Submitted by Hardscrabble Farmer

Why a college degree is not a guarantee of future earnings and why the money spent on one can create more problems than the credential can solve.

It all became real the summer before my senior year of college. It was 2010, and my home phone still had a cord, which I wrapped around my fingers as I waited not-so-patiently for the apathetic representative on the other end to tell me the bad news about my student loan debt. My father was in front of me, his typically ruddy face redder than usual. “A 9.25 percent interest rate?” he yelled, “How can you put that on a kid?” It was clear he was worried, and he had every right to be — as the cosigner of my loans, my debt would be his responsibility, too.

The loan, ironically called a “Smart Option” loan, has a variable interest rate that fluctuates based on changes in the financial market — which may have been explained to me at the time (I truly don’t remember), but I know I didn’t fully grasp what that meant. Either way, neither of my parents wanted me to take it — I could tell that much. My mother didn’t even have to say it, as she sat wordlessly next to me on the couch. Like most working-class parents, she couldn’t fathom paying more than $30,000 a year for my education (let alone $60,000). My father, an electrician who worked nights driving Amtrak trains to put himself through trade school, only earned his associate’s degree in his mid-30s. My mother held a few random part-time jobs over the years while she devoted herself to raising my brother and me, but she never graduated from high school. The concept of attending a private college, let alone paying for it, was completely foreign to them. They wanted me to chase something bigger than they ever had access to. They just didn’t want “bigger” to mean drowning for the next 20 years in an all-consuming pile of debt.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

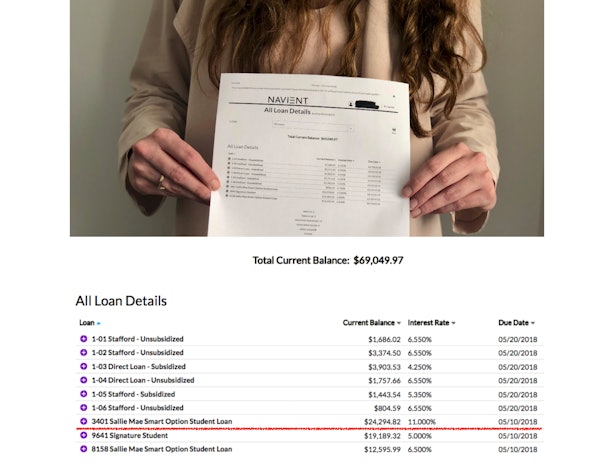

At this point in my education, after two years of private college (and one in a public university), I had already taken out eight substantial loans totaling over $67,000, whose repayment I hadn’t even begun to contemplate. Knowing how much debt I had already amassed, my father tried to impress upon me the difference between this new loan and all of the others I had already taken out — whose average interest rate meted out to a little under 6 percent — and why this loan would be harder to pay in a sea of already-hard-to-pay debt. I knew racking up one more loan and another $24,000 wasn’t ideal, but what was the alternative? Dropping out? Transferring to a new school and hoping my credits would translate? Leaving all the relationships I had cultivated with students and professors alike behind? So I chose to take the loan. In my final year of college, with my back against the wall, Sallie Mae made me an offer I did not know how to refuse.

Bustle

Now, eight years later, that loan — one of nine that left me $95,000 in debt upon graduation (because, yes, interest does accrue while you’re in school) — very clearly marks the exact moment when I lost control of my own financial destiny.

According to a February 2018 study published by the Levy Economic Institute, a nonpartisan policy think tank at Bard College, there are 44.2 million Americans with student loans, which adds up to about $1.4 trillion in debt. There already exists a myriad of research-driven articles that wax on the impact of the student loan crisis on the future of this country (screwed), our economy (broken), and the weight of the loan crisis (crippling). Those are all important to read, but this story isn’t one of them. I’ve learned that citing the national student loan debt totals in the trillions doesn’t get across how this massive problem impacts us individually, in real life. So, I’d rather talk honestly about what it’s like to live this… to explain in everyday dollars and cents how I get by living in a debt spiral, month to month, paycheck to paycheck.

When I was 18, I fully believed that taking out student loans was the only way to achieve my dream and my parents’ dream for me — to transcend my working class upbringing. I was desperate and uninformed and, because of this, I entered into a dangerous relationship with a loan company that will last half my lifetime. Now, I’m finally facing up to the brutal details (after years of sticking my head in the sand) and learning the ins and outs of my debt — and the truth is mind-blowing.

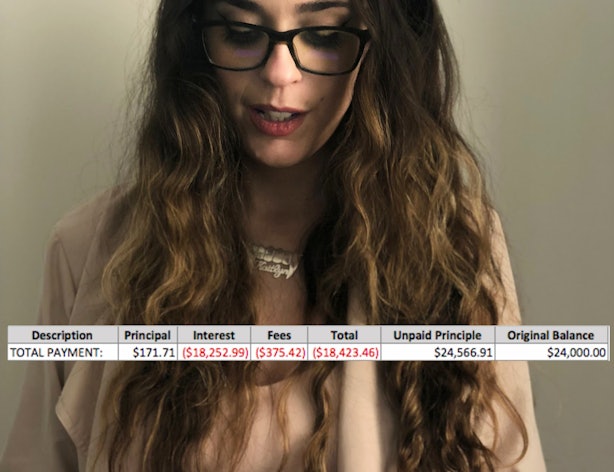

I had no idea so much of the money I was paying did nothing but abate rising interest, barely touching the principal sum.

