“The continuing shortages of housing inventory are driving the price gains. There is no evidence of bubbles popping.” – David Lereah, NAR mouthpiece/economist – August 2005

“The steady improvement in home sales will support price appreciation despite all the wild projections by academics, Wall Street analysts, and others in the media.” – David Lereah, NAR mouthpiece/economist – January 10, 2007

“Buyer traffic is continuing to pick up, while seller traffic is holding steady. In fact, buyer traffic is 40 percent above a year ago, so there is plenty of demand but insufficient inventory to improve sales more strongly. We’ve transitioned into a seller’s market in much of the country. We expect a seasonal rise of inventory this spring, but it may be insufficient to avoid more frequent incidences of multiple bidding and faster-than-normal price growth.” – Lawrence Yun – NAR mouthpiece/economist – February 21, 2013

I really need to stop being so pessimistic. I’m getting richer by the day. My home value is rising at a rate of 1% per month according to the National Association of Realtors. At that rate, my house will be worth $1 million in less than 10 years. My underwater condo (figuratively – not literally) in Wildwood will resurface and make me rich beyond my wildest dreams. Larry Yun, the brilliant economic genius employed by the upstanding and truth telling NAR, reported that median home prices soared by 12.3% in January (down 3.7% from December) over the prior year and there is virtually no inventory left to sell – with a mere 1.75 million homes in inventory – the lowest level since 1999. The median sales price of $173,600 is up “dramatically” from last year’s $154,500 level. I’m sure the NAR meant to mention that home prices are still down 25% from the 2005 high of $230,000. Every mainstream media newspaper, magazine, and news channel is telling me the “strong” housing recovery is propelling the economy and creating millions of new jobs. Keynesian economists, Wall Street bankers, government apparatchiks and housing trade organizations are all in agreement that the wealth effect from rising home prices will be the jumpstart our economy needs to get back to the glory days of 2005. Who am I to argue with such honorable men with degrees from Ivy League schools and a track record of unquestioned accuracy as we can see in the chart below?

Mr. Lereah added to his sterling reputation with his insightful prescient book Why the Real Estate Boom Will Not Bust—And How You Can Profit from It, which was published in February 2006. I understand Ben Bernanke has a signed copy on his nightstand. According to David, he voluntarily decided to leave the NAR in mid-2007 as home prices began their 40% plunge over the next four years. He then admitted in an interview with Money Magazine in 2009 that he was nothing but a shill for the real estate industry, no different than a whore doing tricks for $20. Except he was whoring himself for millions of dollars and contributing to the biggest financial fraud in world history:

“I was pressured by executives to issue optimistic forecasts — then was left to shoulder the blame when things went sour. I was there for seven years doing everything they wanted me to. I worked for an association promoting housing, and it was my job to represent their interests. If you look at my actual forecasts, the numbers were right in line with most forecasts. The difference was that I put a positive spin on it. It was easy to do during boom times, harder when times weren’t good. I never thought the whole national real estate market would burst.”

After Mr. Lereah slithered away from his post he was replaced by the next snake – Lawrence Yun. He proceeded to put the best face possible on the greatest housing collapse in recorded history, assuring the public it was the best time to buy during the entire slide. Five million foreclosures later he’s still telling us it’s the best time to buy. Why shouldn’t we believe the National Association of Realtors and the mainstream media that report their propaganda as indisputable fact? These noble realtooors only have the best interests of their clients at heart. Remember when they warned people about the dangers of liar loans, negative amortization loans, appraisal fraud, nefarious mortgage brokers, criminal bankers, corrupt ratings agencies and the fact that home prices had reached a high two standard deviations above the normal trend? Oh yeah. They didn’t make a peep. They disputed and ridiculed Robert Shiller and anyone else who dared question the healthy “strong” housing market storyline. In late 2011 this superb, above board, truth telling organization admitted what many financial analysts and “crazy” bloggers had been pointing out for years. They were lying about home sales. Their data was false. Between 2007 and 2010, the NAR reported 2.95 million more home sales than had actually occurred. This was not a rounding error. This was not a flaw in their methodology, as they claimed. It was an outright fraudulent attempt to convince the public that the housing market was not in free fall. These guys make the BLS look accurate and above board.

We are now expected to believe their monthly reports as if they are gospel. The mainstream media continues to report their drivel about the lowest inventory level in 14 years without the slightest hint of skepticism.

The Incredible Shrinking Inventory

We are told by good old Larry Yun that there are only 1.74 million homes left for sale in this country and at current sales rates we’ll run out of inventory in 4.2 months. Oh the horror. You better buy now, before it’s too late. We must be running out of houses. Someone call Bob Toll. We need more houses built ASAP, before this becomes a crisis. But there seems to be problem with this storyline. Existing home sales are falling. Even using the NAR seasonally manipulated numbers, sales in January were lower than in November. In a country with 133 million housing units, there were 291,000 existing home sales in January. If there is an inventory shortage, why have new home sales fallen every month since May of 2012? There were a total of 10,000 completed new homes sold in December in the entire country. Housing starts plunged by 8.5% in January. Does this happen when you have a strong housing market? Do you believe the NAR inventory figure of 1.74 million homes for sale? The last time the months of supply was this low was early 2005 – during the good old days.

Let’s examine a few facts to determine the true nature of this shocking inventory shortage. According to the U.S. Census Bureau:

- There are 133 million housing units in the United States

- There are 115 million occupied housing units in the country, with 75 million owner occupied and 40 million renter occupied.

- For the math challenged this means that 13.5%, or 18 million housing units, are vacant.

- Only 4.3 million are considered summer homes, and 3.9 million are available for rent. That leaves 9.8 million homes completely vacant.

- The Census Bureau specifically identifies 1.6 million of these vacant housing units as up for sale.

