Hat tip P2

Guest Post by Martin Armstrong

Warren’s proposal is not only going to be the final nail in the coffin of capitalism and the United States but indeed, investors will migrate to China. The danger is clear. The famous legal case that led to the Supreme Court’s Right to Privacy was Griswold v Connecticut. It involved a doctor who was criminally convicted for giving married persons information and medical advice on how to prevent conception with a condom. The religious extremist took the view that the Bible said go forth and propagate and thus they imposed their religious beliefs upon the majority by criminal law.

The Supreme Court correctly created the Right to Privacy out of a simple logical conclusion. How would the state outlaw the use of a condom in marriage? How could it be enforced? Would a state policeman have to inspect before you had intercourse? Would you then have to apply for a license to have intercourse so the state would then know to send the policeman into your bedroom? In order to impose a Wealth Tax, that means the absolutely EVERYONE would then by law be compelled to list everything they own right down to your wedding rings so the state could them calculate your wealth to impose a tax. This type of tax would absolutely destroy the Right to Privacy.

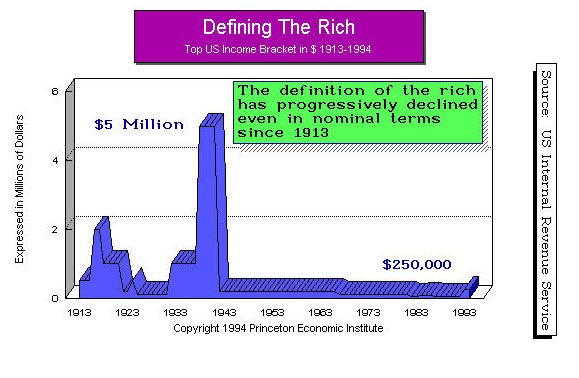

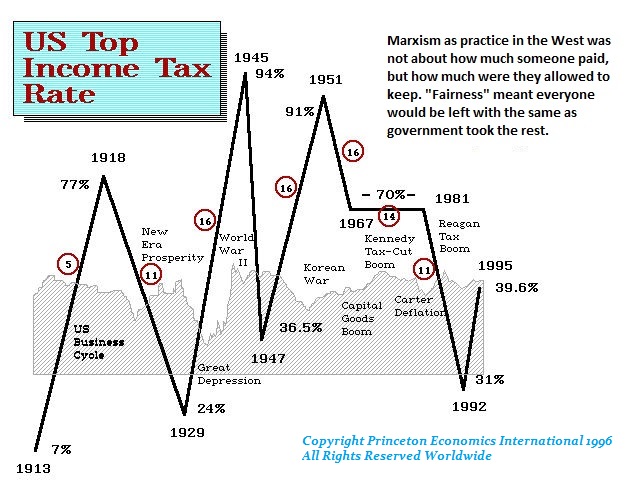

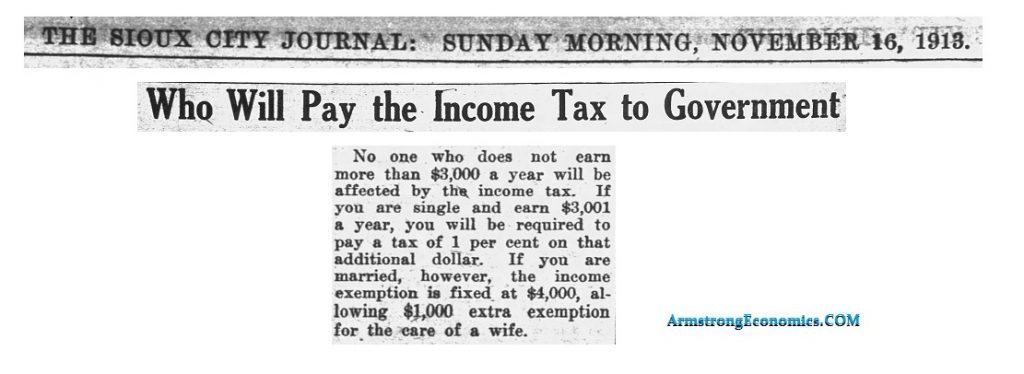

Putting the Right to Privacy aside, the government can NEVER be held to whatever it promises today. The government will always introduce a tax and claim it will only apply to the “super-rich” as she is doing – $50 million will pay 2% annually on the value government claims your assets are worth and $1 billion+ will pay 3% annually. At 8%, you will confiscate all of a person’s assets in less than 10 years. Elizabeth Warren is the new Karl Marx advocating communism in slow motion. To sell the income tax in 1913, it was to be just 1% and only on the rich. Ever since it rose to 94% and now the Democrats want to raise it to 70%. No matter what rate they say today, they will always change it.