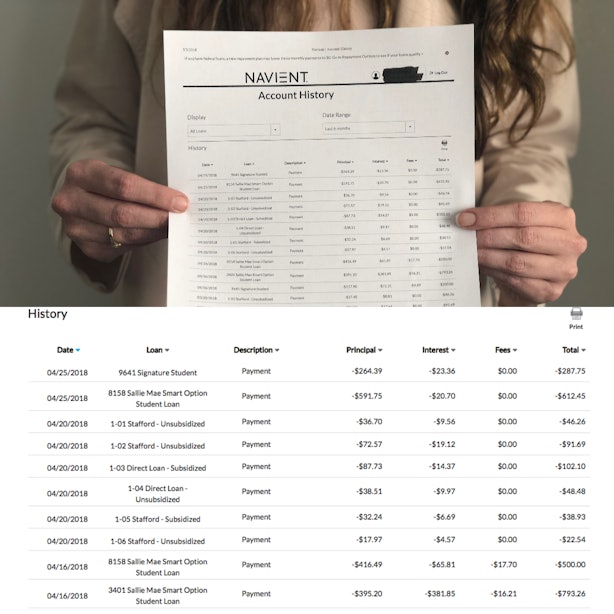

Part of the problem lies in how complicated it is to find that truth in the first place. Navient, as Sallie Mae’s student loan division is now known after it splintered into two companies in 2014, doesn’t make it easy to access the specific details of your loans; sure, it‘s online portal does have a tab that says “Loan Details,” but inside that section, only the money you still owe is listed (not the money you’ve already paid).

Bustle/Navient

(You can also see here that the interest rate for that loan isn’t 9.25 percent anymore. Because it’s a loan with a variable interest rate, it’s up to 11 percent — a fact I only learned when I called to ask why my monthly payments had increased. As my lender matter-of-factly loan-splained, “We’re not legally required to disclose when we change your interest rate, as per the contract.” I had missed that clause in the multi-page contract I signed when I was 20.)

In order to determine how much money you’ve actually paid to a loan, you have to browse your “Account History” and download a jumbled Excel file that’s filled with extraneous details that don’t make simple addition or subtraction easy. (That’s if the files work at all — my browser crashed repeatedly for weeks just trying to get this information. When I called Navient to report this, they offered to mail me the details, which they said would arrive within 18 days.)

Maybe it’s technically difficult to list what a client has paid thus far on that details page… or maybe that information made readily available and visible to the world would catapult most borrowers into fits of rage. It’s hard to tell, and my repeated calls to Navient media reps for comment received no reply. No matter why it’s so difficult to find, the truth behind my payments and how they were allocated stopped me dead in my tracks. I had no idea so much of the money I was paying did nothing but abate rising interest, barely touching the principal sum.

For example, the worst of my nine loans looks like this:

Bustle/Navient

Yes, I’ve paid more than $18,000 to my original $24,000 student loan — and, yes, only $171 worth of my back-breaking monthly payments (more on those soon) even manage to skim the original amount. If, like me, you didn’t receive a ton of financial education in high school, and you’re wondering how that’s even possible, welcome to my boat.

Here’s how I now know student loans work: When paying any money toward the loans, the amount you send over is immediately applied to interest before it can touch your principal balance. Each day a percentage of interest on your outstanding debt (including yesterday’s unpaid interest) is calculated. If you don’t pay that interest, that amount gets added to your total due, and tomorrow’s interest charged will be a percentage of that new total. Every day that you don’t pay off your loans, more interest piles on.

At my current rate, I accrue $16 in interest each day over all my nine loans, meaning that $480 each month goes directly to interest, and anything I pay after that is divvied up to defray my principal sums. If my monthly payment is late or I miss it all together, I’m charged late fees that are added onto my principal sum (so I have to pay even more in interest).

Missing payments is what led to my current interest rate and thus, my balance, but the reason I missed those payments is also worth looking at.

After graduation, most student loan borrowers are provided with a six-month grace period before they need to start making monthly payments. (That doesn’t mean your loans aren’t accruing interest in the meantime, though — they absolutely are. You just aren’t expected to make payments yet or punished for not making them.) One way to extend that grace period is by attending graduate school. Theoretically, when you decide to continue your education, you don’t have to worry about making any payments until you graduate. That wasn’t the case for me, as I decided to attend graduate school outside the United States (a master’s degree I don’t have any student loans for because universities outside of America don’t believe in charging $60,000 a year).

My choice meant that my undergraduate student loan payments of $450 a month couldn’t be deferred while I pursued another degree. Sallie Mae’s explanation? The school didn’t have a code they could punch in their system. And without a code, the system couldn’t recognize that I was in school. I recently called Navient again to ask what determines whether a university gets a code or not and his reply was, “It depends on whether your school provides a code or is listed at the National Clearinghouse.” The National Clearinghouse is a nongovernmental organization that collects educational data and reporting. A third-party data collection firm determined whether or not I was responsible for thousands of dollars in payments while in graduate school. Follow-up questions about the sense of this left me in the same place: code-less and alone.

I would wake up at 6 a.m., take a bus and three trains to work, and every night, I would crawl into my house at 11 p.m. for an extra $120 in overtime a week.

