The political class and their mouthpieces in the corporate controlled mainstream media are desperately trying to spin the oil price surge as a temporary inconvenience that will not derail their phony recovery story. Brent crude closed at $116 per barrel yesterday. West Texas crude closed at $104 per barrel. Unleaded gas has risen by 22% in the last month and 60% since September 1, 2010. I’m sure this slight increase hasn’t impacted Ben Bernanke or Lloyd Blankfein. Their limo drivers just charge it to their unlimited expense accounts. Joe Sixpack, driving his 15 mpg Dodge RAM pickup, is now forking over an extra $1,200 per year in gas expenditures, not to mention more for everything impacted by oil such as food, utilities, and anything transported to their local Wal-Mart by truck (everything). Luckily, the Federal Reserve and crooked politicians only care about their comrades in the top 1% elitist society, for whom oil is an investment, not an expense.

UNLEADED GAS

The “experts” speak as if they know what will happen, even though they never saw the rebellions coming in Tunisia, Egypt or Libya. They assure the masses that Libya doesn’t really have an impact on U.S. oil supply. It’s as if these shills never took Econ 101 in college. World oil demand is 88 million barrels per day. Oil supply is 88 million barrels per day. If 1 million barrels of oil supply are taken off-line, it doesn’t matter that the U.S. doesn’t get their oil from Libya. The Italians need their oil. Do the talking heads understand that oil is fungible? The supplier will ship the oil to the highest bidder. Presto!!! – $116 a barrel oil.

With Friends Like This, Who Needs Enemies

Let’s assess the probability of things getting better in the near, medium, long term or ever term. Take a gander at the chart below. These countries account for 29% of the daily world oil supply. Does it strike you as a list of stable countries with happy populations of employed young men? Egypt, Libya, Yemen, Syria and Iran have already experienced revolution or are on the verge of revolution. Algeria is dead man walking. The Saudi royal family is trying to buy off the masses to stay in power. The revolution genie is out of the bottle. It can’t be put back. Mix 40% unemployment, with millions of young men, no hope, and some Muslim fundamentalism and you’ve got yourself an out of control situation. No amount of public relations spin will create a positive outcome for the United States. The existing world order of despots, kings, and military juntas was just fine for Washington DC. They poured hundreds of billions of “aid”, tanks, helicopters and missiles to these “freedom fighter” despots who diverted the billions to their Swiss bank accounts and fell into line with U.S. policy. No matter who takes power when these revolutions succeed in toppling our puppets, the new regimes will not be friendlier toward America. And they still have the oil.

| Proven Oil | Oil | |

| Country | Reserves (bil barrels) | Production Per Day |

| Saudi Arabia | 265 | 8,400,000 |

| Iran | 137 | 3,700,000 |

| Iraq | 115 | 2,700,000 |

| UAE | 98 | 2,300,000 |

| Kuwait | 102 | 2,300,000 |

| Libya | 46 | 1,600,000 |

| Algeria | 12 | 1,300,000 |

| Qatar | 25 | 820,000 |

| Oman | 6 | 810,000 |

| Egypt | 4 | 742,000 |

| Syria | 3 | 376,000 |

| Yemen | 3 | 298,000 |

One look at the chart of self reported world oil reserves paints a picture of woe for the United States. Countries in the tinderbox of the Middle East and Africa control 65% of the world’s oil reserves. Saudi Arabia controls 20%, Iran and Iraq control 11% each, Venezuela controls 7%, Russia 5%, and Libya 3%. So, countries that can barely stomach our existence, hate us, or just despise us, control 57% of the world’s remaining oil. Sounds like a recipe for lower oil prices in the future. The two countries on our border are the only dependable suppliers for the U.S. Canada controls 13% of the world oil reserves, mostly in its tar sands. Mexico controls just over 1% of the world’s oil reserves, but supplies 13% of the U.S. daily oil supply.

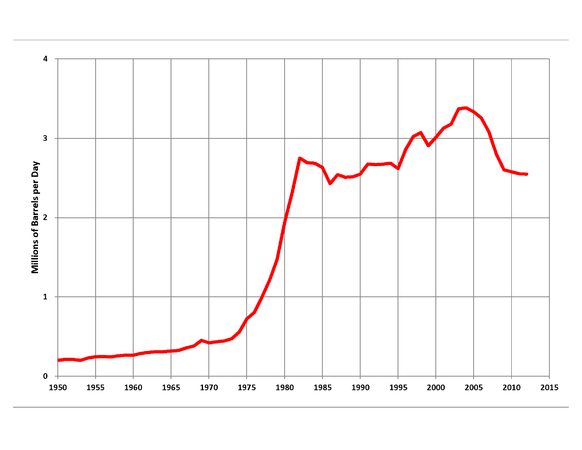

Drill, Baby, Drill

Now for a reality check on the “Drill Baby Drill” propagandists like Larry Kudlow and the other dishonest Republican shills. The United States controls a full 1.58% of the remaining oil reserves in the world. We have 21.3 billion barrels of reserves versus 264 billion barrels in Saudi Arabia. We are currently producing 9 million barrels per day. At that production rate, the U.S. will deplete its proven reserves in the next 6 to 10 years. New discoveries will not be able to keep up with depletion of existing wells. The good news just keeps coming. Mexico’s oil production has been dependent upon one giant oil field since 1976. The Cantarell oil field produced 2.1 million barrels per day in 2003 at its peak. It is currently producing 464,000 barrels per day. Peak oil has arrived in Mexico. By 2015, the country that currently supplies 13% of our daily oil supply will become a net importer of oil. Drill Baby Drill.

Based upon the monthly import data below from the IEA, it would appear that, to paraphrase Chief Brody in Jaws, we’re going to need more corn. As the Obama administration operates in denial of these simple facts, they will continue to push ethanol and Chevy Volts to save us from dirty oil. We are already diverting 40% of our corn crop to the ethanol boondoggle. I’m sure that has nothing to do with the 98% increase in corn prices in the last year. Maybe tax credits for solar panels on SUVs and rubber band propeller cars will save the day.