Putting the Right to Privacy aside, the government can NEVER be held to whatever it promises today. The government will always introduce a tax and claim it will only apply to the “super-rich” as she is doing – $50 million will pay 2% annually on the value government claims your assets are worth and $1 billion+ will pay 3% annually. At 8%, you will confiscate all of a person’s assets in less than 10 years. Elizabeth Warren is the new Karl Marx advocating communism in slow motion. To sell the income tax in 1913, it was to be just 1% and only on the rich. Ever since it rose to 94% and now the Democrats want to raise it to 70%. No matter what rate they say today, they will always change it.

Those below that $50 million thresholds will cheer – go get em. They did precisely that in 1913. To sell the introduction of the income tax, they drew the line at $3,000 when a good job paid $0.30 per hour or $18 a week which was just under $1,000 a year. So to get a new tax in, they will ALWAYS place it above the majority of people and pretend they will never be impacted. This is the luxury tax I saw in Australia pitching they would tax their Ferraris, Fur Coats & French Wines. They cheered. When the tax was imposed, it included all electrical products.

Once they create a new tax under false promises, they ALWAYS change the specifics. Just as ONLY the rich would pay income tax, then comes Roosevelt’s New Deal and morally the same claims were made but suddenly they introduce the Payroll Tax and not everyone pays income tax. They will do the very same thing with a Wealth Tax. You cannot hold the government to whatever it promises. They will constantly change the rates and to whom it applies based upon they need money. They have constantly changed the DEFINITION of the “rich” and now it begins at $500,000. As the pension crisis explodes, they will need money for their own pensions like California, Illinois, and New Jersey, just to name a few. They will drop the Wealth Tax to the same level of income tax. Regardless, EVERYONE will have to report their total wealth in order to make sure you are paying your Wealth Tax.

Once any new form of taxation is introduced, then politicians will ALWAYS raise the rates and lower thresholds as they continually need a never-ending source of other people’s money. The $50 million thresholds will crash to normal levels and the criteria will change for everyone. Every person will have to report their entire wealth right down to inheritance or else the government will be unable to confirm you are under the $50 million entry level. There are a lot of “super-rich” kids who inherited companies rather than cash. If your father’s company was worth $1 billion, how do you get $30 million in cash to pay taxes without liquidating at least part of the company? Then you have to pay that EVERY year!

Once any new form of taxation is introduced, then politicians will ALWAYS raise the rates and lower thresholds as they continually need a never-ending source of other people’s money. The $50 million thresholds will crash to normal levels and the criteria will change for everyone. Every person will have to report their entire wealth right down to inheritance or else the government will be unable to confirm you are under the $50 million entry level. There are a lot of “super-rich” kids who inherited companies rather than cash. If your father’s company was worth $1 billion, how do you get $30 million in cash to pay taxes without liquidating at least part of the company? Then you have to pay that EVERY year!

Warren’s tax will cause a collapse in investment which means that unemployment will only rise. When people appear to make a fortune because their company goes public, they have restrictions that prevent them from selling for a period. A wealth tax will be applied simply based upon values of shares they cannot sell. This would certainly lead to a mass exit of the upper-class the very same as what took place in France – they just left!

Like the income tax, Warren’s Wealth Tax will move to 100% application to everyone because of some new event or war. Since we are already in a collapsing state of socialism, they will argue to raise this new Wealth Tax to save government pensions. Effectively, we will have a NATIONAL property tax that will include your home and then you will have to pay income tax on top of that. The pension funds will become a national emergency and the shift to increasing taxes will take place exactly as we are witnessing in California – if it moves, tax it; it fails to move tax it; and if it has any use whatsoever (like water) tax it.

