Guest Post by Dr. Housing Bubble

Americans are realizing something is wrong with the system. You can see it this year with the rise of outsiders in both political parties. People realize the system is rigged. Instead of some folks that kowtow and simply move forward like subservient lemmings, millions are mobilizing and taking action. Many are voting with their wallets. The number of renter households has increased by 10 million over the last decade while net homeowners has been stagnant. The bailouts were supposed to help American families but what happened is that many were kicked out of their homes (for missing payments) and then giving them to banks that also missed much larger payments (too big to fail). People got a quick education on how things work. This is why the homeownership rate fell dramatically yet somehow, homes sold to investors and now rents are at all-time highs while incomes are stuck in neutral. This is a major problem and people are taking notice.

A crisis in American housing

Zillow has some really good research on the topic. You would think that rising home prices and rising rents would be a sign of more families buying. Yet it is more of a sign of continued manipulation in the market. It is also a sign of outside money, either from big investors, Wall Street, or foreign money pushing up values and crowding out regular families from buying. The Fed has set the stage. By creating a low interest rate environment, big pools of money are hungry for yield in nearly any sector.

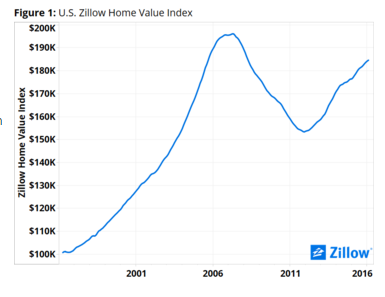

First take a look at home prices:

Source: Zillow

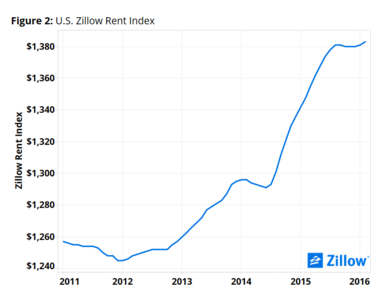

The trend is clear and at least in the short-term, prices seem to nearing a plateau. It is certainly being reflected in rents:

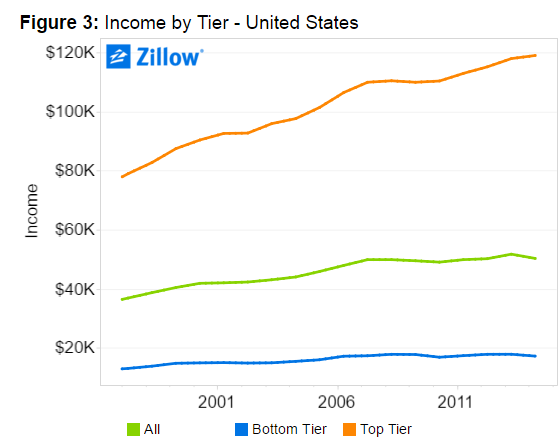

But for most people, incomes are not rising at this pace:

Incomes absolutely matter for the economy. It is naïve to say otherwise. In fact, this is a big reason why so many people are voting for outside candidates. Many people simply feel the American dream slipping away.

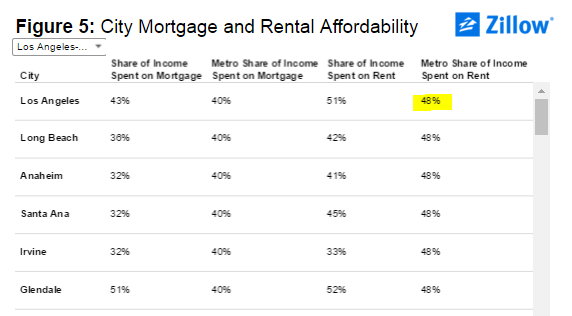

Even in high priced areas like California, most people are living on the financial edge even if their incomes are higher. Just take a look at what renters and homeowners spend as a percentage of their income on housing per month:

Home buyers of crap shacks are spending 43% of their income on the mortgage while renters spend a jaw dropping 51% of their income on rents. This is why L.A. is the most unaffordable rental market in the country.