As I was doing my master’s and researching my thesis, I had very little time left over to work. I got a part-time job in a pizza place to support myself as I continued my education, but the dismal amount of money I was bringing home went entirely to books, food, and housing. I couldn’t afford to make my student loan payments and had to default on them for the entire 12 months I attended the program. When I graduated with my master’s in September 2012, I wasn’t given another grace period (despite my many frantic calls and hours spent on begging anyone at the call center who’d listen). Over that year, my inability to make my loan payments added $5,000 in compounded interest to the principal sum of my $24,000 loan, settling its total at $29,000.

That bump sent my total student loan debt to $95,000. It was clear I had to find a job right away — and so I passed my resume out in a flurry, firing off cover letters and cold emails, applying to jobs I wanted and jobs I didn’t. The response was unanimous and deafening: silence. In the age-old catch-22, I needed experience to get a job, but I also needed a job to gain that experience. So, I began waiting tables while my interest kept piling on.

Bustle/Navient

When I finally got my first full-time office job at the start of 2013, it paid less than $20,000 a year. I would make $1,400 a month and send $750 to Sallie Mae. In New York City in 2013, the average one-bedroom apartment rented for about $3,000 a month, and with more than half my net pay going directly to loans, I made the “choice” to live with my parents in the Bronx, on the last stop on the 6 train. It was nearly a two-hour commute each way to my office, which wasn’t so terrible until I started working overtime and my hours shifted from the typical 9 to 5 to the very long 9 to 9. Every morning, I would wake up at 6 a.m., take a bus and three trains to work, and every night, I would crawl into my house at 11 p.m. for an extra $120 in overtime a week.

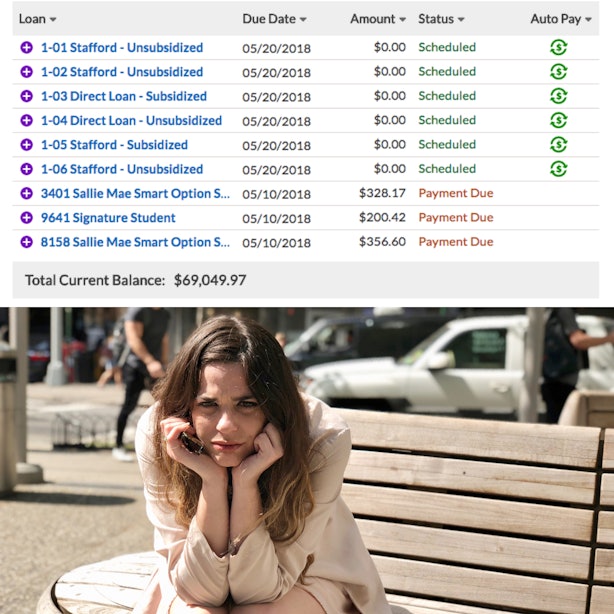

Unfortunately, variable interest rates on student loans are just that — variable — so my monthly payments amounts were, too. If I wanted to prevent the principal from rising as the interest rate went up (usually without my knowledge) because of fluctuations in the average interest rates offered by banks in London (another head-scratcher), I had to up the amount I forked over each month. And so, the more money I made, the more money I paid. Every raise I received was a double-edged sword.

I was only paying enough to keep the interest at bay. It cost me $750 a month just to make sure my balance wouldn’t increase.

Eventually, my dedication at work paid off, and I advanced in the company, finally making enough money to rent an apartment with a roommate on the Upper East Side around January 2014. My commute became bearable (a swift 30 minutes), but my student loan payments grew larger, too, as the variable interest rates increased over time and my steadily-rising balance dictated I pay more just to cover basic interest costs (and not even touch my principal balance). One paycheck went to rent and the other to loans, and that was it. I was successful at work, but at home, I was living a dorm life, scarfing down ramen and arguing with my roommate about splitting the $10 Netflix bill. I slept with my mattress flush against the floor for a month after I moved in — because it took that long for me to scrape up the cash for a bed frame.

When you’re barely making enough money to survive, living from one paycheck to the next, you can feel every cent you spend. Every time you swipe your card, a little part of you shudders in fear you’ll be declined. You don’t go out; you don’t go on dates. You sit in your apartment and wait for the next check to arrive that you don’t have to dedicate to rent.

Any of this struggling might have felt worth it if I was actually making a dent on my principal balance. But I was only paying enough to keep the interest at bay. It cost me $750 a month just to make sure my balance wouldn’t increase.

Bustle/Navient

And it’s not like I can just ignore my debt, either. If I miss a payment, I not only get charged more interest, but my credit is affected, and my father’s is too. If I die before my debt is paid off, my loans won’t die with me — my dad will be on the hook or, depending on the terms of the loan, even the poor soul who marries me.

In the seven years since I flipped my tassel, I’ve dutifully paid a total of $57,170 toward the $95,000 debt I accumulated across nine loans from my undergraduate education. If life existed in an interest-free vacuum, my debt would be more than halfway paid. But it doesn’t, and my principal sum has been reduced to just $69,000. Yes, that means only $26,000 of those $57,170 dollars I siphoned off my paychecks and life have touched my principal balance. And, yes, that means I’ve paid over $30,000 just to be pretty much in the same financial situation I was in when I graduated.