We know for a fact that Mexico’s 1.2 million barrels per day will evaporate in the next few years. But, at least we have that solid dependable 2.7 million barrels per day (30% of our daily imports) from those stable bastions of democracy Nigeria, Venezuela, Iraq, Angola, and Algeria. Makes you want to go out and buy a Hummer. The storyline being sold to the American people is that there is no need to worry. Saudi Arabia will step to the plate and make up for any shortfalls throughout the world. Just one problem. Saudi Arabia is lying about their reserves and their ability to increase production. They’d fit in very well in Congress and on Wall Street.

| Crude Oil Imports (Top 15 Countries) (Thousand Barrels per Day) |

|||||

|---|---|---|---|---|---|

| Country | Dec-10 | Nov-10 | YTD 2010 | Dec-09 | YTD 2009 |

|

|

|||||

| CANADA | 2,064 | 1,975 | 1,972 | 2,104 | 1,943 |

| MEXICO | 1,223 | 1,229 | 1,140 | 1,063 | 1,092 |

| SAUDI ARABIA | 1,076 | 1,119 | 1,080 | 870 | 980 |

| NIGERIA | 1,024 | 806 | 986 | 1,020 | 776 |

| VENEZUELA | 825 | 884 | 912 | 772 | 951 |

| IRAQ | 336 | 340 | 414 | 325 | 449 |

| ANGOLA | 307 | 263 | 380 | 266 | 448 |

| BRAZIL | 271 | 188 | 254 | 181 | 295 |

| ALGERIA | 262 | 379 | 325 | 336 | 281 |

| COLOMBIA | 220 | 489 | 338 | 179 | 251 |

| ECUADOR | 192 | 188 | 195 | 86 | 181 |

| RUSSIA | 158 | 85 | 252 | 168 | 230 |

| KUWAIT | 125 | 170 | 195 | 160 | 180 |

| UNITED KINGDOM | 124 | 80 | 120 | 67 | 103 |

| ARGENTINA | 85 | 35 | 29 | 33 | 53 |

Lies, Obfuscation, Misinformation & Denial

The late Matt Simmons made the strong case In his book Twilight in the Desert that Saudi Arabia has been lying about their reserves for years. Documents released by Wikileaks give support to this contention. Cables from the U.S. Embassy in Riyadh , released by WikiLeaks, urge Washington to take seriously a warning from senior Saudi government oil executive Sadad al-Husseini, a geologist and former head of exploration at the Saudi oil monopoly Aramco, that the kingdom’s crude oil reserves may have been overstated by as much as 300bn barrels – nearly 40%.

The UK Guardian reported:

According to the cables, which date between 2007-09, Husseini said Saudi Arabia might reach an output of 12m barrels a day in 10 years but before then – possibly as early as 2012 – global oil production would have hit its highest point. This crunch point is known as “peak oil”.

Husseini said that at that point Aramco would not be able to stop the rise of global oil prices because the Saudi energy industry had overstated its recoverable reserves to spur foreign investment. He argued that Aramco had badly underestimated the time needed to bring new oil on tap.

One cable said: “According to al-Husseini, the crux of the issue is twofold. First, it is possible that Saudi reserves are not as bountiful as sometimes described, and the timeline for their production not as unrestrained as Aramco and energy optimists would like to portray.”

The US consul then told Washington: “While al-Husseini fundamentally contradicts the Aramco company line, he is no doomsday theorist. His pedigree, experience and outlook demand that his predictions be thoughtfully considered.”

A fourth cable, in October 2009, claimed that escalating electricity demand by Saudi Arabia may further constrain Saudi oil exports. “Demand [for electricity] is expected to grow 10% a year over the next decade as a result of population and economic growth. As a result it will need to double its generation capacity to 68,000MW in 2018,” it said.

It also reported major project delays and accidents as “evidence that the Saudi Aramco is having to run harder to stay in place – to replace the decline in existing production.” While fears of premature “peak oil” and Saudi production problems had been expressed before, no US official has come close to saying this in public.

The overstatement of reserves by Saudi Arabia and most of the OPEC countries should be abundantly clear to anyone with a smattering of critical thinking skills. This eliminates just about everyone on CNBC or Fox News. Essentially, the self reported, unaudited declared oil reserves from OPEC members are a fraud. Production quotas for each member of OPEC are dependent upon their oil reserve amount. When this was instituted in the early 1980s, shockingly OPEC countries miraculously added nearly 300 billion barrels to proven reserves in a six year period with NO NEW DISCOVERIES of oil. The chart below shows the unexplained jumps in reserves in red. Do you honestly believe any self reported number from Iran or Venezuela? Dr. Ali Samsam Bakhtiari, a former senior expert of the National Iranian Oil Company, has estimated that Iran, Iraq, Kuwait, Saudi Arabia and the United Arab Emirates have overstated reserves by a combined 320–390 billion barrels and has said, “As for Iran, the usually accepted official 132 billion barrels is almost one hundred billion over any realistic estimate.”

Using some common sense, someone might ask, “How could Saudi Arabia’s oil reserves remain above 260 million for the last 22 years despite pumping over 60 billion barrels during this time frame, and not making any major new discoveries?” Maybe their statisticians did their training at Goldman Sachs or the Federal Reserve. The monster Saudi oil fields are over 40 years old. They will deplete. Oil is finite. They will not refill abiotically like some crackpots contend. Saudi Arabia’s production peaked in 2005 and it has been unable to reach that level since. The spin sheiks in Riyadh and spin doctors in Washington DC cannot spin oil out of sand. Peak oil is about to choke the American way of life.