So, with 9.8 million vacant housing units in the country and 1.6 million of these identified as for sale, the NAR and media mouthpieces have the balls to report only 1.74 million homes for sale in the entire U.S. This doesn’t even take into account the massive shadow inventory stuck in the foreclosure pipeline. Of the 75 million owner-occupied housing units in the country, 50 million have a mortgage. Of these houses, a full 10.9% are either delinquent or in the foreclosure process. This totals 5.4 million households, with 1.9 million of these households already in the foreclosure process. The number of distressed households is still double the long-term average, even with historically low mortgage rates, multiple government mortgage relief programs (HARP), and Fannie, Freddie and the FHA guaranteeing 90% of all mortgages. Do you think the NAR is including any of these 5.4 million distressed houses in their inventory numbers?

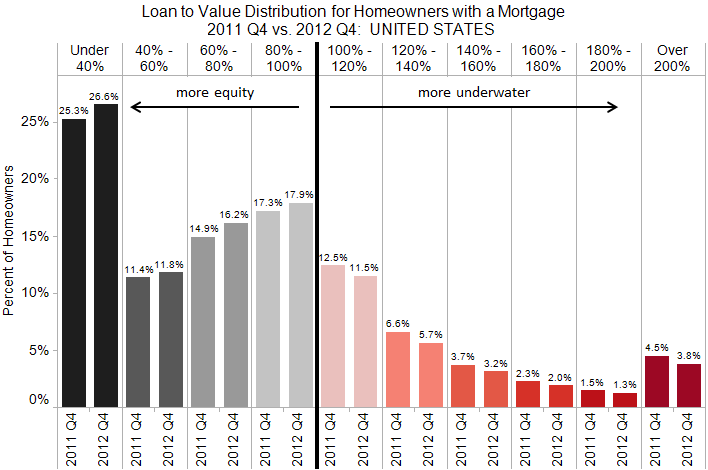

Then we have the little matter of a few home occupiers still underwater on their mortgages. After this fabulous two year housing recovery touted by shills and shysters, only 27.5% of ALL mortgage holders are underwater on their mortgage. This means 13.8 million households are in a negative equity position. Those with 5% or less equity are effectively underwater since closing costs usually exceed 6% of the house’s value. That adds another 2.2 million households to the negative equity bucket. Do you think any of these 16 million households would be selling if they could?

The negative equity position of millions of homeowners gets at the gist of the effort to re-inflate the housing bubble. By artificially pumping up home prices, the Wall Street titans and their co-conspirators at the Federal Reserve and Treasury Department are attempting to repair insolvent Wall Street bank balance sheets, lure unsuspecting dupes back into the housing market, reignite the economy through the old stand-by wealth effect, and of course enrich themselves and their crony capitalist friends. The artificial suppression of home inventory has been working wonders, as 2 million homeowners were freed from negative equity in 2012. If they can only lure enough suckers back into the pool, all will be well. Phoenix must have an inordinate number of chumps with home prices rising by 22.5% in 2012 as investors and flippers poured into the market with cheap debt and big dreams. Of course everything is relative, as prices are still down 44% from the peak and 40% of mortgages remain underwater. I strongly urge everyone without a functioning brain to pour their life savings into the Phoenix housing market. Larry Yun says it’s a can’t miss path to riches.

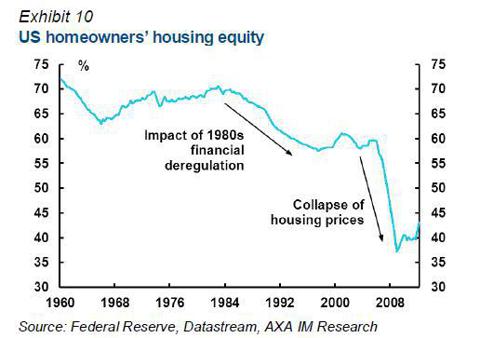

Despite the propaganda, hyperbole, and cheerleading from the corporate media, the fact remains that national homeowner’s equity is barely above its all-time low of 38%, down from 62% in 2000 and 70% in 1980. The NAR shills, Federal Reserve drug pushers, Wall Street shysters, and pliant media lured the middle class into the false belief that housing was an asset class that could make you rich. Homes became the major portion of middle class net worth. As prices were driven higher from 2000 through 2006, the middle class took the bait hook line and sinker and borrowed billions against their ever increasing faux housing wealth. This set up the impending collapse of middle class net worth, created by the 1%ers on Wall Street, in Washington DC, and in corporate executive suites across the land. The median American household lost 47% of its wealth between 2007 and 2010. Average household wealth, which is skewed dramatically by the richest Americans, declined by only 18%. Real estate only accounts for 30% of the net worth of the rich. For the middle 60%, housing has risen from 62% to 67% of total wealth since 1983. Middle class families’ saw their cash cushion fall from 21% in 1983 to 8% before the crash. They were convinced that living on Wall Street peddled debt was the path to prosperity. After the crash, the middle class has been left with no cash, underwater mortgages, declining real wages, less jobs, and a mountain of credit card debt. Delusions have been crushed. But an on-line degree from the University of Phoenix funded by a Federal student loan of $20,000 will surely revive the fortunes of the average unemployed middle class worker.

Despite the destruction of middle class hopes, dreams, and net worth, the ruling plutocracy has decided the best way to revive their fortunes is to lure the ignorant masses into more student loan debt, auto debt and mortgage debt.

Don’t Look Behind the Curtain

“The real hopeless victims of mental illness are to be found among those who appear to be most normal. Many of them are normal because they are so well adjusted to our mode of existence, because their human voice has been silenced so early in their lives that they do not even struggle or suffer or develop symptoms as the neurotic does. They are normal not in what may be called the absolute sense of the word; they are normal only in relation to a profoundly abnormal society. Their perfect adjustment to that abnormal society is a measure of their mental sickness. These millions of abnormally normal people, living without fuss in a society to which, if they were fully human beings, they ought not to be adjusted.” – Aldous Huxley – Brave New World Revisited

What is normal in a profoundly abnormal, manipulated, propaganda driven society? The NAR and Federal government issue their public relations announcements every month and attempt to spin straw into gold. The media then fulfill their assigned role by touting the results as unequivocal proof of an economic recovery. This is all designed to revive the animal spirits of the clueless public. Statistics in the hands of those who have no regard for the truth can be manipulated to portray any storyline that serves their corrupt purposes. When I see a story about the housing market referencing a percentage increase as proof of a recovery I know it’s time to check the charts. You see, even a fractional increase from an all-time low will generate an impressive percentage increase. So let’s go to the charts in search of this blossoming housing recovery.

