“The continuing shortages of housing inventory are driving the price gains. There is no evidence of bubbles popping.” – David Lereah, NAR mouthpiece/economist – August 2005

“The steady improvement in home sales will support price appreciation despite all the wild projections by academics, Wall Street analysts, and others in the media.” – David Lereah, NAR mouthpiece/economist – January 10, 2007

“Buyer traffic is continuing to pick up, while seller traffic is holding steady. In fact, buyer traffic is 40 percent above a year ago, so there is plenty of demand but insufficient inventory to improve sales more strongly. We’ve transitioned into a seller’s market in much of the country. We expect a seasonal rise of inventory this spring, but it may be insufficient to avoid more frequent incidences of multiple bidding and faster-than-normal price growth.” – Lawrence Yun – NAR mouthpiece/economist – February 21, 2013

I really need to stop being so pessimistic. I’m getting richer by the day. My home value is rising at a rate of 1% per month according to the National Association of Realtors. At that rate, my house will be worth $1 million in less than 10 years. My underwater condo (figuratively – not literally) in Wildwood will resurface and make me rich beyond my wildest dreams. Larry Yun, the brilliant economic genius employed by the upstanding and truth telling NAR, reported that median home prices soared by 12.3% in January (down 3.7% from December) over the prior year and there is virtually no inventory left to sell – with a mere 1.75 million homes in inventory – the lowest level since 1999. The median sales price of $173,600 is up “dramatically” from last year’s $154,500 level. I’m sure the NAR meant to mention that home prices are still down 25% from the 2005 high of $230,000. Every mainstream media newspaper, magazine, and news channel is telling me the “strong” housing recovery is propelling the economy and creating millions of new jobs. Keynesian economists, Wall Street bankers, government apparatchiks and housing trade organizations are all in agreement that the wealth effect from rising home prices will be the jumpstart our economy needs to get back to the glory days of 2005. Who am I to argue with such honorable men with degrees from Ivy League schools and a track record of unquestioned accuracy as we can see in the chart below?

Mr. Lereah added to his sterling reputation with his insightful prescient book Why the Real Estate Boom Will Not Bust—And How You Can Profit from It, which was published in February 2006. I understand Ben Bernanke has a signed copy on his nightstand. According to David, he voluntarily decided to leave the NAR in mid-2007 as home prices began their 40% plunge over the next four years. He then admitted in an interview with Money Magazine in 2009 that he was nothing but a shill for the real estate industry, no different than a whore doing tricks for $20. Except he was whoring himself for millions of dollars and contributing to the biggest financial fraud in world history:

“I was pressured by executives to issue optimistic forecasts — then was left to shoulder the blame when things went sour. I was there for seven years doing everything they wanted me to. I worked for an association promoting housing, and it was my job to represent their interests. If you look at my actual forecasts, the numbers were right in line with most forecasts. The difference was that I put a positive spin on it. It was easy to do during boom times, harder when times weren’t good. I never thought the whole national real estate market would burst.”

After Mr. Lereah slithered away from his post he was replaced by the next snake – Lawrence Yun. He proceeded to put the best face possible on the greatest housing collapse in recorded history, assuring the public it was the best time to buy during the entire slide. Five million foreclosures later he’s still telling us it’s the best time to buy. Why shouldn’t we believe the National Association of Realtors and the mainstream media that report their propaganda as indisputable fact? These noble realtooors only have the best interests of their clients at heart. Remember when they warned people about the dangers of liar loans, negative amortization loans, appraisal fraud, nefarious mortgage brokers, criminal bankers, corrupt ratings agencies and the fact that home prices had reached a high two standard deviations above the normal trend? Oh yeah. They didn’t make a peep. They disputed and ridiculed Robert Shiller and anyone else who dared question the healthy “strong” housing market storyline. In late 2011 this superb, above board, truth telling organization admitted what many financial analysts and “crazy” bloggers had been pointing out for years. They were lying about home sales. Their data was false. Between 2007 and 2010, the NAR reported 2.95 million more home sales than had actually occurred. This was not a rounding error. This was not a flaw in their methodology, as they claimed. It was an outright fraudulent attempt to convince the public that the housing market was not in free fall. These guys make the BLS look accurate and above board.

We are now expected to believe their monthly reports as if they are gospel. The mainstream media continues to report their drivel about the lowest inventory level in 14 years without the slightest hint of skepticism.

The Incredible Shrinking Inventory

We are told by good old Larry Yun that there are only 1.74 million homes left for sale in this country and at current sales rates we’ll run out of inventory in 4.2 months. Oh the horror. You better buy now, before it’s too late. We must be running out of houses. Someone call Bob Toll. We need more houses built ASAP, before this becomes a crisis. But there seems to be problem with this storyline. Existing home sales are falling. Even using the NAR seasonally manipulated numbers, sales in January were lower than in November. In a country with 133 million housing units, there were 291,000 existing home sales in January. If there is an inventory shortage, why have new home sales fallen every month since May of 2012? There were a total of 10,000 completed new homes sold in December in the entire country. Housing starts plunged by 8.5% in January. Does this happen when you have a strong housing market? Do you believe the NAR inventory figure of 1.74 million homes for sale? The last time the months of supply was this low was early 2005 – during the good old days.

Let’s examine a few facts to determine the true nature of this shocking inventory shortage. According to the U.S. Census Bureau:

- There are 133 million housing units in the United States

- There are 115 million occupied housing units in the country, with 75 million owner occupied and 40 million renter occupied.

- For the math challenged this means that 13.5%, or 18 million housing units, are vacant.

- Only 4.3 million are considered summer homes, and 3.9 million are available for rent. That leaves 9.8 million homes completely vacant.

- The Census Bureau specifically identifies 1.6 million of these vacant housing units as up for sale.

So, with 9.8 million vacant housing units in the country and 1.6 million of these identified as for sale, the NAR and media mouthpieces have the balls to report only 1.74 million homes for sale in the entire U.S. This doesn’t even take into account the massive shadow inventory stuck in the foreclosure pipeline. Of the 75 million owner-occupied housing units in the country, 50 million have a mortgage. Of these houses, a full 10.9% are either delinquent or in the foreclosure process. This totals 5.4 million households, with 1.9 million of these households already in the foreclosure process. The number of distressed households is still double the long-term average, even with historically low mortgage rates, multiple government mortgage relief programs (HARP), and Fannie, Freddie and the FHA guaranteeing 90% of all mortgages. Do you think the NAR is including any of these 5.4 million distressed houses in their inventory numbers?

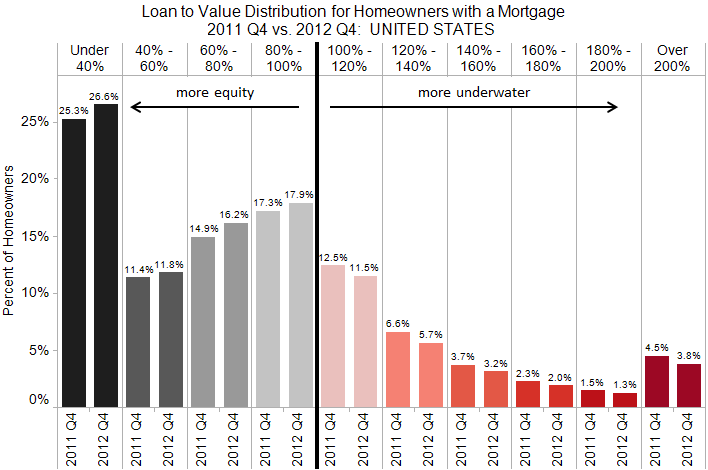

Then we have the little matter of a few home occupiers still underwater on their mortgages. After this fabulous two year housing recovery touted by shills and shysters, only 27.5% of ALL mortgage holders are underwater on their mortgage. This means 13.8 million households are in a negative equity position. Those with 5% or less equity are effectively underwater since closing costs usually exceed 6% of the house’s value. That adds another 2.2 million households to the negative equity bucket. Do you think any of these 16 million households would be selling if they could?