Back in the ’90s, I was working to trying to Privatize Social Security to invest in equities rather than 100% government bonds and reform taxes by moving to a national retail sales tax (indirect) and eliminating the income tax. I was shuttling back and forth between the Speaker of the House Dick Armey and Bill Archer who was Chairman of the House Ways & Means Committee. Dick served in Congress between January 3, 1995 – January 3, 2003. I was sitting in Dick’s office. He had his feet up on the desk with his cowboy boots while smoking a cigar. He said to me that he could not support a retail sales tax because he did not believe he would be able to terminate the income tax. He then said to me that when the political cycle would change, as I told him our computer was projecting, then the Democrats would have both taxes. It was at that moment when I gave up. I told Dick he was absolutely correct. Without restoring the Constitution to prohibit direct taxation, it was hopeless to save the future no less Social Security. I made my decision to stop the nonsense of thinking I could prevent the future economic disaster. All I could do was advise my clients to help them survive not the nation.

Back in the ’90s, I was working to trying to Privatize Social Security to invest in equities rather than 100% government bonds and reform taxes by moving to a national retail sales tax (indirect) and eliminating the income tax. I was shuttling back and forth between the Speaker of the House Dick Armey and Bill Archer who was Chairman of the House Ways & Means Committee. Dick served in Congress between January 3, 1995 – January 3, 2003. I was sitting in Dick’s office. He had his feet up on the desk with his cowboy boots while smoking a cigar. He said to me that he could not support a retail sales tax because he did not believe he would be able to terminate the income tax. He then said to me that when the political cycle would change, as I told him our computer was projecting, then the Democrats would have both taxes. It was at that moment when I gave up. I told Dick he was absolutely correct. Without restoring the Constitution to prohibit direct taxation, it was hopeless to save the future no less Social Security. I made my decision to stop the nonsense of thinking I could prevent the future economic disaster. All I could do was advise my clients to help them survive not the nation.

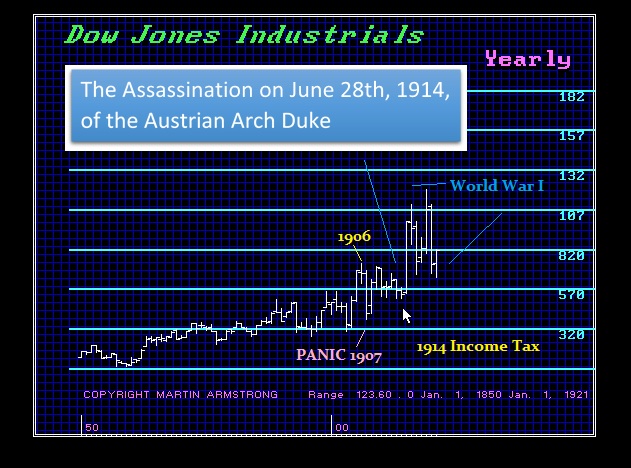

War is a great excuse, which is why politicians like war for it justifies raising taxes and introducing new powers like the Patriot Act. Make no mistake about it, when they introduced the income tax, the economy plunged into a steep recession in the face of the income tax. INVESTMENT dried up and the stock market shifted buyers. Americans were sellers and Europeans were the buyers as SMART money began to move out of Europe. It had been the assassination on June 28th, 1914, in Sarajevo, Bosnia and Herzegovina of the Austrian Arch Duke which began to increase the tensions.

War is a great excuse, which is why politicians like war for it justifies raising taxes and introducing new powers like the Patriot Act. Make no mistake about it, when they introduced the income tax, the economy plunged into a steep recession in the face of the income tax. INVESTMENT dried up and the stock market shifted buyers. Americans were sellers and Europeans were the buyers as SMART money began to move out of Europe. It had been the assassination on June 28th, 1914, in Sarajevo, Bosnia and Herzegovina of the Austrian Arch Duke which began to increase the tensions.

But a 43-month economic boom ensued from February 1915 to 1918, first as Europeans began purchasing U.S. goods for the war and later as the United States itself joined the battle. It was February 1915 is when the Ottoman forces attacked the Suez Canal and Germany defeated a Russian army in Poland. Eventually, the long period of U.S. neutrality made the ultimate conversion of the economy to a wartime base. The economic boom led to real plant and equipment expansion in response to the increased demand from both Europe and the United States.