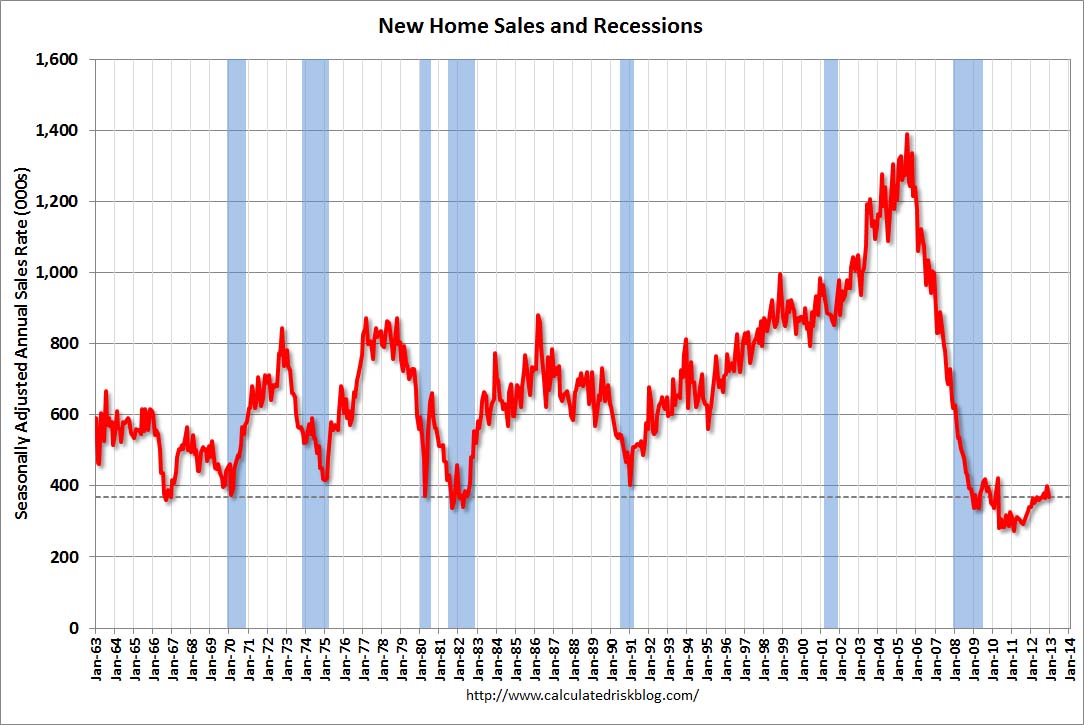

The media, NAHB, and certain bloggers look at this chart and declare that new home sales are up 20% from 2011 levels. Sounds awesome. I look at this chart and note that 2011 was the lowest number of new home sales in U.S. history. I look at this chart and note that new home sales are 75% below the peak in 2005. I look at this chart and note that new home sales are lower today than at the bottom of every recession over the last fifty years. I look at this chart and note that new home sales are lower today than they were in 1963, when the population of the United States was a mere 189 million, 40% less than today’s population. Do you see any signs of a strong housing recovery in this chart?

The housing cheerleaders look at the chart below and crow about a 75% increase in housing starts. I look at this chart and note that housing starts in 2009 were the lowest in recorded U.S. history. I look at this chart and note that total housing starts are down 60% and single family starts are down 70% from 2006 highs. I look at this chart and note the “surge” in housing starts is completely being driven by apartment construction, because the student loan indebted youth can’t afford to buy houses. I look at this chart and note that housing starts are 40% below 1968 levels. Do you see any signs of a strong housing recovery in this chart?

Those trying to lure the gullible non-thinking masses into paying inflated prices for the “few” houses available for sale declare that existing home sales are up 50% in the last two years. Of course, the 3.3 million low in 2010 was the lowest level in decades. Existing home sales are still 30% below the 2005 high of 7.2 million and the abnormal structure of these home sales is dramatically different than the normal sales of yesteryear.

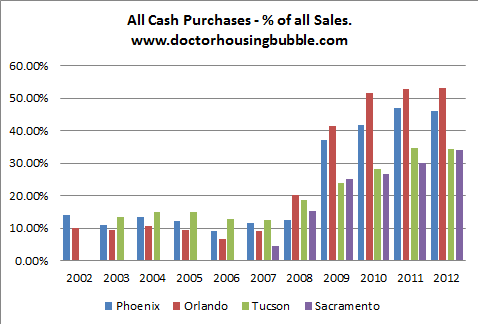

The wizards behind the curtain don’t want you to understand how the 50% increase in existing home sales has been achieved. They just want you to be convinced that a return to normalcy has happened and it’s the best time to buy. The NAR wizards and the media wizards don’t publicize the composition of these skyrocketing sales. At the end of the NAR “buy a home before it’s too late” monthly press release you find out that distressed homes (foreclosed & short sales) now make up 23% of all home sales and have accounted for well over 30% of all home sales since 2010. Another 28% of home sales are all-cash sales to investors looking to turn them into rental units or flip them for a quick buck. Lastly, 30% of homes are being bought by first time home buyer pansies who have been lured into the market by 3.5% down payment loans through the FHA, with the future losses born by middle class taxpayers who had no say in the matter. Prior to the housing crash, normal buyers who just wanted a place to live, accounted for 90% of all home purchases. Today they make up less than 30% of home buyers. Does this chart portray a normal market or a profoundly abnormal market? Does it portray a healthy housing recovery based upon sound economic fundamentals?