| Declared reserves of major Opec Producers (billion of barrels) | ||||||||

| BP Statistical Review – June 2009 | ||||||||

| Year | Iran | Iraq | Kuwait | Saudi Arabia | UAE | Venezuela | Libya | Nigeria |

| 1980 | 58.3 | 30.0 | 67.9 | 168.0 | 30.4 | 19.5 | 20.3 | 16.7 |

| 1981 | 57.0 | 32.0 | 67.7 | 167.9 | 32.2 | 19.9 | 22.6 | 16.5 |

| 1982 | 56.1 | 59.0 | 67.2 | 165.5 | 32.4 | 24.9 | 22.2 | 16.8 |

| 1983 | 55.3 | 65.0 | 67.0 | 168.8 | 32.3 | 25.9 | 21.8 | 16.6 |

| 1984 | 58.9 | 65.0 | 92.7 | 171.7 | 32.5 | 28.0 | 21.4 | 16.7 |

| 1985 | 59.0 | 65.0 | 92.5 | 171.5 | 33.0 | 54.5 | 21.3 | 16.6 |

| 1986 | 92.9 | 72.0 | 94.5 | 169.7 | 97.2 | 55.5 | 22.8 | 16.1 |

| 1987 | 92.9 | 100.0 | 94.5 | 169.6 | 98.1 | 58.1 | 22.8 | 16.0 |

| 1988 | 92.9 | 100.0 | 94.5 | 255.0 | 98.1 | 58.5 | 22.8 | 16.0 |

| 1989 | 92.9 | 100.0 | 97.1 | 260.1 | 98.1 | 59.0 | 22.8 | 16.0 |

| 1990 | 92.9 | 100.0 | 97.0 | 260.3 | 98.1 | 60.1 | 22.8 | 17.1 |

| 1991 | 92.9 | 100.0 | 96.5 | 260.9 | 98.1 | 62.6 | 22.8 | 20.0 |

| 1992 | 92.9 | 100.0 | 96.5 | 261.2 | 98.1 | 63.3 | 22.8 | 21.0 |

| 1993 | 92.9 | 100.0 | 96.5 | 261.4 | 98.1 | 64.4 | 22.8 | 21.0 |

| 1994 | 94.3 | 100.0 | 96.5 | 261.4 | 98.1 | 64.9 | 22.8 | 21.0 |

| 1995 | 93.7 | 100.0 | 96.5 | 261.5 | 98.1 | 66.3 | 29.5 | 20.8 |

| 1996 | 92.6 | 112.0 | 96.5 | 261.4 | 97.8 | 72.7 | 29.5 | 20.8 |

| 1997 | 92.6 | 112.5 | 96.5 | 261.5 | 97.8 | 74.9 | 29.5 | 20.8 |

| 1998 | 93.7 | 112.5 | 96.5 | 261.5 | 97.8 | 76.1 | 29.5 | 22.5 |

| 1999 | 93.1 | 112.5 | 96.5 | 262.8 | 97.8 | 76.8 | 29.5 | 29.0 |

| 2000 | 99.5 | 112.5 | 96.5 | 262.8 | 97.8 | 76.8 | 36.0 | 29.0 |

| 2001 | 99.1 | 115.0 | 96.5 | 262.7 | 97.8 | 77.7 | 36.0 | 31.5 |

| 2002 | 130.7 | 115.0 | 96.5 | 262.8 | 97.8 | 77.3 | 36.0 | 34.3 |

| 2003 | 133.3 | 115.0 | 99.0 | 262.7 | 97.8 | 77.2 | 39.1 | 35.3 |

| 2004 | 132.7 | 115.0 | 101.5 | 264.3 | 97.8 | 79.7 | 39.1 | 35.9 |

| 2005 | 137.5 | 115.0 | 101.5 | 264.2 | 97.8 | 80.0 | 41.5 | 36.2 |

| 2006 | 138.4 | 115.0 | 101.5 | 264.3 | 97.8 | 87.3 | 41.5 | 36.2 |

| 2007 | 138.2 | 115.0 | 101.5 | 264.2 | 97.8 | 99.4 | 43.7 | 36.2 |

| 2008 | 137.6 | 115.0 | 101.5 | 264.1 | 97.8 | 99.4 | 43.7 | 36.2 |

The denial, accusations and misinformation have already begun. Congressional hearings will be called to blame Big Oil and the dreaded speculators. Americans always need a bogeyman to blame for their mindless decisions and willingness to be led to slaughter by corrupt politicians. Big oil companies do benefit from higher oil prices. Big oil companies spend millions buying off Congressmen. Big oil companies cut corners, ignore safety procedures, and seek profits by any means possible. But, they do not control the oil. Nations control the oil. Many of these nations are led by lying, corrupt, evil despots. That is a fact. Blustering moronic Congressmen going after oil executives and phantom speculators is just a sideshow. It will divert the non-thinking masses from the truth that our leaders haven’t allowed a refinery or nuclear power plant to be built since 1977. These leaders have promoted and subsidized corn based ethanol that requires more energy to produce than it creates and has driven the cost of our food sky high. We are more dependent on foreign oil than any time in our history.

The real speculators are the Americans who clog our highways every morning driving monster SUVs, turbocharged sports cars, gas guzzling minivans, and pickup trucks that make them feel like salt of the earth tough guys despite living in their 6,000 square foot energy sucking McMansions in suburban tracts 30 miles from their jobs, if they have one. The ignorance of the average American car buyer knows no bounds. The recent bounce back in auto sales was led by SUVs and pickups. The green clean cars are nothing but hype and bullshit. GM expects to sell about 10,000 Volts this year, and Nissan expects to sell about 25,000 Leafs in the United States, a piss in the ocean compared with the millions of sport wagons and SUVs purchased by Americans annually. Americans have the attention span of a gnat and are already dazed and confused by the surge in gas prices to $3.50 per gallon.

When oil prices spiked to $147 barrel in 2008, Americans were spending $467 billion per year for fuel. By early 2009, the collapse in energy prices due to the worldwide recession reduced the annual expenditure to $265 billion, freeing up over $200 billion for consumers to spend on other items, pay down debt, or save. Expenditures for fuel had already surged back to $400 billion before the recent spike in oil prices. Next stop $500 billion. That should do wonders for the faux economic recovery that has been touted by Obama and the MSM for the last year. The years of denial, lies, indecision, bad decisions, and inertia have left the country vulnerable and at the mercy of countries in far off lands that despise our way of life.

There are no good outcomes, only bad, really bad, and catastrophic. Take your pick. Could gas prices drop below $3.00 per gallon if the world sinks back into recession? Yes. But it would only be momentary. The easy to access supply is dwindling. The medium and long term direction of gas at the pump is up. There is nothing that can be done in the next five years to prevent significantly higher oil prices. A full court press of realistic ideas like converting our truck fleets to natural gas, a major effort to build nuclear power plants, more drilling, greater use of wind, geothermal, and solar would take at least a decade to have an impact. There is no consensus or resolve to undertake such an effort. Therefore, Americans will suffer the consequences. Be a good American and take advantage of GM’s no interest for 7 years deal on their biggest baddest SUVs and buy two. What could go wrong?