The negative equity position of millions of homeowners gets at the gist of the effort to re-inflate the housing bubble. By artificially pumping up home prices, the Wall Street titans and their co-conspirators at the Federal Reserve and Treasury Department are attempting to repair insolvent Wall Street bank balance sheets, lure unsuspecting dupes back into the housing market, reignite the economy through the old stand-by wealth effect, and of course enrich themselves and their crony capitalist friends. The artificial suppression of home inventory has been working wonders, as 2 million homeowners were freed from negative equity in 2012. If they can only lure enough suckers back into the pool, all will be well. Phoenix must have an inordinate number of chumps with home prices rising by 22.5% in 2012 as investors and flippers poured into the market with cheap debt and big dreams. Of course everything is relative, as prices are still down 44% from the peak and 40% of mortgages remain underwater. I strongly urge everyone without a functioning brain to pour their life savings into the Phoenix housing market. Larry Yun says it’s a can’t miss path to riches.

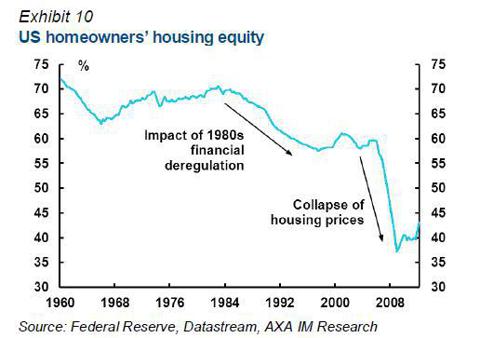

Despite the propaganda, hyperbole, and cheerleading from the corporate media, the fact remains that national homeowner’s equity is barely above its all-time low of 38%, down from 62% in 2000 and 70% in 1980. The NAR shills, Federal Reserve drug pushers, Wall Street shysters, and pliant media lured the middle class into the false belief that housing was an asset class that could make you rich. Homes became the major portion of middle class net worth. As prices were driven higher from 2000 through 2006, the middle class took the bait hook line and sinker and borrowed billions against their ever increasing faux housing wealth. This set up the impending collapse of middle class net worth, created by the 1%ers on Wall Street, in Washington DC, and in corporate executive suites across the land. The median American household lost 47% of its wealth between 2007 and 2010. Average household wealth, which is skewed dramatically by the richest Americans, declined by only 18%. Real estate only accounts for 30% of the net worth of the rich. For the middle 60%, housing has risen from 62% to 67% of total wealth since 1983. Middle class families’ saw their cash cushion fall from 21% in 1983 to 8% before the crash. They were convinced that living on Wall Street peddled debt was the path to prosperity. After the crash, the middle class has been left with no cash, underwater mortgages, declining real wages, less jobs, and a mountain of credit card debt. Delusions have been crushed. But an on-line degree from the University of Phoenix funded by a Federal student loan of $20,000 will surely revive the fortunes of the average unemployed middle class worker.

Despite the destruction of middle class hopes, dreams, and net worth, the ruling plutocracy has decided the best way to revive their fortunes is to lure the ignorant masses into more student loan debt, auto debt and mortgage debt.

Don’t Look Behind the Curtain

“The real hopeless victims of mental illness are to be found among those who appear to be most normal. Many of them are normal because they are so well adjusted to our mode of existence, because their human voice has been silenced so early in their lives that they do not even struggle or suffer or develop symptoms as the neurotic does. They are normal not in what may be called the absolute sense of the word; they are normal only in relation to a profoundly abnormal society. Their perfect adjustment to that abnormal society is a measure of their mental sickness. These millions of abnormally normal people, living without fuss in a society to which, if they were fully human beings, they ought not to be adjusted.” – Aldous Huxley – Brave New World Revisited

What is normal in a profoundly abnormal, manipulated, propaganda driven society? The NAR and Federal government issue their public relations announcements every month and attempt to spin straw into gold. The media then fulfill their assigned role by touting the results as unequivocal proof of an economic recovery. This is all designed to revive the animal spirits of the clueless public. Statistics in the hands of those who have no regard for the truth can be manipulated to portray any storyline that serves their corrupt purposes. When I see a story about the housing market referencing a percentage increase as proof of a recovery I know it’s time to check the charts. You see, even a fractional increase from an all-time low will generate an impressive percentage increase. So let’s go to the charts in search of this blossoming housing recovery.

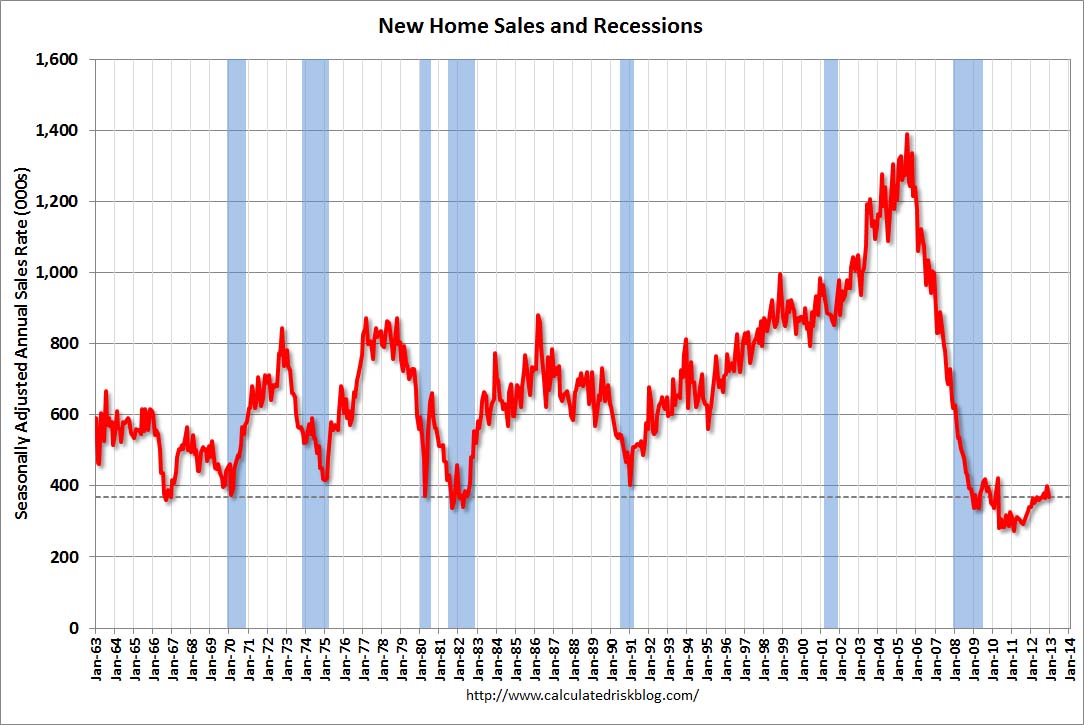

The media, NAHB, and certain bloggers look at this chart and declare that new home sales are up 20% from 2011 levels. Sounds awesome. I look at this chart and note that 2011 was the lowest number of new home sales in U.S. history. I look at this chart and note that new home sales are 75% below the peak in 2005. I look at this chart and note that new home sales are lower today than at the bottom of every recession over the last fifty years. I look at this chart and note that new home sales are lower today than they were in 1963, when the population of the United States was a mere 189 million, 40% less than today’s population. Do you see any signs of a strong housing recovery in this chart?

