I mistakenly took Squawk Box off mute this morning. It was just in time to hear one of the regular anchors—–the one who makes Joe Kernen sound slightly insightful by comparison——forecast a pick-up in global growth on the grounds that “China is recovering”.

Yes, the credit intoxicated land of the Red Ponzi just tied one on for the record books. During Q1 it generated new debt at a madcap annual rate of $4 trillion or nearly 40% of GDP.

And that incendiary deposit of more unpayable debt, which came on top of the $30 trillion already smothering history’s greatest construction site and open air gambling den, did indeed goose China’s real estate prices, state company CapEx, infrastructure building and steel production. Call it fiat growth because even pyramid building adds to stated GDP, at first.

Even then, the overwhelming share of this explosion of new credit went to pay interest on the existing mountain of IOUs. Charles Ponzi could never have imagined a scam so audacious.

Nor are the red suzerains of Beijing unique in the headlong dash toward the financial cliff. Except for the nicety that Japan’s 30-year and 40-year bonds are trading at a microscopic fraction this side of zero (0.3%), Kuroda and his tiny band of mad men at the BOJ have driven the entirety of Japan’s monumental public debt——which is now actually measured in the quadrillions of yen—–into the netherworld of negative yield.

Needless to say, the visage of an old age colony being hurtled toward the edge of a debt cliff by central bankers who have taken leave of their faculties does not bring the idea of economic recovery and growth immediately to mind.

The same can be said for the ECB’s $90 billion per month bond buying bacchanalia. Having made German bunds so scarce as to have eviscerated any semblance of yield and turned Italy’s sovereign junk into super-bluechips, the ECB will soon be slurping up the corporate bonds of any global company that can fog a BBB credit breathalyzer and plant an SPV within the borders of the EU-19.

What happens when Draghi is finally stopped and the Big Fat Bid of the ECB and its fast money front-runners disappears?

The hopeful CNBC anchor-lady didn’t say. And about what happens if he isn’t stopped, she didn’t say, either.

The fact is, Simple Janet has already proven the end game. Money printing central bankers can’t stop. Were they to allow financial prices to normalize and trillions of bad credit to be liquidated, the whole financial house of cards they have built around the planet would blow sky high. The “soft landing” case is a null set.

The FOMC’s expected stand pat posture at next week’s Fed meeting is just another proof. It was actually 36 months ago that Bernanke triggered the first taper-tantrum when he mused out loud about normalizing interest rates. In the span of time since and as of month 82 of this so-called business expansion, they have come up with exactly 25 bips off the zero bound. That is, the Eccles Building is petrified and sliding by the seat of its collective pants from one week to the next.

Stated differently, if someone among the 100 or so central bankers and apparatchiks who rule the financial world knew how to “normalize” and had the will to try, it would have been evident long ago. What they have done, instead, is simply to soldier on toward the financial cliff ahead, thereby absolutely disabling and falsifying the pricing mechanism throughout the global financial system.

The consequence of that is real simple. Every week that this bogus regime of ZIRP, NIRP and massive monetization of existing debt with fiat credits conjured from thin air continues, then more and more speculative excess is being built-up throughout the world financial system. It is becoming a minefield of ticking financial bombs.

And that’s because massive central bank intrusion in financial markets causes everything to be mispriced. Everything!

The stunning irrationality extant in the junk bond market, for example, is usually glossed over with a reference to the quest for yield. But this isn’t some kind of clinical phenomena—a passing phase of the credit cycle which will somehow correct itself.

To the contrary. For example, this week underwriters sold $16.5 billion of Argentine sovereign debt from an order book that was over-subscribed to the tune of roughly $50 billion; and priced it at a yield (7%) once reserved for German bunds. Yet has the world’s greatest deadbeat nation and serial defaulter suddenly, magically rehabilitated itself, and even before its last financial scofflaw regime was even properly buried?

If there was ever a perfect image of lemmings swarming toward the ocean cliffs, it was the bond managers who lined up for Argentine bonds last week. Indeed, the same can be said for the mutual fund PMs and homegamers who have piled back into the junk bond market during the last eight weeks. They were being shown the road back to safety by the early 2016 collapse, but on the hint of an interim bottom they resumed there insensible march to the sea.

To wit, in just the blink of a trading eye, the BB spread came in from 580 basis points, which is not nearly enough to compensate for the massive losses ahead, to just to 375 basis points, which amounts to eyes-wide-shut speculation.

The same can be said for most other sectors, and especially the stock market. You can’t capitalize a “hard landing” at 24.2X corporate earnings——that is, inflated profits which are already sinking fast. What you can expect sooner or later is a re-visitation of the post-crisis lows.

What underlies the market’s current fantastic over-valuation besides sheer central bank enabled speculation, therefore, is the seemingly pragmatic notion that this is all just a slow-slog and that with enough time and patience—-and allowing for the “extraordinary” hangover of damage from the Great Financial Crisis—–economies will recover, financial systems will heal and the world will get back into its old groove. That’s more or less what anchor-lady was conjuring this morning.