In the year 2018, I make a bit more money than I used to, but moving out of that roach-riddled closet meant paying more in rent, and making more money still means paying more to my loans. These days, I send off $1,200 to Navient a month. The interest on student loans is tax deductible, but I am disqualified because of how much money I make. I wouldn’t complain if my payments were making a dent in my principal. But the way these loans are set up, I’m barely even scratching the surface.

By the time I finally finish paying off my loans, I will have paid nearly $170,000 to my original $95,000 loan.

And there’s no sense that it’s getting better (the interest rate increase that happened while I was writing this article has increased my monthly payments yet again). I have 10 years left on this loan, and there’s no telling how many more times the variable rate will increase in the meantime.

According to its website, in 2013, Sallie Mae “celebrated 40 years of helping make education accessible to families around the country,” and that carefully-worded phrase isn’t entirely wrong. I wouldn’t have been able to afford college without a student loan provider. I wouldn’t have had access to an intellectual and competitive learning environment, I wouldn’t have been able to meet and make friends with people from all over the world, and I wouldn’t have the same tools to think critically and dynamically about complicated subjects that I would otherwise have no idea how to approach. It’s obvious that college is an invaluable experience. Still, should it really cost the next 20 to 30 years of my life?

In January 2017, two states brought lawsuits against Sallie Mae, detailing how the company took advantage of students by selling them subprime private loans (with expected default rates at 92 percent) at a massive profit to only the company itself. The lawsuits claim that the lenders knew borrowers would never be able to pay, “ensnaring students in debt traps” for the better part of their young lives.

If we can’t afford bed frames, we can’t afford weddings, children, or mortgage payments. We can’t afford much of anything at all.

And a “debt trap” is exactly what this whole thing feels like. While I acknowledge my role in landing my high interest and payments, the difference between an agreed-upon interest rate in theory and paying that rate in practice isn’t easy for a teenager to wrap her head around. Kids are taking loans out at 17 or 18 that they won’t be able to pay back until they’re 40 or 50. And the companies they’re borrowing from aren’t out to help them — those companies only make more money when students can’t pay.

With the interest accruing at my current rate, by the time I finally finish paying off my loans, I will have paid nearly $170,000 to my original $95,000 loan. That amount feels much more real to me now, too — I know exactly what my apartment could look like (livable), what clothes I could own (not just Forever21), what basic amenities — like a MetroCard — I could afford if I didn’t owe so much. Those numbers bring a frightening sort of insight. Student loans are not only clipping an entire generation’s wings, they’re also crippling their spending power. If we can’t afford bed frames, we can’t afford weddings, children, or mortgage payments. We can’t afford much of anything at all.

Bustle

The fact is, a choice I made when I agreed to my first loan at 18 (to better myself, I thought at the time) will sit on top of my finances almost until I’m middle-aged. If I can appreciate anything about this struggle, it’s that it was ultimately in the pursuit of something bigger than I would have achieved if I had taken a job just out of high school in the Bronx. I just wonder if that opportunity should cost so much.

All they wanted was to for me to have more — and now I’ll have almost $200,000 less.

Our current mode of paying for higher education doesn’t benefit anyone in the long term except student loan providers and for-profit universities. Is this really what we want for future generations? Do we want people seeking an education to be punished by their own ambitions? Do we want to saddle young Americans with debt so astoundingly debilitating that they’re forced to accept the jobs and paychecks and limited opportunities that they went to school to avoid in the first place? Do we believe that only certain people — essentially, people with rich parents — should be allowed to access the jobs and resources and networks to which college is still the best gateway? We don’t want to look at higher education as a class issue, but anyone struggling to pay off their loans, or contemplating whether to take them on in the first place, understands that it is.

I can recall my father’s red face that afternoon so clearly now: the pained, pleading look in his eyes. All he and my mother wanted was for me to have a better life, one unencumbered by the difficulties they had always associated with money. All they wanted was to for me to have more — and now I’ll have almost $200,000 less. It’s not fair to them, to me, or to anyone else with student loans.

Sometimes, I struggle to imagine a future in which life doesn’t swing from one paycheck to the next, like a crushing pendulum of debt, but I know it exists. The year 2030, with its flying cars, hoverboards that don’t explode, and a long-awaited cure for brain freeze, is good for me financially. I’ll have finally paid off my student loans — and now I can finally consider having a big wedding, becoming a mother, or buying a house. It might seem a little late in life to you, but I know many of my peers, so long in debt and ignored, will be in exactly the same place. Forty will actually be the new 20. What a comforting and not at all terrifying thought.

Dumb cunt.

That being said, we should end any governmental involvement in student loans and then remove the exemption they enjoy from being discharged in bankruptcy. Once all of the dumb cunts (of both sexes) can discharge student loans in a chapter 7, student loans won’t be handed out like donuts to fatties anymore.

While I agree the loan game is one that the government should be out of, she is not a dumb cunt. The game was rigged by the banks and politico’s running the great grafting education system. Young people have been sold a bill of goods about a college education being the road to riches. It is easy to get money, and little waiting for them at the end of the line. Bankruptcy for student loans is the only solution that will clean out the system, but is currently prohibited. Loan defaults will continue to rise and the debt slavery will continue until the bubble busts just like all the other fake helping hands.

She’s still a dumb cunt.