Those who are in the “rich” category earn their money from INVESTMENT not wages. This is what Elizabeth Warren is addressing for she wants a tax on wealth – not income. So if you owned $100 million of a stock that was valued at that level because of a bull market, you will then have to pay 2% – $2 million. The stock crashes by 50%. You now pay 2% again every year of the current value of $1 million even though you lost $50 million. This type of Wealth Tax will unquestionably destroy INVESTMENT. You can lose and get no credit for a loss.

What this will do is far worse than the proposed 70% income tax for the new “Green New Deal” of Alexandria Ocasio-Cortez. This dynamic-duo of Warren and Ocasio-Cortez will absolutely complete what our model is forecasting – the end of the United States. Both are completely ignorant of how the economy even functions. They lick their lips at other people’s wealth and just want to get their hands on it to fund their wild ideas of some Green New Deal.

What this will do is far worse than the proposed 70% income tax for the new “Green New Deal” of Alexandria Ocasio-Cortez. This dynamic-duo of Warren and Ocasio-Cortez will absolutely complete what our model is forecasting – the end of the United States. Both are completely ignorant of how the economy even functions. They lick their lips at other people’s wealth and just want to get their hands on it to fund their wild ideas of some Green New Deal.

“The Green New Deal we are proposing will be similar in scale to the mobilization efforts seen in World War II or the Marshall Plan… Half measures will not work… The time for slow and incremental efforts has long past [sic].” – Alexandria Ocasio-Cortez, then-candidate for the U.S. House of Representatives, Huffington Post, June 26, 2018

This manifesto is very serious for they reject gradual change but are demanding immediate change to the economy. What has taken place among the Democrats is a band of newly elected members of Congress is accepting the leadership of Alexandria Ocasio-Cortez to push forward for this Green New Deal by sheer force. She is calling her proposal the most significant blueprint for system change in 100 years.

The core idea demands the mass conversion to renewable energy and zero emissions of greenhouse gases in the U.S. by 2030. Yes – Global Warming is a great excuse to raise taxes. They argue that a transition is not acceptable for it must be immediate action by the elimination of greenhouse gas emissions from our multi-trillion-dollar food and farming system they claim is long overdue because farming and cows represent a degenerative food system generates that accounts for 44-57% of all global greenhouse gases.

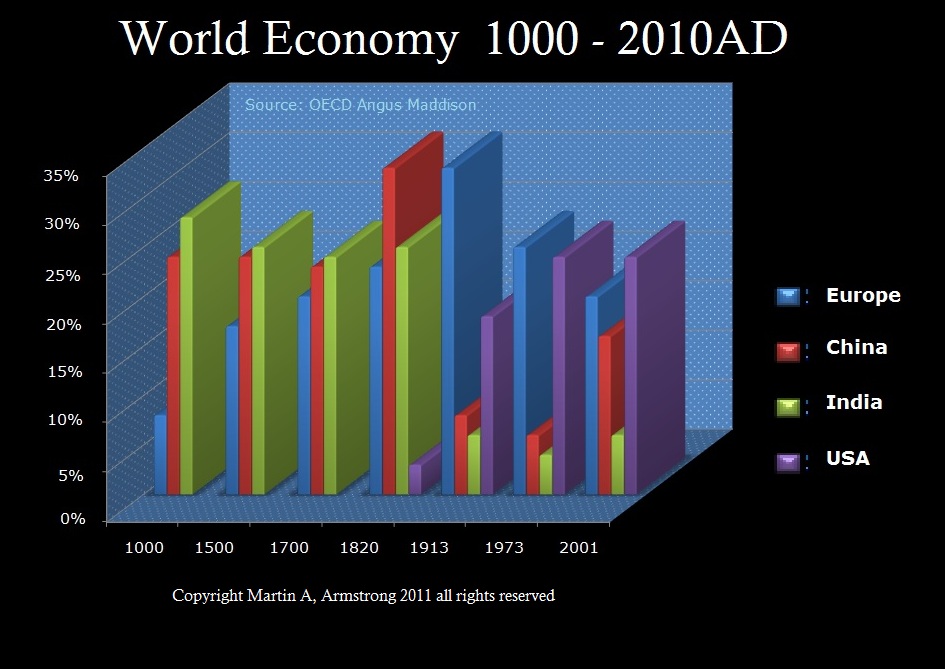

Warren’s proposal will destroy the economy and lower economic growth providing the strongest incentive for capital to migrate to China. As Europe and the United States spiral downward economically, this is how our model will be correct in the shift from the United States to China of the title – Financial Capital of the World. India and China were where all the wealth was which peaked during the early 19th century. After the fall of Rome and them Byzantium, the Financial Capital of the World began to migrate to India. That peaked by about the 14th century as India gradually declined and it moved to China.

