Guest Post by Martin Armstrong

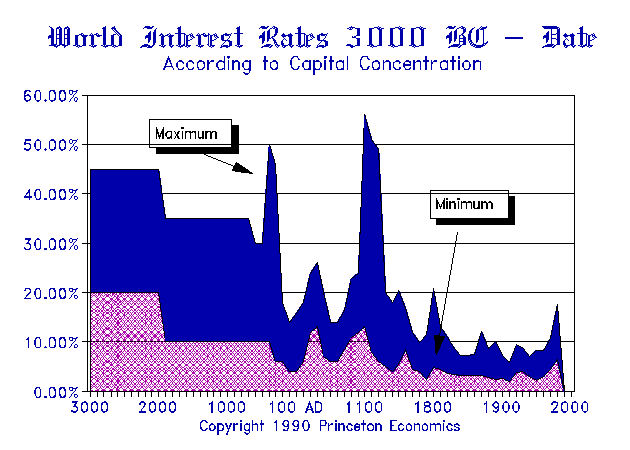

The problem in so many areas is that we can focus on one issue, but the answer is a complexity of variables. The history of interest rates has been provided on this site. Interest rates in a developed economy reflect the “option” value on the expected decline in purchasing power of money. If I expect it to decline by 5%, then I expect a profit and say want 8%. You in turn will pay the 8% only if you think you also can make a profit above 8% perhaps 10%+.

In an UNDEVELOPED economy, we transpose the depreciation risk of money with risk in general. Lacking any developed economy, one will lend only based upon the risk of getting repaid. Therefore, without a legal system, the risk is either the person or the political climate. When we look at the history of interest rates, I demonstrated that the rate of interest even within the Roman Empire increased the further you moved away from Rome. Hence, the lowest interest rates are in the dollar and they rise in other countries based upon perceived political risk. Greece’s interest rates are significantly higher than those in Germany. This is a reflection of political risk, not simple the future inflation rate in the Euro.

The Fed did not increase the money supply with QE easing and we have see that 9 months of QE in Europe has also failed to create inflation. What happened to the whole theory of the quantity of money impacting inflation? The problem lies in the definition. When US government debt was illegal to borrow against using it as collateral, then issuing debt DID NOT increase the money supply. When that was changed and you can post TBills as collateral to trade, then there is no longer a difference between debt and money.

The US government did not issue paper money after the Revolution until the Civil War. To encourage people to accept it (CONFIDENCE), it paid interest. In reality, this was a form of circulating bond. The term “greenback” referred to the issues that did not pay interest and were not purportedly backed by silver or gold. You turned it over and it was just green ink with no promises.

So the Fed buying in bonds did not increase the money supply and it failed to create inflation as expected BECAUSE it merely swapped bonds (money paying interest) with non-interest paying money (electronic entries). The bankers then complained so the Fed created the Excess Reserve Facility, where banks have nearly $3 trillion in cash. The SF Fed argues Milton Friedman said they should pay interest on reserves. That was only on the required reserves. The creation of the Excess Reserves totally negated the entire idea of stimulating the economy for the banks never lent the money out. It became a giant swap of bonds for cash deposits at the Fed which it then had to pay 0.25% interest.

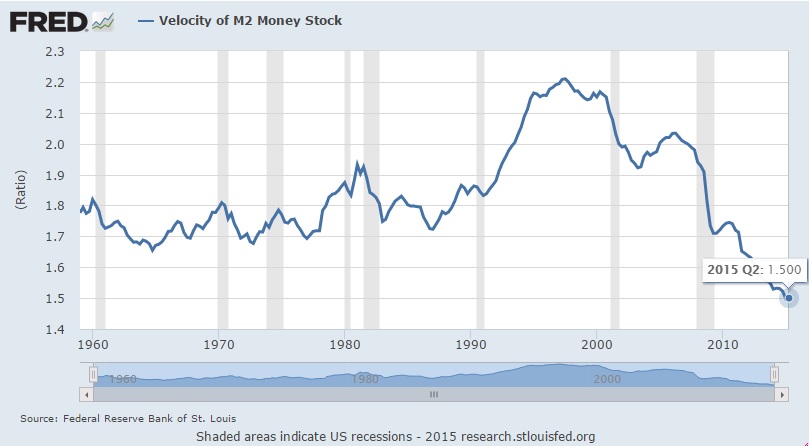

So now turning to the VELOCITY of money, a decline here demonstrates that people are HOARDING cash (rising in purchasing power as assets decline), as well as banks (Excess Reserves). We have companies buying back their own stock further shrinking the supply of equities also fueling the deflationary spiral. The Excess Reserves at the Fed show just how much banks are hoarding cash.

Therefore, we can see the deflationary trend and the contraction right here. The US share market has been at the high-end of trading, but it did not breakout beyond our second target which was the 18500 on the Dow. The market indeed doubled as we warned coming out of the hold in the 6,000 level passing 12,000, which is the MINIMUM requirement to start a Phase Transition. We nearly tripled by the 2015.75 target beating our minimum doubling requirement, but this was still not a Phase Transition. Why? Retail participation has been at record lows in stocks. This is a bubble in government debt and why we are at 5000 year lows in interest rates.

Now top the conspiracy. “The only thing what leaves me with amazement is what do they really intend? I don’t believe that the families who run the banking system, operating for centuries in money business, do not understand that. I can only assume that for being protected by government the banking cartel buys the governments time and keep financing the deficits.”

Banking establishments are some of the WORSE investors throughout history. They always go bust and it is government that devours them every single time. Yes, the government has been protecting the bankers for they have also been fueling the debt assisting governments to borrow. Therein lies their own demise. EVERY major banking house have been destroyed by this very same flirtation with power. They are like moths attracted to the flame of a candle, hoping to dance by the light never realizing their wings may get burned.

Banking establishments are some of the WORSE investors throughout history. They always go bust and it is government that devours them every single time. Yes, the government has been protecting the bankers for they have also been fueling the debt assisting governments to borrow. Therein lies their own demise. EVERY major banking house have been destroyed by this very same flirtation with power. They are like moths attracted to the flame of a candle, hoping to dance by the light never realizing their wings may get burned.

The cycle has change. The wheel of fortune has completed its revolution. Governments are turning against the banks and looking to electronic currency. The days of rumored banking conspiracies is coming to an end as it always has. The banks will be a giant short. When the Sovereign Debt defaults become a contagion, the banks will not be supported by government.

We have used the corrupt , criminal banking power to seize control of the economy , government , education , entertainment ,news even fashion and use all there means to destroy the structure of society , destroy religion , promote atheism , infidelity , abortion , pedophilia , bestiality , racial division , sexual perversion , drug abuse and glorified criminality in movies and tv.Jonathan Ross.

Jonathan Ross speaking on the complete evils of the central banking criminal enterprise and how it’s used to gain control of the major institutions of a society.

I smell a rat. The Joos don’t allow money or gold to sit anywhere without concocting some scheme to steal it. Show me the 3 trillion dollars just sitting unencumbered in US Federal Reserve Central (Rothschild) Banks and maybe we will get the bottom of the 8000 tons of US gold too. Is the economy so bad they can’t even loan it out at 0.01% anymore?