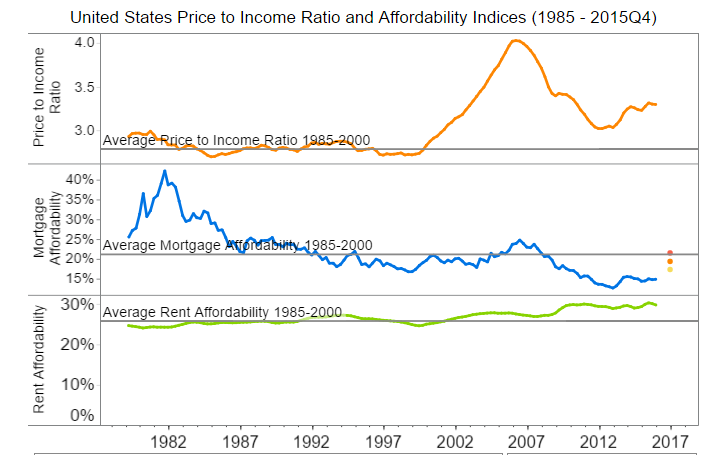

And Zillow also looked at the price to income ratio:

Notice how things got all out of whack starting in the 2000s? This is when housing turned into a speculative asset class right along with hot tech stocks. At this point, we’ve hit a wall and that is why the homeownership rate has hit a generational low. It is also looking like rents are hitting an interim high. There is only so much you can squeeze out of the market when incomes are stuck. And since we have millions of new properties converted to rentals, what happens when the economy hits that first hiccup since early 2009? If your income dries up, no rental money is going to come in. And we now have 10 million more rental households than we did a decade ago.

The manipulation in the market is a problem because builders are reluctant to build even though price signals and demand would suggest otherwise. They look at demographics and income figures and realize people simply can’t afford homes at these prices. There is still a housing crisis in America. All it means is that more income is being sucked into a largely unproductive sector of our economy.

I know many people who have “doubled and tripled up” in order to afford housing. It’s not unusual to see a ton of cars parked on the street in otherwise residential areas, a sign 3 or 4 families are “sharing” a 1,500 ft house. And in some neighborhoods that’s every house on the block.

Westcoaster, we are seeing some of this in Houston, especially among Asians and Mexicans.

Wha? Everyone knows the housing crises is over! After all, the MSM never mentions it anymore so there must not be any problems there.

Just because in every issue of my local rag there are, in the classifieds, 4-5 full pages of foreclosures (almost as much as way back in ugly ’08) must mean nothing important to see here!

Just because I spent $110 on $50 worth of groceries this morning obviously means everything is going just great. Just because toilet paper manufacturers now have three sizes of paper roll (standard, giant and super sized) which translates to standard = 100 sheets, giant is the same as the old standard, super sized is the same as the old giant) and the prices have stayed the absolute same surely tells you that there is no inflation..

Remember inflation is illustrated by the same amount of goods being priced more OR a lesser amount of goods being priced the same as the older, larger amount. Remember it makes no difference as both reflect inflation. A four pound bag of flour costing what a five pound of flour used to be. Same for sugar.

But the fucking Government does not compare what you receive versus the money you pay. If flour stays at $X.xx a pound even if you get less, the cost of flour did not change.

Since there are no economic problems in this country, why do I get a red ass everytime I go to the grocery store (or pay my utilities, or my insurance (up7% this year)).

MA

I can illustrate the Dr.’s point with our own family.

2 boomer parents (us) – we rent.

4 GenX/millennial kids – they all rent

6 people from three generations and not a homeowner among us.

Mortgages are toxic. Nobody wants one. Renting is cheaper than owning.

Home owners insurance was always inexpensive for me.

(and never tied to a mortgage) Auto insurance was about

the same (6 mos.) amount or more. So I sell, and buy a house

for cash. In 2012 home was costing <$400. This May the cost

is $1200+ minus discounts (have the 2 cars w/ them) = $925. even.

