Authored by Lance Roberts via RealInvestmentAdvice.com,

Last week, Jeff Desjardins of Visual Capitalist wrote in a post:

“While it’s true that putting your money on the line is never easy the historical record of the stock market is virtually irrefutable: U.S. markets have consistently performed over long holding periods, even going back to the 19th century.”

This goes back to Wall Street’s suggestion of “buy and holding” investments because over 10- and 20-year holding periods, investors always win.

There are two major problems with this myth.

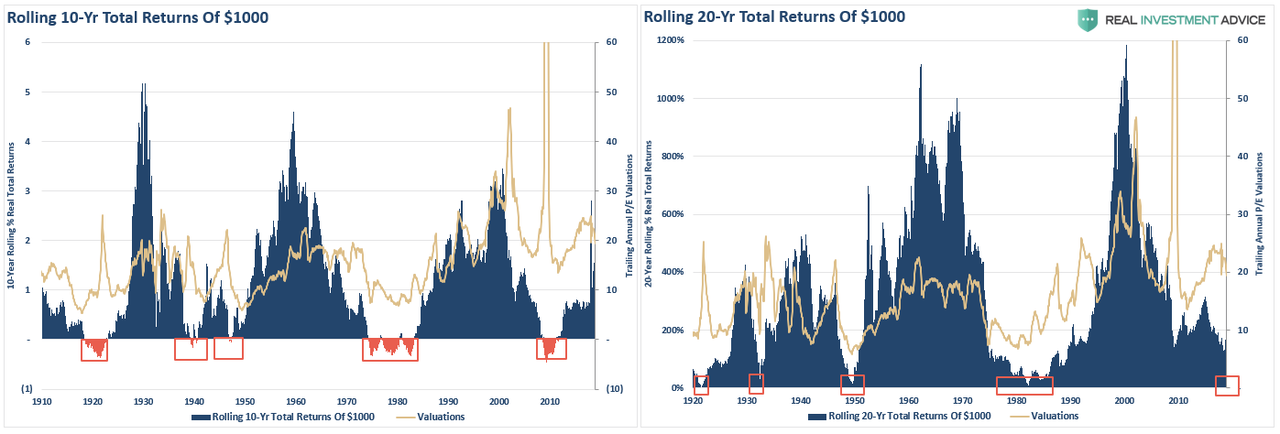

First, on an inflation-adjusted, total return basis, long-term holding periods regularly produce near zero or negative return periods.

Secondly, given that most individuals don’t start seriously saving for retirement until later on in life (as our earlier years are consumed with getting married, buying a house, raising kids, etc.,) a 10- or 20-year period of near zero or negative returns can devastate retirement planning goals.

It should be obvious, when looking at the two charts above, that WHEN you start in investment journey, relative to current valuation levels, is the most critical determinant of your outcome.

(We have written a complete series on the Myths Of Investing For Long-Run. Chapters 1, 2 & 3 cover the concepts above in much more detail)

Baby Boom Generation Should Be Rich

Let’s look at this differently for a moment.

The financial media and blogosphere is littered with advice on how easy it is to invest. As noted above, over long-periods of time there is absolutely nothing to worry about, right?

Okay, let’s assume that is true.