While i admit the demand for oil is high,,there are places in the usa where there is oil,alaska is one.oil shale is available in many western states.Natural gas should be developed.as an alternate fuel source.I also admit were kinda slow about developeing all of this,i mean look at all those new nuclear plants!You sure are right about all those big pu trucks,almost everyone in my small town seems to drive one,lucky to get 10 mpg,of course theres knothing in the bed and no trailer hitch.People could all be driving a small car getting 30 plus mpg.I think there should be a push to get folks to stop buying pu trucks.Tell people we should make pu trucks a commercial vehicle and folks just about get violent,must be something in the water!I was in holland in the late eightys and watched a tv program about the kayoto treaty and the europeans were mad at the usa,they actually stated the idea was to drive up gas prices so high that people would drive less and thus saving the earth from humans.RW

I wonder what the reaction to $4 gas is coming from the FSA. They Escalades get shitty mileage.

“Big oil companies do benefit from higher oil prices. Big oil companies spend millions buying off Congressmen. Big oil companies cut corners, ignore safety procedures, and seek profits by any means possible. But, they do not control the oil. Nations control the oil. Many of these nations are led by lying, corrupt, evil despots. That is a fact. ”

One of the best overall assessments that I have read regarding the factors driving oil prices.

Fucking nailed it.

Smokey

Don’t butter me up.

Our war for oil smackdown awaits.

Admin Says: “By early 2009, the collapse in energy prices due to the worldwide recession reduced the annual expenditure to $265 billion, freeing up over $200 billion for consumers to spend on other items, pay down debt, or save”

$3.99 a gallon today at a Unocal… Pouring our money into the tank instead of saving, paying down debt, or spending will revive the grumps. I have no charts but back when this shit was going on I saw more stress, roadrage and overall grumpiness from all walks of life.

Any hopes of economic recovery are inverse to the pump price. With tuition, health insurance and food costs already eating at any surplus income these prices at the pump will spell disaster when the surplus becomes deficit income. Then the shopping stops. Then the loans aren’t paid. Then the shtf and we all wake up to find that even gold is being sold off. Then more layoffs.

Not good.

Smokey and Admin: I want a front row seat at a war for oil battle royal! It’s been a little too civil around here, no?

Colma

I agree. This site is becoming a lovefest. Too much agreement. Too little anger and foul language.

Administrator,

Indeed, that rumble looms large. I will show you no mercy. It will go down in history as the most complete thrashing ever administered on this forum. I’m going to drag G.W. Bush into it, Dick Cheney into it and your throngs of sycophants will be pleading with me to ease up.

I can hear them now—“Come on Smokey, it’s not worth it. Lay off. You’ve annihilated him, what else do you want ? This brutal beatdown is despicable. We get it Smokey, damn. You won already. Geez, what’s with the overkill ? We’re begging you. Leave the Administrator with the tiny amount of dignity he has left.”

Excellent summary Jim.

All should know who the other HUGE beneficiary of high oil prices is. FEDERAL Govt.

Taxes and Royalty on production at the well head is 12.5 – ??%, effective tax rate on oil companies is “about” 20%, State and Federal tax at the pump is combined ??%. Tax on truckers and pipelines hauling refined products is ??%. Sorry about he unknowns, as do not have time to research the facts, but you get the issue of BIG numbers when combined. Combined it will be pushing 50% of gross, not net.

The big hit is going to be the impact of diesel and jet fuel. Head of common lettuce at Wal Mart as of last night jumprd from 90 cents to $1.50. Pickens is right to convert the entire fleet of semi trucks to LNG. A permit for a new refinery, pipeline, power plant or new transmission line is either hopeless or a lawyers dream come true.

It is not just the Mexican decline curve, but as Simmons laid out ALL the elephant fields look the same. Pull the decline curve for Alaska, looks the same.

The mega deal that no one dare speak off is the Saudis maintaining a relatively flat decline curve by water injection, ie, doing tertiary recovery on the aging reservoirs. When the salt water hits the well bores it is instant stop to oil production. The last I saw was Simmons or another professional documenting the Saudie leaks of information of water poduction accelerating from nil to 35-40%. Simmons passing was a huge loss.

As usual it will take a crisis to get the moron blood sucking pollies to do anything at all. We can only hope they do not do something more stupid than usual.

Administrator said:

“Colma

I agree. This site is becoming a lovefest. Too much agreement. Too little anger and foul language.”

_____

i think that is the natural result of intelligent, knowledgeable, factual discourse. um, sorry.

Admin:

I agree. Time to trade the beads and bongs for boxing gloves.

Pimp slaps, groin shots and gratuitous sucker-punches. Now THAT’S customer service!

I have come to the conclusion that we are fucked. We have seen this oil crisis coming for years but government has yet to address it as a concern. This issue will be addressed when it is too late and there is chaos.

Howard in NYC:

I’m about to call some dipshit truthers and tell them about a new truther website they’d just love: TBP!

When they arrive here we can watch Smokey and Admin blast their dumbasses. I will relish in the fact that I have set a trap for my own viewing enjoyment.

Koombaya and hari krishna EAT SHIT

SAUDI ARABIA BANS DEMONSTRATIONS. I SMELL SMOKE.

Saudi Arabia Bans Demonstrations As Its Plunge Protection Team Sends Stocks Surging

Submitted by Tyler Durden on 03/05/2011 12:43 -0500

Proving that Saudi Arabia is a fast learner from both China’s and America’s experience, today Saudi’s interior minister announced he is banning all protests, marches and strikes following the world’s realization courtesy of the clip posted on Zero Hedge yesterday, showing that not all is well in the kingdom in which protests are banned. Dow Jones reports: “Top oil exporter Saudi Arabia has banned all protests, marches and strikes in the kingdom after small protests continued over the weekend in the oil-rich Eastern province towns of al-Ahsa and Qatif, interior ministry said Saturday, according to state-owned channel al Ekhbariyah. These activities don’t conform with the Islamic laws and harm the interests of the nation and the society, the Saudi channel quoted the ministry as saying.” What does, however, comply with Islamic law is openly using your plunge protection team to bid up the market: “Saudi stocks rose for the first time in three weeks, rallying the most in more than two years, after the finance minister said the Arab world’s largest economy is benefitting from higher oil prices and in “excellent” shape… The state-run General Organization for Social Insurance also purchased stocks, according to Ajeej Capital’s Fuad Aghabi.” Not letting a crisis go to waste, Saudi has quickly learned Econ 101 and is now advising its citizens that America’s massive economic contraction is its personal gain. And if that doesn’t work, it will just use its pension fund to bid up stocks, as a massively Marked to Myth market is apparently in everyone’s interest: just ask the Chairsatan.