The stupidity – she needs to go to grad school – WTF. Sounds more like a semi-career student. So she get’s out, works her ass off – to pay back $200k.

Could have gotten a cheap 2 year degree from a Community College – and netted more money – and purchased a home.

Cultural Marxism did this. Feminism taught women that they can make poor choices. No kids out of high school go into debt wo parents cosigning. My sisters are products of this thought process too. Now some parents find that their S.S. is taken for their debts signed for. Gary North on lew Rockwell has cheap college advice article.

Perfect comment,Iska.

Let’s just say that she clearly was not a math major….

Iska – I fully agree. Here is what she wrote: “I knew racking up one more loan and another $24,000 wasn’t ideal, but what was the alternative? Dropping out? Transferring to a new school and hoping my credits would translate? Leaving all the relationships I had cultivated with students and professors alike behind? So I chose to take the loan.”

What was the alternative? Well, gee, I dunno. Night school? Just say no? Part-time? Stop?

Seven years ago she started out making $20k, in NY, with a masters. Holy fucking shit, she must have been REALLY qualifies, right? She lacked experience, she says. She lacked the sense god gave an ant.

“A 9.25 percent interest rate?” he yelled, “How can you put that on a kid?”

You cosigned it you twit – you are on the hook.

How could you cosign a variable interest loan???????

Kok, I love it when people use the word “Twit”

Boo frickin’ hoo.

A sad story. I was lucky. I Graduated in the mid-70’s from a good state university. I had earned one year of credit on the CLEP tests, so I made it in three years. I washed pots at night and, after my first summer in USMC PLC officer training, I received a stipend from the Corps. I worked in the summers, of course, in a concrete plant, as a security guard or making pizza. I got my Master’s doing part-time work, with the GI Bill, and a small student loan. Things are not that way now. These kids are victims of a ruthless loan shark business and a liberal/leftist educational establishment that feathers its own nest while chirping about “equality”. Cynical, lying, cheating bastards. I am sorry for this girl. The country has gone down the wrong road. And don’t try to sell me any, “Well, she made her own choices, blah, blah, blah…” These are young people trying to do the “right thing” and a gang of greedy, soulless co__suckers in the banks and the universities have rigged this thing for their own benefit.

Agreed. My first semester’s tuition at a solid State flagship was $850 in 1979! Even at $3/hr for summer work, I could cover expenses easily while at school. Four years of school cost me and my folks around $15K all in. That wouldn’t buy you a semester these days. Even CPI-adjusted, today’s prices are an outrage.

Student loans are nothing new – in my era, the interest rates were even higher. It’s just that the costs are now outrageous. Administrative bloat, regulatory compliance costs, too many students and excessive loan subsidy have combined to drive a cost spiral in higher education that kids like her cannot overcome.

Of course, this is a feature, not a bug. Corporations and Gov’t want more debt slaves.

That “gang of greedy, soulless co__suckers” is a (((gang of greedy, soulless co__suckers))). Don’t forget it. This is part of taking us down. Make no mistake, the consequences to our society are absolutely predictable, and intentional.

Debtors’ prison is back.

Here’s a plan for ya. Marry a guy with a good career, have some kids, bake some cookies. Not good enough for you? Then good fucking luck with your worthless expensive education and poor poor me attitude.

Probably only does “Missionary Position.”

A guy with a good career? You mean a guy with $200k in student debt and not a penny to spare for a family? Or else you mean an old guy.

One perhaps unintended, perhaps intended, consequence of the scheme is that women like this one are pushed to either prostitute themselves, or marry a guy many years their senior, with no debt and the ability to help them with theirs.

Welcome to the American Plantation, sweetie. On the American Plantation you get to be both the slave & the harvest!

1) loan-splaining. Wahahaha

2) “Indentured Servitude for $400, Alex”

3) you are taking a risk by going to college if you don’t have rich parents and must take loans. Yes, only the rich can pay 4 years of college especially if you have 2.3 kids.

4) we, as a country should not want our up and coming generation to have to take this kind of risk.

5) the health of the country is affordable education and affordable health care among other things. We care about the country as a whole, don’t we?

6) college wouldn’t be that expensive without government and/or loans.

7) dynamic learning environment? Me thinks we are suffering from intellectualism.

8) yep, I agree, 40 is the new 20. Shameful.

#6

#6. college wouldn’t be that expensive without government and/or loans.

And neither would be healthcare.

First of all, don’t give this woman a pass. She’s 30, she still can’t do 8th grade level math, she tells more lies in that single essay than my kids have told in their lives combined and she tries to come off as a victim of her own cupidity and desires.

Read some of her other posts. She brags about binge drinking, globe hopping and other not so virtuous activities, but tries to make it seem like she’s made every effort to discharge this debt. She’s made the bare minimum of payments over the last 7 years prolonging her debt and has convinced herself that she made a smart choice with her advanced degrees (in comparative lit) when by her own disclosure she’s making less than 30K and living in Manhattan. Now she’s reached a point where she’s realizing the error of her ways and is looking for both a villain to blame and a sucker of a man to help her pay off her decade of frivolity and libertine impulsiveness.

You want to know why she’s still in debt? Give this gem a read-

https://www.elitedaily.com/life/culture/signs-self-destructive/916766

“I loved waking up on Thursday and going to bed on Sunday. I loved bruising my legs and examining the bottoms of pint glasses.