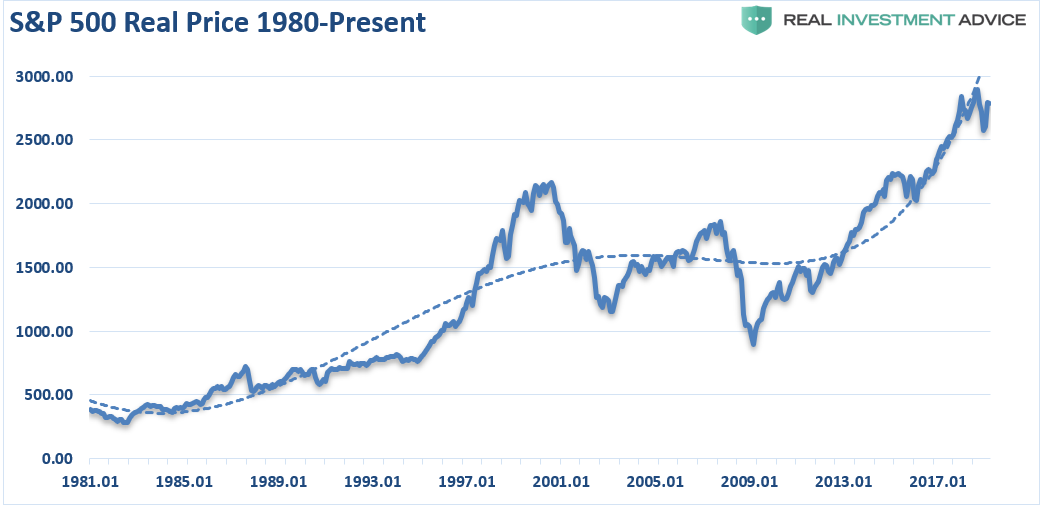

The “Baby Boom” generation are those individuals born between the years of 1946 and 1964. This means that this group of individuals entered the work force between 1966 and 1984. If we assume a bit of time from obtaining employment and starting the saving and investing process, most should have entered the markets starting roughly in 1980.

So, despite the little “flatish” period of the markets between 2000 and 2013, the markets have been in a extremely long rising trend. (One could argue the bull market which began in 1980 is still going.)

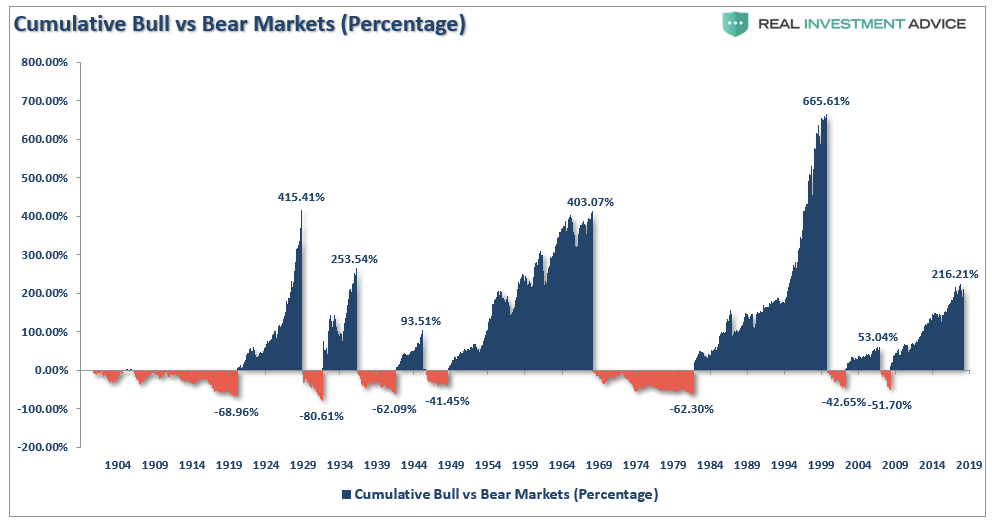

And, if we look at it the way the financial media and most financial advisors show it, the bull markets have exploded personal wealth historically. (The chart below is the cumulative percentage gain (real total return) of the S&P 500 index.)

Despite those two little minor percentage drawdowns, baby boomers have been fortunate to participate in two massive bull markets over the last 38-years.

So, given this steadily rising trend of the market, most individuals should be well prepared for retirement, right?

The why isn’t that case. Let’s take a look at some of the myths and facts.

Myth: Everyone contributes to a retirement plan.

Fact: Not so much.

