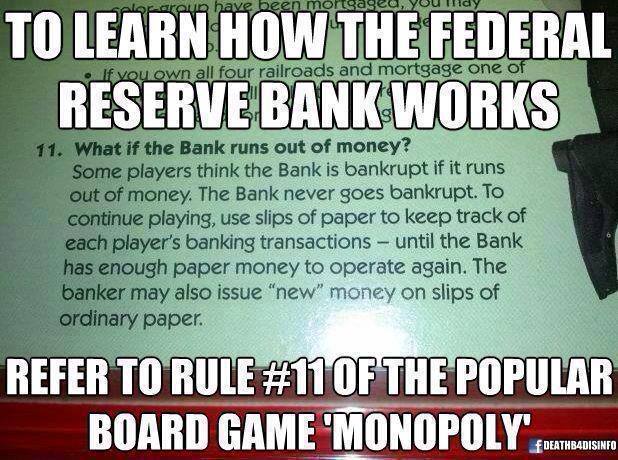

More of an open discussion than a question today. I went to the bank on Friday to help the kid open a money market account so she could take advantage of the .0015 interest rate. The lady at the bank tells me it is now Federal law that you are limited to exactly 6 transactions per month with that account. Now, according to the article below, it’s six withdrawals, not transactions, but still, WTF? Oh, the reason was priceless, the Fed’s don’t want you using a savings account as a checking account. Wait, what??? Please note, this is the federal reserve making law, again, WHAT???. Also, this happened in 2009. What’s next, telling me how many peanuts I can have in a sitting or how big a shit I can take, or how many in a day?

https://www.depositaccounts.com/blog/federal-reserve-changes-reg-d-to-allow.html

…..money market account. Why?

I called our bank a couple of months ago after looking at the statement and seeing the 0.0015 interest rate. WTF says I, there must be some mistake. Was kindly told that there was not a mistake that was in fact the current rate. Banks eat shit.

Gotta teach you kid that walking into a bank is like walking into a room full of pickpockets. They right the rules, they decide the fees, they are judge, jury, and executioner. The less you deal with them, the better.

In the late 80’s – I had over $1 million in a Prudential Brokerage account. When you have that much money they kiss your ass. Fast forward Prudential folds to Wachovia, Wachovia folds to Wells Fargo – service goes to shit.

He’d be better to buy gold and silver to keep at home safe. I know a person who has a saving account with a debit card. He has to do a minimum of 10 debit card transactions per month to get interest applied to the account for that month. You do less than 10, no interest.

Not to worry….. pretty soon they will be charging you a fee to store YOUR money there.

Makes sense right? You pay them for the privilege of storing YOUR money at their address.

Quid Pro Quo……

Tommy, she needs a place to put money that she can’t spend it. You can’t make interest anyway, so even at 1%, what’s the difference, 2 tanks of gas a year?

Zelmer, they have that too, 12 transactions, actually, it is linked to the mm so she will get 1.75%.

The point of this questino is the fed overreach, not the low interest rate.

I happened across Jim Rickards new book in .pdf format. Get it before someone shuts it down. It is an interesting read.

http://www.zempreneur.com/uploads/5/7/6/1/57616765/rickards_bigdrop.pdf

Remind me again why we need banks (scratching head), they are not on our side and never have been. Didn’t the Fed’s charter run out in 2013……..Oh that’s right, they don’t need no stinking charter.

Your kid would be better off investing a 25% each in gold, silver, cash under the mattress and buying/selling shit on Craigslist (or similar) for a profit.

Think about it, could you spend $25 on one or more items (new or used) and turn around and sell those same items for $50 in 30 days time? If the answer is yes then the path ahead should be clear.

Transaction limits on Money Market accounts have been in place for at least the last three decades in my personal experience. A bank is a private business. Don’t like the rules? Don’t do business with them! Hope she doesn’t get “bailed in”.

The “Need” To Raise Interest Rates

Posted November 9th, 2015 at 10:00 AM (CST) by Bill Holter

http://www.jsmineset.com/2015/11/09/the-need-to-raise-interest-rates/

This past Friday the BLS released another “whopper” set of employment numbers. The economy supposedly created 271,000 new jobs. I was fortunate to be able to speak with John Williams (I encourage you to subscribe to his service at http://www.shadowstats.com) and asked him two questions. First, with the current backdrop of an extremely weak global economy, how was this whopping big number generated? Mr. Williams believes the “seasonal adjustment” has been an extreme outlier this month and last, a seasonal adjustment of near 70,000 jobs were added. This would have left the jobs number at close to 200,000 jobs. I also asked what the “birth death” model added and he responded 165,000 jobs. If you do the math, between the unusual seasonal adjustment plus the birth-death model addition, 235,000 of the 271,000 in job gains are “fictional”!

Switching gears but still looking at macro economics, the Baltic Dry Index just hit the lowest level ever for http://www.zerohedge.com/news/2015-11-06/its-official-baltic-dry-index-has-crashed-its-lowest-november-level-history the month of November. (While editing, this story http://www.zerohedge.com/news/2015-11-08/ceo-worlds-largest-shipping-company-global-growth-worse-official-reports came out). It confirms what we knew and tells us global trade is quite weak and shrinking. This is important because it flies in the face of the Fed looking at “BOGUS” employment numbers and deciding to raise rates next month. I do want to remind you, two weeks ago on Monday and Tuesday we heard two separate trial balloons for negative interest rates …and then BAM! …Janet Yellen and company strongly hint they will raise rates! So which is it? Will they raise rates, lower them or do nothing?

My opinion is this, the Fed will either leave rates the same or even be forced to lower them into the depths of negative territory. No matter how many “fabricated” reports come out, it will not in any way change the reality that Main St. economy is weak. False reporting to try and fool the masses is one thing …but the truth is the truth no matter how many times or to what extent you tell the lie. I believe the Fed would truly like to raise rates but they are petrified what they might unleash with a rate hike. Interest rates have been zeroed out since 2009 and now the talk of negative rates. The Fed has lost all credibility, “talking” about raising interest rates is as close to the real thing as I believe they will get. The Fed “needs” to raise interest rates to have any credibility at all. Problematically, if the Fed actually does do anything at all, raise OR lower rates, they will probably spark a panic.

Going further into opinion and theory, I believe what we may be seeing now with such fabricated economic numbers accompanied by the Fed talking hawkish is the “set up” for an excuse. Geopolitical events between the U.S. and Russia/China have been heating up rapidly. Are we seeing a lead up to something very bad financially or geopolitically? Are we being fed prior “cover” to create the ability to say “our policies were clearly working, the Fed was even going to raise interest rates but (this or that came up) and disturbed the recovery”?

The weak U.S. and global economy is fact, the ability to raise interest rates I believe is fiction. Interestingly, we are heading into December which each year is THE largest delivery month for COMEX gold. We are entering this timeframe with a registered gold inventory lower than any time in memory. Less than $200 million can now clean out ALL registered gold stocks on COMEX. This, at a time the U.S. has pushed both Russia and China very hard. As I have maintained for months now, do not be surprised if a “truth bomb” is dropped on the American population. This may be the only way a war can be avoided, show the American people the truth and take any public support for aggression away. Reveal the truth and our markets will be crippled. Cripple our markets and the ability to make war will largely be neutered. I believe we are very close to a point in time where the bleak reality can no longer be hidden and the attempts to hide it will become desperate. Truth will reveal an entirely different world than what many believe we are in!

Standing watch,

Bill Holter