The housing cheerleaders look at the chart below and crow about a 75% increase in housing starts. I look at this chart and note that housing starts in 2009 were the lowest in recorded U.S. history. I look at this chart and note that total housing starts are down 60% and single family starts are down 70% from 2006 highs. I look at this chart and note the “surge” in housing starts is completely being driven by apartment construction, because the student loan indebted youth can’t afford to buy houses. I look at this chart and note that housing starts are 40% below 1968 levels. Do you see any signs of a strong housing recovery in this chart?

Those trying to lure the gullible non-thinking masses into paying inflated prices for the “few” houses available for sale declare that existing home sales are up 50% in the last two years. Of course, the 3.3 million low in 2010 was the lowest level in decades. Existing home sales are still 30% below the 2005 high of 7.2 million and the abnormal structure of these home sales is dramatically different than the normal sales of yesteryear.

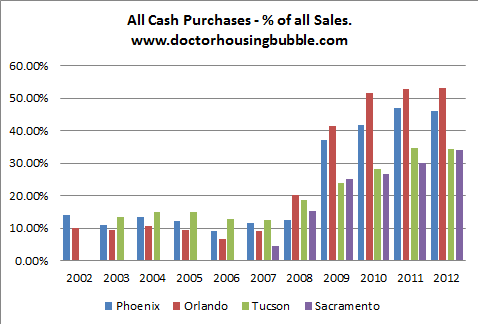

The wizards behind the curtain don’t want you to understand how the 50% increase in existing home sales has been achieved. They just want you to be convinced that a return to normalcy has happened and it’s the best time to buy. The NAR wizards and the media wizards don’t publicize the composition of these skyrocketing sales. At the end of the NAR “buy a home before it’s too late” monthly press release you find out that distressed homes (foreclosed & short sales) now make up 23% of all home sales and have accounted for well over 30% of all home sales since 2010. Another 28% of home sales are all-cash sales to investors looking to turn them into rental units or flip them for a quick buck. Lastly, 30% of homes are being bought by first time home buyer pansies who have been lured into the market by 3.5% down payment loans through the FHA, with the future losses born by middle class taxpayers who had no say in the matter. Prior to the housing crash, normal buyers who just wanted a place to live, accounted for 90% of all home purchases. Today they make up less than 30% of home buyers. Does this chart portray a normal market or a profoundly abnormal market? Does it portray a healthy housing recovery based upon sound economic fundamentals?

The answer is NO. The contrived elevation of home sales and home prices has been engineered by the very same culprits who crashed our financial system in the first place. This has been planned, coordinated and implemented by a conspiracy of the ruling oligarchy – the Federal Reserve, Wall Street, U.S. Treasury, NAR, and the corporate media conglomerates. Ben’s job was to screw senior citizens and drive interest rates low enough that everyone in the country could refinance, attract investors & flippers into the market, and propel home prices higher. Wall Street has been the linchpin to the whole sordid plan. They were tasked with drastically limiting the foreclosure pipeline, therefore creating a fake shortage of inventory. Next, JP Morgan, Blackrock, Citi, Bank of America, and dozens of other private equity firms have partnered with Fannie Mae and Freddie Mac, using free money provided by Ben Bernanke, to create investment funds to buy up millions of distressed properties and convert them into rental properties, further reducing the inventory of homes for sale and driving prices higher. Only the connected crony capitalists on Wall Street are getting a piece of this action. The Wall Street big hanging dicks have screwed the American middle class coming and going. The NAR and media are tasked with what they do best – spew propaganda, misinform, lie, cheerlead and attempt to create a buying frenzy among the willfully ignorant masses. The chart below reveals the truth about the strong sustainable housing recovery. It doesn’t exist. Mortgage applications by real people who want to live in a home are no higher than they were in 2010 when home sales were 33% lower than today. Mortgage applications are lower than they were in 1997 when 4 million existing homes were sold versus the 5 million pace today. The housing recovery is just another Wall Street scam designed to bilk the American middle class of what remains of their net worth.

The multi-faceted plan to keep this teetering edifice from collapsing is being executed according to the mandates of the financial class:

- Distribute hundreds of billions in student loans to artificially suppress the unemployment rate, while the BLS adjusts millions more out of the labor force – CHECK

- Have Ally Financial (80% owned by Obama) and Wall Street banks dole out subprime auto loans to millions and offer 7 year financing at 0%, while GM (Government Motors) channel stuffs its dealers, to create the appearance of an auto recovery – CHECK

- Drive mortgage rates down, restrict home supply through foreclosure market manipulation, shift the risk of losses to the taxpayer, and allow Wall Street to control the housing market – CHECK

- Have the corporate mainstream media continuously spout optimistic, positive puff pieces designed to convince an ignorant, apathetic public that the economy is improving, jobs are being created, and housing has recovered – CHECK

Free money, government subsidies, no regulation, Wall Street hubris, get rich quick schemes, media propaganda, and an ignorant public – what could possibly go wrong?

Here is what could and will go wrong. Everyone in the country that could refinance to a mortgage rate of 4% or lower has done so. Contrary to Bernanke’s rhetoric that “QE to Infinity” would lower mortgage rates, they have just risen to a six month high as the 10 Year Treasury rose 60 basis points from its 2012 low. If mortgage rates just rose to a modest 5% the housing market would come to a grinding halt as no one would trade a 3.5% mortgage for a 5% mortgage. As I’ve detailed earlier, there are 3.9 vacant housing units available for rent. Almost half of the new housing units under construction are apartments. The Wall Street shysters are converting millions of foreclosed homes into rental units. This avalanche of rental properties will depress rents and destroy the modeled ROI calculations of the brilliant Wall Street Ivy league MBAs. These lemmings will all attempt to exit their “investments” at the same time. The FHA is already broke. The mounting losses from their 3.5% down payment to future deadbeats program will force them to curtail this taxpayer financed debacle. There will be few first time home buyers, as young people saddled with a trillion dollars of student loan debt are incapable of buying a home.

These are the facts. But why trust facts when you can believe Baghdad Ben and the NAR? It’s always the best time to buy.

“All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable.” – Ben Bernanke – May 17, 2007

Still a slow lift..

[img [/img]

[/img]

I’m so full I just gotta take a na————-zzzzzzz..

[img [/img]

[/img]

My house is infested with the dreaded tiger squirrel

This is what Muck’s squirrel was doing before he fell asleep.

Stucky – that’s a really cute baby tiger. Here’s something back at you. Watch it from 0:39. I remembered you liked this song.

http://www.youtube.com/watch?v=KblC1SADX2c

backwardsevolution

Thank you very very much. That was great!

SV – nope,you are not getting it. Speculation is a term that defines the type of asset and risk associated. The asset returns no income, and the asset is highly volatile and risky. People just do not like the term, and prefer to call themselves investors.

Stucky

Knock that doppelganging shit off.

BTW, I got a smoking, and I mean smoking, deal on some silver (Silver Eagles and Morgan Silver Dollars) yesterday. Got ’em at spot and slightly less than spot. Match THAT, punks.

matt

Yeah, there is a new wave of house speculators, small fry that will probably discover the frauds in what they thought they bought too late. The real market is government-driven, first with The Bernank sequestering away $40 billion of fake securitized mortgages — and an implicit “we’ve got your back” from TPTB to Blackrock and such ilk buying by arrangement, by the thousands.

