This was another tumultuous week to nowhere in the stock market. In fact, two days of robo trader enthusiasm based on headlines that Greece and China are fixed got us all the way back, well, to exactly where the market was last December 7th.

That was seven months ago, and come to think of it that was also Pearl Harbor Day. Perhaps the metaphor is a tad more than apt.

After all, FDR and his advisors claimed they didn’t see the great Japanese fleet’s 12-day steam to Hawaii. According to the textbooks it was a dastardly “sneak attack” without warning.

Not exactly. While the Japanese fleet was enroute, the Roosevelt Administration tightened its embargo on Japan and cut off oil supplies for even civilian use. The Japanese archives make clear that this was the final straw. The attack was executed because war hawks in the Japanese government were finally able to prove that negotiations aimed a lifting a two-year US embargo on oil, scrap steel and other crucial industrial commodities were futile.

So FDR wasn’t surprised by the Pearl Harbor attack. He knowingly brought it on.

When the above chart finally cliff-dives off the bottom of the page, Wall Street and officialdom will claim it was another “sneak attack”——a financial Pearl Harbor akin to the mysterious “contagion” which struck the markets on September 15,2008. But that was a lie and so is their current spurious denial with respect to the thundering break ahead.

In fact, this week delivered all the evidence you could need that the third bubble of this century is steaming toward its own day of infamy. Underneath the headlines it became ever more obvious that Eurozone is going down for the count; China’s house of cards is now in its terminal phase; and the US is drifting toward a recessionary contraction that will shatter confidence in the money printers at the Fed.

On the Greek front, Tsipras has utterly capitulated and completely squandered whatever mandate he received last Sunday. Whether Frau Merkel accepts his white flag or not over the weekend doesn’t really matter. This week’s events prove beyond a shadow of doubt—if any further proof was needed—–that the Eurozone is a doomsday machine that will end sooner or latter in a massive financial conflagration.

The “new” Greek plan submitted late Thursday evening (which is really the Troika’s plan all along) cannot possibly be successful, meaning that the Greek debt crisis will become a recurring, serial condition; and one which sooner or later will shatter the tenuous, unanimous-consent federation on which the Eurozone decision-making is based.

So if the third Greek bailout doesn’t bust the Eurozone—-then it will be accomplished by the next bailout of Portugal or Spain’s virtually certain demands for a better deal or Italy’s paralytic drift toward the fiscal wall.

But take the case at hand. Alexis Tsipras is semi-brave politically, but he is utterly naïve and stupid economically. He has now solemnly promised years of fiscal frugality that no Greek government can possibly deliver after the 61% referendum vote against austerity and the integral rejection of heavy-handed, continuous fiscal governance from Brussels and Berlin.

Setting aside all the tax, pension and other budget details, the opening paragraphs of the Greek proposal commits it to a primary budget surplus of 1% of GDP in 2015, followed by 2%, 3% and 3.5% during 2016-2018. That’s flat out ridiculous because this year’s commitment is already impossible; the next three years are far-fetched; and even if achieved would do exactly nothing to reduce Greece’s crushing 180% of GDP public debt.

Consider these facts. During the January-May year-to-date period, Greece has collected 18.6 billion euro and spent 20.0 billion euro. That’s a fair amount of new deficit for a 175 billion euro economy with a public debt of 320 billion euro, but it’s not the half of it. Like any other bankrupt enterprise, Greece is desperately fighting off the flood of red ink by shoving its bills in the drawer!

Indeed, the arrearages to vendors, pension funds, employees, municipalities, hospitals and many more agencies that are embedded in the 20 billion euro of recorded cash outgo are huge. Even if Greece were actually hitting its highly optimistic budget spending targets for 2015, year-to-date spending would be 2.6 billion euro higher—-meaning that its true deficit on an accrual basis for the first five months was in the order of 4 billion euro or 5.5% of GDP.