The answer is NO. The contrived elevation of home sales and home prices has been engineered by the very same culprits who crashed our financial system in the first place. This has been planned, coordinated and implemented by a conspiracy of the ruling oligarchy – the Federal Reserve, Wall Street, U.S. Treasury, NAR, and the corporate media conglomerates. Ben’s job was to screw senior citizens and drive interest rates low enough that everyone in the country could refinance, attract investors & flippers into the market, and propel home prices higher. Wall Street has been the linchpin to the whole sordid plan. They were tasked with drastically limiting the foreclosure pipeline, therefore creating a fake shortage of inventory. Next, JP Morgan, Blackrock, Citi, Bank of America, and dozens of other private equity firms have partnered with Fannie Mae and Freddie Mac, using free money provided by Ben Bernanke, to create investment funds to buy up millions of distressed properties and convert them into rental properties, further reducing the inventory of homes for sale and driving prices higher. Only the connected crony capitalists on Wall Street are getting a piece of this action. The Wall Street big hanging dicks have screwed the American middle class coming and going. The NAR and media are tasked with what they do best – spew propaganda, misinform, lie, cheerlead and attempt to create a buying frenzy among the willfully ignorant masses. The chart below reveals the truth about the strong sustainable housing recovery. It doesn’t exist. Mortgage applications by real people who want to live in a home are no higher than they were in 2010 when home sales were 33% lower than today. Mortgage applications are lower than they were in 1997 when 4 million existing homes were sold versus the 5 million pace today. The housing recovery is just another Wall Street scam designed to bilk the American middle class of what remains of their net worth.

The multi-faceted plan to keep this teetering edifice from collapsing is being executed according to the mandates of the financial class:

- Distribute hundreds of billions in student loans to artificially suppress the unemployment rate, while the BLS adjusts millions more out of the labor force – CHECK

- Have Ally Financial (80% owned by Obama) and Wall Street banks dole out subprime auto loans to millions and offer 7 year financing at 0%, while GM (Government Motors) channel stuffs its dealers, to create the appearance of an auto recovery – CHECK

- Drive mortgage rates down, restrict home supply through foreclosure market manipulation, shift the risk of losses to the taxpayer, and allow Wall Street to control the housing market – CHECK

- Have the corporate mainstream media continuously spout optimistic, positive puff pieces designed to convince an ignorant, apathetic public that the economy is improving, jobs are being created, and housing has recovered – CHECK

Free money, government subsidies, no regulation, Wall Street hubris, get rich quick schemes, media propaganda, and an ignorant public – what could possibly go wrong?

Here is what could and will go wrong. Everyone in the country that could refinance to a mortgage rate of 4% or lower has done so. Contrary to Bernanke’s rhetoric that “QE to Infinity” would lower mortgage rates, they have just risen to a six month high as the 10 Year Treasury rose 60 basis points from its 2012 low. If mortgage rates just rose to a modest 5% the housing market would come to a grinding halt as no one would trade a 3.5% mortgage for a 5% mortgage. As I’ve detailed earlier, there are 3.9 vacant housing units available for rent. Almost half of the new housing units under construction are apartments. The Wall Street shysters are converting millions of foreclosed homes into rental units. This avalanche of rental properties will depress rents and destroy the modeled ROI calculations of the brilliant Wall Street Ivy league MBAs. These lemmings will all attempt to exit their “investments” at the same time. The FHA is already broke. The mounting losses from their 3.5% down payment to future deadbeats program will force them to curtail this taxpayer financed debacle. There will be few first time home buyers, as young people saddled with a trillion dollars of student loan debt are incapable of buying a home.

These are the facts. But why trust facts when you can believe Baghdad Ben and the NAR? It’s always the best time to buy.

“All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable.” – Ben Bernanke – May 17, 2007

Recent headlines here confirm what I’ve said for months, that the Austin real estate market is in a new bubble (fueled in my opinion by a steady influx of people from all over the country, attracted by the strong job market and low taxes). Home sales for January alone were up 33% over the same month last year. The median price has jumped 10% over the last year.

I’ve had to rethink my own plans for buying an additional house. Months of systematic looking did not reveal any good deals, and now (in just the last three months) the credit market for people in my circumstances is drying up.

Paradoxically, I just failed to close on a refi on my lake cabin as a result of an absolutely abysmal appraisal. It came in 60K lower than the very same property was appraised one year ago. It’s bullshit, the appraisers are just running scared again. The mortgage lenders say “jump” and the appraisers ask “how high. The market for recreational second homes is flat, and the money guys are tightening the screws. The funny thing is that I already had a 30 yr 4.25% note. I was trying to go to a 15 yr note, so I could get it paid off before I retire. An additional principal payment twice a year will accomplish the same purpose. Fuck Wells Fargo.

I’ve decided to wait a year or two on my house shopping, based on what you and other trusted sources are writing. My cash might buy a lot more if the bubble pops sometime in this 2013-2016 time window. Smart money says all bubbles have to pop, sooner or later.

Great article. It’s simply mind-boggling how all losses, from the sub-prime collapse, Fannie and Freddie insolvency, student loan default, TBTF banks, Wall Street, and every other bubble-blowing, insider-profit generating entity is the responsibility of the taxpayer. No bad deed goes unrewarded, and instead of bankruptcy and jail, the gamblers are enriched.

We don’t live in a free-market economy, we live in a centrally-planned, crony capitalist system where the gamblers never lose, and are always bailed out. The taxpayers are screwed 12 ways to Tuesday and most aren’t smart enough to figure it out.

Accordingly, the whole mess will collapse:

[img [/img]

[/img]

A real free-market economy will then start again with what’s left of this country.

Context: I would rather buy a home right now at this period of housing re-inflation and low inventory than pay exorbitant rental prices like I have been. I can lock in a home right now for 2.8% over 30 years and lower my monthly outlays (rental vs mortgage) by over 35%. If one thinks that interest rates are going to stay at these levels much longer they are fooling themselves. I understand everything above, but one still has to live and make wise decisions that will save his or her family a few fiat bucks.

That said great read!