Muck About

The only reason the early glut of foreclosures happened in Florida was due to the senile judges they call out of retirement to rubberstamp whatever lies the banks told. But robosigning started a growth industry in foreclosure defence and thousands of people are taking the fraudulent banks on.

Imagine buying a house and putting $65,000 into renovations only then to be told, Oops, it turns out there was a lien on the previous mortgage that we overlooked, too bad for you. Or the ‘forgiveness scam’ in foreclosures, where the banks sell that ‘debt’ to collection agencies at pennies on the dollar. Or the one where the mortgage is paid off and then some vulture turns up with the original note and says that house is mine.

Another bank anomaly is to file for foreclosure, the people bite the bullet and move out, and never learn the case was withdrawn, then the local government tracks them down for the back taxes. Et bloody cetera and so forth.

As for gold, “When Money Dies” tells some interesting facts as to what is worth something in such a situation. One thing’s for sure: they ain’t printing any more double eagles, etc. Heh.

@SSS: anytime you can get .99% silver at below spot, do it! Good on you. (Wanna go partners?)

Also, at least Stucky didn’t dopplegang a nipple in there although there’s a close call on that left side!

MA

What moron would sell silver below spot?

I 1st read this post at work and couldn’t get all the pics. I now see the very first pic- LOLZ! ha ha ha! man, fuckin’ nail on the head. Goddamn I love ResiBrokers.

I own a bunch of rental property. No vacancies, it’s just not worth as much as is used to be. Same rents rolling in though. All 30 year fixed at 7%…

Muck and Admin

I swear it’s true. I got the Silver Eagles below spot and the Morgan Silver Dollars at spot. And that included local retail sales tax. So it was even better than I said. It was a perfectly legit sale.

Major bonus. One of the Morgan dollars was an 1884-O (O standing for the New Orleans mintmark). It grades about EF-AU (extremely fine to about uncirculated) and catalogues $35-40. Nice strike, no dings, good eye appeal. Got it for $22, which is spot for a 90% silver dollar.

Do you think I’m going to advertise on the Internet where and how I got this deal? No fucking way. I’m gonna milk this cow dry.

SSS

You should back up the truck and buy all the silver you can get for $22.

Inflation. Ben is printing, housing and stocks went down, Ben waves his pen, money appears, now stocks and housing goes up. For the average person the stock market success does not help them (90% not very invested) and same with housing, this is a speculative bubble for investors fueled by Bernanke’s money and low interest rate policy, money goes somewhere… average person cannot afford the house (see mortgage applications), this is another investment bubble. Maybe 2 more years, maybe 2 more months… PoP!!! Whatcha gonna do then, Ben?

First take the facts and distort them at your leisure. -Mark Twain

You present a lot of data but very little (if any) context or history. The Census report shows that vacancy rates for residential units has varied from 7% to 11% going back to 1995. You discuss the foreclosure rate but fail to discuss historic trends. These factors have been a part of the real estate market for many years.

NAR presents national numbers that show trends. Several years ago they continually reported that home values were declining as well as the pool of buyers. Do you think those were just scare tactics? Real estate is local – sometimes local trends match national trends and sometimes they don’t. The national trends tend to affect every market eventually.

The NAR report doesn’t state “there are virtually no homes for sale”. The report states there are about 1.74 million homes for sale and goes on to state that number represents a 4.2 month supply of homes on the market. Additionally, the report states that the median home price for January 2013 was up 12.3% from January 2012. The report does not state that home values were up 12% for the year. The trend in median price only shows exactly what it is – a trend. Overall home values tend to mirror the overall trend for median prices, but it’s not tit for tat.

I read nothing in the report that states home values are rising 1% a month.

Jon

Are you really as dumb as you sound? If the price is up 12.3% over the prior January than it has gone up at approx 1% per month. Math is hard, especially for dumbasses.

The NAR purposely overstated home sales by millions for years. That is a fact you dumbfuck.

Historic trends make the current foreclosure rates look even worse you fuckwad. Today, 43% of ALL home sales are distressed sales. HISTORICALLY this number was less than 5%.

You must be a member of the NAR to be so dimwitted.

I sell real estate in MA. I recently discontinued my membership in NAR, I found it to be a waste of my money because all they were doing was using my money to push their own agenda and BS. I personally complete between 50-75 valuations for the banks on properties that are in some stage of foreclosure or short sale. That’s 50-75 a MONTH. In MA ONLY, and not the whole state! Many of these properties I am reporting on 2-3 times a YEAR. Some sit vacant for months or years, rotting away, while the bank dilly dallies getting them back on the market or the homeowner tries in vain to complete a loan modification or short sale. I personally do not see a recovery anywhere, with an average of 20% of the transacitons just in my local neck of the woods being either REO (bank owned) or short sale, or overpriced and just sitting hoping for a magic buyer that will bail them out. I constantly get calls from non-approved buyers wanting to go out and look at homes. I tell them I will NOT shop them around to homes until they have spoken with a lender and get pre approved so they know what they can afford. 95% never call me back because they CANNOT get pre approved.

People watch the news and think it’s just this very, very easy thing to buy with little or no money down (VA and USDA rural still has 100% financing but more guidelines than 3.5% down FHA or MassHousing). Because we typically have the oldest homes in the country, often times the house or “triple decker” someone wants to buy will not qualify for any of these programs due to condition issues, such as old roof, peeling paint, or a heating system on it’s last gasp. Now, if you are a cash investor, this is a market gold mine.

You can purchase a multi-family home (4 or less units) for about 10-20K a unit depending on the area. Rents for a 3 bedroom, 1000 sq foot apartment with nothing included by water and sewer, typically rent for about 900-1200 a month in most areas. Do the math: 55-60K spent for a building that needs about 20K work=75-85K total investment. Monthly income: 3K. 36K a year, you pay for your investment outright within 3-4 years as opposed to the saps that bought same place in 2005 for 350K!!!!!! Even if you are a regular buyer with FHA, you can get into a “move in ready” 3 unit for 150K Your monthly payment would be roughly 1300 and that includes PMI, taxes and insurance. Collect 2K from the other units and you are doing very, very well. The rental market is very hot right now, with good units in decent areas being rented in under 25 days. I have a client who has a beautiful unit (3 bedrooms, 1 bath, 2 levels, granite, fenced yard, good neighborhood) for $1350 in 20 days. And honestly, most of the applicants are people who are selling their homes in a short sale or who lived in an apartment building that got foreclosed on and they had to move.

The ongoing problem is the short sale market. The typical wait time from offer to actual closing is 90-120 days, and there is NO guarantee it will actually be approved and close (you need to make sure all parties know what the heck they are doing. Just because they are a real estate agent or even an attorney does not mean they know what they are doing with a short sale). Buyers will overwhelmingly prefer financeable foreclosures over short sales, so short sales, even really nice ones in good condition, sell for less than comparable foreclosed homes. There is no way you can compete against that.

The “shadow” inventory is out there, just waiting in the wings to spring upon us. . So many people are one blow out tire, one flu season, one broken appliance, away from entering foreclosure. These people may actually enter the loan mod process and get approved, but they never can stick with it becuase no matter what they are on such financially shaky ground, and so they hold on for maybe 3-9 months and then default again. I personally know of people who have lived in their home making no mortgage payment for up to 3 years! The bank either does not move forward with foreclosure or they cannot evict them for whatever reason (or choose to wait, they are so afraid of being sued), and these are hanging in the wings too.