I loved semi-coherent banter in languages I didn’t speak, and finding myself on a road-, train-, plane-, boat trip to a new state or a new country (sometimes with my passport, sometimes without).

Because self-destructive people are moved by the unconscious urge to run themselves ragged, to martyr themselves to unequivocal hedonism.

Self-destructive people eviscerate needs in the favor of wants and break themselves into millions of little pieces sprinkling like confetti over the grave of shame and the ghost of regret.

Because there’s something beautiful about giving your everything to this life, dedicating yourself so wholly to the pleasure and pursuit of vice. Because it’s a pretty thing to live in sin.”

As the kids would say, Wow. Just wow.

I’m saving this one (and the link to her other writing) for the next person who tries to make the case for the advantages of a “college degree” as some kind of guarantor of financial security. She may have a couple of degrees, but wisdom is not something with which she has even a passing acquaintance.

While I agree HSF, the real rot lies with the system. As you well know, you reap what you sow. The gross failure at the lowest school level that gets worse as you go up higher, plus the social leanings and pressures of the me society, makes it tough to be smart or even educated in early life. The values of yesterday are not on the I phones of today, or in the Internet selfies. They are false gold. It will all lead to failure as I have warned many times. This is just another example of a broken spoke in the wheel that can no longer roll.

Greetings,

She can do these extra curricular activities because she hasn’t hit the wall yet. Now that she is approaching it, she will find out that there are better pump and dump choices that men with money can make. She will be a sad and lonely cat woman with debts she will carry with her for the rest of her life. 40 will not be the new 20 for her.

I wondered what her degree was in. Figured it was something totally useless.

The author has a BA and MA in comparative literature. https://www.bustle.com/profile/kaitlyn-cawley-1912533

She’s the editor of a website https://www.elitedaily.com/about “for and by women who are discovering the world, and themselves in the process”. Well isn’t that special? At least they have the honesty to call themselves elite. I’m guessing her plight would evoke little sympathy among the men who ride on the back of dump trucks collecting garbage at -20F or the men who string up power lines in the night after an ice storm or the men who man the oil rigs that fuel her jets to Paris. She needs a good bitch-slapping by Camille Paglia.

Now get a Ninja (Nigga) Loan for a $200,000 house and if you stayed there 30 years (assuming rioters don’t burn it down, rape and kill you), Section 8 would end up paying 2 million dollars.

Ninjna Loan: No job – No income – No assets.

Before the bubble I was chief developer for Title Insurance and Mortgage Recording applications.

They gave these people Ninjna loans with the logic: The property will appreciate 10% a year – thus they will have equity. Remember how that worked out?

Ninjna Loan: No job – No income – No assets.

Ahem, that sounds like a NJNINA loan, another thing entirely; a New Jersey loan shark loan.

Too soon old, too late smart!

Saaaaay….I’m starting to think you don’t need a master’s degree to make less than $20K/year. You can do that while attending high school with even a slight be of effort. A phrase that really turned my stomach was “escape a working-class life”. Escape? Really? Becaue “working class” sounds a helluva lot better than endless boozing/drugging/fucking in between whatever useless job you’re doing that you got with your useless degree.

$20,000 a year = $10 hr

Dishwashers make more.

This is her tithes and offerings to our Satanic world system. Hopefully she will forever learn from this experience.Stay out of Debt.

I think the real dumbass is the father who co-signed these loans. Bad parenting in that she pursued worthless degrees, but that’s common with first generation college students. Parents think any degree has value because it’s a degree. Yeah, they don’t. The parents own this – literally.

Then I skim down and see she lives in NYC and makes shit money. Fuck that, go live somewhere that is inexpensive and will probably pay about the same. You don’t have to travel far. There’s office drone jobs up in Buffalo and the rent is a heckuva lot cheaper.

Sure, the student loan system is a racket but this bitch is making bad decision after bad decision and now trying to blame others. Sorry sweetie – I have no sympathy for you.

Old people exploiting young people. Just like strong/weak, smart/dumb, beautiful/unattractive, cunning/simpleton, rich/poor. EXPLOITATION.

What about boomer/gen Xer.?

It is the most common theme in history. How to teach this without life experience is nearly impossible. Love your kids and impress that …

“Neither a beggar nor a lender be, do not forget, stay out of debt.”

The above is BB.

I was beginning to worry about BB. I hadn’t seen any comments for a while.

Now, is it not obvious that debt has but one purpose!!! To feed the rentholders. Nothing, (by which I mean it CAN only get worse) will change until the debt-money monetary system is history. Which means a revolt against the financial elite… does anyone think that will happen without blood.

Poor Dear!

My parents told me I was on my own in paying for college. Was accepted to dental school, but I passed due to 20+% interest rates in the early 80’s.

Told my kids they were on their own for college, 2 went into the Marines, GI bill is working for them, 1 is going to welding school, he pays cash.

The system is going to collapse soon, no doubt in my little brain.

Home school the kids, public school is child abuse and dangerous.

Went to a State University. Back in the 70’s you could earn most if not all of your tuition working on a construction crew or an auto plant- did both. I also had a work study job on campus, 15 hours per week. I did not have expensive clothes, stereo system, car, or take vacations. When school ended, I had one duffle of clothes, walked out to the freeway and stuck out my thumb. Definitely different times! This period of austerity taught me discipline and responsibility. 45 years later, still a no debt, pay as you go kind of guy.