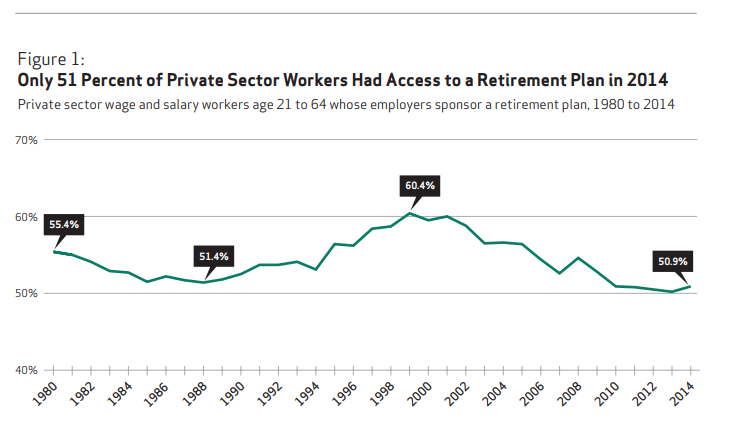

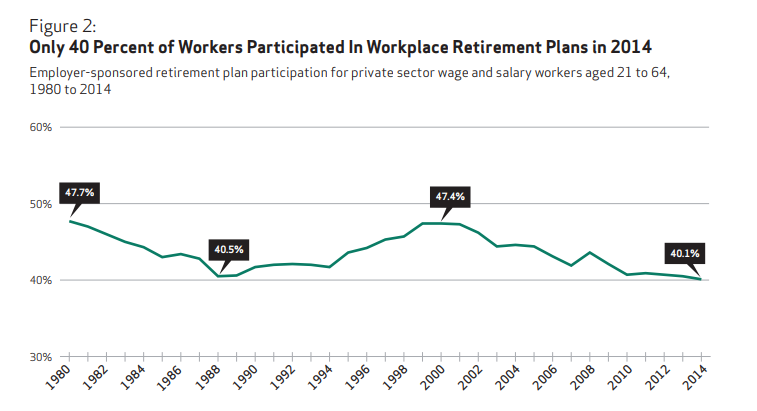

According to a recent NIRS study only 51% of Americans have access to a 401k plan.

More importantly, only 40% of individuals actually contribute to one.