People are not getting raises as well. And even myself, who makes a pretty decent living selling real estate, must sell FOUR TIMES AS MANY HOMES AS I DID 3 YEARS AGO TO MAKE THE SAME AMOUNT OF MONEY. That alone speaks volume of the lack of “recovery”.

Yes, many homes sell above asking price. Why? Well, the banks sometimes listen when agents tell them to slightly underprice to get competitive bids, and those properties are psychologically “hot” and garner up to 10 or more bids in a few days. These are almost always cash buyers who can close in under 20 days.

So, the bottom line is this: Right now, real estate is a good investment, but it’s also relevant to each individual. Not everyone who can buy a house should. If you can COMFORTABLY afford your payment, and you are aware of maintenance issues, taxes, water, sewer, etc. then by all means, buy. But I always advise my clients to really sit down and think about WHY they want a house, and if so, what house do they want vs what they need? Does a single guy with no kids or wife on the horizon need a 2000 square foot home with 3 bedrooms on an acre of land? NO. Does he want it as a status symbol? If so, be honest with yourself and your agent. Talk about your lifestyle and why you want to buy, where you want to live, how much time you want to spend on grass, painting, etc.

And if you think you are going to be a real estate god and purchase rental units and live on easy street, think again. I do not recommend this to anyone who is new to real estate. Most people have not one clue about how to rent apartments, what makes a good tenant, the 3am stopped toilet phone calls, the higher rates on commercial lending, etc. One bad tenant can literally bring you to financial ruin. It’s true.

These are the hard conversations a good agent will have with you wether you are buying or selling. It’s my job to educate you about the MARKET, not just about houses. You already know what a house is. But buyer’s and seller’s live in their own little house bubble, and do not understand what motivates most people to buy or sell. Right now, I am telling my clients, if you don’t have to sell, don’t. If you can buy comfortably, and you have solid reasons for doing so, call me, I will be happy to help.

Good luck to everyone out there in this crazy housing market, and don’t believe the hype! A good agent will never regurgitate the party line.

realestatepup

Fantastic frontline info. I love when people who know the truth post. Stay around. Your insights will add a lot to TBP.

INTEREST ONLY LOANS ARE BAAAACK. WHAT POSSIBLY COULD GO WRONG????

The return of interest-only mortgages

These loans promise low monthly payments, but plenty of risks

By AnnaMaria Andriotis

Affluent borrowers are signing up for the same type of mortgage that pushed many homeowners into foreclosure just a few years ago.

Interest-only mortgages, in which borrowers pay interest but no principal during the first few years of the loan, are attracting buyers who like the lower monthly payments—and can divert the savings to income-generating investments.

Lennar Lenders say these borrowers are attracted to the loans’ low monthly payments, which can be 30% to 40% lower than regular mortgages. And with interest rates near record lows over the past year, these loans have become even cheaper.

Interest-only mortgages accounted for about 14% of private mortgage originations from January 2012 through October, according to the latest data from CoreLogic, a real-estate analytics firm. (Private loans are mostly held on lenders’ books rather than sold to government-backed agencies.)

National lender EverBank (NYSE:EVER) says interest-only loans make up 15% to 20% of all the private jumbo mortgages it originates. At Bank of New York Mellon’s (NYSE:BK) wealth-management group, applications for interest-only private jumbos increased nearly 50% so far this year compared with the same period in 2012. “This has been a very robust first quarter for us,” says Erin Gorman, national mortgage sales director with the group.

Other lenders are entering the market. For instance, in April, lender and servicer Stonegate Mortgage Corp., based in Indianapolis, will roll out interest-only private jumbos. Jim Cutillo, chief executive of Stonegate, says he expects many wealthy borrowers who would have applied for adjustable-rate mortgages (ARMs) to instead turn to interest-only jumbo loans, specifically those that have fixed rates.

Likely to spur demand are new mortgage rules announced earlier this year by the Consumer Financial Protection Bureau. Starting in 2014, lenders offering ARMs will have to evaluate borrowers based on their ability to pay a higher interest rate than the initial rate on the loan. As a result, some applicants will find that they qualify for a smaller mortgage. Cutillo says Stonegate’s interest-only mortgages will have a fixed rate for the duration of the loan, allowing home buyers to maintain borrowing power.

Still, under the CFPB’s rules, lenders who continue to provide interest-only mortgages beginning next year could face greater liability in lawsuits filed by borrowers who fall into foreclosure. But lenders are playing down the risk, saying that they provide these loans only to affluent borrowers who have significant assets and are unlikely to fall behind on payments.

Most of these loans permit interest-only payments for the first 10 years, making them appealing to buyers who plan to sell their home within that period since they won’t have to pay principal toward the loan. On a 30-year $1 million mortgage with a 4.08% fixed rate—the average rate on private jumbos, according to mortgage info website HSH.commonthly interest-only payments come out to $3,400, compared with roughly $4,820 a month for interest and principal.

Separately, some affluent borrowers find these mortgages provide more flexibility. For instance, wealthy self-employed borrowers with seasonal fluctuations in their income, as well as individuals whose bonuses make up a large chunk of their income, often prefer interest-only mortgages because of their small monthly payments and the ability to make larger payments, if they prefer, when they have the extra funds, says Tom Wind, executive vice president of residential lending at EverBank.

The loans also have flexible payment options. Borrowers who want to prepay the principal can do so without incurring a penalty in most cases.

Still, these loans come with many risks. Borrowers won’t build equity in their homes with interest-only payments, and if home prices fall, they could end up owing more on the home than it’s worth. Here are a few other issues to consider.

More up front: Some lenders require larger down payments, which can be 30% or more, than they would with a regular mortgage.

Higher interest rates: Some lenders will charge higher rates, often ranging from 0.12 to 0.25 of a percentage point more, than they would with a mortgage that requires principal and interest to be paid monthly.

Liquidity needed: Most interest-only mortgages have adjustable rates, which means borrowers could see their monthly payments get bigger if rates begin to rise. Borrowers should consider whether they have enough liquid cash to manage sudden spikes in payments.

Admin, the ONLY way interest-only loans make sense is if you know you are selling in a very, very short period of time and you have put 20% down AND you are in a market that is relatively untouched by the general housing market. In other words, a wealthy plastic surgeon, let’s say, purchases a condo in Boston in the very hot, expensive, and limited, waterfront area, leather district, or Back Bay. He/she knows they will only be there for a year, and puts 20% or more down. They are maybe just guest-doctoring somewhere, or teaching, and will not be staying, and want to keep their cash free for another investment or perhaps to make that final real purchase somewhere else. Condos like this don’t have big price fluctuations because they are 1. rare 2. swanky addresses with status 3. incredible quality, location, and amenities. The Doctor can quirrel away a lot by paying interest only. For example, a 1,099,000 condo on Beacon St with 20% and 5% would be a $10,514 per month payment. If he did the interest only, it would be $3886 per month. FYI, both payments assume condo fee of $523 month in the payment. That’s a significant savings per month if they absolutely know they are not staying for long and don’t want to shell out money for nothing. Even if they had to move and didn’t have a buyer right away, the rent for something like this would be $4500 a month, and would cover the nut. But of course, that’s not a long term solution and they should price it correctly to get an offer within 30 days. Anybody else in a regular house is insane or severely brain damaged trying this.

@realestatepup Thanks for the intel. I wonder – do you get many MA potential buyers asking about title issues? Just how well or poorly informed are buyers regarding MERS, fake trusts and broken chain of title?