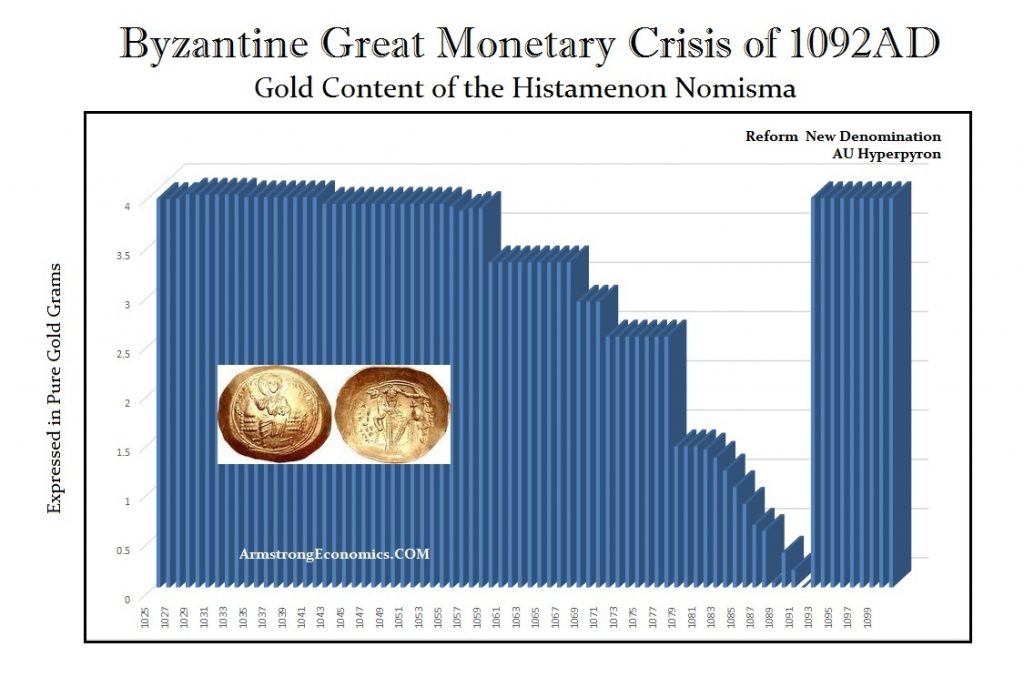

Following the Great Monetary Crisis of 1092, the Financial Capital of the World migrated to India – the land of the Spice Trade. Southern India has long imitated Roman gold coins to facilitate the local economy. We begin to see actual India coins but only under the Kushan Empire. Southern India continued to mint Roman imitations until the mid 3rd century AD. After that period, we begin to see actual India gold coins being struck showing that governments began to win the confidence of the people.

Following the Great Monetary Crisis of 1092, the Financial Capital of the World migrated to India – the land of the Spice Trade. Southern India has long imitated Roman gold coins to facilitate the local economy. We begin to see actual India coins but only under the Kushan Empire. Southern India continued to mint Roman imitations until the mid 3rd century AD. After that period, we begin to see actual India gold coins being struck showing that governments began to win the confidence of the people.

India’s economic boom period lasted about two Pi Cycles of approximately 630 years. The time period that it had captured the title of the Financial Capital of the World appears to be only about 224 years. China’s rise also lasted about 224 years. The rise of the United States has come into play for also about 224 years.

It’s just time. So thank you Warren and Ocasio-Cortez for ensuring our model will be correct once again. What these people refuse to ever look at is that the government is incapable of ever managing anything. Economic growth declines with rising taxation and regulation. No matter how many examples there are of how socialism destroys economies right down to present day Venezuela, they just cannot help themselves trying to change the very nature of human behavior. Any one who believes this tax will stay at $50 million+ is an absolute fool. History would beg to differ.

