Guest Post by Martin Armstrong

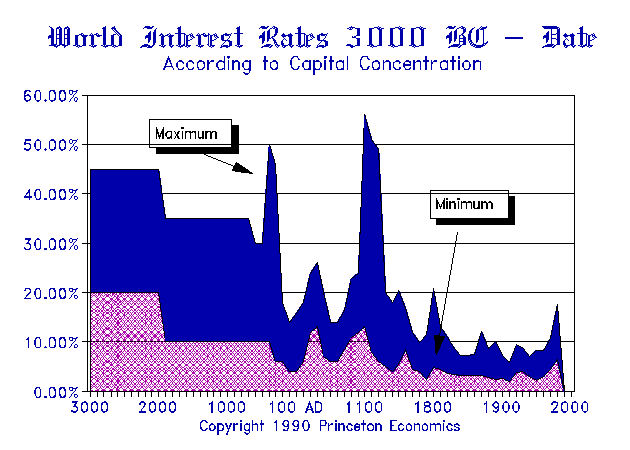

The problem in so many areas is that we can focus on one issue, but the answer is a complexity of variables. The history of interest rates has been provided on this site. Interest rates in a developed economy reflect the “option” value on the expected decline in purchasing power of money. If I expect it to decline by 5%, then I expect a profit and say want 8%. You in turn will pay the 8% only if you think you also can make a profit above 8% perhaps 10%+.

In an UNDEVELOPED economy, we transpose the depreciation risk of money with risk in general. Lacking any developed economy, one will lend only based upon the risk of getting repaid. Therefore, without a legal system, the risk is either the person or the political climate. When we look at the history of interest rates, I demonstrated that the rate of interest even within the Roman Empire increased the further you moved away from Rome. Hence, the lowest interest rates are in the dollar and they rise in other countries based upon perceived political risk. Greece’s interest rates are significantly higher than those in Germany. This is a reflection of political risk, not simple the future inflation rate in the Euro.