Brooklyn Law School students issued a white paper on how the errors and omissions in securitization of mortgages opens the door for numerous IRS violations.

Once a failed REMIC – Never a REMIC

http://www.msfraud.org/LAW/lawarticles/Once-a-Failed-REMIC_Never-a-REMIC_1-13.pdf

Hello, great article in general. I was talking to a realtor who is also big with real-estate investors and he told me after talking with a west coast regional bank mucky muck, that hedge funds ( probably reale-state funds) were buying foreclosures from the major lenders,10k to 50k homes at a crack with the promise not to put them on the market for 3-5 years. He indicated that there is not the shadow market everyone thinks there is and why there aren’t as many foreclosures as before. What think you all.

Stephen, I am not surprised. I chatted with a realtor myself recently. She said most of her business lately comes from short sales and is quite proud that she has managed to close every one of them.

Recently my son at 28 with a really good job, income, down payment and credit score went to buy a duplex in the $130,000 range. Half the payment plus would have been made by the rented side, he is single with no children and no debt what so ever.

He got turned down for the loan stating even though he has worked for the same company he has only been on straight commission for a year and they need two even though his income has doubled since he has been on commission. That is when I realized this hype was just that if he cannot get a loan, then I doubt many can. I talked with the mortgage company and they said today you need all four qualifications to get a loan and he was one half shy. During the bubble you only need one half of one. I understand we need to tighten up.

They did say they are making loan modifications for people who are upside down in their house with government help up to $150K so we are helping those who made bad choices while punishing those who are doing the right things.

All you need to know about the current ‘speculator’ wave is John Paulson and Blackrock.

Z, I wonder how many of her closes were fraudulent?

Jim … “those who made bad choices” meme is talking their own book of prevarications. As long as that meme is alive, few will look at the reality of fraudclosure. Playing the moral hazard card assumes:

A. the bank has standing, proper documentation, and

B. everyone foreclosed is a deadbeat.

P.S. finding someone who actually got a modification is like searching for hens teeth.

How many times can a ‘bank’ lose the paperwork they requested?!

Where has our country gone? Crooks everywhere. The people who bought my home several

years ago, now pay over $11,500 a year in school district taxes alone. My P & I and taxes weren’t

that much. You may get away with not making your house payment, but miss a tax payment and

you’ll be on the street very quickly. Teacher pay and school district expenses always go UP. They

teach socialism, and got Obama re-elected… with help from the complicit RHINOS. Part of the

bailout, an average of $200 million per state, went to public teacher retirement plans. Then Obama

steps in and cheats GM bondholders out of 97 cents of every dollar they have invested… but pays

the UAW and the GM retirement plan $1.65 per every dollar they had invested… the UAW investment

was the $400 million they forked over to get and keep Obama in office.

I love the way you write. Not so all these commenting people. First you grab the attention of unsuspecting readers prepared for another course in mandatory financial instruction boredom by laying it on the line and then you hammer down the truth. Good for you, Mr. Jim Quinn. I think you walk alone.

s. peterson says “not so all these commenting people”.

On behalf of all commenting people everywhere, let me be the first to invite you to get fucked.

Snarky asshole.

Administrator:

You must have no more than a high school math background (if that). Median price is not value. It’s simply a statistic. The median price in your town/state/wherever could go up or down, and the value of your home could do exactly the opposite.

You certainly have no understanding of the real estate market or statistics.

You all seem to be infatuated with how “bad” the market is. The *fact* is that the market is either balanced, a buyer’s market or a seller’s market. If you think otherwise, you’re only showing your ignorance.

Keep in mind, many purchasers over the past several are investors paying cash. These are usually seasoned individuals/groups who are snatching up properties because they know they are good values and over time will reap nice ROI.

If you don’t agree, no worries. Simply don’t participate and let the investors reap the benefits.

jon

The NATIONAL median price went up 12.3% you fucking idiot. That means the National median price went up by 1% per month. Math is hard, especially for NAR real estate douchebags like yourself. You’re drivel is pathetic.

You’re a paid shill for the NAR spewing your propaganda just like Lereah and Yun. I’m infatuated by facts, reality and the truth.

Keep in mind that my article details that 43% off ALL home sales in 2012 were distressed sales. THAT is a FACT. In a “normal” healthy non-manipulated market that figure is 5% or less. Do you dispute that?

The Wall Street scum are the “investors” buying with cash. The “cash” is being provided by the 0% interest loans to the Wall Street scum by Bernanke.

You can try to spin your bullshit on this blog, but no one is buying it.

Go fuck yourself and take your NAR propaganda with you.

So we’ve got Jon, the mouthpiece for the NAR, declaring it’s the best time to buy. Let’s assess his thesis.

Existing home sales are pacing at 5 million per year. This is the same pace as the late 90’s and early 2000’s. Here is the current breakdown:

Distressed sales (foreclosures or short sales) – 43% – 2,150,000

Investor purchases (Wall Street) – 28% – 1,400,000

Normal purchases by people who want to live in a home – 29% – 1,450,000

In the normal pre-bubble days prior to the Fed and Wall Street rigging the markets:

Distressed sales (foreclosures or short sales) – 5% – 250,000

Investor purchases (Wall Street) – 10% – 500,000

Normal purchases by people who want to live in a home – 85% – 4,250,000

Jon the shill wants the muppets to believe it’s the best time to buy. Yes, the housing market is back to normal despite the fact that traditional home purchases are 66% below what they were prior to the bubble.

We breathlessly await jon’s response.

“Administrator: You must have no more than a high school math background (if that).” — jon

jon

Admin has an MBA. He’s been in finance all his life. He single handily kept Ikea afloat and shit-free for over a decade. He now does budgeting (I believe) for an Ivy League University. He had more math knowledge in 1st grade than you do now.

A GOOD insult … like a good joke …. is based on some semblance of REALITY. For example, you could have called him a “small dicked maroon” … cuz he’s Irish. That would make sense, see?

Either apologize to him, or get the fuck outta here.

Thanks Stuck

I knew my posse would come to my defense. jon was overwhelming me with his West Philly public school level brilliance.

I’ll use the “small dicked maroon” line in a future battle.

“Keep in mind, many purchasers over the past several are investors paying cash.” —- jon

Big fucking deal.

Go to China, jon. You’ll make a killing. Until you don’t. [/img]

[/img]

[img

Jon should move to that city. He would be the second smartest person there.

Sorry about the math education comment.

Now you’re saying the national median PRICE went up 12.3%. True. In your article you stated that your home value went up 12% – obviously basing that on the NAR report that the median price went up 12%. I read the article again. I could not find that NAR said home values went up 12%. Again, median price is not “value”.

For example, let’s say you’re tracking 1000 stock prices. On January 1, 2012 the median stock price is $50. Then a year later, on January 1, 2013 the median stock price is $56. In that case, the median stock price went up 12%. Would you infer that each stock went up 12% in price? Would you come to the conclusion that the median price rose 1% a month? Hopefully not.

Over the past several years I know that many purchasers were investors purchasing with case. I have no idea where they got their money. There have also been people paying cash for owner occupant properties. Again, I have no idea where they got their money, nor do I care. You apparently have strong feelings about that… I don’t.

Also, no where in my posts have I said it’s “the best time to buy”. One could argue it’s a good time for investors to buy for several reasons – values are low, there are a lot of people looking to rent and many of the distressed homes need work an investor is used to doing. It could work out great.