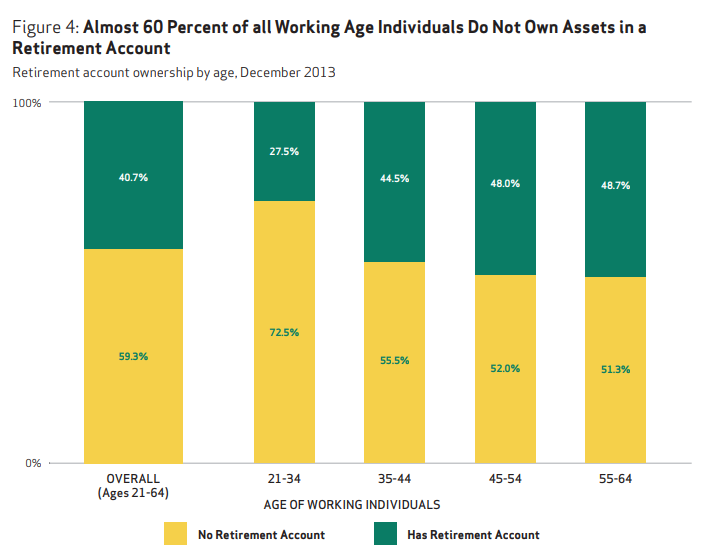

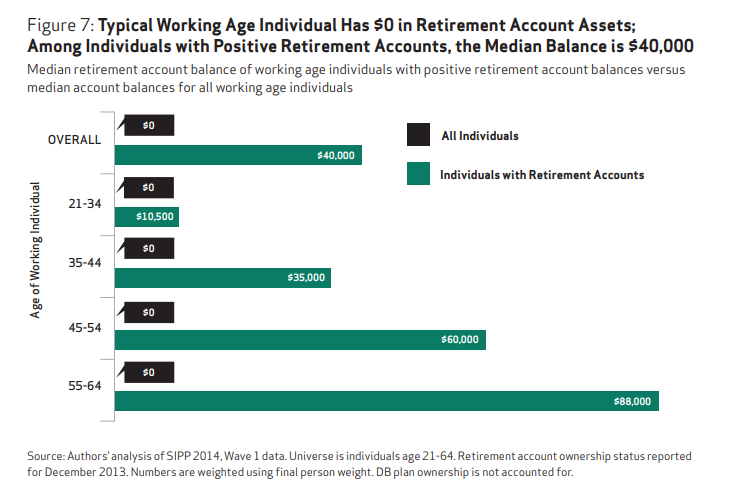

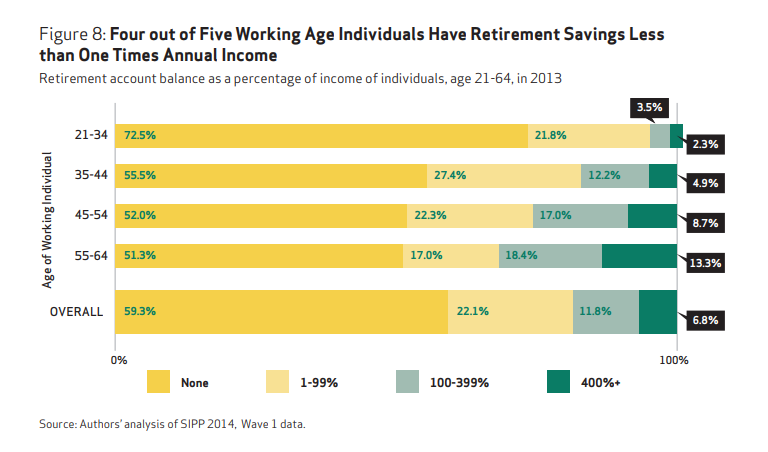

Here is another way to look at it. Almost 60% of ALL WORKING AGE individuals DO NOT own assets in a retirement account.

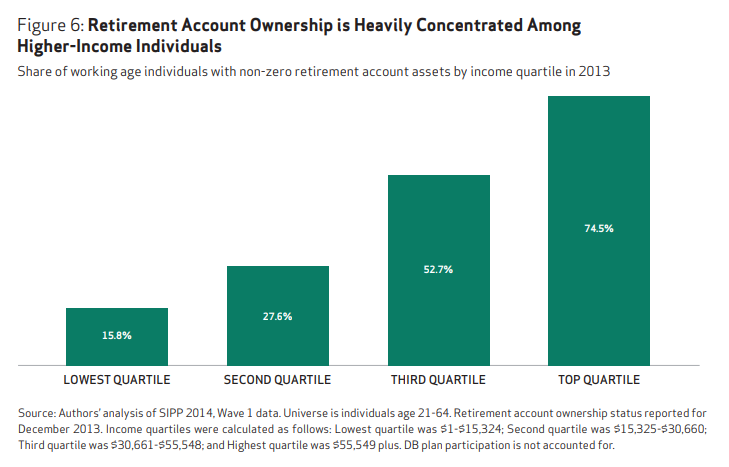

And of those that do own retirement accounts the majority are of the wealth, unsurprisingly is owned by those with the highest incomes.

It’s actually worse than that.

The typical working-age household has only ZERO DOLLARS in retirement account assets. Importantly, “baby boomers” who are nearing retirement had an average of just $40,000 saved for their “golden years.”

Lastly, only 4-0ut-of-5 working-age households have retirement savings of less than one times their annual income. This does not bode well for the sustainability of living standards in the “golden years.”

Myth: Individuals save money in lot’s of other ways.

Fact: Not so much.

