Authored by Nick Giambruno, chief analyst, The Casey Report,

There wasn’t a group of people more wrong about the 2008 financial crisis than those at the Federal Reserve.

Mere months before the disaster hit in earnest, the nation’s highest economic and financial officials were vocal that there was nothing to worry about.

Most memorable of these are perhaps two comments from former Fed Chairman Ben Bernanke…

In January 2008, he said, “The Federal Reserve is not currently forecasting a recession.”

And later that year, in July, he said Fannie Mae and Freddie Mac – the two government-sponsored enterprises that kicked off the credit crisis a few months later – were “in no danger of failing.”

And it wasn’t just Bernanke. The same delusional sentiment was echoed by almost all the top Fed and Treasury officials… as well as those in the mainstream financial media and academia.

Of course, we all know how things played out…

When the housing bubble burst in 2008, the effects rippled throughout the economy, kicking off the largest financial and economic crisis since the Great Depression.

And the S&P 500 – a good proxy for the U.S. stock market – went on to fall by over 56%.

The reason I’m telling you this today is to remind you that people exhibit laughable sentiments near the peak of bull markets.

And today, we’re hearing much of the same sentiment that was displayed before the 2008 crisis.

But as you’ll see below, it’s not the only sign I’m seeing of a coming crisis…

A Contrarian Indicator

I’ve written before about why I believe we’re near the peak of the largest bubble in human history.

And as I’m about to show you, there are clear indicators of a coming crisis… in the auto sector… the housing sector… and in the economy as a whole.

Despite this, Fed Chairman Jerome Powell recently said, “I don’t see a recession [in 2019].” And when asked if the bull market can go on indefinitely, he said:

Not every business cycle is going to last forever, but no reason to believe this cycle can’t go on for quite some time, effectively indefinitely.

We don’t see the kind of buildup in risks in the financial markets, let alone the banking system.

That echoed Powell’s predecessor, Janet Yellen, who said this in 2017 when asked about the next financial crisis:

Would I say there will never, ever be another financial crisis? You know probably that would be going too far, but I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will be.

But there are a few reasons why I’m not convinced…

About-Face

Despite all this bullish talk, the Fed recently did a 180 on its tightening of monetary policy.

If you remember, the Fed has been steadily raising rates since December 2015. It raised them four times in 2018 alone… and in December last year, it claimed it would raise them twice in 2019.

But at its meeting last month, the Fed announced it would likely not raise interest rates in 2019, and it would likely raise them only once in 2020.

Here’s why this about-face matters…

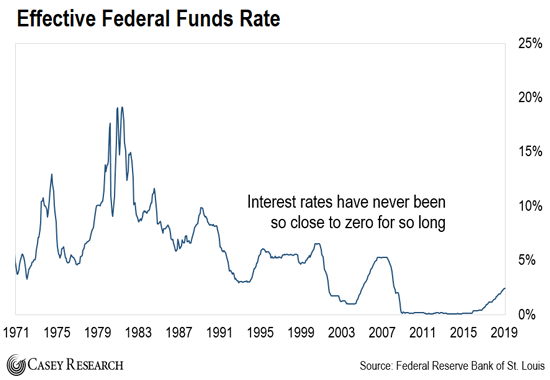

Interest rates are barely coming off the lowest levels they’ve been in all of human history.

The Fed artificially brought rates down to 0% after the 2008 crisis and kept them there for over six years. You can see this in the next chart:

The Fed also announced it would phase out its balance sheet reduction program in the fall.

You might recall that the Fed created $3.7 trillion out of thin air in the wake of the 2008 crisis, under its money-printing programs euphemistically known as quantitative easing, or QE. That money was used to buy bonds, which sit on the Fed’s bloated balance sheet.

Now, some people think the Fed saved the day by pushing pause on its rate hikes. After all, it claims it’s doing this as a precaution “in light of global economic and financial developments.”

But I don’t buy it.

In fact, this whole charade proves to me that a crash is already underway – as the Fed inadvertently admitted we’re on the cusp of big problems.

