It’s funny how the truth sometimes leaks out from the government. I’m guessing that Mr. Ted Berg will not be working for the Office of Financial Research much longer. This new agency was created by the Dodd Frank Law and is supposed to protect consumers from the evil Wall Street banks. But we all know the evil Wall Street banks wrote the bill, have gutted the major provisions, have captured all the regulatory agencies, own the Federal Reserve, and control all the politicians in Washington D.C. So, when an honest government analyst writes an honest truthful report that unequivocally proves the stock market is grossly overvalued and headed for a crash, the Wall Street banking cabal will surely call the top government apparatchiks to voice their displeasure. Truth is treason in an empire of lies.

The soon to be fired Mr. Berg’s verbiage is subtle, but pretty clear.

Option-implied volatility is quite low today, but markets can change rapidly and unpredictably, a phenomenon described here as “quicksilver markets.” The volatility spikes in late 2014 and early 2015 may foreshadow more turbulent times ahead. Although no one can predict the timing of market shocks, we can identify periods when asset prices appear abnormally high, and we can address the potential implications for financial stability.

Markets can change rapidly and unpredictably. When these changes occur they are sharpest and most damaging when asset valuations are at extreme highs. High valuations have important implications for expected investment returns and, potentially, for financial stability.

However, quicksilver markets can turn from tranquil to turbulent in short order. It is worth noting that in 2006 volatility was low and companies were generating record profit margins, until the business cycle came to an abrupt halt due to events that many people had not anticipated.

The full report can be found here:

http://financialresearch.gov/briefs/files/OFRbr-2015-02-quicksilver-markets.pdf

The meat of the report is in the charts. The CAPE Ratio, which has been a highly accurate predictor of market tops is now almost two standard deviations above the long term average and at the same level it was before the 2008 crash. It has only been higher in 1929 and 1999. That should give you a nice warm feeling about the coming bull market. Right?

Profit margins are at all-time record highs as corporations don’t have to pay higher wages, can borrow for virtually free, and continue to outsource to foreign countries. Profit margins are 60% above the long-term average and always revert to the mean. Do you expect them to expand or contract from here?

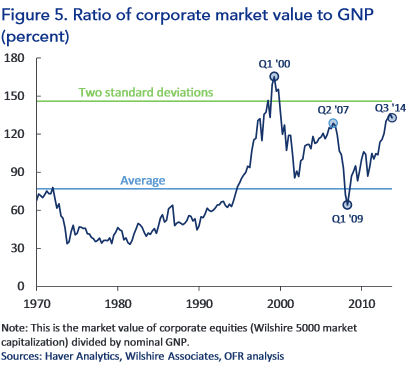

Warren Buffett, before he became a shill for the status quo, judged the value of the market based upon corporate market value to GNP. This ratio is also almost two standard deviations above the long term average. It is higher than it was in 2007. It is 75% above the long-term average. It has only been higher during the internet bubble in 2000. Would you bet on it reaching 3 standard deviations above the long-term average? Wall Street and CNBC are telling you to make that bet.

We all know about the cash on the sidelines ready to come into the market and drive it higher. The fact that margin debt is at an all-time high shouldn’t be a concern at all. Right? What you have are a bunch of monkeys who think they are brilliant investors. They are sure Janet has their back. The panic when this market begins to go south will be epic. As the margin calls come in, the market will spiral out of control, creating more margins calls. The bodies will be piled high and calls for Janet to save the monkeys will be shrill.

As you may have noticed, the market is now regularly experiencing 200 to 300 point swings on a regular basis. Low volatility and a steady rise in prices is a hallmark of bull markets. High volatility and choppy markets is a sign of bear markets. The spike in volatility since September is a warning sign. But the captains of the Wall Street Titanic banks declare “full steam ahead”. We all know what happens next.

Some people never learn. Even though we’ve experienced two horrific stock market crashes in the last fifteen years, with losses of 40% to 80%, the professional monkeys posing as investment experts ignore facts, history, and common sense. At current stock market valuations, you are virtually guaranteed to lose money in the market over the next ten years, and experience a death defying collapse in the foreseeable future. Will the Ivy League MBA’s heed these warnings? Not a chance. They think they are the smartest guys in the room.

We’re Lost in Space. Danger is everywhere, but no one seems to care.

I was really intrigued that the CAPE, Q-Ration is approaching two-sigma thresholds. I just KNEW that was gonna be a problem.

I’ll probably lose sleep tonight because of that.

Same goes for the Q-Ratio.

Stuck

I do these posts just for you. I know you love statistics and graphs.

Why is two-sigma relevant? Valuations approached or surpassed two-sigma in each major stock market bubble of the past century. And the bursting of asset bubbles has at times had important implications for financial stability. The two-sigma threshold is useful for identifying these extreme valuation outliers. Assuming a normal distribution in a time series, two-sigma events should occur once every 40-plus years; in equity markets, they occur more frequently due to fat-tail distributions.