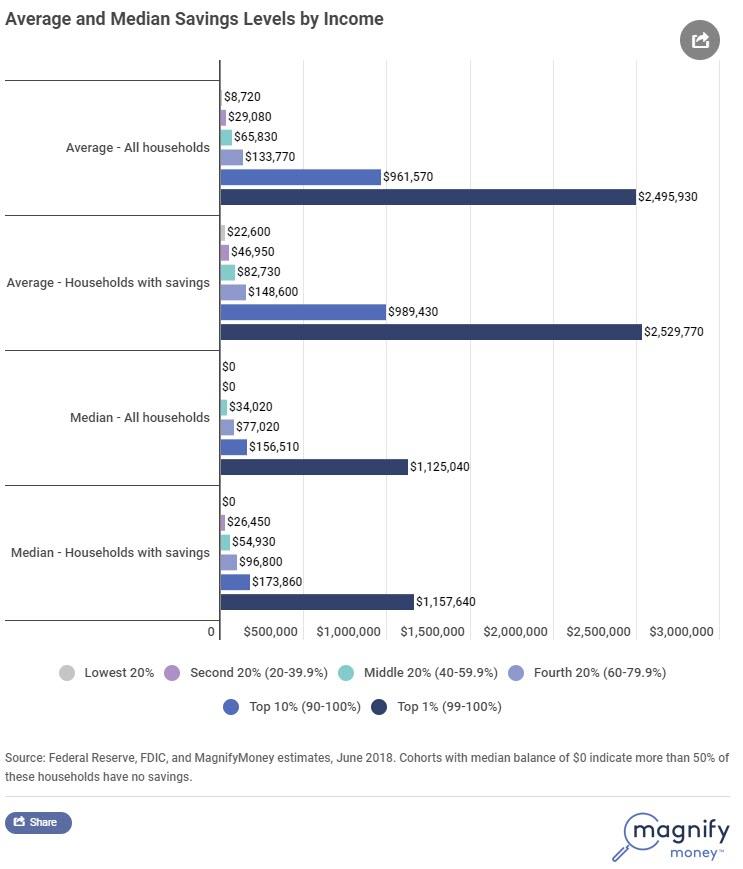

According to the study by MagnifyMoney:

“Although the average American household has saved roughly $175,000 in various types of savings accounts, only the top 10 percent to 20 percent of earners will likely have savings levels approaching or exceeding that amount. 29 percent of households have less than $1,000 in savings.”

So, What Happened?

If investing is as easy as the financial media and advisors portray it to be, then why is the vast majority of American literally broke?

Go back up to that S&P 500 cumulative percentage gain and loss chart above.

That is the most deceiving chart ever made to convince individuals to plunk their money down in the market and leave it.

As Mark Twain once quipped:

“There are three kinds of lies. Lies, damned lies, and statistics.”

Using percentages to dispel the impact of losses during bear market declines false into the “statistics” category.

If the market rises from 1000 to 2000, it is up 100%. However, if it then falls by 50%, you don’t lose just 50% of what you gained. You lose 50% of everything.

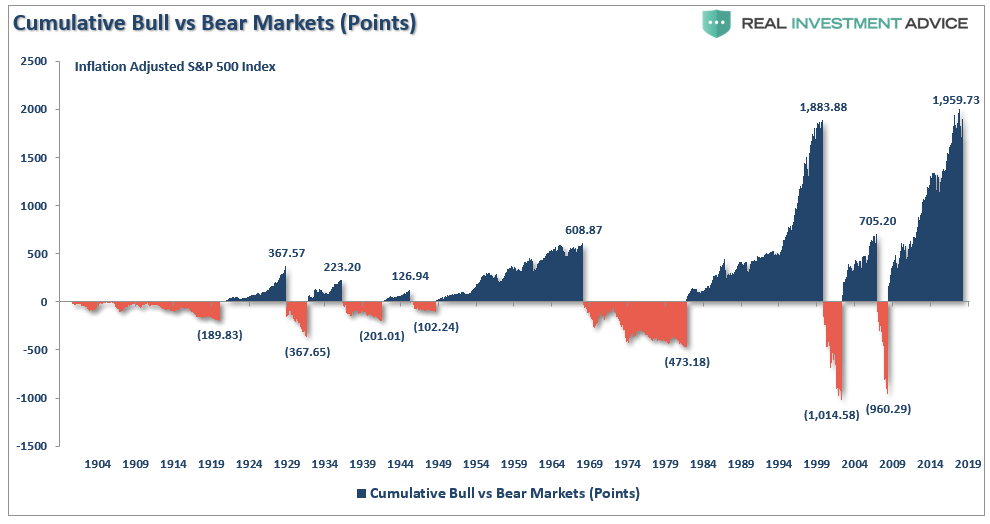

If we revise the chart of the real, total-return, S&P 500 chart above to display the cumulative gains and losses in points, rather than percentages, the reality of damages from bear markets is revealed.

You will notice that in every case, the entirety of the previous bull market advance was almost entirely wiped out by the subsequent decline.

