rate is nearly 10 percent, a large number of people can find only part-time work, and a substantial fraction of the unemployed have been out of work six months or longer. The heavy costs of unemployment include intense strains on family finances, more foreclosures and the loss of job skills.” – Ben Bernanke – Washington Post Editorial – November 4, 2010

Ben understands his dual mandate of high employment and low inflation, but he seems to have a little trouble accomplishing it. Things were so much easier at Princeton. Since August 2010 when Ben let Wall Street know he was coming to the rescue, the working age population has gone up by 991,000, while the number of employed Americans has risen by 401,000, and another 1,422,000 people decided to kick back and leave the workforce. That is only $1.5 million per job created. This should get him a spot in the Keynesian Hall of Shame.

The official unemployment rate is rising after Ben has spent $600 billion and stands at 9.1% today. A true measurement of unemployment as provided by John Williams reveals a true rate of 22%.

Any reasonable assessment of Ben’s success regarding part one of his dual mandate, would conclude that he has failed miserably. He must have focused his attention on mandate number two – low inflation. Bernanke likes to call inflation transitory. Inflationistas like Bernanke will always call inflation transitory. His latest proclamations reference year over year inflation of 3.5%. This is disingenuous as the true measurement should be since he implemented QE2. The official annualized inflation since December 2010 is 5.3%. The real inflation rate as calculated exactly as it was in 1980 now exceeds 10%.

Mr. Dual Mandate seems to have slipped up. As he stated in his editorial, he wanted to fend off that dreaded deflation:

“Today, most measures of underlying inflation are running somewhat below 2 percent, or a bit lower than the rate most Fed policymakers see as being most consistent with healthy economic growth in the long run. Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling. In the most extreme case, very low inflation can morph into deflation (falling prices and wages), which can contribute to long periods of economic stagnation.”

He certainly has succeeded in fighting off deflation. Let’s list his anti-deflation accomplishments:

- Oil prices have risen 35% since September 2010.

- Unleaded gas has risen 50% since September 2010.

- Gold has risen 24% since September 2010.

- Silver has risen 85% since September 2010.

- Copper has risen 20% since September 2010.

- Corn has risen 67% since September 2010.

- Soybeans have risen 40% since September 2010.

- Coffee has risen by 44% since September 2010.

- Cotton has risen 88% since September 2010.

Amazing how supply and demand got out of balance at the exact moment that Bernanke unleashed a tsunami of speculation by giving the all clear to Wall Street, handing them $20 billion per week for the last seven months. Another coincidence seemed to strike across the Middle East where the poor, who spend more than 50% of their meager income on food, began to revolt as Bernanke’s master plan to enrich Wall Street destroyed the lives of millions around the globe. Revolutions in Tunisia, Egypt, Libya, Yemen, Bahrain, and Syria were spurred by economic distress among the masses. Here in the U.S., Bernanke has only thrown savers and senior citizens under the bus with his zero interest rate policy and dollar destruction.

Bernanke’s Virtuous Circle

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.” Ben Bernanke – Washington Post Editorial – November 4, 2010

Ben Bernanke could not have been any clearer in his true purpose for QE2. He wanted to create a stock market rally which would convince the public the economy had recovered. As suckers poured back into the market, the wealth effect would convince people to spend money they didn’t have, again. This is considered a virtuous cycle to bankers. He declared that buying $600 billion of Treasuries would drive down long-term interest rates and revive the housing market. His unspoken goal was to drive the value of the dollar lower, thereby enriching the multinational conglomerates like GE, who had shipped good US jobs overseas for the last two decades. Bernanke succeeded in driving the dollar 15% lower since last July. Corporate profits soared and Wall Street cheered. Here is a picture of Bernanke’s virtuous cycle:

Whenever a talking head in Washington DC spouts off about a new policy or program, I always try to figure out who benefits in order to judge their true motives. Since August 2010, the stock price of the high end retailer Tiffany & Company has gone up 88% as its profits in the last six months exceeded its annual income from the prior two years. Over this same time frame, 2.2 million more Americans were forced into the Food Stamp program, bringing the total to a record 44.6 million people, or 14.4% of the population. But don’t fret, Wall Street paid out $21 billion in bonuses to themselves for a job well done. This has done wonders for real estate values in NYC and the Hamptons. See – a virtuous cycle.

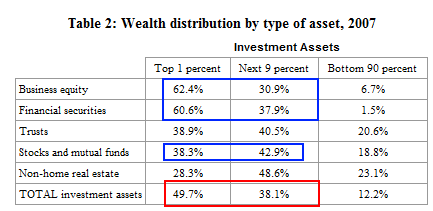

Do you think Bernanke mingles with Joe Sixpack on the weekends at the cocktail parties in DC? Considering that 90% of the US population owns virtually no stocks, Bernanke’s virtuous cycle only applied to his friends and benefactors on Wall Street.

But surely his promise of lower interest rates and higher home prices benefitted the masses. The largest asset for the vast majority of Americans is their home. Let’s examine the success of this part of his master plan. Ten year Treasury rates bottomed at 2.4% in October 2010, just prior to the launching of QE2. Rates then rose steadily to 3.7% by February 2011. I’m not a Princeton professor, but I think rising rates are not normally good for the housing market. Today, rates sit at 2.9%, higher than they were prior to the launch of QE2.