[img [/img]

[/img]

[img [/img]

[/img]

Anyone can see that the market is only propped up through lies – lies that are propagated by a completely captivated media conglomerate and a government that functions to protect corporations from their customers, and not vice versa.

Nobody talks about this out loud. But everyone is thinking it. The mutters are around the water cooler, at family reunions, and at the bar. Churches, shopping, school…people know they are being fucked hard. They just aren’t sure what to do about it.

The stock market might not be the start of the shit hitting the fan, but it is the one sure-fire indicate that all is going to hell, that the fourth turning is well and truly moving into its next, most violent phase.

Love how all the borrowed money and stock buybacks did not manage to budge EPS by much.

Things are soooooooooooooooooo much worse than they appear.

Re the volatility issue – I suspect high speed traders make more money when there is substantial volatility. The old paradigm no longer exists due to the way the system is manipulated by high speed and frequency traders.

The old adage – that when you are playing cards and cannot figure out who the sucker is, then you are the sucker – applies now more than ever.

I have followed Mr. Quinn for several years. He has been pessimistic about the economy and markets the whole time. He knows we are not going to a good place. The doom and gloom has always been in the future before. This article conveys a sense of urgency. We would do well to listen to him.

TPC the timing of this crash relative to the generations theory and 4 th Turning is ominous.

TPC – I wish you were right but I don’t agree that there’s enough citizens who will initiate a backlash or revolt.

It certainly doesn’t take a well informed person to get angry that things just aren’t working the way they should and that our entire economy is a enormous charade that will likely crumble but many are just too apathetic and financially dependent on government so have no incentive to fight. To the contrary, they fear standing up for themselves BECAUSE many are financially dependent and don’t want to risk losing government benefits so they support the government no matter how corrupt it becomes.

Once most are cut off from government financial support, it will be tool late since they won’t have the means to fight back.

We all have our own suspicions regarding timelines for collapse and should act on them – probably sooner than later.

Mr. Berg’s statement, ” we can address the potential implications for financial stability.” is a wingdinger.

There’s a big difference between ‘financial stability’ and ‘market stability’. One tries to maintain a equilibrium in the small financial sector, whereas, the other tries to maintain equilibrium in the exchange of goods and services: the big kahuna. The market is a sum of all the transaction that occur every day, world wide.

It has been said that nature abhors a vacuum. What that means is the the Universe seeks equilibrium. Ever wonder why the Earth doesn’t go spinning off toward Alpha Centauri ? Equilibrium folks.

Since market stability has been forsaken for financial stability, deformations are occurring on a daily basis with increasing magnitudes. A 2 sigma deviations soon to be 6 sigma deviations. Held together with propaganda, capital controls, and brute force. It’s all doomed to fail as Mother Nature is enormously more powerful than those creating these deformations. God is not mocked. He has rules that govern the Universe (you and me). I’m betting with Mother Nature. She is, yet, to be fooled even tho man in his infinite stupidity has tried so many times to his undoing.

Range Population in range Approx. frequency for daily event

1σ 1 in 3 Twice a week

1.5σ 1 in 7 Weekly

2σ 1 in 22 Every three weeks

2.5σ 1 in 81 Quarterly

3σ 1 in 370 Yearly

3.5σ 1 in 2149 Every six years

4σ 1 in 15787 Every 43 years (twice in a lifetime)

4.5σ 1 in 147160 Every 403 years (once in the modern era)

5σ 1 in 1744278 Every 4776 years (once in recorded history)

5.5σ 1 in 26330254 Every 72090 years (thrice in history of modern humankind)

6σ 1 in 506797346 Every 1.38 million years (twice in history of humankind)

6.5σ 1 in 12450197393 Every 34 million years (twice since the extinction of dinosaurs)

7σ 1 in 390682215445 Every 1.07 billion years (a quarter of Earth’s history)

You can see the the probability as the sigma event increases.

ss—sayz, “I wish you were right but I don’t agree that there’s enough citizens who will initiate a backlash or revolt.”

That’s not even important, whether there is or isn’t ‘enough citizens’. It will fail from it’s own shaky foundation. Debt-fiat money scheme’s basic premise is rooted in error. What possible good can come from an idea conceived in error. Good can only come from good. A Chinese saying goes, “If an evil man tries to do good, it will result in evil. However, if a good man commits evil, it will turn out good.” I guess, it’s what you are and your intentions that are defining.

Market stability is allway hard to achive

ciuperca la picior—That’s what bid and ask are all about. A free market always returns to stasis.

We don’t have a market, today. Everything is manipulated. All prices are phony. This leads to the mis-allocation of capital and the destruction of wealth. Just like the old Soviet Union with their central planning–You got fir coats in the summer and bikinis in the winter.

There isn’t any price discovery, so you can’t determine value therefore you can’t determine risk.

the only two-sigma i believe in is between white christian europeans and undocumented shoppers in a certain midwest oppressed suburb.

better have more whiskey- my iq is as low as the undocumented shoppers right now.