I think the chances of military conflict with Iran in the next two years are better than 50%. Students stormed the UK embassy in Iran. London is kicking the Iranians out of their embassy in London. Israel blew up an Iranian missile base a couple weeks ago. Israel will not let Iran get a nuke. Obama needs to distract the public from our terrible economy with a foreign crisis. The implications of Iranian oil coming off the worldwide markets would be devastating. China would not be happy since they get 10% of their oil from Iran. The world is already on the verge of collapse and a surge in oil prices would create a worldwide depression. This Fourth Turning sure is interesting.

Funds, refiners ponder oil Armageddon: war on Iran

REUTERS – Oil consuming nations, hedge funds and big oil refineries are quietly preparing for a Doomsday scenario: An attack on Iran that would halt oil supplies from OPEC’s second-largest producer.

Most political analysts and oil traders say the probability of military action is low, but they caution the risks of such an event have risen as the West and Israel grow increasingly alarmed by signs that Tehran is building nuclear weapons.

That has Chinese refiners drawing up new contingency plans, hedge funds taking out options on $170 crude, and energy experts scrambling to determine how a disruption in Iran’s oil supply — however remote the possibility — would impact world markets.

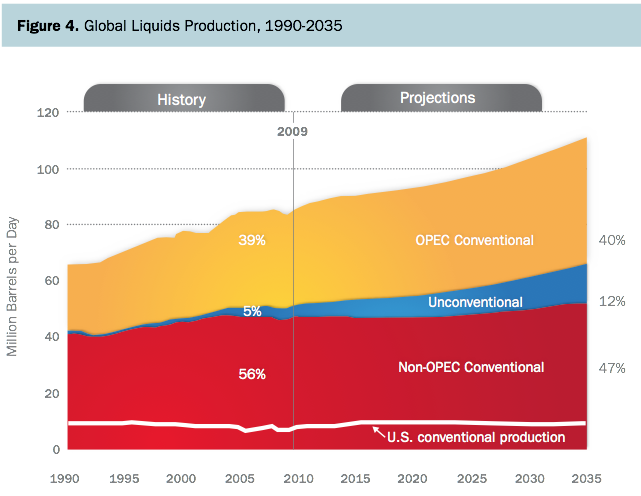

With production of about 3.5 million barrels per day, Iran supplies 2.5 percent of the world’s oil.

“I think the market has paid too little attention to the possibility of an attack on Iran. It’s still an unlikely event, but more likely than oil traders have been expecting,” says Bob McNally, once a White House energy advisor and now head of consultancy Rapidan Group.

Rising tensions were clear this week as Iranian protesters stormed two British diplomatic missions in Tehran in response to sanctions, smashing windows and burning the British flag.

The attacks prompted condemnation from London, Washington and the United Nations. Iran warned of “instability in global security.”

While traders in Europe prepare for a possible EU boycott of imports from Iran, mounting evidence elsewhere points to long-odds preparation for an even more severe outcome.

In Beijing, the foreign ministry has asked at least one major Iranian crude oil importer to review its contingency planning in case Iranian shipments stop.

In India, refiners are leafing through an unpublished report produced in March to look at fall-back options in the event of a major disruption.

And the International Energy Agency, the club of industrialised nations founded after the Arab oil embargo that coordinated the release of emergency oil stocks during Libya’s civil war, last week circulated to member countries an updated four-page factsheet detailing Iran’s oil industry and trade.

The document, not made public but obtained by Reuters, lists the vital statistics of Iran’s oil sector, including destinations by country. Two-thirds of its exports are shipped to China, India, Japan and South Korea; a fifth goes to the European Union.

Hedge funds, particularly those with a global macro-economic bias, have taken note, and are buying deep out-of-the-money call options that could pay off big if prices surge, senior market sources at two major banks said.

Open interest in $130 and $150 December 2012 options for U.S. crude oil on the New York Mercantile Exchange (NYMEX) rose by over 20 percent last week. Interest in the $170 call more than doubled to over 11,000 lots, or 11 million barrels. Still more traded over-the-counter, sources say.

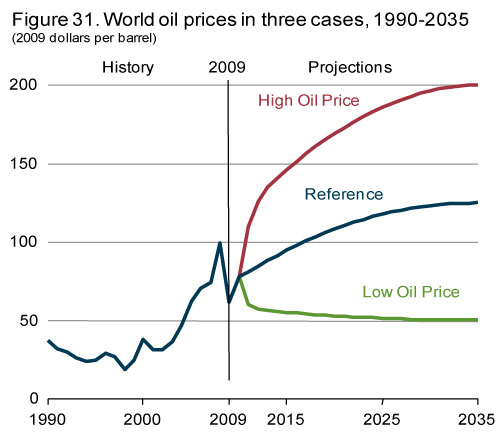

McNally says that oil prices could surge as high as $175 a barrel if the Strait of Hormuz — conduit for a fifth of the world’s oil supply, including all of Iran’s exports — is shut in.

IAEA CITES “CREDIBLE” INFORMATION

This month’s speculation of an attack on Iran is the most intense since 2007, when reports showing that Iran had not halted uranium enrichment work fuelled speculation that President George W. Bush could launch some kind of action during his last year in office. Those fears helped fuel a 36 percent rise in oil prices in the second half of the year.

The latest anxiety was set off by the International Atomic Energy Agency’s November 8 report citing “credible” information that Iran had worked on designing an atomic bomb. A new round of sanctions followed, including the possibility that Europe could follow the United States in banning imports.

That alone would roil markets, but ultimately would likely just drive discounted crude sales to other consumers like China.

A more alarming — if more remote — possibility would be an attack by Israel, which has grown increasingly alarmed by the possibility of a nuclear-armed Iran. Israeli Defense Minister Ehud Barak said on November 19 that it was a matter of months, not years, before it would be too late to stop Tehran.