I’m sure Ben would argue that interest rates rose because the economy is recovering and the virtuous cycle is lifting all boats (or at least the yachts on Long Island Sound). Surely, housing must be booming again. Well, it appears that since Ben fired up his helicopters in November, national home prices have fallen 5% and are accelerating downward at an annual rate of 10%. There are 10.9 million home occupiers underwater on their mortgage, or 22.7% of all homes with a mortgage. There are over 6 million homeowners either delinquent on their mortgage or already in the foreclosure process. It certainly looks like another Bernanke success story.

Bernanke’s conclusion at the end of his Op-Ed in November 2010 was that his critics were wrong and his expertise regarding the Great Depression trumped rational economic theory. By enriching Wall Street and creating inflation, his virtuous cycle theory would lead to job creation and a chicken in every pot.

“Although asset purchases are relatively unfamiliar as a tool of monetary policy, some concerns about this approach are overstated. Critics have, for example, worried that it will lead to excessive increases in the money supply and ultimately to significant increases in inflation. But the Federal Reserve has a particular obligation to help promote increased employment and sustain price stability. Steps taken this week should help us fulfill that obligation.” Ben Bernanke – Washington Post Editorial – November 4, 2010

Anyone impartially assessing the success of QE2 would have to conclude that it has been an unmitigated failure and has put the country on the road to perdition. In three weeks, the Federal Reserve will stop pumping heroin into the veins of Wall Street. The markets are already reacting negatively, as the S&P 500 has fallen 6% and interest rates have begun to fall. As soon as Bernanke takes his foot off the accelerator, the US economy stalls out because we never cleaned the gunk (debt) out of the fuel line. Jesse puts it as simply as possible.

“The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.” – http://jessescrossroadscafe.blogspot.com/

Bernanke and his Wall Street masters want to obscure the truth so they don’t have to accept the consequences of their actions. The economy and the markets will decline over the summer. Bernanke is a one trick pony. His solution will be QE3, but it will be marketed as something different. He will appear on 60 Minutes and write another Op-Ed. Ben Bernanke will go down in history as the Federal Reserve Chairman that brought about the Greatest Depression and hammered the final nails into the coffin of the Great American Empire.

“Stable Inflation” is an oxymoron which brings into doubt everything else he says and does.

MA

NICE JOB!

Yep, who benefits from these government programs? I dunno. Let me go to my Food Stamps EBT Account servicing page… as facilitated by JP Morgan Chase:

https://www.ebtaccount.jpmorgan.com/JPM_EFS/

Let me quote the neo-American philosopher Usher Raymond: “LET IT BURN”

I listened to his babble the other day and he sounded like he was blaming India and China for the higher cost of oil and commodidties. Did he say there wasn’t enough inflation to worry about, or that the only inflation he was concerned about was oil, which was not our fault? Thanks Benny, Timmy and OPEC for fucking us hard!

Bernanke POTUS 2012

Now, of course I would NEVER advocate violence. Ever. EVER.

But…

When is somebody going to SHOOT THAT FUCK?!

I would consider donating to the ‘Rig The Jury Fund’ for anyone accused of such a heinous act…

I pay in silver… any takers?

@Admin

“Ben Bernanke will go down in history as the Federal Reserve Chairman that brought about the Greatest Depression and hammered the final nails into the coffin of the Great American Empire.”

Are you congratulating 100% Ben for this great accomplishment? Mission accomplished?

Yes, I will buy his book in 2020: “How I destroyed the narcissistic, reckless, infantile, warmonger Great American Empire by printing monetary opium.”

When do the hangings begin? Or should we resort to tar and feather? Battery cables on the testicles?

From Simon Black of Sovereign Man

Is The Debt Problem As Bad As They Say

On the rare occasion that I’m bored, I like to watch 24-hour news television for entertainment. It’s hilarious watching the talking heads spin out of control in apoplectic fits when they’re essentially arguing the same point; they might be from different parties, but they’re merely battling over small details of the same government-sponsored solution.

Recently I caught one of these talking head financial experts on TV arguing about debt levels in the United States. He was saying that the US debt doesn’t matter all that much because the US government has so many assets to offset its debt.

For example, he suggested that things like the highway system, national parks, and strategic petroleum reserve would more than offset America’s liabilities, so the looming national debt isn’t such a big deal after all.

He couldn’t have been more wrong.

The Government Accounting Office (GAO) puts out an annual financial report that looks and feels like corporate financial statements… of course, the US government doesn’t have to abide by the same accounting principles as the private sector, so they get to cheat quite a bit in overstating their position.

The most recent report is signed off by Tim Geithner and includes oodles of newspeak from the Ministry of Plenty about how dazzling their economic recovery measures have been. Needless to say, the numbers paint a different picture.

Even when you add up -all- of the assets, right down to every desk, chair, and lifeguard stand, and even if you throw in a healthy boost to the asset column to account for premiums in the market value for land and “gold” in Fort Knox, the government is still in the hole to the tune of over $10 trillion. It would take more than 300,000 years to count that high.

And yet, the fake recovery is vanishing, the dollar keeps falling against anything of real value, and the average guy on the street is realizing limited benefit for his share of the debt and inflation burdens. How is this possible?

I’ve often said that bureaucrats and politicians have an extremely limited playbook consisting of taxation, regulation, and inflation. These three ugly sisters of bureaucracy effectively serve to steal from people, make things more difficult for them, and rob them of their purchasing power… and yet they’re dressed up as solutions instead of problems.

Consider the case of Illinois– the state is completely insolvent and running out of cash quickly. It doesn’t have the luxury of printing its own currency, and is thus being forced to deal with its fiscal reality… much like Greece.