It’s just time. So thank you Warren and Ocasio-Cortez for ensuring our model will be correct once again. What these people refuse to ever look at is that the government is incapable of ever managing anything. Economic growth declines with rising taxation and regulation. No matter how many examples there are of how socialism destroys economies right down to present day Venezuela, they just cannot help themselves trying to change the very nature of human behavior. Any one who believes this tax will stay at $50 million+ is an absolute fool. History would beg to differ.

Will this end up causing a mass exodus of Americans? Yes! It will simply be time to turn out the lights and leave. This is how the United States will be destroyed like every other empire. Far too often there ends up more people in government living off the tax collections disprotionately to the living standards of the people paying taxes.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

If every single dime was taken from the top 20% in America it would run the government for maybe 6 months and then there would nothing left to take and it would be goodbye America.

If government were the proper size, you wouldn’t need an income tax at all.

How many times have I heard we have privatized gains and socialized loses?

Privacy? Anyone born today or anyone with no real wealth already has no financial privacy. The rich have financial privacy (from what I know anyway).

If wealth/income inequality wasn’t as distinct as it is now, would these kinds of ideas be batted around?

No cost is too high when utopia is your shining-eyed goal. (AKA: the banality of evil.)

I realize the left could abuse a wealth tax just as they did an income tax or the estate tax but that is not an argument against any of them. Revenue has to be raised through taxation so some method has to be used and a wealth tax is better than an income tax for the simple reason that income is earned and someone thinks you are worth your pay otherwise they wouldn’t hire you or buy your services. We can say that an actor, a singer or doctor earns too much money but we don’t have to buy what they sell.

OTOH why should we not tax Stephen A. Cohen for his art collection. He doesn’t display it for the public to enjoy like Mr. Getty did with his museum. If he buys a $100 million Van Gogh it hangs on his mansions wall. We tax the mansion based on its value why not the art inside? The point would be to lower the income tax as we want people to MAKE more money as that benefits us all. Take my hypothetical doctor. He could perform surgery on Wednesday or play golf. What does our society want him to do? If we tax his marginal income at a high rate he may decide golf is a better use of his time. He already makes enough to live comfortably so taxing his marginal income at a high rate discourages him from working more.

OTOH taxing wealth would encourage those with vast fortunes to put more of their capital to work as investments in productive assets not in the work of long dead artists or antique cars. Stephen A. Cohen might decide he doesn’t need to buy another $100 million dollar painting if he has to pay a $1 or 2 million dollars per year to keep his first Van Gogh hanging on his wall. He would need to generate enough income to pay his wealth tax so some percentage of his fortune would have to be invested in productive assets not art.

Where an excess of power prevails, property of no sort is duly respected. No man is safe in his opinions, his person, his faculties, or his possessions. – James Madison

And what in the hell does that have to do with taxation??? Madison, I can assure you needed revenue to run the government. We are going to have to tax something. Perhaps stupidity. It would put you in the top tier tax bracket.

If you were conversant with the history of the US, you would know what Madison said and it’s relation to taxation. Did Madison need taxes to run his Dept of Education? How about his EPA? His HUD? His NASA & NOAA? I could go on. But you probably still don’t understand.

Spoken like a true tyrannical central planner.

OK Mr “Liberty” what would you tax? Stupid comments? Sheesh!

Taxation is pure theft as a means for eliminating the need for government accountability for the “services” its provides and whether or not anyone actually wants them. In the private business world, you offer up a service and if enough people purchase it, you stay in business. Others offer up similar or superior services, and the consumer wins with great choices (including the right to not purchase at all). Not so with government. THEY decide what you will have, whether you want it or not, and they TAX you because they know that if all they did was offer services for a cost, they would go out of business overnight, or the services that THEY wish to “provide” would not actually be wanted. Shut down the government completely. Allow a fully competitive, private market in services, to deliver to the people what they desire. I carefully thought out what I would say to your rambling post, and the first thing that came to my mind was that you sounded exactly like EVERY central planning tyrant in history. You have an answer for everything, and a formula for getting everyone in society to act exactly as YOU would have them act for “everyone’s” best interest. Like Hitler, Stalin, Mao, FDR, and all the rest, didn’t say similar things. Clearly I don’t seem to be the only one who disagrees with your micromanagement of everyone’s lives, approach to our economy and FREEDOM.