It is easy to call “stupid”, but that is speaking from an old dudes wisdom. When you were 18, you too did stupid stuff. I remember those 19% credit card loans, and I remember getting married and having kids and watching her leave with them and paying 50% of my gross income to her the next 20 years. My daughter isn’t going to school because she likes the idea of the debt. She is doing it because otherwise she works crap jobs the rest of her life and never gets ahead. To her, the loans are a reasonable gamble she might improve her situation. It obviously won’t work, as the economy is just getting worse, but try explaining that to a youngster. They have no experience to tamper that optimism.

I didn’t have a credit card until I was 30. I may be stupid, but I wasn’t that kind of stupid.

Iska nailed it with the first comment: make student loans dischargeable via bankruptcy once again and the problem is instantly solved. Tuition will plummet 60-70%, like it should. The suddenly laid-off ‘diversity’ branch in administration would finally get ‘educated’ too. That’s a win-win.

Vodka – tuition would not plummet, except if tied to a big decrease in services. But the number of students and schools would. As should happen.

60 years ago, my father told me to never loan my car and never co-sign a loan. Life is hard and it’s harder when you’re stupid. You can’t repeal the laws of physics.

That should be titled “Why I’m Supporting Bernie Sanders for President” The scary thing is lots of young people have fallen into this trap, and there are plenty of filthy leftists who will exploit them. Worse yet, they feel entitled to vote for someone else to carry their load. After all, we can share what we got of yours because we done shared all of mine.

This is not idle talk, Sanders would won if the election were held this November. IF HE Doesn’t doe by 2020 HE will be running with Kamala as his VP. First promise of the platform make all student loans Federal rather than personal responsibilities and free college for everyone.

So this fair maiden can’t do Maff, spends her best years doing Le Tour De France on the cock carousel. Then now as she looks back on the misguided efforts, wants us to feel sorry for her. Nobody held a gun to her head and made her do any of this. There are consequences to bad choices and she should have to pay for them not anyone else. All because she can only make the minimum payments back on her excesses during her reckless path thru higher education… So what did she study. Does anyone want to venture a guess.

This women spent her prime years frittering it away. Folks wonder why the MGTOW trend among Men is moving ahead at full steam. Well the answer is pretty simple really. Why would a young man take her on. She is a liability. She has been rode to town and back by every man with a good pick up line. Likely has a snatch that looks like a ham sandwich with extra mayo.

[img [/img]

[/img]

But folks stay tuned as the best bits are yet to come. See cuz in about 5 years Daddy’s little precious is gonna hit the wall in sexual market place. Yep the wall always wins and when it does the best she can hope for is an occasional blow job in parking lot behind local dive bar. And when she gets tired of that she can begin her collection of cats and morph into yet another crazy cat lady..

[img [/img]

[/img]

Either way score one for Feminism. Yeah for womyn they have come and have they roared…

https://www.youtube.com/watch?v=V6fHTyVmYp4

Awwww, we left the same comment but you used images and the reference to a ham sandwich – bravo!!!!!

@Nickel.. Great minds think alike, I guess. I didn’t read your bit before posting that..Anyways I went back thru thread and read your comment. Funny. The thing I really don’t get with these young women is they so effortlessly brag about being whores. Maybe I am old fashioned and a relic but not really good selling feature if you ask me.

The pendulum will swing, Rins. I don’t know when but it will.

I think you are right MC. Sad the way things are. There are lots of decent men out there being left behind while young ladies like Kaitlyn are chasing around bad boys and bad habits. The thing that amazes me is women like her shamelessly put out their dirty laundry for all to see.

I watched this video a while back. Pretty funny guy and he is unrelenting in his critique for another fine Lady.. a bit long but he hit all the targets. Then again after reading the bit this woman wrote it was a target rich environment anyways…

The Article first

https://www.vice.com/en_us/article/a37gx5/i-tried-to-give-up-on-men-for-a-month

And His response

And a song for her from me…

Rins,

I will have to listen to Redonkulas in a few.

The article from Vice is so sad.

1. She needs to lose a few pounds.

2. Quit trying so hard.

3. Your body is a gift. Treat it like it’s worth your weight in gold and give it to the guy who you will spend the rest of your life with.

I am not throwing stones. I learned this the hard way.

I would hate to be single now.

Greetings,

I believe that the bragging part is a holdover from the sexual revolution. To a young “liberated” woman it scream “I am valuable! I am special! I am in demand!” It must work because I can’t help but notice that the army of homeless people that surround me and are sleeping on the sidewalk doesn’t have any hot twenty year old’s – not a one and there is a big pool of homeless to examine. Even a bi-polar hot twenty-something of a wreck can find some poor sap to take her in.

That new car smell doesn’t last forever and I see plenty of women that have hit the wall hitting the sidewalk come beddy bye time.

I have an unmarried daughter that will be 31 soon. She took on massive amounts of debt because she thought she could buy herself credentials and a job rather than work hard. Only now does she finally realize the trap she is in and the prison that she built for herself. It’s tough, really tough. No one wants to date a middle aged woman drowning in debt.

Edit: I read that Vice article. Who would have sex with this pig???

” …. when you decide to continue your education, you don’t have to worry about making any payments until you graduate. ” ———- article

I think she should stay in college until she’s 70. And then kill herself. A beautiful life.