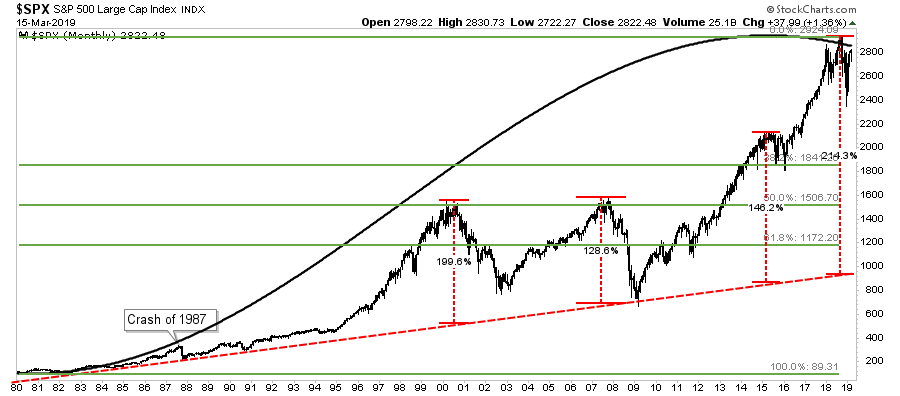

So, what happened to all those baby boomers? Well, let’s walk through the sequence:

- Age 30’s: In 1980 the “baby boomer” generation is working, saving, and participating during one the 80-90’s bull market.

- Age 50’s: From 2000 to 2002, the “Dot.Com” crash cuts their savings by 50%.

- Age 53-57: From 2003-2007 the full market grows savings back to their previous level in 2000.

- Age 57-58: The 2008 “Financial Crisis” wipes out 100% of the gains of the previous bull market and resets savings values back to 1995 levels.

- Age 58-63: From 2009-2013 financial markets rise growing savings back to the same levels in 2000.

At the age of 63, “baby boomers” are staring retirement in the face. Yet, because of the devastation of two major bear markets they are no closer to their retirement goals than they were 13-years earlier.

This problem is clearly shown in the retirement statistics above.

But it is actually worse than that.

From 2008 to present, the S&P 500 has more than tripled in value. Yet, as shown by the table from Fidelity investments below which is a great sample size for most Americans, 401k accounts and IRA’s barely even doubled.

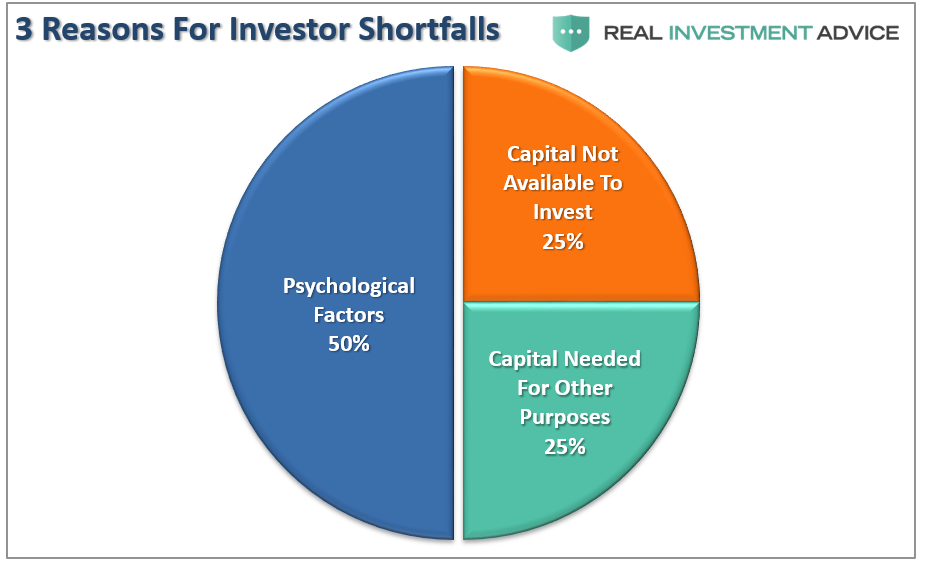

The reason, of course, is psychology. Despite the best of intentions, psychology makes up fully 50% of the reason investors underperform over time. But notice, the other 50% relates to lack of capital to invest. (See this)

These biases come in all shapes, forms, and varieties from herding, to loss aversion, to recency bias and are the biggest contributors to investing mistakes over time.