More on the demonstration ban from Dow Jones:

[The interior ministry] said any attempt to cause public disorder will be prevented by security forces.

Saudi Arabia’s authorities on Thursday night detained 22 people in Qatif, the main Shi’ite town in the Eastern Province, after they staged a demonstration demanding the release of prisoners they say are being held without trial.

“About 200 people took to the streets in Qatif on Thursday night. The protests were peaceful, but still the authorities interfered, they tried to stop them and arrested 22 people,” according to Human Rights First, an independent human rights group.

Look for a kind but firm request for all foreign journalists to depart the country next week ahead of the planned days of rage, as Saudi confirms it had also learned from the USSR in dealing with social discontent.

And while Saudi Arabia is now openly using its pension fund to bid up stocks, thereby setting its own Plunge Protection Team loose to stabilize the market, this time learning from the US, we wonder just how widely the same scheme has been used in the US, as various pension funds receive a command from the New York Fed to do just that… or else mutual assured destruction. Not only that, but Finance Minister Ibrahim al-Assaf pulled an Obama, and told the general population “stocks are attractive now, the economy is in “excellent” shape” and that “with my trust in this economy and this country, I also seized the opportunity” and bought shares, Finance Minister Al Assaf said. “I am a long term investor.” Poor guy doesn’t realize nobody is a long-term investor any more, especially not the GETCOs of the world, whose only job is to stabilize the market from plunging (alas, it didn’t work too well for GM).

From Bloomberg:

Saudi stocks rose for the first time in three weeks, rallying the most in more than two years, after the finance minister said the Arab world’s largest economy is benefitting from higher oil prices and in “excellent” shape.

The rise in oil prices will boost the “strong condition” of the kingdom, Finance Minister Ibrahim al-Assaf told Al Arabiya TV. Stock prices in Saudi Arabia, which holds about 20 percent of the world’s proven oil reserves, are attractive now and the Saudi Public Pension Agency bought shares last week, he said. The state-run General Organization for Social Insurance also purchased stocks, according to Ajeej Capital’s Fuad Aghabi.

“Assaf’s comments have had the biggest impact on the market,” said Aghabi, Ajeej Capital’s investment director in Riyadh.

Stocks tumbled across the region last week, sending the Bloomberg GCC 200 Index of Persian Gulf shares to the lowest level since 2009 and propelling the Saudi benchmark down the most in two years, on concern the turmoil in Libya will spread through the Middle East.

“With my trust in this economy and this country, I also seized the opportunity” and bought shares, Finance Minister Al Assaf said. “I am a long term investor.”

Stocks are “attractively valued and the moves by government agencies signal continued confidence,” said Asim Bukhtiar, an equity analyst at Riyad Capital in Riyadh.

How much this latest bout of totalitarian market control (so welcome by market overlords such as Larry Fink) and centrallized planning calms people ahead of next week’s days of rage is unknown. After all Saudi Arabia is quite a few months behind in spinning the “wealth effect” to its citizenry.

u doran

Avalon said there was sign in our supermarket yesterday that there was a lettuce shortage. the case was empty.

Smokey

You can even bring along your friend Cancer Hating Gingrich. Looks like he is running in 2012. He fits the Prophet leader profile to a tee.

When I’m done thrashing you on the war for oil post, you will slink away like a mangy cur with its tail between its legs.

[img [/img]

[/img]

Serious subject. I’m really contemplating shorting my IRA PM holdings for a burp. That was my big regret in the bust. I have physical holdings there and like the hands-off long term gains but if the next dip, due to these rising pump prices, is anything like the last dip, a quick short position at the right time could nearly triple the holdings.

Knowing my luck, I’d fuck it all up. I’m not in front of a computer or near a fax machine to play the dips anyway.

Something tells me the next dip is going to be a bit different too.

Colma

I’ll post a 9/11 thread next week and I’ll unban David Pierre. We have a lot of new members who’ve never experienced the redneck brilliance of that American traitor David Pierre.

I want to hear fellow TBPers voice their opinion on what alternative energy idea they think would be most efficient as a fuel and power source for the future. Matt Simmons was a firm believer in ocean energy. Boone is in favor of natural gas but he has a massive financial stake in natural gas. Where should we be focusing our attention? This is a very serious issue. Oil is used in so much of our daily lives. We may not ever be able to get completely off of our oil addiction but we have to find a new energy source to make up for future supply imbalances and higher prices we are experiencing now and will be experiencing in the future.

jmarz

I don’t think there is one answer. Nuclear plants could supply more of our electricity, freeing up more natural gas to power truck and bus fleets at first. Battery technology will improve as oil prices rise. We will be forced to use less energy to run our country. If it is gradual we could adapt. If it is rapid then we will have chaos. The longer we do nothing, the more likely we have chaos.

Admin:

DPES

I’m grumpy today and would love a crack at that dicknugget. He posts at ZH? I just lurk there…

I’m going to register here because TBP is just better than ZH in my opinion. Plus the likelihood of being snatched up by goons in a black suburban for joining is lower.

Colma

ZH is my go to site. I love it. They’ve done wonders for TBP by posting every article I send them. This article already has 122 comments on ZH.

am out on the lake ice fishing now. all this newz is terrible, just terrible. wait.. I think I just got a nibble!

re

jmarz:

I’m with you on that one. This subject must be adressed in a big way.

The alternative energy market isn’t enough, at least that’s what I’ve been convinced of by Admin’s charts and realistic observations. That being said, nickel and diming the dependence on crude with the alternatives will help, even the small percentages…

Nuclear for sure. Solar farms. Natural Gas. Yes, even coal. Hybrid cars. Diesel. All the dirty options must remain on the table. As we have been shown, though, these are just drops in the bucket.