Rather than trying to make their state more competitive in order to attract talent and capital, they’ve opted for the old playbook… starting with taxes. Specifically, Illinois lawmakers have targeted companies like Amazon, arguing that online transactions through the company’s Illinois-based affiliates are within the state’s sales tax jurisdiction.

For Amazon, the calculus involved is totally objective– once the Illinois legislature passed this legislation, the cost of doing business in the state exceeded the benefit, and Amazon cut all ties to its Illinois affiliates.

Thousands of people across the state who used to earn a portion of their living as an Amazon affiliate were stripped of their income thanks to do good lawmakers trying to squeeze a little more dough out of a productive company.

Peoria, Illinois based Caterpillar Inc. is in a similar position, now threatening to leave Illinois because the politicians keep raising income taxes. Now the financial powerhouse CME Group is echoing this sentiment. The impact this would have to the state economy is devastating.

These steps that Illinois lawmakers are taking, along with their destructive consequences, are reflective of what will happen when the federal government is finally forced to deal with its own fiscal reality.

$10 trillion in the hole and facing a steep downward trend, the US government is either looking at substantially higher borrowing costs, substantially higher inflation, or both. Investors are getting jittery about loaning money to the United States, so they will either demand a higher return, or the Federal Reserve will hyperinflate the currency to mop it all up.

Regardless of the scenario, Congress will reach deep into this playbook until they chase away every productive citizen and company they can… In fact, it’s already happening.

The number of people renouncing US citizenship has been more than doubling year-over-year for the last several years. Meanwhile, many businesses are moving overseas, or at least focusing on international operations and shifting profits offshore.

It’s easy for companies to move… much more difficult for people who have emotional ties, fear, anxiety, etc. that maintains their geographical inertia. As such, it will ultimately be the individual citizens remaining behind who will be exploited like malnourished milk cows to pay for the destruction.

In the coming days, I’d like to tell you a lot more about how I see this playing out. Stay tuned.

Screw Bernanke with a giant clown shoe.

The scary part is that 98% of Americans can’t follow this very basic economics lesson. When I repost some of these, the nitwits on facebook tell me I’m “out there”. Morons. They’ll never see the train coming.

muck

hard to beat this oxymoron …

[img [/img]

[/img]

“Ben Bernanke wants it both ways. He is trapped in a web of his own making and he will lie, obfuscate, hold press conferences, write editorials, seek interviews on 60 Minutes, and sacrifice the US dollar in order to prove that his economic theories are sound. They are not sound. They are reckless, crazy, and will eventually destroy the US economic system. You cannot solve a crisis caused by excessive debt by creating twice as much debt. The man must be judged by his words, actions and results.”

I couldn’t agree with you more. What’s more, I believe that Bernanke is mentally ill. His theories have consumed him to the point where is fixated on defending them. I have not seen one shred of evidence that he is able to admit that the “assumptions” he bases his forecasts and opinions on are completely unrealistic and ivariably prove false. The man appears to me to have a Messiah Complex. My sense is that behind the (mostly) calm facade is a person who is stressed to the point of incapacity and is merely continuing to functio as a professor. He lstands before his class of students, who follow his lead without any serious questions. (go along to get along). The students knowi that, at the end of the day, when the house of cards comes crashing down, they can say they followed the great guru’s lead. Bernanke, on the other hand,is the type that will go to his grave believing that his theories are all true and it was only those around him that failed in their duties. As his faulty assumptions lead to faulty decisions, Bernanke will claim that his assumptions were perfectly appropriate but for others failures. (Have you ever noticed that his decisions are always justified based on what “we” believe. How could anyone call all of those Bobbleheads “we”?) This is Greenspan 2.0. The world is brought to the brink and all we get is: “:we made some mistakes”

God help us. Erick Fromm wrote a book called “The Sane Society” where he questioned if society could go mad to the point that many people out of the mainstream were actually the sane ones. He then questioned whether it was the duty of the health professional to treat the out-of-the mainstream sane characters, to fit in with the in”Sane Society”. My recollection is that he answered NO. Seriously, can anyone keep a straight face and tell me that Obama kept that Republican appointee as Chairman of the Fed because he believed he was the bst man for the job? Give me a break. Only the Village Idiot could not follow the logic of Bernanke’s reappontment. Obama makes a change and things go wrong — no second term for sure. That leaves us with the comfortable thought….that the inmates running the asylum.

Aww come on guys. Greenspan baked this cake long ago. Uncle Ben is merely putting the cherry on top. But just as you can’t shape-up a cowpat with a cherry, you also can’t beautify an ailing economy or a lost-spirited nation with happy talk. How would I describe the state of today’s global economy? Imagine a large fan….

…covered in shit

[img [/img]

[/img]

Politically, the only option available to policy makers at this point is precisely what they are doing. The masses in this country have been programmed over threedecades to expect and demand quick and easy solutions to every economic problem. Therefore, this is the only option available to those who are at the helm. The drip drip drip of quick solutions will surely lead to a catastrophic implosion and a final clearing of the wreckage that owns and controls the economic system which teeters on the edge. The merger of state and bank will be dissolved and a system of law will be reinstitutued. After the crash that is.

Blah, blah, blah. No news here except Stucky’s great picture of the “Peacemaker”.. That’s irony.

No news here, nothing new, nothing thought provoking. That’s the problem with alternate media (such as TBP) and the rest of the MSM.

There is only bad news to report that even doomers get bored with it – seen that/heard that/ what’s new?

When do we use the facilities of TBP to organize and deliver a huge protest – with real bodies and stuff – to the illuminate/Federal Government that is continuing to put the screw to you and I?