Did Bunga Bunga Just Kill The US Housing Recovery As Lumber Futures Plunge

Submitted by Tyler Durden on 02/25/2013 11:16 -0500

It seems that as long as lumber futures are rising they are an excellent indicator of the strength of the housing recovery, but once they show any weakness, it is technical or negligible. A few things we know: inventory is epically low; homebuilder stocks are priced for perfection (and missing); NAHB confidence is rolling over; and now Lumber futures have tumbled by the most over the last five days in 15 months. So much for a sustained ‘recovery’.

[img [/img]

[/img]

oh dear, we are doomed. As usual, I do not feel good about this article

Wow, good stuff. All those numbers made my head spin, .. in a good way.

Admin understands finance the way I understand the fine art of pleasing women.

This is how Stucky pleasures women

[img [/img]

[/img]

“I would rather buy a home right now at this period of housing re-inflation and low inventory than pay exorbitant rental prices like I have been. I can lock in a home right now for 2.8% over 30 years” —— Dogood

Good comments you made. Quickie comments of my own;

1) If you have a mortgage, you are, of course, still renting. Your landlord is the bank.

2) “Mortgage” is from the French, and means “death contract”. I hear a loud “Amen!” from anyone who has ever had a mortgage.

3) Admin might shoot me … I might get thumbs down flak ….. but, yeah, NOW is the time to buy if you can afford it. What should you wait for? An interest rate of 10 per cent? It”s only a matter of when interest rates will skyrocket, not “if”.

4) Only factor in the 30 years if you really believe you will keep the home at least 30 years. The average life of a mortgage is around 5 years. That’s one reason banks are willing to lend at a low rate today even though they know rates will be higher tomorrow.

5) Are you 100% sure your loan is locked in at 2.9% for 30 years? Be aware of the Demand Clause. A demand clause allows the lender to demand repayment for ANY reason. A demand clause permits the lender to raise your interest rate in a rising rate market even when you aren’t selling your house (where they are protected via a Due-On-Sale clause). The lender can force you to accept a higher rate by threatening that if you don’t agree, the loan will be called. The Truth in Lending Disclosure has a statement that reads “This loan has a demand feature,” which is checked “yes” or “no.” If it’s checked yes, do your very best to get it unchecked. Everything is negotiable.

(Note: Don’t confuse this with the Acceleration Clause. An acceleration clause allows the lender to call the loan if you violate some contractual provision; missed payment, failure to pay property taxes , failure to adequately insure, death of a borrower, or even – fearfully — failure to maintain the property)

The other thing I find interesting is the fees for title and mortgage insurance have exploded. I needed to bring 10K to the table just to pay for the fees from all the insurance to make the banks whole if I default.

This if for a 187K home. Not excactly the Taj. People forget the 1970’s 80’s.

it is the best time to buy with qe to infinity and endless money printing (that will be, so book it danno). for example soon if you buy a loaf of bread at the market, by the time you check out, the stock boy marked it up 3x on the shelf. just think how rich we’ll all be if we’re invested in the stock market or real estate. soon my 200.5k retirement plan will be 401,000,000,000,000. . .k! yippee!

b.r.

I spent my entire career in the real estate business.

For what it’s worth, people think they are buying houses/homes. For the most part, they are buying a monthly payment. For a hundred thousand dollar mortgage amortized over thirty years, every two points of additional interest increases a house payment by a hundred plus a little bucks.

People can afford the payment that they can afford. When, not if interest rates for residential mortgages snap back to the mean, the price of housing will fall as the price of money increases.

If you think you want to buy a house now and aren’t going anywhere anytime soon, by all means do so, but lock in your financing over 30 years at a fixed rate and ignore the headlines.

if you think you might be moving around some, rent it. Buy when rates are high and then refinance over time as they come back down.

All of this advice isn’t worth a damn of course if your wife just wants that new house.

Great article! Regarding this…

“When I see a story about the housing market referencing a percentage increase as proof of a recovery I know it’s time to check the charts. You see, even a fractional increase from an all-time low will generate an impressive percentage increase. So let’s go to the charts in search of this blossoming housing recovery.”

Here is the only chart you will ever need…

This is an intentional global herd thinning…

http://www.boxthefox.com/articles/premiere%20article.html

Deception is the strongest political force on the planet.

“Ugh, I wish I had followed AWD’s advice and bought those puts”

[img [/img]

[/img]

Cramer Does It Again

Submitted by Tyler Durden on 02/25/2013 16:42 -0500

“From the “Bear Stearns is fine” man himself, circa 7 hours ago (talking about the unstoppable bull market in progress): “It is a monster move. A lot of people being left behind. A lot of shorts. This thing won’t die. There is a show, again, very good ratings, The walking dead. You know, you can’t shoot this thing. Shoot it in the head and nobody’s been able to do it. This thing has legs…. Can’t talk enough about it”

Dow: down 216 S&P: down 27 OOPS!

[img [/img]

[/img]

@Admin Thanks for breaking thru the propaganda to set the record straight. Tokyo Rose is spewing so much BS these days – ya think she would be hoarse by now. Sheesh…

In addition to propping up the markets, some of us think that the NAR propaganda machine is in full swing is because Bank of America owns the patent on securitizing mortgage applications.

I had heard about this from my pals at the Anti Foreclosure Network. It was a theory tho, and we didn’t have proof.

I was Googling one night and the Patent, held by Bank of America for securitizing mortgage applications was online. I downloaded the file and sent it to AFN. Here’s the link to the patent for you to review.

http://www.google.com/patents/US20090037321dq=patent:11833013&hl=en&sa=X&ei=auErUe6bMO680AH0joGIAQ&ved=0CDYQ6AEwAA

Every time a consumer submits a mortgage application – whether it’s a purchase, refi or modification request, the application is assigned a CUSIP number, and placed on a server that blasts out the characteristics of the borrower (FICO, HHI, etc). The applications are bid on by global investors. If the application is approved it goes in one bucket. If it is declined, it goes in another bucket. Either way, it gets sold to investors, who then securitize the application. Not the loan. The application for the loan.