When the pump prices jump, people will again clamor for efficient vehicles. We don’t need the gov mandates for that.

I’m sure we’ve all heard how energy companies have supposedly bought off patents for alternatives and hidden them away. If this is at all true, the books must open on that stuff. If it eats the big boys’ profits then we’ll have to figure out how to let them continue to profit. That may be unpopular but when push comes to shove we need big oil’s support and that comes from lining their pockets. Even if we could draw energy from the atmosphere for free they’ll have to run the meters or there will be no incentive for their implementation. That’s IF the patent conspiracy even exists.

Really… I don’t have a clue. Estamos Jodidos…. We’re all fucked.

Admin:

ZH is cool. TBP is my go-to. Therefore, to me, TBP is better.

Check out the link below. This Italian physicist has got something going – tested, reproduced and is being studiously ignored by the MSM. His stuff is starting to be printed in the tech journals but very cautiously considering the last cold-fusion fiasco.

I’ve been following his efforts and have a feeling it just may not be a hoax… If it isn’t, here’s a technological game changer just in the nick of time.. We’ll see..

http://pesn.com/2011/02/22/9501770_Rossi_cold_fusion_reactor_achieves_15_kW_for_18_hours/

MA

MuckAbout:

That would be a gamechanger. If the 1 Megawatt generator works we shall see… clean, safe and smooth. How much do you think he’d be offered for the technology and by whom?

Something’s got to give. Billions of people are depending on what oil delivers.

U Doran-Interestingly, federal gas taxes (taxes at the pump) are not a percentage of sales price. They are a fixed tax of 18.4 cents a gallon for gas, 24.4 cents for diesel. Last time the tax rate went up was under Clinton, when fuel prices were much lower (what, about $1.50?). Why don’t they raise the rate? FHWA says increasing fuel taxes is politically unpalatable. So instead, the intend to switch to VMT (vehicle miles travelled) taxes. They will still tax drivers more, it will just be based on how far you drive, and in some scenarios, when and where you drive. For some reason, they claim that drivers won’t object to paying more, as long as it doen’t happen when they buy their gas. Sounds a little fishy to me.

Yes, most plans do involve on-board tracking of your vehicle’s position. But don’t worry, the planners ensure us that our privacy will be respected. And we can trust the gov’t, right?

Muck

Thanks for that link. That is an interesting website. Oil elites will make it hard for anything that will affect their industry to make it MS.

The subsidizes housing units where residents pay $13.00 a month for rent will no doubt need more help to buy gas for their SUV’s and Escapades.

All these protests have been promoted to/by Facebook members and each country has responded on a regular schedule!

Saudi Arabia is set to have demonstrations on Friday March 11

May want to buy some OIL contracts or Call Options before then.

Regular newscasts do not seem to mention this easily identifiable prognostication.

The Egyptian Military’s got everything under control, at least…

http://www.allheadlinenews.com/briefs/articles/90038511?Egyptian%20protesters%20storm%20government%20security%20building

Muck and Colma

Thus far, not one claim of achieving cold fusion has proved to be legitimate. Not one. We shall see where the current claim by Italian scientist Andrea Rossi goes. He’s already been refused a patent for the device, nor has he released any scientific data on how it works, which is probably why he didn’t get the patent.

I note that there are plans to build a 1 megawatt power plant with Rossi’s cold fusion technology. In terms of power produced, that’s a pin prick. A single, modern nuclear reactor produces 1,154 megawatts of power.

I remain skeptical.

Interesting paper

http://www.cwsx.org/21darts.pdf

Even if it’s true (and we won’t know that until someone else does the same experiment and duplicates his efforts) it may never see the light of day because of several factors.

Big Energy will literally kill to maintain their vig. Governments will also suppress it to the detriment of their citizens and the world. Why?

There are two things that governments in this day and age cannot abide by. One, cheap energy – doesn’t fit their plans for dominance. Two: real money.

If a man has an independent power source, controlled by himself and none other and real money that cannot be inflated away then what? He becomes ungovernable, liable only for his behaviour, responsible for his own well being.

The thought of a citizen with an independent power source that costs pennies a day to run and real money terrifies the ruling illuminati because it rips the legs out from under what they use to control the peons and loot them.

Gee whiz, cold fusion (if and when), gold and silver money, dig a septic tank and dig a well and where are you? Totally independent except through force of arms against you.

I wish the Prof. all the luck and hope he doesn’t get too greedy or end up in a ditch with his lab torched and all the research “vanished”…

I wouldn’t be so cynical or such a “conspiracy theorist” except for Admin. It’s all his fault.

MA

Muck

You’ve been reading too much RE.

Admin: That referenced article is a killer. First the Big Banksters and their fraud, mark to fantasy and robbery. Now the SEC in cahoots with Big Oil to overstate and mark reserves to fantasy to drive up stock values.

We need a knight on a Big White Horse with a very sharp weapon to mow ’em all down and start over.

What causes this evolution of fraud and dishonesty in the USA? I cannot be imagining the fact that it is growing and getting worse all the time because no one is ever thrown in jail for 15-20 years. They are fined a minuscule amount of the infraction,lying, cheating, fraud amount – perhaps 1%, don’t admit culpability and off they go to do it again.

WTF can we, as citizens, do about it?

MA

Muck

If you lead the revolution, I’ll be right behind you.

It doesn’t matter if we produce 9 million barrels a day–it’s my understanding that the oil companies can sell that oil to anyone anywhere. So calls of “drill, baby, drill” don’t exactly help our situation unless we nationalize the oil companies (and fat chance of that).

We need to subsidize wind, water and solar. Every damn gov’t building should have had solar panels decades ago. But our congress is too corrupt so, I repeat, fat chance of that. We are screwed.

Re gas taxes – the US pays some of the lowest in the world. Three or four dollars a gallon is common. It is both a revenue raiser and a curb on usage. The politicians haven’t dared do it in the US.

llpoh

If they put a $4 tax on gas, Congress would increase spending to $5 trillion per year.

Admin:

How long, would it take to get a Nuk Plant up and running? Gas lines at our local Stop and Shop have been long anytime I drive by, luckily I have always driven smaller, cars and wonder how much longer those SUV’s will be around. Told my wife years ago they should of raised the price of taxes on gas to get people into more efficient cars and used that tax money to pay down the debt (yes, I did live in a fairy tale world). I left a job paying slightly more back in 1995, commute was 35 miles one way, job now is 11 miles round trip , thinking just what I save in gas each week.