For the right protest, I will volunteer to drive to Washington D.C. and practice pissing in the bushes with 999,999 other people who want to stop the madness, default on the un-payable debt and, clean out fiscal house, fire all the crooked ethicless politicians, bite the bullet and get on with starting a true recovery.

//sarcasm on// All I ask is that someone pay for my gas and food and lodging and, say $50 an hour for the wear and tear on my little red race car and my time! //sarcasm off//

Seriously, I’d do it in a minute if we could organize it. I’ll pay my own way and bring food for others. At this point, it is time to stand up and be counted and stop muttering about all this crap on alternate media WEB Sites.

I’m old but, for some reason, in reasonably good health, and dammit, I’ll do whatever it takes to start a massive demonstrative action against the madness that will drive us all to perdition.

What say you?

MA

Burn it down.

[img [/img]

[/img]

Seriously, I’d do it in a minute if we could organize it. I’ll pay my own way and bring food for others.- Muck About

Throw in the Guinness and I’m in .

[img [/img]

[/img]

Burn it down!

http://www.youtube.com/watch?v=u5vn6OqnD_Q

China warns U.S. debt-default idea is “playing with fire”

By Emily Kaiser

SINGAPORE | Wed Jun 8, 2011 8:41pm EDT

(Reuters) – Republican lawmakers are “playing with fire” by contemplating even a brief debt default as a means to force deeper government spending cuts, an adviser to China’s central bank said on Wednesday.

The idea of a technical default — essentially delaying interest payments for a few days — has gained backing from a growing number of mainstream Republicans who see it as a price worth paying if it forces the White House to slash spending, Reuters reported on Tuesday.

But any form of default could destabilize the global economy and sour already tense relations with big U.S. creditors such as China, government officials and investors warn.

Li Daokui, an adviser to the People’s Bank of China, said a default could undermine the U.S. dollar, and Beijing needed to dissuade Washington from pursuing this course of action.

“I think there is a risk that the U.S. debt default may happen,” Li told reporters on the sidelines of a forum in Beijing. “The result will be very serious and I really hope that they would stop playing with fire.”

China is the largest foreign creditor to the United States, holding more than $1 trillion in Treasury debt as of March, U.S. data shows, so its concerns carry considerable weight in Washington.

“I really worry about the risks of a U.S. debt default, which I think may lead to a decline in the dollar’s value,” Li said.

Congress has balked at increasing a statutory limit on government spending as lawmakers argue over how to curb a deficit which is projected to reach $1.4 trillion this fiscal year. The U.S. Treasury Department has said it will run out of borrowing room by August 2.

If the United States cannot make interest payments on its debt, the Obama administration has warned of “catastrophic” consequences that could push the still-fragile economy back into recession.

“It has dire implications for the economy at a time when the macro data is softening,” said Ben Westmore, a commodities economist at National Australia Bank.

“It’s just a horrible idea,” he said.

Financial markets are following the U.S. debate but see little risk of a default.

U.S. Treasury prices were firm in Europe on Wednesday, supported by a flight to their perceived safety on the back of the Greek debt crisis and worries about a slowdown in U.S. economic growth.

Marc Ostwald, a strategist with Monument Securities in London, said markets were working on the assumption that the U.S. debt story “will go away.” But nervousness would grow if a resolution was not reached in the next five to six weeks.

‘WOULDN’T HAPPEN’

The Republicans’ theory is that bondholders would accept a brief delay in interest payments if it meant Washington finally addressed its long-term fiscal problems, putting the country in a stronger position to meet its debt obligations later on.

But interviews with government officials and investors show they consider a default such a grim — and remote — possibility that it was nearly impossible to imagine.

“How can the U.S. be allowed to default?” said an official at India’s central bank. “We don’t think this is a possibility because this could then create huge panic globally.”

Indian officials say they have little choice but to buy U.S. Treasury debt because it is still among the world’s safest and most liquid investments. It held $39.8 billion in U.S. Treasuries as of March, U.S. data shows.

The officials declined to be identified because they are not authorized to speak to the media.

Oman is concerned about the impact of a default on the currency reserves of the sultanate and its Gulf neighbors.

“Our economies are substantially tied up with the U.S. financial developments,” said a senior central bank official, who spoke on condition of anonymity.

“It just wouldn’t happen,” said Barry Evans, who oversees $83 billion in fixed income assets at Manulife Asset Management. “They would pay their Treasury bills first instead of other bills. It’s as simple as that.”

Monument’s Ostwald called the default scenario “frightening” and said bondholders’ patience would wear thin if lawmakers persisted in pitching this strategy in the coming weeks.

“This isn’t a debate, this is like a Mexican standoff and that is where the problem lies,” he said.

Yuan Gangming, a researcher with the Chinese Academy of Social Sciences, a government think tank, smelled some political wrangling behind the U.S. debt debate as the 2012 presidential election draws nearer and said Republicans “want to make things difficult for Obama.”

But with time running short before the U.S. Treasury exhausts its borrowing room, Yuan said default was a real risk.

“The possibility is quite high to see a default of the U.S. debt, which would harm many countries in the world, and China in particular,” he said.

(Reporting by Kevin Lim and Jong Woo Cheon in Singapore, Suvashree Dey Choudhury in Mumbai, Aileen Wang and Kevin Yao in Beijing, Abhijit Neogy in Delhi, Marius Zaharia in London and Umesh Desai in Hong Kong; Editing by Dean Yates and Neil Fullick)

Muck

You’re cranky tonight.You’re also right. Sometimes the blogosphere can seem like this.