For an average individual, it may or may not be a “good time to buy”. In fact, you could infer from the NAR release you’re talking about that it’s a bad time to buy. Inventory is down (lack of choices), buyer traffic is up (competition) and many sales are distressed (condition). Whether or not it’s a good time to buy is very subjective and depends on a lot more than just home values.

jon

That is the difference between you and me.

I want to know why something is happening.

You don’t give a fuck.

That’s fine. I’m sure you didn’t give a fuck in 2005 either.

I did.

What bothers people like you is that my articles are fact based assessments of what is really happening and it puts a crimp in the storyline of the NAR and the rest of the shills trying to convince the ignorant masses that we have a normal healthy recovering housing market.

The housing market is being manipulated and controlled by Wall Street and K Street. Their efforts will fail. I’m sure you’ll know exactly when to get out.

With respect to the housing market and NAR’s EHS report:

I stand by my assertion that you are wrong when you say “My home value is rising at a rate of 1% per month according to the National Association of Realtors.” The NAR report doesn’t say that, and to infer that changes in median price equate to changes in home values is wrong.

The NAR report doesn’t state “there are virtually no homes for sale”.

The NAR report doesn’t nor I state “it’s the best time to buy”.

In your article you state “The median sales price of $173,600 is up “dramatically” from last year’s $154,500 level.” – why the emphasis on “dramatically”? That’s not in the NAR report.

You state that mainstream media is touting that the “housing recovery is propelling the economy and creating millions of jobs”. CNN reports 48,000 in February, and 151,000 over the past 5 months.

http://money.cnn.com/2013/03/08/news/economy/construction-jobs/index.html

CNBC reports that residential related job growth *could* start to add 25,000 to 30,000 a month. The report goes on to state that even with the higher rate, it will take many years to reach previous levels.

http://www.cnbc.com/id/100457954/Housing_Recovery_to_Boost_Jobs_Growth_Goldman_Sachs

I’m not saying there are *no* media outlets claiming that the housing industry is creating millions of jobs, but I haven’t heard that, nor can I find it.

Would you please show me where “Larry Yun says [the Phoenix real estate market] is a can’t miss path to riches.”? You say that people who invested in the Phoenix real estate market are “chumps”, but you go on to say that home prices have risen 22.5% in value. Are you saying home prices really *didn’t* rise? I don’t get it. I’ll admit I’m not a savvy investor, but it seems to me that if someone invests in something and the value goes up 22.5% then they have a pretty good ROI.

Exactly what are you saying about the housing market? Is it a bad time to buy because values are at historic low levels? Is it a bad time to buy because there aren’t as many people buying now as there were in 2006? Is it a bad time to buy because any gains in the housing market right now are just manipulations by the government, Wall Street, etc?

Hasn’t the housing market always been manipulated by the government, Wall Street, banks, etc? Has the housing market always been a charade? Will the housing market always be a charade?

I think jon comes here just to get Thumbs Down.

jon

Your comprehension skills are on par with a 2nd grader’s. If I wanted to reprint the NAR propaganda press release, I wouldn’t have written the article. I wrote the article and gave my opinion of the NAR drivel, backed up by facts.

When a press release says inventory is the lowest in 14 years, they are attempting to create fear that you need to buy before it’s too late. I then proceed to demolish their contention that there is so little inventory. Can you get that through your thick skull?

“Raw unsold inventory is at the lowest level since December 1999 when there were 1.71 million homes on the market.”

Next quote from good old Larry:

“We expect a seasonal rise of inventory this spring, but it may be insufficient to avoid more frequent incidences of multiple bidding and faster-than-normal price growth.”

He is trying to scare people into buying before prices rise even more. It’s always the best time to buy. You are either a dullard or a shill if you can’t comprehend my point.

Do you have a clue what the term median means? It means that 50% of all houses sold above that level and 50% of all houses sold below that level. It means that on a national basis the median house sold for 12.3% more than the same house one year ago. And to not think this means that prices have risen on a national basis by that amount is the utmost in stupidity. Not surprising based on your next comments.

I can’t tell whether you really are as dense as you appear or you just refuse to understand the facts laid out before you. The purpose of the article is to provide critical thinking people with the facts about the housing recovery. After seeing the facts about Larry Yun and the NAR, their credibility is zero on anything about the future.

You can’t be serious about the housing market always being manipulated. I suggest you google Robert Shiller and learn something about the housing market. Home prices had risen at about the rate of general inflation for 100 years prior to 2000. We had no massive national bubbles. It has all happened in the last 13 years. It is happening again. It is all in the article as clear as day for those who choose to see the facts. You evidently don’t want to understand or you have an agenda.

The fact that any housing market goes up by more than 20% in one year is PROOF of a manipulated abnormal market. This does not happen when there is a normal interaction by buyers and sellers.

Some idiots will never learn.

First of all, I want to say that this article is of a very high quality and I enjoyed reading it.

And its the same approach in Canada right now. When you check Positive Outlook of Canadian Real Estate Market in 2013, you can see that everything looks great and people can spend on the housing again. And that article is not even overly positive. There are many more from the official agencies like Real Estate Board of Greater Vancouver, which constantly use the same phrases as your guy in US.

You know what. We talk about it here, on other blogs, we try to warn people we know, our family… and they don´t give a DAMN about it.

Actually, you gave your opinion of the NAR press release backed up by hyperbole and/or mis-statements.

I think this is interesting though:

“It [housing bubble] is happening again. It is all in the article as clear as day for those who choose to see the facts.”

Well thank god you figured it out. There’s a big conspiracy to artificially inflate home prices to create another housing bubble, and you figured it out. AND you were able to come to the conclusion from publicly available press releases – genius!

[img [/img]

[/img]

Save yourself, buy stocks!

[img [/img]

[/img]

I’m going to get the popcorn for big smack down on NAR shill Jon coming from Admin. Jon all you did with last post was try and lay a shit screen instead of answering the god damn question. Hyperbole and/or mis-statements is the market you sir have the corner on.

jon is the pathetic result of our government run public education system. It’s sad that there are so many dullards wandering the countryside incapable of thinking critically, understanding math, or compehending facts.

So it goes.

Jon there is a conspiracy to inflate home prices by Central Banks. It’s called low interest Govenment backed loans. What do you suppose would happen to home prices if all these programs were withdrawn. Sure Investors and Banks can load up on real estate for a while and become rich on paper but eventually the abode has to be sold/rented to someone who is prepared to plunk their arse in it. Like Jim said in the pre-bubble market distressed sales made up 5% of sales. Now it’s balloned to 43% but that according to you this is the new normal. What go possibly go wrong. Just as long as another sucker can be found to buy then we can kick the can further down the road ( see guy on bike above). We need cheaper houses not more expensive ones. If not the best my 3 sons can hope for when they are my age is a cheap Chinese made bicycle and latest ICrap phone so they can surf the web at public library..

The home as an investment thesis with another reality check.

Our hot water heater crapped out yesterday.

The first one lasted 11 years.

This one lasted 6 years. I thought technology was improving our products. The BLS adjusts inflation downward for these improvements every month.

I guess my new hot water heater will last three years.

Progress.

A prediction…your new hot water heater will not produce as much hot water in high demand times as did your previous one. We are experiencing this with our new (same size) unit.

Administrator:

Well, I suppose you feel very clever with statements such as “pathetic result of our government run public education system.” You must have been given a private education or were home-schooled. Thank goodness for all your readers, as your astute education gave you the ability to keenly hone in and identify conspiracies by national organizations and the government.