Even if Merkel gives a hearty “jawohl!” to the Greek plan on Sunday, it will take months to work out the details and even longer to reverse the current plunge of economic activity owing to the banking freeze. So revenues which are already significantly behind budget plan year-to-date will come in drastically short on a full year basis. Thus, when vendors and others are finally paid and revenues are collected for the full year there is little chance that Greece can record a fiscal deficit of less than 6-8% of GDP—without resort to accounting tricks and deferrals which only postpone the day of reckoning.

But here’s the skunk in the woodpile. Due to the drastically concessional terms of the 250 billion of Greek loans now accounted for by bilateral Eurozone country loans, EFSF advances, the IMF loans and the SMP and ANFA bonds held by the ECB, Greece’s weighted average interest bill has already been cut to the bone. Specifically, in 2011 its weighted average interest rate on the public debt was about 6% compared to only 2.2% today.

Accordingly, Greece’s interest bill is currently about 7 billion euro annually or 4.0% of GDP. The math of the thing, therefore, is that its primary deficit during 2015 on an honest accounting basis will be in the order of 2-3% of GDP, not the 1% of GDP surplus the Syriza government has foolishly promised.

Needless to say, the German bean counters will figure out something like this within hours, but even if Merkel decides to blink, the can will not get kicked very far down the road. The reason is that even if Greece implausibly manages to hit its new out-year fiscal targets to the cent, it would still have 30 billion euro of additional debt by the end of 2018. In short, it is already swamped in unpayable debt, but anything like its own rescue proposal will bury it once and for all.

Just assume that it grows its nominal GDP at an average 3% rate through 2018 (including a later catch-up from the certainty of a negative result in 2015) and that it hits it primary surplus targets. If this minor miracle happened, it would still add 10 billion euro to its debt after paying even today’s concessional interest obligations.

Next assume that to “save” the Euro yet another time, Greece’s paymasters grant it something in the order of its 50 billion euro request for three-year financing support. About 30 billion euro of that will be recycled to pay-off maturing debts through 2018, while the balance would presumably be incremental debt incurred to fund “investment projects”. Its hard to say who would more effectively waste these new public funds in the years ahead——a fractured, quarreling Greek government or its overseer apparatchiks from Brussels and Berlin.

But the math is pretty straight forward. The plan tabled by Greece last night does not contain one word with respect to cancelling even one euro of the Greek debt. And, besides, Merkel and Schauble have made clear that any “classic haircut” (i.e. honest debt relief) is a violation of the EU treaty ban on bailouts!

So the best that could be expected is that Greece’s staggering debt might be slightly “reprofiled”. That is to say, pushed out to the decade of the 2030s and beyond.

In short, by the end of 2018 under its own proposal Greece would still be lugging its 320 billion euro of existing debt plus 30 billion more. And even if the engines of growth manage to restart at the 3% annual rate indicated above, it would have 200 billion of GDP against 350 billion of public debt.

Yes, that does compute to a debt ratio of 175%. And, no, today’s “Greece is fixed” rally in the Wall Street casino was not price discovery at work. It was “hopium” enjoying one more run at the tables.

Needless to say, if this plan makes it through the weekend it will blow-up Greek politics, the Greek economy and the paymasters’ governance process before the ink is dry. Indeed, Tsipras’ white flag plan is proof positive that the Eurozone is ungovernable, and that the casinos of the world remain squarely in the line of fire for the ultimate accident—the demise of the euro.

Likewise, the time frame for a “Chicident” got a huge boost this week as well. The arrogant authoritarians who claim to run red capitalism from Beijing self-evidently made a huge mistake in trying to manage the country’s staggering $28 trillion of public and private debt by igniting a stock market mania during the last 12 months. The fact that a $3.5 trillion margin-financed stock market bubble—- equal to 35% of China’s tottering hothouse GDP—–was created in just 60 trading days, as I demonstrated yesterday, and was then ionized in 20 trading days, is proof positive that China’s hard landing is near.