[img [/img]

[/img]

I can tell you that in my own life, people around me are not pissed off. Not at least, at the government or the fed or any damn thing that matters, they grumble about food prices or gas prices but always end it with a shrug and a look like “What can you do?”.

You are here.

[img [/img]

[/img]

They are here.

[img [/img]

[/img]

So just STFU and be patient. Have a stiff drink and start planning a protest. Start with permits and portapottys.

Ben Bernake: keeping banks, AIG, investment bankers, and Wall Street hacks solvent with taxpayer money since Feb. 1st, 2006.

I don’t know if any of ya’all have seen “Too Big To Fail” on HBO. What a piece of shit. Makes Hank Paulson look like some kind of hero. WTF is wrong with HBO? Bill Maher is 10 years past being funny or interesting. Big Ben is played by Paul Giamati, a great job.

[img [/img]

[/img]

I highly recommend the movie/documentary “Inside Job.” great stuff, if it’s too boring for MA, tough shit.

Wanna know where all Helicopter Ben’s Funny Money s going? Into trying to Bubble up Tech Firms again! Lst week we had Pukeon, a company which lost some $90M over the last decade file for a $750M IPO. This week, Biz communications provider Avaya is filing a $1B IPO. Note a few things in this story. Avaya has $6B worth of debt, posted a loss of $615M for the last 6 months, around $1.2B annualized. What a GREAT fucking Investment Opportunity! LOL.

Note who the Bookrunners are for this insanity. The Usual Suspects, Goldman, JPMC, Shity Bank, Deutche Bank et al. WTF would BUY this shit? You guessed it, the same people underwriting the IPO! They gotta have somepalce to dump the funny money Helicopter Ben shovels at them. I bet Moodys and Fitch rate the paper AAA also! LOL.

This JOKE is getting to be a little much to bear, wouldn’t you say? LOL.

RE

——————–

Avaya Files for $1 Billion IPO

By Michael Baron 06/09/11 – 09:39 PM EDT

Add Comment inShare.1NEW YORK (TheStreet) — Avaya took the first step toward a return to the public markets on Thursday as the Basking Ridge, N.J.-based provider of business communications software and equipment filed with the Securities and Exchange Commission for a new $1 billion stock offering.

More on Tech

Microsoft Loses Patent Case in Victory for Smaller EntitiesFusion-io Wows in IPO DebutFusion-io IPO Spurs Big Flash InvestmentsThe company was spun off by Lucent Technologies in 2000 and then bought out by private equity firm Silver Lake Partners and TPG Capital for more than $8 billion in 2007. Reports of its plans to go public surfaced earlier this week.

In Thursday’s S-1 filing, Avaya said it plans to use the proceeds to pay down long-term debt, redeem preferred stock, and pay monies related to the termination of a management agreement with Silver and TPG. The company said its total debt as of March 31 sat at $6.18 billion.

Avaya disclosed a loss of $615 million, or $1.26 a share, for the six months ended March 31 on revenue of $2.76 billion in the filing.

The company also said Silver Lake and TPG hold warrants to purchase 100 million shares at an exercise price of $3.25 each. These warrants are subject to various lock-up agreements, but must be exercised prior to Dec. 18, 2019.

Joint bookrunners for the deal are Morgan Stanley(MS_), Goldman Sachs(GS_), and JPMorgan Chase(JPM_), along with Citigroup Global Markets, Deutsche Bank Securities, BofA Merrill Lynch, Barclays Capital, UBS Investment Bank and Credit Suisse Securities (USA) LLC.

I hate the fact that the Fucktard is from South Carolina. If I had it in my power we’d strip him of his Southern Heritage . Hmmmm….maybe a blood transfusion with some guy from an insane asylum that way his blood wouldn’t be Southern anymore !!!! HOLY SHIT….maybe that’s why he’s been doing crazy stuff for soooo long…someone already did it !

[img [/img]

[/img]

Bernanke after the transfusion (if I’d had done it).

[img ?1B608EE7AFCE3765E176F3C6FBB98002B3D18C64572F2307D76EAC72A67DF7BE8818[/img]

?1B608EE7AFCE3765E176F3C6FBB98002B3D18C64572F2307D76EAC72A67DF7BE8818[/img]

[img [/img]

[/img]

RE

[img [/img]

[/img]

RE

Remember though, this is YOUR fault, because YOU voted for these guys!

[img [/img]

[/img]