Here’s the summary:

Anti Foreclosure Network

This e-mail has attached files – see below

If you listen to Ari long enough, you’ll eventually hear him say that loan applications are securitized. Up until this point we had nothing more to go on other than Ari’s word. Well now we have the proof.

There are at least two US Patents filed by Bank of America detailing the System and Methods for Processing Loan Applications. One was filed in August of 2007 with a patent issued February of 2009 and another filed at the same time with a patent issued July of 2010. These patents prove that there is a banking system out there that is intentionally set up to syndicate or securitize loan applications whether those loans were accepted OR DENIED.

What does this mean for you? It means that EVERY SINGLE LOAN you apply for … whether it’s a loan modification or otherwise … ACCEPTED OR DENIED … is securitized or otherwise collateralized. This means … THE BANK MAKES MONEY ON YOUR LOAN APPLICATION whether it is accepted OR NOT.

Smelling some fraud here anyone?

The patent says the following about denied loan applications:

… wherein the underwriting entity approves at least some of the plurality of loan applications to create a plurality of approved loan applications and denies at least some of the plurality of loan applications to create a plurality of denied loan applications ….

So they are intentionally denying some loan applications presumably for the sole purpose of making money off that denied application because they know the application will be acceptable for syndication or securitization.

And people wonder why their loan modifications aren’t being approved???

The loan applications (approved and denied) go through a bidding process. Once the winning entity is determined, a contractual relationship between that entity and the financial institution is established.

The patent specifically states the benefit of this particular invention, saying:

“By reviewing the denied loan applications specifically for syndication and securitization profitability, the financial institution can accept more applications, creating more loans and greater potential profit for the institution. Additionally, incorporating internal competitive bidding into the process of selection between different distribution mechanisms for a financial institution works to ensure that each loan is distributed in the most profitable manner possible. Configuring the system and method to incorporate origination and competitive bidding for loan applications from external sources provides further maximized profit and efficiency not only for the institution operating the auction forum, but also for the many external entities involved in the forum. Likewise, bidding for services related to loans and application also enhances efficiency and profit for all entities involved in the transaction.”

So let me get this straight. The bank securitized my loan and has already been paid. But they also securitized my loan application, making money off of that as well. And if I’m involved in a loan modification process, presumably every time they tell me they “lost” my paperwork or I didn’t submit all of my paperwork and I have to resubmit it over and over and over again, more than likely what they’re doing is submitting my application multiple times just so it can be securitized and they can make more money off me.

And now they want my home as well?

I’m sorry, who wants a free home?????

What can you do with this information? Well, it’s probably a good idea to ask for a copy of your loan application and specifically request the CUSIP number for your loan application. If any of you have requested this information and actually received a CUSIP number for your loan application, we at AFN would love to see it.

EDDIE: Thanks…I second your opinion…..F__K…Wells Fargo & the entire Banking & Mortgage debacle!!

Admin – thanks.

As for me, I never worry about the price of real estate or the timing. The price is what it is on the day. Anyone listening to people being paid to sell real estate telling them that prices are sure to go up are morons.

If I want to sell, I sell. And I buy something else at the same time. So my position is more or less a net wash – i get market value on each transaction. I do not really care if I make money or lose money on my house – it is where I live, and I pay cash. I prefer to make money, but whatever.

As I pay cash, and as I buy a house at the same time I sell, I never cash in the profits in any event, and only roll over the money into a new house. If I pay a million and value drops to half a million, I will get the same quality of house when I sell as I have been living in. Overall, I have made. a lot of money on my houses, but it has not been chrystallized, and probably never will be. For instance, I made fifty percent on my first house, sold it, added money to the sell price and upgraded, doubled my money on that one, sold it and added money to it and upgraded again, etc. i will no longer be upgrading, but I suppose I am up around fifty percent on the current home even given the crash.

My kids may think differently if and when they come to inherit.

I think folks should view a house as a place where they live and have some measure of control as opposed to a financial investment. All well and good if a person can make money, of course. Best if there is no mortgage, in my opinion. I know your opinion is different and you use cashflow as your basis for this stuff. I think people should not borrow money at all except for investment purposes, and a house is not an investment by true definition – it does not generate income.

PS – precious metals are not an investment either. They are speculations.

THat should start a shitfight.

Holy crap Mary Malone, that is almost unbelievable. My poor little pea brain really doesn’t grasp the securitization of of loan applications as it makes no sense at all….kind of like the credit default swap swindle.

Either I’m really dumb and these financial wizards are really smart or:

I’m the only sane person in the room because this shit is comic book crazy.

Thanks for posting.

“PS – precious metals are not an investment either. They are speculations.”

Precious metals are insurance.

Precious metal ETF’s are speculations. Futures and options on metals are speculations.

Cash is a speculation these days.

Gold is speculation? And cancer is healthy. Eastern countries, China in particular, is getting as much gold as they can get their hands on; tons and tons. Western countries are selling them gold. And so, China will gain world reserve currency backed by gold, and we’ll be wiping our asses with $20 bills. Having millions of dollars makes you feel rich now, but not so much when they’re worthless.

[img [/img]

[/img]

AWD – do I question your medical expertise? Hell no.trust me – precious metal purchases are speculations. One speculates in gold, one does not invest in it. It can be used to spread risk or hedge, as Eddie suggests.

LLPOH has worked himself up in a lather and is now trying to pick a fight.

OK I’ll bite.

————————————–

“Llpoh says:

PS – precious metals are not an investment either. They are speculations.”

———————————-

All investments are speculation. Period – ci.

llpoh,

Not questioning AWD’s medical advice detracts from your creditability.

I was already aware of all these numbers for the past 4 years. This is why I no longer own a TV. Why pay a cable bill to get lied too. I have not read a newspaper in 8 years. Again why pay to get lied to. Even Stanberry and Porter Associates has been pushing by a house since about 18 months ago. I canceled my subscribtion.