In that context, every tremor has been unnerving for markets. Some experts say an explosion at an Iranian military base earlier in the month was the work of Mossad, Israel’s intelligence agency. An unusually large tender by Israel’s main electricity supplier to buy distillate fuel raised eyebrows, although it was blamed on a shortage of natural gas imports.

REFINERS BRACE

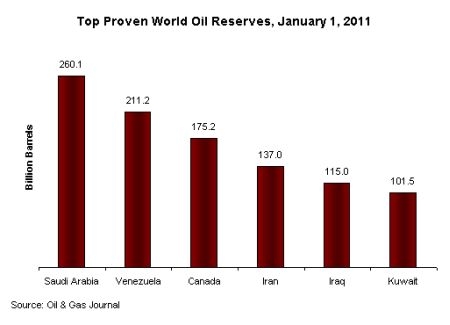

No country has more reason to be concerned than China, which now gets one-tenth of its crude imports from Iran. Shipments have risen a third this year to 547,000 barrels per day as other countries including Japan reduce their dependence. Sinopec, Asia’s top refiner, is the world’s largest Iranian crude buyer.

The Foreign Ministry and the National Development and Reform Commission, which effectively oversees the oil sector, have asked companies that import the crude to prepare contingency plans for a major disruption in supply, a source with a state-owned company told Reuters.

The precautionary measure preceded the latest geopolitical angst and is broadly in line with Beijing’s growing concern over its dependence on imported energy. Earlier this year it issued a notice for firms to prepare for disruptions from Yemen.

But the focus has sharpened recently, the source said.

“The plan is not particularly for the tension this time, but it seems the government is paying exceptionally great attention to it this time,” said the source on condition of anonymity.

In India, which gets 12 percent of its imports from Iran, refiners had a potential preview of coming events when the country’s central bank scrapped a clearing house system last December, forcing refiners to scramble to arrange other means of payment in order to keep crude shipments flowing.

That incident — in addition to the Arab Spring uprising and the Japanese earthquake — prompted the government to document a brief but broad strategy for handling major disruptions.

The document, which has not been reported in detail, says that India could sustain fuel supplies to the market in the event of an import stoppage for about 30 days thanks to domestic storage, and would turn to unconventional and heavier imported crude as a fall-back.

It also urged the country’s state-owned refiners to work on developing domestic storage facilities for major OPEC suppliers, consider hiring supertankers to use as floating storage and to sign term deals to price crude on a delivered basis, a copy of the document seen by Reuters shows.

The government has not tasked refiners with additional preparations this month, industry sources say. And in any event, there’s not much they could do.

“If they cut supplies we will be left with no option than to buy from the spot market or from other Middle East suppliers,” said a senior official with state-run MRPL, Iran’s top India client.

To be sure, there’s only so much any refiner can do. The gap left by Iran will trigger a frenzy of buying on the spot market for substitute barrels, likely leading the IEA to release emergency reserves, as it did following the civil war in Libya, or other countries like Saudi Arabia to step into the breach.

“We probably need to do this ASAP but are putting our heads in the sand so far,” said one oil trader in Europe.

For refiners like Italy’s Eni (ENI.MI) and Hellenic Petroleum (HEPr.AT), the most pressing issue is not necessarily an unexpected outage but an import boycott imposed by their government. France has won limited support for such an embargo, but faces resistance from some nations that fear it could inflict more economic damage.

CHEAP PUNTS

Unlike in 2007, there’s not yet much evidence that a significant geopolitical risk premium is being factored into prices.

European benchmark Brent crude oil has rallied 4 percent in the past two days, partly due to accelerating discussion of a Europen boycott as well as Tuesday’s unrest in Tehran, during which protesters stormed two British diplomatic compounds.

But it is also down 4 percent since the IAEA’s November 8 report. Analysts say that it’s impossible to extract any Iran-specific pricing from a host of other recently supportive factors, including new hope to end Europe’s debt crisis, strong global distillate demand and upbeat U.S. consumer data.

“I don’t think there’s very much evidence (of an Iran premium),” says Ed Morse, global head of commodities research at Citigroup and a former State Department energy policy adviser.

And he does not see an attack as likely: “I think it’s a low probability event. Maybe higher than a year ago, but still low.”

But that is not stopping some from looking ahead. Oil prices would likely spike to at least $140 a barrel if Israel attacked Iran, according to the most benign of four scenarios put forward this week by Greg Sharenow, a portfolio manager at bond house PIMCO and a former Goldman Sachs oil trader.

He refused to predict a limit for prices under the most extreme “Doomsday” scenario in which disruptions spread beyond Iran and the Straits of Hormuz is blocked.

With that in mind, hedge funds are buying cheap options in a punt on an extreme outage. For about $1,500 per contract, a buyer can get the right to deliver a December 2012 futures contract at $150 a barrel; even if prices do not rise that high, the value of the options contract could increase tenfold.

The spark of demand for upside price protection this month is an abrupt reversal from most of this year, when the bias was toward puts that would hedge the risk of economic calamity.

“The kind of put skew we were seeing in the last three to six months was remarkable with people preparing for disaster – the Planet of the Apes trade, another massive market crash,” says Chris Thorpe, executive director of global energy derivatives at INTL FC Stone.

“Only in the last three or four weeks has there been increased call buying.”

Options remain relatively costly compared to earlier in the year, with implied volatility — a measure of option cost — of 43 percent above this year’s average of just below 35 percent, the CBOE Oil Volatility index shows.

But nonetheless it’s clear that for some funds the potential upside of violence in Iran means that interest is increasing.

Says Thorpe: “It’s at the back of people’s minds.”