Ummm, wait a minute…

RE

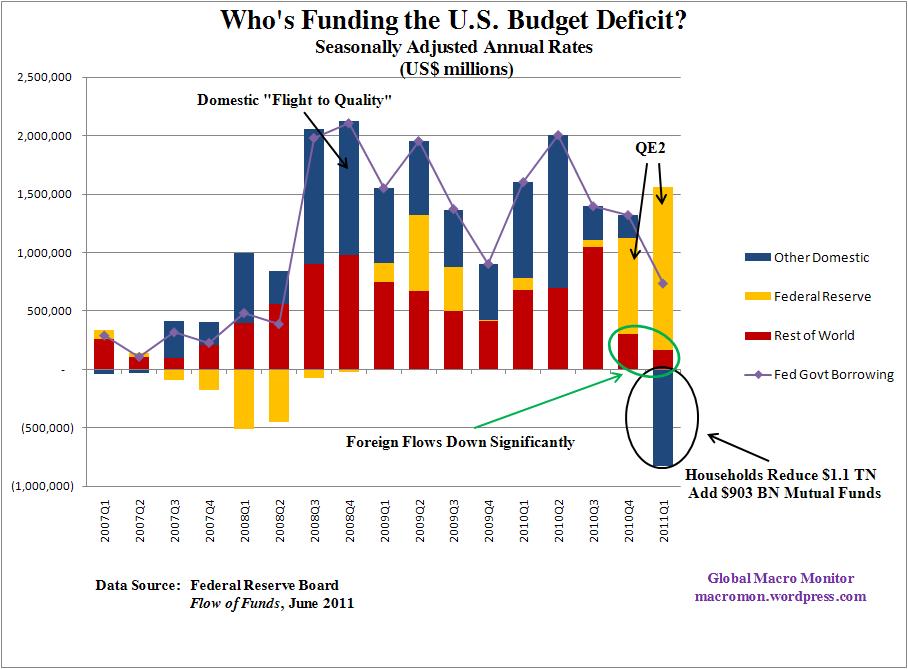

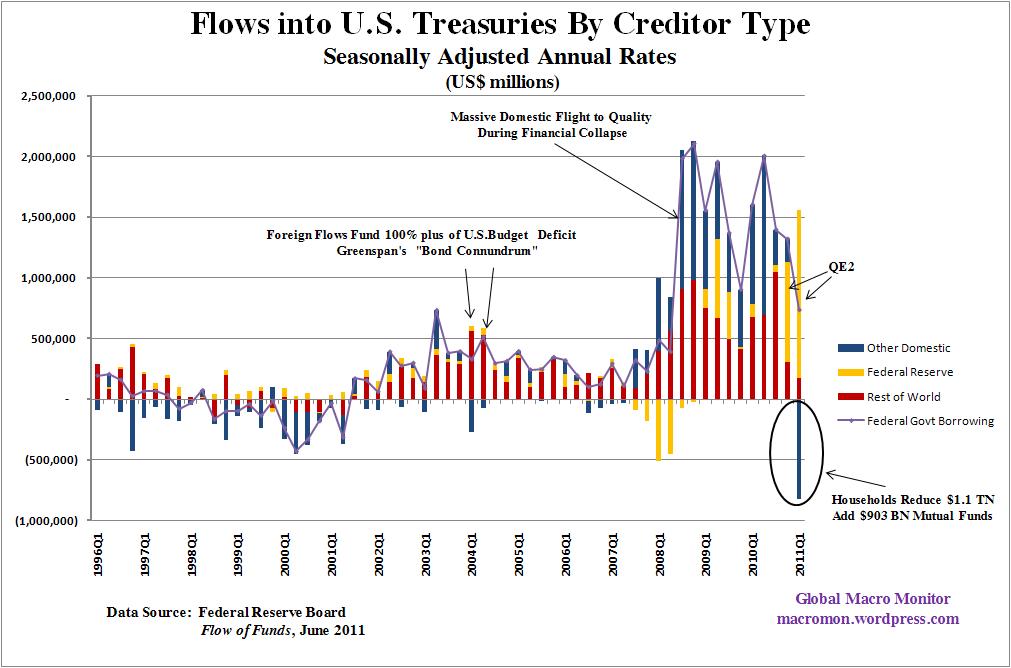

REALLY IMPORTANT CHART. WHO WILL BUY TREASURIES IN THREE WEEKS WHEN QE2 ENDS?

[img [/img]

[/img]

[img [/img]

[/img]

[img [/img]

[/img]

Market finished on a big slide, Dow went under 12,000. Gold and Silver also down. Are we finally seeing capitulation and margin calls?

RE

Stock Market Stocks Sink as Global Growth Fears Mount

By Chao Deng 06/10/11 – 02:48 PM EDT

NEW YORK (TheStreet) — Stocks plunged Friday as new evidence of slowing global economic growth deepened investor fears of a double-dip recession in the United States.

More on Stock Market

Futures Fall on Signs of Slowing GrowthStocks Snap Losing StreakFutures Up Despite Rise in Jobless ClaimsMarket Activity

Goodyear Tire & Rubber Co| GT Dow Jones Industrial Average| ^DJI S&P 500 Index| ^GSPC The sell-off pushed the Dow Jones Industrial Average below the 12,000 mark in intraday trading for the first time since mid-March, and sent the Nasdaq Composite into negative territory for the year.

The Dow was recently down 134 points, or 1%, to 11,990, getting a slight bounce off a session low of 11,937. The S&P 500 was shedding 14 points, or 1.1%, at 1275, and the Nasdaq was losing 31 points, or 1.1%, at 2654.

Lackluster economic data from overseas and a subsequent slump in world stocks provided a catalyst for the selling. China’s trade surplus in May came in lower than expected, while British industrial production in April saw a steeper-than-projected decline.

The uninspiring economic outlook from the Federal Reserve’s Beige Book report and an increase in jobless claims, both reported on Thursday, have left the markets struggling to find a reason to claw upwards.

The financial sector was a drag on the major averages for much of the session as the Federal Reserve announced plans to expand checks on capital levels at 35 of the nation’s largest banks. The KBW Banker Index was down nearly 2% at one point but staged a rebound to just below the flat line following reports that the central bank’s surcharge plans may not be severe as originally anticipated.

Of the 2.2 billion shares trading on the New York Stock Exchange, 92% were falling while about 8% were rising. 1.2 billion shares were changing hands on the Nasdaq.

Within the Dow, 27 of the blue-chip index’s 30 components were in the red. Travelers(TRV_), Caterpillar(CAT_) and Pfizer(PFE_) were among the biggest laggards. Bank of America(BAC_), JPMorgan Chase(JPM_), and AT&T(T_) were slightly higher.