As soon as I read the first paragraph of this article I knew there were over 11 million empty homes at minimum. I was expecting more disinfirmation. I was wrong. Way to go for being accurate and backing it with enough research to shut down the banker controled media. But th sheep do not have the emotional intelligence nor the time to read the truth. I look forward to putiing bullets in these bankers heads.

Admin,

great article, this hits home for me. I am watching the market right now and am disgusted at the new bubble blowing. I am ready, able but no way willing to jump into this buying frenzy. In all reality, housing prices should mirror the weak economy and inflation, but the low rates are realing people in. I don’t believe in the lower rates washing out the higher home prices. In my mind, if you pay $500k for a house at 3.5% interest, you are gambling that the rates stay low. That might happen, but if you get caught with your pecker in the vise and rates double, you just lost your ass. I can rent for a few more years and watch, maybe it’s a bad move but maybe it’s not.

Crazy – investments return money on the investment, ie rental income from property, dividend income from stocks, etc. investments carry risk, but that does not make them speculations.

Matt – financially it has been shown to be better to rent if you invest the difference between cost of buying and cost of renting. If you simply blow the difference on wine and women, it is generally better to buy, as it is effectively a forced savings plan.

LLPOH,

I agree with your scenario of renting vs. buying. I owned my first house for about 10 years and it was an expensive roller coaster, highs and lows. I have been renting for about 2 1/2 years and have a nice chunk of change in the bank, so I have been better able to save as a renter. However my rental isn’t nearly nice as the home I had before. I have my cash availbale at a moments notice, I don’t have to re-fi to get it, and that feels good.

Owning a house is not an investment. It’s a never ending expense.

As I was sitting in my office reading these comments I heard an unusual noise. I couldn’t figure out what it was. I got up and moved toward the wall. I lifted the access door to my water main and lo and behold it was spraying water. I don’t know for how long it was spraying, but the rug was soaked and the drywall is soaked. I turned off the main water valve, but it continues to drip. The plumber arrived and assessed the situation. They can’t get the parts until tomorrow morning and my bill will be in the $400 range. Shit wears out after 18 years. I now have a plastic bag funneling the dripping water into a trashcan.

Investment my fat ass.

“If you simply blow the difference on wine and women, it is generally better to buy, as it is effectively a forced savings plan.”

Now, there’s a true pearl.

This is at the heart of why I like real estate as an investment. Most Americans go for the wine and women, imho. Real estate mortgage payments represent forced savings.The lack of liquidity is a plus for most people.

However, in today’s world, it might still be easy to see a mortgage go upside down…but a mortgage at 3% is a good liability to have. Risk and benefit. You can be upside down and still no worse for wear, unless you lose your job. The biggest risk is a loss of income. Of course, one might argue that if you’re homeless, that it doesn’t matter much whether you were renting before, or whether you defaulted on a great mortgage.

“Crazy – investments return money on the investment, ie rental income from property, dividend income from stocks, etc. investments carry risk, but that does not make them speculations.” llpoh

I ask you, simply.

In what way are some investments not speculations, and other investments are speculation.

It’s called “the money pit”

My water heater blew something and water soaked the whole room, the bedroom next to it, and the laundry room. The carpet was soaked, the drywall was ruined. The plumber cost $300 to fix the damn pipe that broke. I haven’t fixed the drywall, I just poured bleach on it. It’s a never ending expense.

[img ?1340743758[/img]

?1340743758[/img]

Waking Dreams End Unpleasantly

“…In the end, the madness of debt spending is going to annihilate this country anyway. Fiat printing and infinite QE will eventually result in the dumping of our currency as the world reserve, causing devaluation and hyperstagflation. Stimulus and the monetization of government liabilities are crippling us. The problem is, this nation is irrevocably dependent on such measures. Cuts will result in almost similar catastrophe, but on a faster time frame and perhaps a slightly shorter duration (depending on who runs the show in the aftermath). I’ve been saying it since 2008 – there is no easy way out of this situation. There is no silver bullet solution. There will be struggle, and there will be consequence. It is unavoidable. All we have to decide now is how we will respond when the inevitable disaster comes.”

http://www.zerohedge.com/news/2013-02-25/guest-post-waking-dreams-end-unpleasantly

Believe it or not, high winds have been blowing shingles off my roof all afternoon. Maybe renting isn’t such a bad idea.

Here is the example given at investopedia:

If you buy one house with a reasonable down payment and rent it out for income, it is an investment.

If you buy a dozen houses on limited down payment in hopes of flipping them for a profit it is speculation.

Speculation is somewhat akin to gambling, except that speculators can make very informed decisions based on what is happening in the marketplace.

As gold, for instance, does not generate a return, the only basis for profit is for its price to go up. It is a speculation. Not an investment.

@LLPOH and others who say gold is speculation – I would rather say it is an insurance. Is insurance a speculation? For some people “YES” but I will never want my insurance to give a positive return. I’d rather lose all the insurance premiums I paid than get a positive return on my investment. But I would not want my family to suffer in case the best case scenario does not occur.

As for gold, it is an insurance against inflation, war, unemployment, currency collapse, etc. Definitely it is not an insurance against government confiscation. Gold is preparation for all of the above, but I will never want any of the above to happen anytime. But if it happens, I need to be prepared.

Also gold is the best form of inter-generational wealth. Companies will go bankrupt (most Fortune 500 companies), land can lose value (Detroit), farms can become barren and houses will be depreciate in value, but gold is that wealth which you can take on your person and run when things go wild.

Gold definitely is defintiely not an investment, rather there is a small cost of maintenance – storage issues, protection from burglary, etc. But people who have significant net worth would be better off with a small percentage of that in gold.

“As gold, for instance, does not generate a return, the only basis for profit is for its price to go up. It is a speculation. Not an investment.”

Spoken exactly like someone who doesn’t own any.

Nor does cash begat cash. In fact, cash loses purchasing power.

And gold does not increase in value, but rather money decreases in value. That is the reason to buy and hold; it is called savings.

Oh, all buildings depreciate.

