Guest Post by Eric Peters

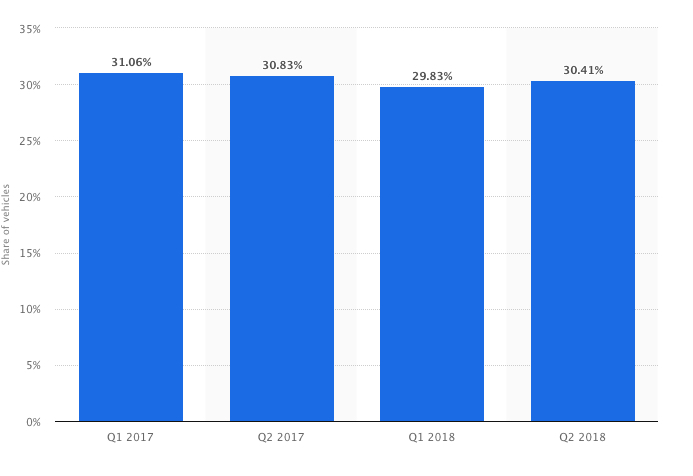

Did you know that the percentage of new cars sales that are actually leases has risen from about 3-5 percent in the early-mid 2000s to more than 30 percent as of this year?

It appears about a third of the population – about five times as many as used to be able to – is no longer able to afford to buy new cars.

At least, not the cars they want – the $30,000 and up ones, laden with all the latest gadgets they want (plus the ones mandated by Uncle).

There are still new cars priced under $20,000 – and most people can still afford those. But they’re the slow-movers. And they’re disappearing – both because they are slow-movers and also because the government-corporate nexus is pushing electric and hybrid-electric cars, which are on track to become the only kinds of cars we’re allowed to buy.

The average car transacted for more than $30,000 last year. The average electric car will transact for much more.

But the monthly nut on a $30k-plus transaction is too high for about a third of the car buying population to grapple with – even when the payments are stretched out over seven or more years.

And so they rent – just like people who can’t afford to buy a house.

But there is an important difference. A house (or an apartment) is a thing of enduring value while a car is a depreciating appliance, like a washing machine or toaster.

But a house or apartment that X rented for $800 per month this year will cost the same $800 per month when Y signs the new lease next year.

Possibly, it will cost more. It is not unheard of for landlords to raise the rent.

Cars are very different.

They leak value almost from the moment they leave the assembly line – and hemorrhage it the moment they are driven off the dealership’s lot. At the end of its lease, a car is always worth less than it was worth at the beginning.

Usually it is worth about 30-40 percent less.

There is even a term for this – residual value.

As in, what’s left of its former value.

This is why payments can only be stretched so far. The new car’s price goes up, consistently – while its value goes down over time, just as consistently. That’s not good math – if you’re trying to sell new cars.

Or finance them.

Meanwhile, the ex-lease car goes on the used car market – where it will be sold for 30-40 percent less than its original value.

This is very good news for people in the market for a used car.

But the unprecedented deluge of ex-lease cars that are now flooding the market is very bad news for those trying to sell new ones. Because of the alternative they present to high-priced new cars. Keep in mind that most of these ex-lease cars are hardly used cars. Most will have less than 50,000 miles on them – and be less than five years old.

These cars may have lost 30-40 percent of their original value, but most have plenty of life left.

When good used cars were hard to find, it made sense to buy new – particularly for people who haven’t got the time, interest or ability to nurse along a fixer-upper.

This is what has driven the record-high number of new car sales (and leases) over the past ten years, since the crash of ’08.

One reason good used cars were hard to find circa 2008 was that Uncle had so many crushed. You may recall the odious Cash for Clunkers program.

We may see a repeat of this orgy of gratuitous destruction – in order (as before) to “stimulate” demand for new cars.

Another ominous harbinger of something not-good coming is the news last week that the private banking cartel which controls the country’s money supply – the “federal” Reserve – will be raising interest rates.

Dracula just saw the dawning sun.

Even a slight uptick in the cost of money will result in more leases – and an ongoing tsunami of hardly used off-lease vehicles flooding the market, each successive wave stronger than the last.