Viet Vet

From start to finish it takes 10 years with today’s approval process to get a nuke plant built.

You’re kidding right? Some Wop descendnt of Nicholas Tesla comes up with working Cold Fusion RIGHT when the M.E. Oil is going up in flames. How fucking convenient, the Cavalry arrives JIT here! LOL. Please SPARE ME and just buy into Abiotic Oil with the rest of the Cornucopians! EVERY time we have an energy crisis some Jackass has the KEY to Cold Fusion! It is WAY more likely there is a relationship between Magnetic Pole Shift and Global Climate change than some Itie Inventor came up with Cold Fusion JUST in the Nick of Time here. LOL.

RE

Viet Vet-70 asked, “How long, would it take to get a Nuk Plant up and running?”

Average estimated time in today’s bullshit bureaucratic world is 7-10 years. Actual construction time for the physical plant is less than 3 years. You can always count on the federal government to fuck up a wet dream.

SSS, so what you are saying is we are screwed, blued and tattoed when it comes to setting up any new nuk plants to help out our energy efficiency?

Sharonsj

You need to do a lot of research on solar and wind energy. And I mean a lot.

Solar makes some sense in places like Arizona (where I live), California, Nevada, New Mexico, And Texas. But you know something weird about even those good places for solar energy? The fucking sun sets every day!!! And I mean every damn day. No exceptions.

And you know what else happens at the major solar projects that generate significant amounts of power. When the sun sets, the natural gas turbines kick in so that the power generated remains at a constant state. Did you know that, Sharon?

The largest solar project in the U.S. is in California, and it covers over 6,000 acres. That’s just shy of 10 square miles. Big chunk of land, Sharon. And the project produces only 350 megawatts of power for just two-thirds of the day. A single nuclear reactor produces 3 times the power, 24/7.

Have you thought about getting solar power from a sunny, but remote, desert spot to where it’s needed, ie. where people live? It’s moved by high-voltage transmission lines, and the cost could run as much as $3 million a mile. I’m sure you’re 100% behind the copper mining industry in the U.S. (you know, those nasty open pit mines that dig a really deep hole in the Earth), because that’s what gonna be needed to make those transmission lines.

I could go on, but I think you catch my drift.

“There are no good outcomes”, it depends on what outcome you are after. For those of us who are “betting the farm” on the economic collapse of the United States and the end of the euro, the rise in oil is fantastic news as is the relentless upsurge in the economic collapse hedges (Gold and Silver). Having said that “vulture swooping” relies on some semblance of law and order. During Argentina’s collapse you could snag bargains, you could not in the case of SOMALIA or ZIMBABWE.

How bad will things get when the can slams up against the wall? That is the 5000 oz question.

Regardless, having Wall Street hover up EVERYONE’S wealth (with the exception of the Ruling Class elite and select Multinationals) will RESULT in serfdom and eventual violent revolution ala France in the 1800’s or the American Civil War.

I for one refuse to live in bondage. Let the dice fly…

Viet Vet-70

No, we’re not screwed, at least not just yet.

The nuclear power industry has actually gotten together and funded an entire company devoted to addressing the maze of paperwork and permits required by the federal and state governments to build a nuclear plant. This bewildering process is estimated to add about $55 million to the cost of the plant, but it does take years off the start to finish time.

Just how much time has yet to be seen. We’ll know more when the nuclear plants are finished in Alabama, Georgia, South Carolina, and Florida.

What’s all the hoopla about? This is just what the doctor ordered. Time to get the grand die-off going. Clear out those third-world dung heaps and reduce it by a few million here too. I say, get on with it. Maybe we’ll be lucky and have a few secondary plague outbreaks as well. Kill ’em all and sort ’em out later. Better stock up though, SHTF is coming…Grim Reaper Time!

Bart

I wanna party with you.

JMarz – RE alternative energy, for powering cars and trucks natural gas IS the only short term alternative to oil. In the very long term future (when we have battery technology that EQUALS or exceeds the energy density of gasoline/diesel/petrol AND the energy infrastructure to handle it) electric vehicles WILL become viable (at this time gasoline will be at ~ $20 a gallon and oil at ~ $500 a barrel).

For baseload power we burn fossil fuels (coal, oil, Natural gas) or better yet atoms (Nuclear). Alternative energy will be a bust, it’s energy density is both lousy/unreliable and the cost of getting it to where it is needed will make it very expensive (triple your power bill cost).

Room temperature superconductors and fusion power are both theoretically possible, having said that I give myself 50/50 odds of seeing it in my lifetime. (I’m 28).

MuckAbout – Google “Polywell fusion”. Is it a crank? Who knows, the Department of Defense is kicking the tires as we speak. Having said that if it works…

http://theeconomiccollapseblog.com/archives/people-of-earth-prepare-for-economic-disaster

Go here, for a preview…

llpoh “Re gas taxes – the US pays some of the lowest in the world. Three or four dollars a gallon is common. It is both a revenue raiser and a curb on usage.” Exactly. But seriously, are you telling me the spinmasters of the universe can’t convince the drivers of the US to pony up another 50 cents a gallon? But that instead, they will welcome, with open arms, deleting the 18.4 cents a gallon tax, installing tracking devices to the OBD-II diagnostic ports that report their movements and automatically deduct the VMT taxes from an electronic account?

The last time the federal gas tax was raised, it represented over 10% of the cost of gas. Now it is less than 5%. Everyone (except the FSA, I suppose) recognises that taxes are usually a percentage of the price of the commodity. (Which was the misconception by u doran I began trying to clarify).

Nope, the VMT is a red herring-taxes WILL go up for virtually every driver (especially those who use less gas, like Admin). That is clear in the TRB proposals-no effort to hide the fact. It will just be collected differently, with the coincident “benefit”(?) of allowing TPTB to easily monitor your vehicle’s location in real time. Paranoid? Or just cautious?

SSS-Are you serious about a 7-10 year start-up time? That seems ridiculously optimistic to me, but maybe that’s just my cynical nature and living in Alaska. It takes longer than that to start a gold mine up here, I can tell you that.