And that became more than evident in the last two days’ of “dead cat” bounce when the comrades rolled out the paddy wagons to arrest anyone caught selling a stock, and cranked-up the investor mandates and PBOC printing presses to generate an utterly phony and unsustainable wavelet of buying. So what is happening is that the mind-boggling explosion of credit, construction and craps-shooting which underpins the Chinese economy is fixing to blow.

When it does, the deflationary gales which are already roiling the world economy will dramatically intensify. Crude oil will drop through the $40s/barrel range, iron ore through the $30s/ton and there will be equivalent drops in the rest of the commodities and manufactured goods complex. In that context, the world’s $200 trillion of debt will become that much more onerous, and the central banks pinned on the zero-bound and possessed of zero credibility will be able to do nothing about it.

And hopefully the “de-coupling” minstrels of Wall Street will give up the gig before they are revealed as complete charlatans. Indeed, the “incoming data” for May released this week was just one more rebuke to that notion, and to the spurious claim that “escape velocity” is just around the corner.

Specifically, both export and imports for May were down 7% on a year-on-year basis. The latter means that businesses believe final demand in the domestic economy is cooling rapidly and the latter means that the temporary boost to GDP given by exports is now over and done. In fact, as shown below, the export trend has been heading south since last July when the dollar first began it’s lift-off——-a trend which will only intensify as the troubles in Europe and Asia make the greenback an even less dirty shirt in the global currency laundry.

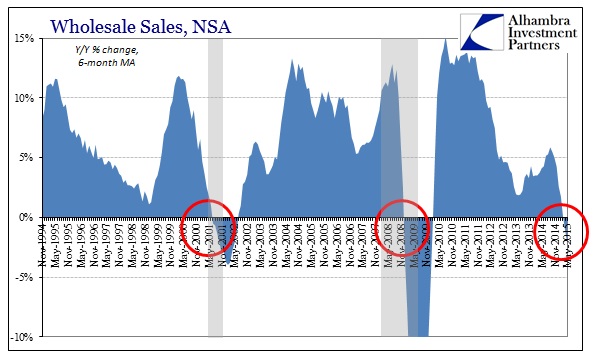

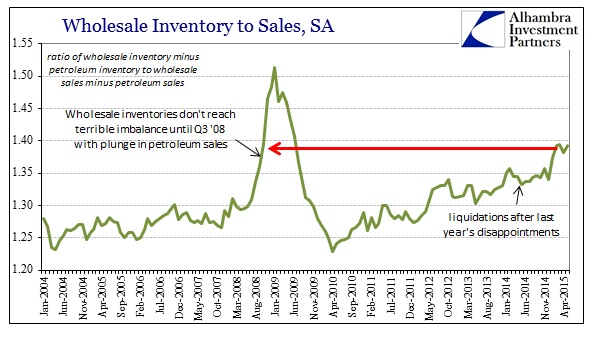

But the real bad news this week is that wholesale sales continued to plummet and are now also down 7% on a year-on-year basis, while inventories continued to build. As Jeff Snider was quick to point out today, wholesale inventories are usually the leading edge of the business economy, but the ratio is now approach levels last seen in the 2001 and 2008-2009 recessions.

Meanwhile, the casino ignored all of this, and rallied back to square one. Yes, the boys and girls are having a romp, but the day of reckoning draws ever closer.

When this fucker blows, it will take pensions, cities, states, governments & the whole concept of central banking will be discredited.

What is sad is 99.9% of people don’t know anything is wrong. They will be completely blindsided. My former students have watched the trainwreck, but most grownups fight reality.

Economan,

I’m betting it will result in a call for a bigger, stronger, and more powerful central bank by those on high.

A dazed, confused and normless population will not only accept it but join in the call for it without realizing it means their inescapable enslavement as a result.

I’ve given up on trying to predict much of anything, given how all this has dragged on longer than I could have imagined possible, But as to “inescapable· enslavement, well, I have come to believe that escape velocity became unreachable quite some time ago. The only way out of enslavement is death.