The car industry is utterly dependent on ready credit – and cheap money. If a third of new car “buyers” can’t – and have to lease – because the monthly payment is too high when there is no (or almost no) interest tacked onto the bill, what will happen when it is?

And what will happen 40 percent – or even 50 percent – of all new car transactions are leases? Will everyone sign up for perpetual revolving debt? Or will the government simply order the destruction of hundreds of thousands of owned cars in order to “stimulate” demand for the new ones fewer and fewer of us can afford to buy?

Consider it fair warning – like that odd lump in the water, way out in the middle of the ocean.

1992 Honda Accord EX just turned 80k, still running strong.

Comment: With good maintenance, should go out to 300K-400K. I have almost 350K on my Dodge pickup. Encountered some guy in the next town who has close to 425K on his vehicle.

Question: How do you manage to put less than 4K per year on your vehicle?

Own more than one, but the trick is being able to afford the maintenance and upkeep.

Park the one vehicle that gets less mileage part of the season and only drive it locally. Use the others for trips and daily driving until achieving beater status, but keep ’em in running condition.

Easy to do if you have two earners in the family, your job is twenty minutes from the house, and your wife drives a Prius.

My 2002 Honda Accord EX has 220000 miles on it.

My 2002 Silverado has 250,000 miles and still runs great.

Car sales are falling everywhere. China, the US, Europe and Japan. Its more than just price though even if that is a high barrier. It is also demographics. Older people drive less and less until they stop driving altogether so the demand for new autos slows. In Japan where 30% of the population is over 65 and more people die every year than are born domestic demand is doomed. In the US rising housing costs and student loan debt make a new car unaffordable for many young people while at the other end ageing baby boomers worry more about having enough money to retire rather than tooling around in a $50,000+ luxury car.

You’d think the auto industry would think about building two seat autos like the original Ford Thunderbird or Mazda’s Miata or for single moms something like the Nash Metropolitan with built in child seats instead of rear seats for adults. The problem is auto companies profits come from deluxe pickup trucks and SUVs loaded with dubious features like heated seats and steering wheels and ‘entertainment packages’ as if people really need 8 speakers to listen to the radio.

Just bought a used ( previously leased) 2017 Chevy Equinox. On a cold winter morning, those heated seats are like heaven.

I pooh-poohed heated seats too. Not any more! Then I went to the next step and my 2017 Subaru even has heated rear seats. Of course I still pooh-pooh sissy stuff like air-conditioned seats (until the wife gets them?) but my arthritic hands can’t get enough of the heated steering wheel on cold days. I also admit to having a 540 watt stereo in my car too. I don’t crank it but it is very clear and easy for an old fuquere to hear.

I’ll go out on a limb and say the damn prices are too damn high.

Not sure I believe your reasons. New leases require a 3-4 thousand dollar up front payment, then a lease rate in the 400-600 per month range for the big priced items. If other facts are true, where most MID Americans have little money for any crisis or in the bank who is doing the leasing? I think it is the baby boomers who are now smart enough to see the new car loses 25% of its value quickly and the cost of maintaining an expensive car is well —- EXPENSIVE! So a lease for 3 years reduces everything and has less cost for the term. Plus they are the only ones with $$$$$, it sure isn’t the younger crowd with their student loans eating them alive.

Dave Ramsey has mentioned studies that conclude that leasing a new car is the most expensive way to purchase a new car and that you are paying the same as 14% (!!!) Interest on a lease. Yikes!!! I have yet to understand why people pay $45,000 for a new car when you can buy a good used car for $2,000. I see used Mercury Grand Marquis’s, Ford Crown Victoria’s, and Lincoln’s that are in EXCELLENT shape on my local craigslist for as cheap as $750!!! I once did some research on what is the actual cost of a new $50,000 vehicle over 7 years. I added up purchase price plus depreciation plus sales tax plus sky high insurance & personal property taxes plus interest on a 7 year loan. The total came to $117,000!!!!!!!!! No wonder the lazy, worthless, Prius driving Millenials have no money to retire on!!!! P.S. my neighbor has a 04 Buick LaSabre with 400,000 miles on it. Still going strong with no major repairs!!!