The Bureau of Labor Statistics said import and export prices each rose by 0.2% for May, after growth of 2.1% and 0.9%, respectively, in April. Import prices, excluding fuel, rose 0.4% in May, and export prices, excluding agriculture, gained 0.5%.

“Unless there is a catalyst to take us back up, the path of least resistance is on the downside,” said Jay Suskind, a senior vice president at Duncan Williams. “The latest economic numbers have been ‘tepid at best,’ so the concern over a possible double-dip recession remains the underlying factor behind the weak market,” he said.

Im going to drink some vodka,and buy more vodka.Im tired of all the weiner talk on the tube.Makes me think it would be easy to distract all the genius folks out there.

We R SAVED!

Da Fed is increasing its Central Planning Authority and will now only distribute Free Money to those banks who will submit a Capital Plan approved by Da Fed. since Da Fed is so good at managing money, this will quickly resolve all our problems.

And here I was worried. I feel so foolish now.

RE

Fed to Expand Bank Capital Review Plan

By BLOOMBERG NEWS

Published: June 10, 2011

. The Federal Reserve on Friday said it would expand a capital planning program to the 35 largest United States banks to ensure they had an adequate buffer in an economic crisis.

Bank holding companies with at least $50 billion in assets would be required to adopt “robust, forward-looking capital planning processes that account for their unique risks,” the Fed said in a statement.

Banks also would need to submit plans to raise dividends or repurchase stock as part of the Fed reviews, to begin early next year, the Fed said. Banks whose plans were rejected would have to get approval before distributing capital.

Some investors welcomed the tougher supervision, saying it was long overdue.

“This amount of oversight is something that has been lacking in the corporate board room in most banks,” said Joel Conn, president of Lakeshore Capital in Birmingham, Ala.

In March, the 19 largest banks, including Wells Fargo and JPMorgan Chase, completed capital reviews that allowed many to increase dividends or buy back shares. The new reviews are part of a broader effort, which includes the Dodd-Frank financial regulation legislation, to tighten supervision of financial companies and reduce the risk of another crisis.

Before the recent crisis, “many bank holding companies made significant distributions of capital, in the form of stock repurchases and dividends, without due consideration of the effects that a prolonged economic downturn could have on their capital adequacy,” the Fed said in its proposed rule.

The initiative may compel banks to hold additional capital and reduce profitability measured by return on equity, said Bert Ely, an industry consultant based in Alexandria, Va.

“There will be tremendous pressure to downsize,” he said, or have “financial engineers to come up with new forms of shadow banking” by moving activities outside commercial banks.

Looks like the Dollar is getting the Recharge I predicted resulting from Euro Sovereign Debt problems and collapsing Equity values. If the run on the Stock Market continues into next week, look for the Dollar to climb in relative value as Equities collapse. PMs will probably bounce around until we pass maybe a 10% drop in Equities, that would e enough to set off Margin Calls. Then the PM Bubble will collapse rapidly with a lot of sell side forced deleveraging.

Its still IFFY. Helicoptr Ben can certainly drop in next week to stem the tide. Right now however, Da Fed is still holding fast to the no further QE line. Next week should be very good entertainment. Break out the Popcorn (if you can still get any).

RE

—————-

WORLD FOREX: Dollar Rises: Global Jitters Spark Safe-Haven Buying

By Javier E. David

Of DOW JONES NEWSWIRES

NEW YORK (Dow Jones)–Global economic concerns led investors to seek shelter in the safe-harbor dollar Friday, pushing the euro to its deepest one-day selloff in a month. Persistent fears about the Greek debt crisis also weighed on the single currency.

Markets have grown unsettled by a combination of slowing global growth and rising price pressures. On Friday, inflation fears manifested themselves in the form of May U.S. import prices, which posted an unexpected gain of 0.2%. Higher-yielding assets such as stocks and oil sold off sharply in response.

Given loose U.S. monetary policy and widening fears over a possible breach of the debt ceiling, traders aren’t favorably disposed to the dollar. But with Europe racing against the clock to secure a permanent solution to Greece’s sovereign debt woes — and inoculate other troubled euro zone economies against the risk of contagion — the dollar is winning out, if only by default.

“At the same time you have these euro negatives, you’ve had the U.S. slowdown story take hold” which has undermined the dollar, said Alan Ruskin, foreign exchange strategist at Deutsche Bank.

Investor risk aversion “is the easiest place to point the finger because there’s a dearth of news in Europe. There are so many balls in the air it’s easy to drop one or two,” he said, citing a rout in commodities, a rise in Mideast tensions and soft economic data out of China as factors as giving markets pause.

Late Friday, the euro was at $1.4350 from $1.4510 late Thursday, according to EBS via CQG. The dollar was at Y80.34 from Y80.36, while the euro was at Y115.23 from Y116.63. The U.K. pound was at $1.6223 from $1.6366. The dollar was at CHF0.8431 from CHF0.8417.

The ICE Dollar Index, which tracks the U.S. dollar against a basket of currencies, was at about 74.836 from 74.192.

The euro’s sharp slide has come in spite of a market that has bought the currency in anticipation of higher interest rates from the European Central Bank (ECB). Recent market action suggests the prospect of higher rates is largely factored into the single currency’s price — and that the euro can no longer count on its yield advantage to the dollar to compensate investors for the risk of a Greek credit event.