The conspiracy you’ve undoubtedly uncovered here (artificially inflated home prices) is quite interesting. You’re basically claiming that the National Association of Realtors is purposely misleading the general public about the housing market in order to dramatically raise prices. NAR is able to do this by placing all of the telling information at the end of their press releases. Is that your premise?

You claim that in the past NAR willfully stated statistics they knew were wrong in order to protect the then market. However, for some unknown reason, years later they apparently gained a conscience and decided to release the “real” numbers. Knowing their dubious history, you’re still able to read through their thinly veiled attempt to characterize the housing market as “healthy” and “can’t miss paths to riches”. NAR is able to create frenzies with statements such as “there are 1.74 million homes for sale”, “there are 4.2 months of inventory” and “the national median home price rose 12%”, statements that the general public doesn’t really have a gauge for. Oh, but also, national media outlets are making statements supporting the buying frenzy with claims of millions of jobs being created by the housing industry (still waiting on sources of this).

Nonetheless, let’s suppose there is a conspiracy to create another housing crisis. What would be the motivation? So that the “shysters” on WallStreet can “get rich”? Maybe NAR wants to simply devastate the housing market (again), the industry on which it is based…

jon

The NAR came clean about their three years of lies because bloggers and real analysts proved that their numbers were a fraud. You really are a gullible person.

Yes it is a conspiracy between the Wall Street banks who hold hundreds of billion of bad mortgages on their books, the Federal Reserve who also hold hundreds of billions of bad mortgages on their books, the US Treasury, and the shills at the NAR to artificially pump up home prices in an effort to get out from under all of that bad debt.

I’m sure this is too complicated for your pea brain, so don’t bother trying to understand.

@Mary Malone:

Sorry for not getting back to you sooner.

You have raised an excellent question. And the answer is: NO. 90% of buyers (not cash investors) are just regular joes and janes, and have not one clue as to how title actually works. Amazingly enough, I have encountered a lot of people who don’t even understand how a mortgage works, what equity is, who actually has the rights to it, etc.

Why? Why would someone be so uninformed about the potentially biggest investment they will ever make? Simple. Lazy. And when people are lazy, it means they leave everything up to someone else. In other words, if the majority of people actually went out, did the research on ALL THE SIDES OF AN ISSUE and then used common sense (not emotion) to come to a rational decision based on a compilation of facts, then we would actually not be in any of the huge messes we are in, be it housing, taxes, the dollar decline, poor health, education, crime and….well, actually, everything.

Sadly, we are in this boat because lazy people (hereinafter referred to as LPs) do not want to be actually responsible for their own lives, money, health care, education, and lifestyle. Because when you learn something, and know the facts, you must make a decision. And making a decision is very, very scary. It is far easier to take your Prozac, eat your McD’s, and play XBox than actually run your own life.

This may seem WAAAAY off topic, but it is not. Giving up control and decision-making to others has allowed them (read “them” to be anyone from the FDA to BofA) to take full advantage of these dupes. And dupes they are, make no bones about it. As I had mentioned in my very first post, common sense would have shown someone that a three-unit property selling for $300K in 2007 with rents for each unit being only 900 a piece was not at good idea when the interest rate was a blended 8% with no money down or the satanic interest only product, otherwise dressed up as “pick a payment” like you were going to the apple orchard to “pick your own”.

“We the People” can point fingers at anyone we so choose, but the bottom line is “WE” are the ones responsible. Sadly, most people are so willing to trade “stuff” (food stamps, housing, cell phones) so that they don’t have to be responsible for themselves.

I hear everyday people who are actually blaming Bank X or Lender Y for “screwing them”. For example: Mrs and Mr X bought a house over 15 years ago for 85K. It was a triple decker in fairly crappy conditon, but it was bought with the intention of renovation and renting while they lived in their father’s apartment building (for free). They then moved into the ground floor, rented the other 2 units and did some very minor restoration work on the interior only. Over 15 years time they managed to refinance that same property up to 180K!!!!!!!!!!! They rented to garbage tenants who were the only people willing to rent their slums, but of course did not pay. 2011: Mr and Mrs X call me, because they have not made a morgage payment in 12 months and they need to sell. Mrs X, with very little grasp on reality, is shocked, stunned, and amazed when I tell her that her piece of excrement building with a 20 year old roof, asbestos siding, original single-hung windows, no central heat (gas stoves), lead paint, and ancient wiring is now only worth 65K. She cannot believe this, as she HAS TO GET AT LEAST 250k SO THEY CAN MOVE TO FLORIDA AND BUY ANOTHER HOUSE. I repress a laugh and tell her that will never happen. Oh, and they have never paid a water bill so there is a 6000 water lien on the house too. But, hey, even crappy clients get my best representation, so I put on my real estate hat and get to work. Months later, BofA accepts a cash offer of 65K for their short sale, agrees to pay the water lien too, AND GIVES THESE TWO $3000 “MOVING EXPENSE” MONEY even though they don’t even live there anymore. This was more than I made on commission. I know, I know, you are thinking, “there is no way everyone is like that?!”. And you would be right. Many people are not, but sadly, many, many people are.

Folks, when has common sense become a disease?

Once again, if anyone is moving to or from the great State of MA, please, please, CAREFULLY INTERVIEW your real estate agent prior to getting in the car and going on the Bataan Death march to look at homes. Or sell your home. Please. I am begging you.

Administrator:

Gosh, you’re so smart. I’m surprised you don’t have a national talk show.

jon

Thanks. The national talk show is in the works. I will interview clueless dimwits like yourself. It should be a smashing success.

@realestatepups: “Why? Why would someone be so uninformed about the potentially biggest investment they will ever make? Simple. Lazy”

The mortgage process is one of the most onerous things I’ve ever been put through. The system is fucktarded, with a million miles of non-essential rules, regulations, questions and checkpoints.

The sheer amount of middle-men required to get a home loan is staggering.

People are uninformed because those in the know have created a colossal system bent on hiding exactly what is going on.

I’m not kidding when I tell people my next home purchase will be with cash, this country has too many fucking middle-men, and I plan on cutting them out of my life as much as possible.

@TPC:

Yes and no. IF you go to a “mortgage broker” which many, many people do, (not doing the research again!) then there will be a lot of “middle men” who take more slices of the pie and drive up your closing costs.

IF you go to your local bank (NOT a big-name bank) like a credit union, savings bank, or co-op, you will get your loan based on the desicsions of men and women, not machines and the great underwriter in the sky. You will then be able to walk into said bank and *GASP* pay your mortgage at a counter, to a person, who will give you a receipt.

Yes, you will probably have to put down at least 5%. Yes, you will probably have a more rigorous application process. But isn’t that a good thing?

There is a local bank in my neck of the woods, has I think, 7 branches total. Quite a few of my “repeat performers” (investment property owners) use them.

Why?…..well…..they KNOW THE GUY!!! They can call this said person when they have a question. They generally have more competitive commercial products as well, and generally will make a lending decision based on the person’s performance with current loans and their relationship with the bank.

That’s how home buying should be anyway. When you get the government involved, who wants to give mortgages to everyone with a pulse, the amount of paperwork goes up precipitously. Why?….welll….they need to cover their ass when said idiot defaults on said loan. The paperwork makes it look like “we did everything possible to vet this person and make sure they would pay. it’s not our fault they didn’t”. And then we, the taxpayers, are on the hook for this person’s loan gaurantee.

I am not saying FHA is inherently evil. It is not. The problem is it is made to encompass too many people, to allow the fringe buyers the same rates and benefits as someone more responsible.

I agree, however, that if you can pay cash, DO IT.