There is a local entrepreneur who proposed building one of these “pre-fab” mini-nuke plants near Fairbanks. The guy probably has the cash and the connections to pull it off, too. DOE told him at least 20 years to get it permitted-he said screw it, he wouldn’t live that long. Oh well.

SSS et al-IMO, the only way solar or wind makes sense is A) In the right location (as you described) and B) used for electrolysis to produce hydrogen. As you accurately describe, the problem is energy storage and hydrogen is the most viable medium IMO. Now what you do with that hydrogen is a whole separate issue-use as a vehicle fuel would require large infrastructure investment. You could also use to generate electricity in the dark. And yes, I realise there are inefficiencies doing that. But it is better than having a black out at night or when the wind stops blowing (isn’t that when you are supposed to recharge your electric car?).

Blah Blah Blah, end of the world. Peak oil. I saw the meltdown in RE coming back in 03-04. I shorted the big banks before they went down. Sure, oil is going to surge again but it’s going to do the same damn thing it did last time. It will skyrocket briefly and collapse. That’s how this market behaves. It’s not the end of the world. Gas isn’t permanently going to 5 or 6 per gallon. I mean think about that? This price is essentially controlled through a variety of mechanisms. Do you really think they’re going to let it sit at the high of a price while panic devolves into an outright revolution. One thing the powers that be know is they can only take so much away and the powder keg blows. I assure you they have no interest in having it blow. They’ll pump it up, siphon off the profits and collapse it as everyone runs for the exits. Count on it. this market can easily be controlled for another decade or more. Easily.

Jmac

Try reading for comprehension. The U.S. has 1.58% of the world’s oil. Do you really think we are in control? Do we appear to be in control of what is happening in the Middle East? Open your eyes and try thinking.

My point is that they needed to do something to discourage consumption long ago. We are well and truly addicted to cheap gas and withdrawal will be a bitch.

Your point is well taken re congress spending the money. All research indicates that govt will spend all they collect and then some. Dirty bastards.

Jmac – no offense but you are one clueless dimwit.

486 comments on this article on Zero Hedge.

Saudi Arabia, Which Allegedly Hiked Output, Just Raised Crude Export Prices To Asia And Europe

Submitted by Tyler Durden on 03/05/2011 21:12 -0500

Two weeks ago Zero Hedge claimed that Saudi Arabian “gestures” to hike crude output were about as hollow as the heads of those suggesting that dealing with surging oil prices involves reducing interest rates even more (which just happen to be at zero already), mostly as a result of the country’s recent adoption of “whorism” or its doomed strategy to buy the love of its citizens. The reason is that as UBS’ Andy Lees noted, Saudi “will need to ramp up production by about 10% (more capital spending) without prices falling” to fill the suddenly gaping budget hole left from literally throwing $37 billion out of Bernanke’s leased helicopter. Yesterday, BusinessWeek’s Peter Coy essentially reaffirmed our theory verbatim in the piece “Saudi Arabia Must Keep Pumping Oil to Buy Stability”… needless to say we completely agree with this. Obviously, the bigger issue here is that as WikiLeaks recently suggested, and was reconfirmed by Jim Rogers, Saudi Arabia is simply lying about its excess capacity. Because if Saudi had indeed raised output as many have hoped for, and as Saudi has represented, it would have made up for the funding differential simply by the hike in export volume. Instead, as Reuters reports, Saudi Aramco just hiked prices on oil to customers in Asia and Europe up substantially. This, at least to us, does not appear like the rational action of a player seeking to moderate surging oil prices to avoid further social conflict, and one who can plug offline capacity.

From Reuters:

Top oil exporter Saudi Arabia has raised the price of its flagship Arab Light crude oil in April to customers in Asia, State oil giant Saudi Aramco said on Saturday.

Aramco set the price at Oman/Dubai plus $1.95 a barrel, up 65 cents from March.

The price to the United States was reduced by 30 cents to parity with Argus Sour Crude Index and the price to northwest Europe was raised by 80 cents to BWAVE minus $3.40.

Saudi term crude supplies to the United States are priced as a differential to the Argus Sour Crude Index (ASCI).

Good thing Saudi reduced its export price to the US. Too bad Canada, which exports far more to the US than Saudi did not follow suit.

And more on the April changes in carious price schedules:

April March Change

Arab Extra Light +2.60 +2.70 -0.10

Arab Light 0.00 +0.30 -0.30

Arab Medium -2.20 -1.85 -0.35

Arab Heavy -3.90 -3.65 -0.25

Prices at Ras Tanura for Saudi oil destined for Northwest Europe are set against ICE Brent crude weighted average (BWAVE):

April March Change

Arab Extra Light -1.10 -1.75 +0.65

Arab Light -3.40 -4.20 +0.80

Arab Medium -5.90 -6.10 +0.20

Arab Heavy -8.45 -8.55 +0.10

Saudi term crude supplies to Asia are priced as a differential to the Oman/Dubai average:

April March Change

Arab Super Light +6.05 +5.80 +0.25

Arab Extra Light +3.95 +3.30 +0.65

Arab Light +1.95 +1.30 +0.65

Arab Medium -0.45 -1.10 +0.65

Arab Heavy -2.55 -3.05 +0.50

Prices at Ras Tanura for Saudi oil destined for the Mediterranean are set against the ICE Brent crude weighted average (BWAVE):

April March Change

Arab Extra light -1.60 -3.15 +1.55

Arab Light -3.75 -4.75 +1.00

Arab Medium -7.70 -7.30 -0.40

Arab Heavy -10.05 -9.70 -0.35

And to see how a cartel deals with supply demand imbalances, Bloomberg summarizes:

Aramco this week offered European refiners additional cargoes of Arab Light crude for loading this month, two officials involved in the negotiations said. The official prices for light grades to Northwest Europe and the Mediterranean Sea gained as oil prices rose and as lighter Libyan crudes were taken out of the market.

One can only hope, and the ruling oligarchy surely is, that the combination of increasing output and prices will be able to offset next week’s planned demonstrations in Saudi. Look for many more billions to be thrown at Saudi’s discontents over the next week as D-day approaches. And on, and on…

http://cleanskies.tv/articles/alaskan-nuclear-power-plans-dropped.html I stand corrected-15 year wait.