On Friday, Greek Finance Minister George Papaconstantinou said his country expects its euro-zone partners to cover its financing needs with a new loan for the next two or three years. Although an agreement in principle exists, market observers still fear that it won’t be enough to prevent bondholders from having new terms foisted on them in the form of a restructuring or default.

“Greece will default,” said Guy Stern, head of multi-asset investing for U.K.-based Standard Life Investments. Over the course of the next three years, he sees the euro falling as low $1.16.

Europe’s leaders “will support Greece for long enough so [peripheral economies] can get strong, and then they will allow Greece to default.”

Repeat after me, the ENTIRE point of QE and the stimulus was to bail out the TBTF banks. That is the ONLY goal of the Fed and if it requires hyper inflationary collapse to make them whole from their broken risk management, greed and incompetence, then YES WE CAN!!!

RE – There will never be any recovery anywhere until ALL the TBTF banks are destroyed…

The Eurozone is toast…

Giving money to the very banks which own the Fed at virtually no cost (while they rermain free to impose usurious 30% APR on their credit cards) is not Quantitative easing, it borders on crime: Interior Secretary Albert Fall,of Teapot Dome Scandal fame, went to prison after being convicted of accepting an interest-free loan from Sinclair Oil (in return for giving them leases on the Strategic Petroleum Reserve lands)- after all, with an interest free loan, what is wriong with paying back a billion at one dollar a year?. And yet the Fed’s actions are criticized only in terrms of being “misguided.”

For the wage earner, there has been no easing. Simply having a moratorium on paycheck withholding (which was only started as an “emergency” during WWII) would have been simple and effective. But simplification and big government never go together. Even in autocratic Russia, (where the President claims the right to override states’ right to select their governors), they have seen the wisdom of simplifying their tax system with a 14% flat tax. No free ride for their version of GE.

R- Albert Fall and Teapot Dome occurred back when the FS of A still had a functional system of justice. Nowadays the Justice Department can only exert itself chasing down whistleblowers of gummint wrongdoing and conflating computer hacking with terrorism.

Blankfein, Dimon et al would be facing indictment if Eric Holder were still alive…

“The Federal Reserve’s objectives – its dual mandate, set by Congress – are to promote a high level of employment and low, stable inflation.” Uncle Ben Bernanke

Interesting that. Seems I recall Greenspan raising the interest rates 8 times in 2000 becauseof fear of non-existant inflation, so he raised the rates to create unemployment.

Unemployment.

Square that to Uncle Ben’s statement….as we march Fed officials to the gallows.

Wasn’t McDonald’s (And G.E. since they are mentioned), the “Great Hirer” of the last fiscal quarter….a recipient of one of Uncle Ben’s bailouts?

I do believe they were…..I’d be curious to see how much they received….against future earnings by their newly hired.

OK. Are we all agreed? We meet in Washington, D. C. and burn down all of the banks. Oh yeah, Muck About is supplying the Guinness.

Barbarossa – Let’s discuss a date for this and see how far the message can get out. I think it should start on a scorching HOT day so the piggies will get heat stroke in their riot gear, middle of the week so we can fuck up traffic, and to hell with any stupid permits. The Constitution IS the permit.

Thoughts, guys and girls?

If I counterfeit bills I go to jail. if the government counterfeits bills and calls it monetary policy and tells us it will make us all better off, it somehow is palatable. Has the world gone nuts?

@Frank H: It’s well on the way. You have a fringe alt-media (like TBP) putting out the straight skinny, the MSM who is in the pockets of big Corp/Banks, The Fed who is in the same pockets and a vast unknowing, uncaring J6P interested only in his/her Reality TV, beer and cheap shit processed foods. The last (J6P) does not think beyond the end of his dick (or other private parts if it’s a she) and really truly, only cares for the freebies the Government promises to hand out.

When the hand out stop – and they will , great shock and woe will be expressed (“Like, uhh, whatjudothatfor”) and more QE will be forthcoming to pump more food stamp and freebies to the masses (and they are the masses with 51% on Government checks).

Why, do you imagine that the recent riots in Chicago, NJ, Miami etc. aren’t covered by the MSM? Large groups of unemployed young people gathering and looting, attacking cars and pedestrians as they go about their business? Heard about these a lot? Thought not.

They are happening more and more often and pretty soon, some of these assholes are going to get blown away in large numbers by people who won’t stand for the car windows to be smashed by gangs of hooligans and the fight back starts..

But they are keeping it quiet now. No use frightening the sheeple.. Bah..

MA

The wonderful ‘wise’ man running the so-called ‘central bank the the USA’ finally said it. Publicly. Quote:

“Even a short suspension of payments on principal or interest on the Treasury’s debt obligations could cause severe disruptions in financial markets and the payments system,” Mr. Bernanke said in remarks prepared for delivery at an event sponsored by the Committee for a Responsible Federal Budget.

Inaction could also “create fundamental doubts about the creditworthiness of the United States, and damage the special role of the dollar and Treasury securities in global markets in the long term”

So, officially, the Fed chairman wants to increase national borrowing, preferably to infinity by removing the debt ceiling. Otherwise, both the pristine AAA credit rating and world reserve currency status will be in jeopardy. He puts his stick on the ground.

Therefore, if Congress do not do what chairman Ben said, the poor guy must resign.

And if Congress do not raise the debt ceiling and the administration do not borrow more, yet AAA rating is not affected, what will chairman Ben do? Utterly discredited, chairman Ben must resign, again.

But there is no need to resign twice. First he resign. Then Congress repeals the Federal Reserve Bank Act after refusing to raise the debt ceiling.

Now isn’t that a breadth of fresh air? For this I will give it AAAA rating.