It’s not going to happen. In fact, the “old groove” was part and parcel of the hard landing ahead. There never was an honest and sustainable global boom during the last 25 years when Wall Street peddled the myth of the BRICs miracle and the notion that a flat earth and new world economic order were teeming with capitalist exuberance and breakaway eruptions of prosperity.

What there was, instead, was a stupendous expansion of financial credit that generated a temporarily virtuous cycle of household borrowing and consumption in the DM and an unprecedented tidal wave of borrowing and investing in the EM. They were symbiotic; the one triggered and reinforced the other.

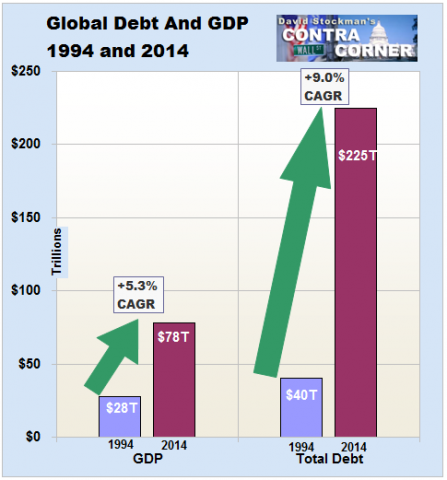

The world is now $185 trillion of debt downstream from the mid-1990s starting point. The $50 trillion of incremental GDP booked during that fantastic eruption of debt was far more borrowed than earned. That is, it was stolen from the future by means of the age old expedient of hocking tomorrow’s income for cash today.

Alas, the future is arriving because global growth is grinding to a halt. Now comes the payback time, but don’t tell Wall Street’s lemmings.

They have almost reached the cliff.

“……….. forecast a pick-up in global growth on the grounds that “China is recovering”

How do we always end up with total idiots in places of high influence?

(Actually, I know the answer to that. It serves the World Establishment for them to be there and keep the people ignorant of reality. If they didn’t do that job they wouldn’t be there.)

FDA lemmings: http://www.healthy-holistic-living.com/the-bitter-truth-about-splenda.html?t=ET

I’m not much of a drinker and never have been. I’m impartial between white and red wine, enjoy a Blue Moon or Shock Top Belgian ale, or have a traditional margarita on the rocks with a salted rim. I’ll have a drink to be social and limit myself to two. I’ve only been drunk twice since college and both times it was that third drink that put me over the edge. There’s an analogy here. Patience, grasshopper.

Have you ever had too much to drink and reached the point where you desperately hope you don’t vomit, but think you might? That was me the two times I had that third drink. Both times I got home late in the evening and was dizzy, laid down, the room spun, and any attempt at a restful sleep escaped me. Both times I sauntered into the bathroom, kneeled before the porcelain throne, and rocked back and forth for what seemed like hours before I inevitably threw up, felt better, and was able to sleep soundly with the alcohol (and everything else) out of my system.

To be clear, I HATE throwing up. I’ll do just about anything to avoid vomiting, whether trying to think peaceful thoughts to resting my head on the cold ground to taking small sips of a cool drink. In the same moment I desperately hope NOT to throw up, yet desperately hope to throw up with as little agony as possible. That’s my summation of the economy the past eight years.

Speaking of the economy, the twin mantras of “the end is near” (I’m going to throw up soon) and “more signs of recovery” (this feeling will go away) have been with us as we crouch, still drunk (economically speaking), before the toilet. Most of you reading this want to throw up and get it over with, while others are trying to do everything they can to delay the inevitable vomit. In this example, delaying the inevitable doesn’t make the vomiting any worse, but it would have been so much better than to experience the agony in the meantime.

We need to throw up. It won’t be pretty, it won’t comfortable, but it’s time to remove the alcohol from our system. Maybe a black swan will do it for us. It’ll be the proverbial finger down our economic throat. Until then, rocking back and forth on the bathroom floor continues.

[img &imgrefurl=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3D0ogzsWhZcmM&docid=ex4iv9o2RH_G6M&tbnid=iDpkPd2KIwgThM%3A&w=480&h=360&hl=en-us&client=safari&bih=559&biw=375&ved=0ahUKEwj84MTf26fMAhXCHT4KHcYiDW4QMwggKAUwBQ&iact=mrc&uact=8[/img]

&imgrefurl=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3D0ogzsWhZcmM&docid=ex4iv9o2RH_G6M&tbnid=iDpkPd2KIwgThM%3A&w=480&h=360&hl=en-us&client=safari&bih=559&biw=375&ved=0ahUKEwj84MTf26fMAhXCHT4KHcYiDW4QMwggKAUwBQ&iact=mrc&uact=8[/img]

You forgot the picture of the horrible Photoshopped pseudo-female with lemur eyes, blond ponytails and masculine features.

Thank you!