So, dumbshit does not understand that wealth includes productive capital? Dumbshit does not understand that wealth was taxed when it was earned, and so why should it ever be taxed again? Dumbshit says that because it is ok to tax a mansion it is ok to tax what is in it, never stopping to think that it is not ok to tax the mansion, and hence the equivalence made is a fallacy.

No stupid! I want to lower INCOME TAX but to do that we have to raise the revenue from someone. How about John “The Gigolo” Kerry or Alice Walton. What in the hell did they ever ‘earn’. The answer is not much. Maybe old man Heinz or Sam Walton worked their butts off but , e.g. if Sam Walton owned 50% of the stock of Walmart in 1970 when it was cheap why should his children still own 50% today when it is dear?

No, we do not have to raise the revenue from someone else so fuck that. Our career politicians love to make a promise they can’t keep in exchange for a vote.

The full faith and credit of the United States hinges on the governments ability to tax it’s producing citizens as the government produces nothing of value it can exchange for revenue, or just create more money that the tax serfs have to deal with later.

As a small business owner I would have gone out of business in my first few years if I thought I could overspend and simply charge my customers more money every time I overspent my budget.

I find it odd that the debate about taxes always revolve around who to tax more, and never the government needs to learn to control spending.

Card is 100% right – not unusual for him. We do not need to raise revenue – it is not a revenue issue, it is a damn expenditure issue. unit472 is too stupid to understand that.

The simply answer to the moronic question from unit re the Waltons is that the money was earned, and taxes paid upon it. So by natural justice, it should be their right to do with it as they please – including passing it to their children.

I do admit to being torn by this issue, however, as passing wealth generation to generation does tend to create a type of royalty. However, children and their children very often tend to lose the wealth of the founder over time, so it does generally tend to self-limit.

And dumbshit unit seems not to understand that the wealthy already pay all the income tax, and that over 50% of the population pays none whatsoever? Just why does unit want to reduce the tax on the “wealthy” just to tax the “wealthy”?

It’s also idiotic to think that a wealth tax will allow for lower income tax rates. It’ll never happen. Youll just have both. Dick armey was 100% correct. Our current deficit is over a trillion dollars. Just wait until the Medicare trust fund runs out.

I am by no means wealthy, but I do own a house and I make a comfortable 5 figure income. Anyone that thinks this ‘wealth tax’ wouldn’t eventually reach people like me is too stupid to even argue with.

You are expressing the attitude Armstrong is condemning in the article. Using your art example we would see no one able to make a living as an artist because the art would be taxed forever. No one would buy anything as every single additional possession diminishes personal resources. Eventually everything up to and including your underwear and toothbrush would be a liability and eventually government property.

Armstrong correctly sees the idiot patrol’s fantasies as the end of it all.

Au contraire. Is everyone on this forum retarded? Da Vinci has been dead for half a millenium. How does buying his art help the contemporary artist? To help you out it doesn’t. OTOH if Leonardo’s works were in a museum, people who want own ‘future masterpieces’ would have to buy them from someone working today… as an artist!

Unit – you have assumed the mantle of village idiot.

Why does buying art have as a requirement to help a contemporary artist? Fuck that. I should be able to buy an damn thing i want with money that has already been taxed, without having it taxed again – in perpetuity – for the mere act of having earned it in the first place.

You just explained communism to a “T” thank you for that bullshit of a authoritative comment.

it may be too late to save the usa no matter what we do but imo we are looking at this wrong–

we need to start by disbanding the fsa at all levels and by changing people’s perceptions of why we have a tax system,which is to fund the govt,not set social policy–

how about some realistic ideas on how we cut govt expenditures?

The socialist definition of wealthy is anybody that has more than ones self. The temptation to have the government steal from others for personal benefit is great.

The issue the “wealthy” have is that the US is the only nation, with a partial exception of Eritrea, that taxes its citizens on their world-wide income. US citizens are tax slaves wherever they are on earth, for life. And getting out of bondage is no easy feat these days, I assure you.

Serious question: will things get worse or better with expanding income/wealth inequality?

If things get worse, what do you expect people to vote for? Knowing the answer to that question would lead you to make what changes?

If your answer is less taxes, show me how that would reduce tensions between the classes.