We have two LeSabres in our family fleet. A 2000 and an ’05. Any LeSabre driven where they use salt on the roads can expect to have major frame failure. All the GM full size cars from this period used garbage Chink steel and are suffering catastrophic frame failures. Try not to hit any big bumps, or else.

It is a crime as those cars were excellent otherwise. The 3.8 V6 is simply one of the best designs ever.

The Toyota Avalon is likely the best used car out there replacing the LeSabre. Car and Driver once said the Avalon is the best Buick the Japanese ever made. LOL!

The price of high miles used cars are very crazy. Yes, new cars are too expensive. My daughter ended up with a low mileage economy car for under 10 grand. I think it will last a long time. but it is small, but good on gas.kind of rough riding but she doesn’t seem to care.

Watch for mandatory replacement of airbags and associated electronics. Maybe every car 10 years or older? Failure to comply means no tag from the state, and it is un-insureable. Lots of 10 year old cars are not worth the cost of removing and replacing all the airbags. That would be easy for them to pull off. Sweeten it up a bit, and a new wave Cash for Clunkers is born.

I think they are saving this one to get rid of all the old IC cars on the road, but I have been wrong before.

I bought a 2010 Impala with 8000 miles on it. Now 58,000. Last week the dash info screen told me I need to have my airbags checked. (’03 4×4 Silverado HD diesel with 160,000 too)

Sounds about right… airbags are only helpful in a catastrophic crash (which are relatively few: 1 per 100 MILLION miles driven)… otherwise, they are nothing more than expensive boondoggles!! and the sensors STILL cant tell the difference in acceleration between a bad crash, and say, skidding into a ditch. For example my wife spun out on ice, and bumped into a large rock in a yard at very low speed, and it deployed the side airbags. Airbag manufacture got to sell us a $5k replacement …grrrrrr…..

The auto industry has made nothing I would buy for the last 12 years. I judge all vehicles by the 67 ford falcon, the 87 nissan hardbody PU, and the 90 chevy v6 PU.

I need to replace my car and will buy a s10 PU or a mazda 5 van. Both weigh about 3400lbs, get about 30 mpg on the highway, and I can sleep in the back of them on road trips.

I just saved up till I could get my 89 F150 4×4 motor rebuilt. It was in a minor rollover so I got it cheap. The motor & drive train were not damaged. Needs some body work & minor cosmetics, but not desperately. Saved again till I could get 4 new tires. I am an ‘odd man out’ compared to most people in this regard because my best friend is an ace wrench & I know how to do most stuff myself anyway.

For half the price, or much less, of a new vehicle one could rebuild a decent car. I only get older cars because in my state it’s less expensive to insure them & registration fees here are based on the auto’s age, so the older vehicles I get are less expensive to keep registered.

I have never had a brand new car. Never wanted one. Now the new stuff is so full of electronics that are very expensive to repair, which adds to the overall expense of owning new vehicles. Percentage wise, electronic problems/failures for autos these days is fairly high.

I’m easy. All I need is a vehicle to get from A to B & back. A heater & a decent stereo are the most important options for me. Next on my to do list is get the AC going in that F 150 4×4.

SamFox

A car is an asset with a constantly declining value. A car is an expense. Many times a lease makes more sense since you are going to have the expense in any case. Who cares if you own it ever?

Some cars are reliable enough that once paid for the maintenance cost is still low enough to justify keeping the car. But there is always a maintenance cost and one day the cost is greater than the value of the car.

When the sales market is soft leases can be a smoking deal. When you turn in a leased car a soft market can also give you a shot at getting the car for an under market price.

So its the market that serves us and different deals are available at different times.

The last one I bought new was in 1999, and it was a deal. Buying used ever since, and paying down debt. Next year I will be down to a mortgage, no car notes, and no CC debt on rollover (have to use it occasionally for certain purchases, but pay it off monthly now). Helps (vital) to have a wife who’s on board!