These biases are specifically why the greatest investors in history have all had a very specific set of rules they followed to invest capital and, most importantly, manage the risk of loss. (Here’s a list)

The problem that is unfolding for investors going forward is that while the mainstream financial press continues to extol the virtues of investing in the financial markets for the “long-term”, the assumptions are based on historical data which is not likely to repeat itself in the future.

Jeff Saut, Liz Ann Sonders, and others have continued to prognosticate the financial markets have entered into the next great “secular” bull market. As explained previously, this is not likely to the be case based upon valuations, debt, and demographic headwinds which currently face the economy.

More importantly, as John Mauldin recently noted:

“When that next recession and bear market hit, it will take even longer to bounce back. The recovery will be even slower than this last one. As the research I’ve shared in previous letters shows, large amounts of debt slows recoveries. Very large amounts create flat economies. We are approaching large amounts in the US…but I think the recovery will be much slower, at a minimum. A double dip recession is clearly possible, making those stock market index fund losses even worse.”

John goes on to restate what I have detailed many times previously,

“You must have some kind of strategy for dealing with market volatility.

Invest in programs that give you at least a chance to dodge bear markets. Buy and hold works in theory, but not for most people because we are humans with emotions. We should recognize that and take steps to control it. “

Bingo.

He’s right. Combine high levels of debt, with high valuations, and psychological impediments and the outlook for investors isn’t great.

Does this mean you should NOT invest at all when valuations are high?

No. What it means is that you have to CHANGE the way you invest.

- When valuations are low and rising, you absolutely should be a “buy and hold, dollar cost averaging, investor.”

- Conversely, when valuations are high, you have to shift your thinking more to capital preservation and being more opportunistic on how you invest.

Controlling risk, reducing emotional investment mistakes and limiting the destruction of investment capital will likely be the real formula for investment success in the decade ahead.

With this in mind, individuals need to carefully consider the factors that will affect their future outcomes.

- Expectations for future returns and withdrawal rates should be downwardly adjusted.

- The potential for front-loaded returns going forward is unlikely.

- The impact of taxation must be considered in the planned withdrawal rate.

- Future inflation expectations must be carefully considered.

- Drawdowns from portfolios during declining market environments accelerate the principal bleed. Plans should be made during rising market years to harbor capital for reduced portfolio withdrawals during adverse market conditions.

- The yield chase over the last 8-years, and low interest rate environment, has created an extremely risky environment for retirement income planning. Caution is advised.

- Expectations for compounded annual rates of returns should be dismissed in lieu of plans for variable rates of future returns.

Chasing an arbitrary index that is 100% invested in the equity market requires you to take on far more risk that you likely want. Two massive bear markets over the last decade have left many individuals further away from retirement than they ever imagined. Furthermore, all investors lost something far more valuable than money – the TIME that was needed to reach their retirement goals.

Yes, you can do better.

You just have to turn off the media to do so.

There should be no one more concerned about YOUR money than you, and if you aren’t taking an active interest in your money – why should anyone else?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Golly, did I miss the part where he talks about no interest on investments? The part where CD’s and bank accounts and other savings were totally stripped of any interest? Kinda hard to have a retirement when your nest egg of say, $60k earns $21.83 per annum. Can’t live off that, but once upon a time you could live off investments. Then, did I miss the devalutation of the dollar and inflation part? Hmm, silly me, I forgot those ‘psychological factors’ causing all that grief, like fifty percent worth of grief….yup. At least he did mention lack of capital. like if you ain’t got it how in hell can you invest it?

AT&T hangs around $30 a share a lot of the time so I will use it as the example. $60k gets 2,000 shares @ 6% plus, currently $2.04 per share. That is $4,080 per year which when reinvested gets you maybe 125 more shares paying another $255. Next year you have 2,125 shares paying you, $4,335~buying you another 150 shares etc. After two years you have around 2,300 plus shares, which because of the compounding is getting you more than the advertised yield.