The fact is, on any quantifiable measure, world-wide individuals are better off today than at any time in history. Things are better off all the time, taking the world as a whole. Inequality is discussed because of relativeness, not because of absolute measures. It is a matter of envy, and nothing more.

I do not care how much anyone else has, if it is earned honestly. I could care less about tensions between classes. The US has no poor by any absolute measure of poverty. If the non-poor want to cut their own throats by destroying the system that has eliminated poverty, because they are envious of those with more, then stupid is as stupid does.

Llpoh, what would you do about the American oligarchs who have stolen the wealth of our nation. Let’s not talk about earners, we are on exactly the same page there, let’s talk about the people who have stolen their wealth. Borrowing counterfeit FED money at 0% and buying up the productive assets of the nation. Do you believe they have earned this? Do you believe they should be able to keep this? I don’t. I don’t care what mechanism we use to sort this out. And we’re going to have to sort this out, or socialism is going to look better and better to the people with no hope for a better life.

Star – my caveat is earned honestly. Most billionaires I put in this category, such as Bezos, may he rot, etc. . Goldmansucks types, not so much.

You will need to be more specific – name names and crimes – for me to comment further. As I said, there is no poverty in the US by any objective measure. Every “poor” person has a mobile, Nikes, a fridge, big screen TV. The issues are relative not absolute. And that will always exist. There can be no changing that.

You said enough. I missed your caveat. We’re totally on the same page. I’m not going to name names, there’s no reason for us to make enemies that we don’t even know.

Thanks star. You are a gentleman.

LLPOH, I think you are missing my point.

Point: Human nature, as it is, will never change. Envy and greed are both sins and are related. Many many times the rich have been slaughtered.

Envy and greed will always exist. But ONLY with the direct assistance of the guns and “legal” violence of the state/government, can they truly be exploited against the will of the rest of society. Without government assistance (regulations, easy money, easy credit, permits, tariffs, taxation, subsidies….an even longer total list), the ONLY way someone can exploit their greed, is either by stealing from others (a crime that everyone agrees is a crime), or by providing great products and/or services in a competitive marketplace, that meet the needs of vast numbers of voluntary consumers. In our contemporary world, I contend that virtually NOBODY who is filthy rich – including Mr. Bezos, Mr. Gates, and others, got that way COMPLETELY on their own. I always remind people that as 25% of all PCs are owned by the government, and file sharing, etc. is more easily accomplished with similar computer formats, the presence of that massive influx of cash to Microsoft, AND the resulting purchases by vendors and other dealing with the government, gave him a massive advantage that others never had….as one example.

There are entire organizations…legal organizations that are nothing but theft. Taxation is theft but show me any place on earth where there is no tax.

Unit makes a good point…why go after (tax) income more than wealth? To make it more difficult to challenge the rich?

I mention Greed and envy together most of the time because they both cause much problems. Human nature as it is will go after the rich if they “feel” they have been wronged/exploited. The US citizen is being abused if for no other reason than (I believe) greed. Low income illegals willing to work for shit wages plus the greed for more power by politicians to get votes.

a buddy sent me this a couple of days ago& being king of the procrastinators local,i had not erased it–

if we’re lucky,this is the worst that will happen to us,and this ain’t pretty–

Tampa, are you saying Democrats are the only party that overspend? Lol

What happened to Argentina is and was bound to happen here as well. Its baked into the cake no matter how you slice it.

No one has the right to stick their hand in my pocket no matter how he wishes to define it. Taxation is theft pure and simple.

If taxation without consent is robbery, the United States government has never had, has not now, and is never likely to have, a single honest dollar in its treasury. If taxation without consent is not robbery, then any band of robbers have only to declare themselves a government, and all their robberies are legalized. Lysander Spooner

Spooner established this over a hundred thirty years ago and now more than ever remains irrevocably true.

do you mean consent of the governed as a group or consent of the individual?

I think we are waaaaay beyond that point.

yep,but if we had the will we could engineer a moderately hard landing for our kids/grandkids,but i don’t see it happening–

along w/the no nips rule could we add a no injuns rule–

I appreciate your work in putting your website together however I will not contribute or follow it any longer due to the terrible “You May Like” attachments. I don’t open them but you do not have to. The image is repulsive enough.

Arlis Owen

Moore, SC