I am guessing people are skipping homeowners insurance if they

can. The good news is that my prop. taxes are 15% of what they were!!

We built our first home in 1980. Savings from working overseas and cash flow from savings built it and it took a full year to do it. Mortgage? $0.00.

Started out to be a small self-contained cabin in the woods of N. Idaho so I could go back to school and get my first degree (age 43). The “cabin” started out to be 800 sq. ft.. Ended up a 2400 Sq. Ft. two story passive solar home with a 36 foot double glazed greenhouse with rock bed heat storage under it along the South side of the house. I plumbed the air-tight wood stove so hot water from the stove circulated through the rock bed to retain and store the heat. My wife and I did everything on that one including digging the 5 foot deep footing for the concrete sonotubes. Most expensive single item? A 300 foot well into the aquifer that ran right under the property. 180′ of water in the pipe. Eternal water supply.

Post Degree, we moved to Maui, and we built our second home in 1986, hired hammer swingers by the hour when I had beams I couldn’t lift, rig or jack into position. Post and beam, 4,000 sq. foot under the roof (including 1,500 sq. ft. of deck on three sides up at 2500 feet in Kula on Maui.. Views forever. Took 1 1/2 years to finish with me working at observatories atop Mt. Haleakala at night and working on the home during the day (fell asleep on top of a ladder once!). Cash flow built it. Mortgage $0.00. Then I built a second home on the lower part of the property and a mama-in-laws cottage attached to the main house by a sky walk and bridge. We turned those into a bed and breakfast which my sweetie managed. Funds for the second dwelling and cottage came from the loan payoff on our first owner-built home in Idaho (we carried the paper to maximize the profit).

Between those three and 1/2 owner built homes and working overseas (with housing furnished, bonuses and NO TAXES!) we were able to retire a bit early and have owed no one a red cent since 1973.

It’s called putting all your eggs in one basket and then living in the basket!

It is also extreme bust-your-ass work. But it allows you to have a whole lot more ov everything for a minimum outlay of money. Build your own home and you are guaranteed $200+ for every hour you put in on it. You will never loose money building your own home.

There are many more ways to own a home without fighting to pay mortgages to bankers who don’t give a shit about you or what you are trying to do..

My daughter and son-in-law (RIP sadly) did it a different way. They asked for my advice and I told them to buy (conventional mortgage) a house that was in the poorest condition in the best neighborhood they could afford – preferably a rental – and completely refurbish it using cash flow to pay for it. They did. Too three years to do, they sold the house for 3 times what they paid for it and subsequently bought a old but sturdy revolutionary dated farm house, fixed it up (a years part time work) and ran a B&B with it for 6 years. Mortgage $0.00. Income generated roughly $1600/month with my daughter managing the B&B. Her husband was a Chief Fire Control Tech on a Fast Attack Sub.

So stop whining about having to pay through the nose for a home. BUILD ONE..

MA

MA

MA

Counties and/or states will allow you to build your own home? What about liscencing?

@WIP

Not a problem. Except for a few. Like in Lake Country Florida, when you file for a building permit, some shit head PE(“Professional Engineer”) estimates the worth of your finished home and they charge you an “Impact” fee (for schools – even if you’re 60 years old) wear and tear on roads (even thought that’s paid for by gas taxes) and maintenance of City/Country government (whether you need it or not).

In Lake County, you are charged roughly $7,800 in “impact fees” before you’re issued the permit.

My first home I built in Idaho, I filed for a permit, never received it, called them every time something needed inspection (water, electric, et al plus final inspection) and no one ever showed up. All their “permit” features spelled out that if the country didn’t respond with 21 days, you could go ahead anyhow.

(Now that’s the way to do business!)

MA

@WIP:

If you run into a hard ass building inspector department, rent (for a fee) the licenses you need from licenses contractors. You do the work, pay them a few $$, they check it out and stamp it “Meets Code” which the Country or City inspector merely rubber stamps.. You can build it, plump it, wire it, finish it for 5% of what it costs licensed contractors to do it and most places, if you tell them you’re an owner builder. everyone will bust their ass to help you out!

MA