If the price shoots up 10% you then have $75 or $80K. If the price drops, you get even more shares for your dividend reinvestment paying you even more. What are your results after five or ten years?!

Has anyone ever stated it this simply when they are trying to sell you an “investment?” You HAVE to do it yourself.

As for the amounts. $1,000 or $2,000 dividend reinvested in Intel or McDonalds or Chevron Texaco or Oneok over the last twenty years has produced THOUSANDS of percent gains. I got $40,000 from a $960 investment of Intel. Over $50,000 so far from $2,046 invested in McDonalds. I buy dividend payers that are good businesses, put them on DRIP and forget about them. That’s the other thing. They will go up and they will go down. Harvest a little fruit if you need it when they go up and let them compound like crazy when the price is way down. Patience and courage will win the investing game.

The trading game is a whole other breed of cat and too many have it confused with investing. It is gambling and the pros have a zillion ways to skin our asses if we get in there unprepared.

Yours is a fine example and all, but there is one problem with it. You assume an investment of $60k. With the average household income around $55k or less, and saving ten percent per year, it would take about 11 years to save that amount of money. And you are cherry-picking a particular dividend-paying stock. What about an investment in, say, GE 20 years ago, a darling then but not so much now. Most company 401(k)’s and typical IRA’s do not allow you to invest in single stocks. You have to use a self-directed IRA, as I have done. If you are investing outside of retirement plans, any capital gains are taxed when you cash in…

Cash savings have also gone toward buying real estate, and $60k represents a 20 percent down payment on a $300k house, which is not a particularly expensive house now. If it takes 11 years to save the down payment, it will take another 11 years to save that nest egg. And then we are talking about half of the BB generation who have little to nothing saved in retirement accounts. Not really surprising considering the financial roller-coaster we’ve seen in the past 25 years.

I am not disputing your examples. I am saying that, while the opportunities certainly exist, they are not slam-dunks.

MG, be sure to deduct about $6.55 for income taxes on the $21.83 interest earned-the goobermint fully expects you to make that “contribution” to them from your shrinking nest egg.

Sorry for being so anal about it, but am in the middle of my tax returns.

Carry on.

Anon: I made a conscious decision to cut way back on my earnings several years ago. I refuse to pay for the illegals, the welfare generations, the wars, Obamacare and a host of other evils that we get taxed for and I’ve never looked back. I make enough money to get by, I live frugal but I don’t lack for anything, I don’t pay credit unless it’s a major emergency and I pay off credit cards every month. I remember ol’ Hussein’s ‘you didn’t build that’ remark and I mentally said fu to the system.

Another nothing burger financial article. You have to learn about finance and economics. Did it say anywhere in this article that 60% of all stock gains come from dividends? Did it mention dividend reinvestment?

Why are they so broke? Let’s see… They…

…Get taxed to death.

…Get “insuranced” to death.

…Finance millions and millions of welfare bums and illegal immigrants, cradle to grave.

…Pay insanely inflated prices for EVERYTHING.

…Lost huge chunks of their pensions because other people bought houses they couldn’t afford.

…Still don’t make any interest on their investments.

…Have to “subscribe” to things that used to be free.

Shall I go on?…

Missed one: scammed up the ass by worthless politicians who live far beyond what their accomplishments deserve.

Could part of it be that the boomers have spent more than they had?

the REALITY of money/wages/income is, if you come from the haves, then you are required to play with your money, make money off of trading/investing/etc. but, you do this from the insider perspective, as that is where you come from.

the rest of us learn a trade, add value to the world, make other people rich through our effort, and maybe, just maybe, we get to gets some crumbs.

if you are the former, go fucking die, you evil money loving bastards. your kind, I will note dine with.

if you are the latter, welcome to investing, it’s probably not for you, but I will drink with you, while we wait and watch the useless money loving scum, floating at the top, going to group therapy to figure out why they are not happy.

money is the root of all evil.

most rich people are unhappy sociopaths.