Entropy, not just an idea but the law.

Overtheedge – spoken like an idiot. You know nothing about me, it seems. Speculation is not necessarily bad, and I did not say it was. It is what it is.

Just some assholes do not like the sound of the word. Too fucking bad.

Sv – best form of intergenerational wealth is farmland, in my opinion.

“Speculation is somewhat akin to gambling, except that speculators can make very informed decisions based on what is happening in the marketplace.”

@Llpoh: PMs ARE a speculation, based upon the definition of needing a higher price to make a profit. They are basically a form of currency exchange. Speculators involved in this exchange CAN make very informed decisions based on what they see going on, and it doesn’t look good for fiat. BUT–when I buy PMs, I never ask what the “price” might be at such and such a time. I’m stashing money, changing it from a much more perishable form to a much less perishable form. Kind of like canning, smoking, or drying food.

Davidnrobyn – no problem with any of that, and I agree.

It is just that people hate the word “speculate” and do not want themselves to be speculators but rather want to be investors. Too bad, calling a dog a cat doesn’t make it a cat. I do not find it offensive at all – I speculate in PMs myself.

I will personally not buy gold to see it going up in price, but if I have to buy a house in another 10 years and do not want to take a loan, I’d definitely save in gold. Even though gold gives exceptional returns once a few decades, in the very long run gold price track inflation.

So some speculators will make supernormal amount of money and some speculators will lose money, but those who save in gold will retain their purchasing power.

SV – that is pure speculation. 🙂

CLASSIC MSM HEADLINE. THE NON-SEASONALLY ADJUSTED HOME PRICES ARE LOWER THAN THEY WERE IN SEPTEMBER

Annual U.S. home-price rise is best in seven years

Price increases driven by investors in Phoenix, Las Vegas, LA and Miami

[img [/img]

[/img]

New Home Sales Seasonal Adjustments Go Full Retard

Submitted by Tyler Durden on 02/26/2013 10:42 -0500

Ok Census Bureau: enough is enough.

In the government’s endless desire to show just how blistering, nay, stupendously amazingful the gargantuantest housing recovery has been, we just got news that New Home Sales in January soared, SOARED, to 437K from an upward revised 378K, slamming expectations of a 380K print (chart). “This is the best New Home Sales print since August 2008!” the mainstream media roared with adoration and approval (hoping for an avalanche of ad RFPs from Trulia, Zillow and of course, the NAR). Alas, as so often happens, there was more than meets the eye.

Much, much more.

For one: the actual, unadjusted number of homes sold in January was a meager 31K (of which 1,000 houses sold in the $750K+ range): a tiny 4K increase from December, the same as August, and lower than all months from March to July 2012 (chart); the houses for sale rose to the highest since December 2011; the Median Price plunged to $226,400, the lowest since January 2012 and down $23k from December’s $249,800. Finally of the 31K houses sold in January, just 12K were actually completed, with 10K under construction and 10K not even started. So who cares: seasonal adjustments happen all the time, and January just happens to be an important inflection point right? Yes.

Which is precisely why we took the December-to-January change in New Home Sales as reported since the peak of the housing bubble, to get an accurate sense of how this inversion has behaved in history. The result is plotted below: the blue bar shows the sequential change in actual data. The red one shows the seasonally adjusted one.

Please highlight the full retard seasonal adjustment.

@Llpoh – Probably you have a point, but I am not getting it. Is it speculation to convert my dollars (or Indian Rupee) to gold so that it retains its purchasing power? If it is speculation, how is it explained?

Admin – what a fantastic job of summing up what’s happening. Very, very good article!!!

“This has been planned, coordinated and implemented by a conspiracy of the ruling oligarchy – the Federal Reserve, Wall Street, U.S. Treasury, NAR, and the corporate media conglomerates.”

There needs to be a class action lawsuit against the above by all of the people who have suffered because of their manipulation. And Bernanke is QEing, he says, in order to get the unemployment rate down? How fortunate he has that as part of his mandate because he can just keep hammering on the levers under the guise of helping “the people”.

Been helping my children with their up-to-the-eyeballs homework lately (Milton’s Paradise Lost, Hobbes’ Leviathan, Rene Descartes, the Reformation, Renaissance history). Jesus H. Christ!!! When you stand back and look at history, you can see the repetition.

If it’s not greedy churches, it’s greedy bankers controlling the crap out of people. Through labor surpluses, plagues, labor shortages, enclosures, the elite continue to piss on the herd from great heights.

A conspiracy of the ruling oligarchy? You bet it is and always has been. Thank you for the great article and for giving me faith that someone else sees it.

OT – speaking of being lied to and manipulated: they no longer need to take your land; they’ll just control its seeds.

http://theautomaticearth.com/Finance/time-to-stop-monsanto-and-the-us-supreme-court.html

This better be stopped yesterday. I’m going long “rope” and “guillotine blades”.

Wake up, America!

A quick reprieve from the insanity.

Isn’t this a lovely picture?

[img [/img]

[/img]

This is more appropriate for TBP

Here in Central Florida, the tide a year ago in housing was flooding the foreclosure market and driving housing inventory to 4-5 year clearance levels.

A year ago, when TSHTF on robo-signing, fraud of all kinds, et al, foreclosure notices dropped from 8 pages in the local rag down to 2 for a good seven months.

Now that political payoffs have been made, politicians bribed, token tiny wrist slaps have been administered to the banks and mortgage companies a strange thing is happening……….

We are now back to 6 pages of foreclosure notices in the paper and rapidly rising again.

This a MA’s own “Pain in Real Estate” indicator because real estate sales between Ocala and Orlando are beginning to slip-slide into the dumper again. Inventory will rapidly increase with more and more foreclosures and before you know it, we’ll be into round #2 of the housing crash. Especially when the Fed loses control of interest rates, the USA is shown (not just known) to be bankruptured and we go into Depression #3

@llpoh: We have defined real money on this site so many times that I’m surprised you forgot the definition of it.

MA

A slow lift…..