Not much to add to the great comments. As I was reading, by the the time I got to the 6th paragraph I was thinking to myself will this article ever end??? Holy shit, I really can’t recall reading an article with more putrid sorry assed whining and self-pity.

Aaaaaand, she majored in Comparative (c)Lit??? BWAHAHAHAHAHAHA!!!

Welcome to the debt-racketeering gulag, zek.

Her Dad is complicit in this two ways:

1. He failed to teach her basic math and value. A masters degree in lit? At what cost?

2. He co-signed the loan papers. She probably would have hated him for a year or two, but she would have found either an alternative way to fund her education or an intelligent alternative to the degree she achieved.

The first thing she did not learn was there are three vampires that will latch themselves to someone who is financially illiterate. The taxman,the banker,and the insurance industry. I may have missed it,but what kind of degree did she earn? Also those close relationships….Were they assorted niggers she was banging or what? In any event. Sometimes you get what you deserve.

I am really the only person who finished university richer than when they started?

Making money off of college kids is pretty easy,…

I had an Army scholarship and traded four years in the Army for four years at Texas A&M. The EE degree I earned has really been great and when I added an MBA at North Texas things got better. The Army showed me Korea, Panama and Ft Polk, LA……

Hated Polk…..

Barefoot and pregnant doesn’t sound so bad now, does it?

I saw so much of this type of thinking when I was a mechanic in the Ford dealerships. These youngsters that wanted to be a wrench would go to “automotive college” ended up with 30+ grand worth of debt before they even set foot in a dealer. With zero experience they would be changing oil and rotating tires all day for $8/hour. The good ones(the few that there were) would eventually make it on their own after being a helper for a while but most failed miserably. They were so sure that they would just step into the dealer and become a mechanic making $30/hour right away after schooling with no experience. Morons. I used to love telling them about how they could have just hired in off the street doing the same job all while going to classes paid for by Ford Motor Co. and getting paid for an 8 hour day at the same time AND getting a BETTER education while working for experience! That’s exactly how my friends and I did it. They hated us for that 🙂 It’s all about THINKING BEFORE YOU ACT!! Wake up kids! I thank god all the time knowing that I have no debt worth losing sleep over and that I don’t live paycheck to paycheck. I now work for Ford Motor Co. making more than I ever have when I was a wrench. Although I still love to work on autos, it’s just not the same since Cash for Clunkers. Thanks Obama!

COMPARATIVE LITERATURE?

(Hat tip to Iska Wara, above: “The author has a BA and MA in comparative literature.”)

What moronic parents allow their daughter to get nonsensical degrees in that field???

The field is 77% female (huge surprise):

https://www.payscale.com/research/US/Degree=Master_of_Arts_(MA)%2C_Comparative_Literature/Salary

SUPPOSEDLY, it pays $86.5K in New York – – yeah, right…

but the graphic shows the median salary for women at $38,978 – $82,794.

The fact is, she put off paying these loans for YEARS, if not decades, by making the minimum payment. If you do that with a credit card, it NEVER gets paid off. Daddy didn’t tell his princess about that harsh reality?

Yet, she acknowledges that she’ll probably be able to pay off the (nine!) loans by her 40’s or maybe age 50…if not, well, I feel sorry for her parents, who will suffer a much harsher old age existence.

You make your choices and you live with them — but if you’re a woman, you whine about it and expect someone else to deal with it. Welcome to the harsh reality of adulthood and equal rights.

Here’s a thought experiment, my dear snowflake – – flip the sex in your article and let’s see how many people would give the slightest bit about a guy in the same position!

Good luck, honey, you’re going to need it.

I have a BA in Music, Comp & Theory. I recently investigated going to community college for an AAS in IT Unix concentration. Found out the tuition was more than I could afford on SS. Funny thing is grant donors get income info from the fed. But that is 2 years behind the current scholastic period. For me to qualify for a grant, I would have to wait until the 2020 school year. By that time I will be 68. If I want to attend, I will have to wait until 2020 and would get the diploma in 2022 when I am 70. Shessh!.

I absolutely refuse to go into debt on a student loan!

What takes the cake is I’ve been working in the computer field for 40 years and I started out supporting and administering Unix. However, I have not regularly supported it for more than 20 years. What I need is documentation that says I can do the work. Sad that I need a piece of farking paper to prove I can do the job I have been doing for 40 years.

“I wouldn’t have had access to an intellectual and competitive learning environment, I wouldn’t have been able to meet and make friends with people from all over the world, and I wouldn’t have the same tools to think critically and dynamically about complicated subjects that I would otherwise have no idea how to approach. It’s obvious that college is an invaluable experience. ”

True liberal horse shit right there folks. She spent all that money on education but she did not learn anything of value. I got to say if you love your career that is the entry fee. Is it worth it? Aaaaand, could her parents be even stupider than she? Some of these same genius’s that want to dictate policy.

If only you would have talked to my wife & I Before you signed anything . I am sorry for your predicament but financial management that is good for student loan originators and colleges is generally a royal screwing for students . Remember when your liberal professors and snowflake fiends supported Obama and his ilk they pushed your loans in many cases to be satisfied by the taxpayer and now the IRS becomes the collection agency for your delinquent loans . They will follow you and your co-signer to the grave !