Guest Post by Lance Roberts

“Everyone wants a house, and that’s a big problem.

We’ve noted in the past that there is a substantial issue in the housing market right now. Too few homes are being built for the number of people that want to move into them, thus driving up prices and keeping some lower-end or first-time buyers out of the market.“

It is quite amazing that amount of optimism surrounding the housing market which has yet to recover substantially from post-financial crisis lows given the exorbitant amount of monetary stimulants injected into it.

The chart below shows the Total Housing Market Activity Index which is a composite of new and existing home sales, permits and starts. Yes, housing has recovered, but remains well below levels seen in 1999.

But let’s not let a trivial matter of data get in the way of a good story.

“Meanwhile, according to the Conference Board, although the share of households planning on buying a home in the next six months ticked down in April to 5.4%, that is significantly above the average of 3.6% recorded since 1978,” wrote Matthew Pointon, property economist at Capital Economics.

While individuals may CLAIM they want to buy a home when asked, there is a massive difference between “wanting to do something” and actually being able to do it.

Notice in the chart above that the spike in “home ownership desires” spiked in 2011 and has been steadily climbing since then. Surely, if we have a record number of households planning to buy a home, that should be reflected in the home ownership rate as well.

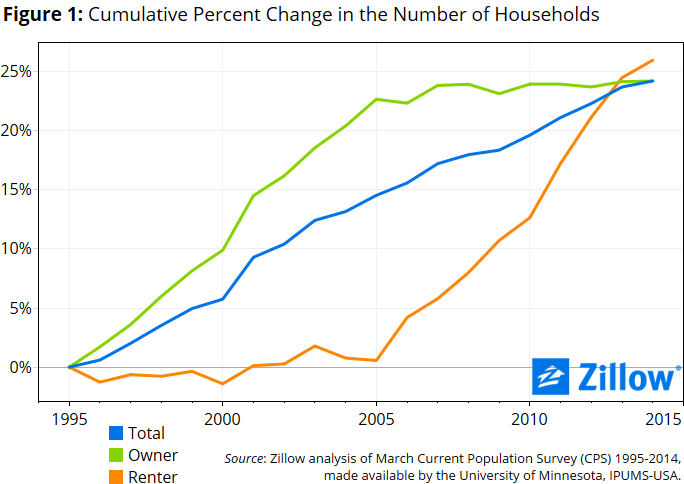

Considering that almost 80% of Americans can’t meet small emergencies, 1-in-5 families have ZERO members employed, and incomes are less than they were in 2000 – the chart above makes a good deal of sense. It is also why we have seen the rise of the “renter nation.”

Of course, I am assuming that Matt Pointon wasn’t talking about the newest fad in housing for Millennials: The 150-sq. ft. micro-home.