After all, why would the Fed stop tightening monetary policy if it thinks there’s no chance of a recession?

Trouble Ahead

Something doesn’t add up. And at the core of this charade is the fact that the U.S. economy is hooked on artificially low interest rates.

You see, the damage from the previous rate hikes and balance sheet reduction is already done.

For one, the cost to service debt has gone up across the board. And that could be fatal for many companies and entire industries that have grown dependent on artificially low rates.

After nearly six years of 0% interest rates, the U.S. economy is hooked on easy money.

It can’t even tolerate a modest reduction in the Fed’s balance sheet and 2.25% interest rates, which are still far below historical averages.

And we’re already seeing this take its toll in industries most dependent on easy money and 0% interest rates – the housing and auto markets.

“Constrained Financial Conditions”

For example, single-family new-home groundbreakings recently plummeted to a four-year low. That’s lower than what analysts had expected.

Then there’s the fact that housing sales are contracting in ways not seen since the last crisis.

And John Williams, the president and CEO of the New York Fed, says we’re seeing signs of a construction slowdown. The culprits, he says, are “constrained financial conditions.”

This might be the closest we get to the Fed admitting that the modest rise in interest rates is hurting the housing market.

But we don’t need the Fed to admit anything. We can already see this weakness in homebuilding stocks.

Take the SPDR S&P Homebuilders ETF (XHB), for example. This fund tracks the performance of companies with exposure to homebuilding activity.

Before the Fed announced its pause, XHB had collapsed over 33% from its peak last year. Today, it’s still down over 13%.

And like I mentioned earlier, the car market is also getting hit.

Auto sales in the first quarter of 2019 are off to their slowest start in six years. And they’re expected to be 4.9% lower than a year ago.

At the same time financing costs are surging, overall car prices are hitting record highs. And in February, auto loans were the most expensive they’ve been over the past 10 years.

Higher interest rates and tighter credit in the future will make further growth almost impossible.

Shockwaves

The point of all this is that, in the weeks ahead, we will see shockwaves spread out, not only through the car and housing industries, but the economy overall.

That’s why now is a good time to take a close look at your portfolio.

Look at every position you own, and ask yourself: Would I be comfortable holding this through a recession… or even a crisis?

If the answer is no, consider lightening up on those weaker positions.

This way, you won’t have to worry about losing all your wealth in the recession I see coming.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Weeks away, huh? “The U.S. economy is hooked on easy money. It can’t even tolerate a modest reduction in the Fed’s balance sheet and 2.25% interest rates.” That’s a misread of the situation. Not only did the US economy tolerate those things, we had 3.2% growth in the first quarter, traditionally the slowest quarter every year. Powell didn’t do a u-turn, he simply slowed the pace of rate hikes. This is what an economy looks like based on production as opposed to inflation. There is no fundamental reason for a crash in the US economy at the moment.

More “NeverTrumpers” at work here…

Here is another data point that backs up the author:

On TV, they are running 1/2 hour info-mercials on house flipping, AGAIN. This is the ultimate tell that we are at the peak of the bubble.

“buy and sell houses for profit, without using your own money”

Unfortunately, history does repeat, and soon a big financial house will go down, that triggers a domino of events to complex to comment on.

relax, it is all planned by our globo homo elites, so they can buy up the rest of the world for pennies on the dollar, after this next crash.

The house flipping thing is being run for different purposes now that it was 10 years ago. The REITs use it to get rid of the least desirable crap that they own, “put a little effort into this place and you’ll make a fortune!” They care not whether you ever make it out alive. The other good one they do is convince people that buying condos or townhouses are good deals. HOAs can now be run as for-profit entities, and they are. You can never pay it off and they can raise the monthly as high as they want. Private taxation. Truly a sucker’s market

I agree with Star. No housing bubble. Why? Because new homes are only being built for the upper middle class and above.

The push for flipping is at an all-time high, and what I am telling my investors is WAIT. Prices are too high, houses are sitting for longer now, and across the board prices have declined about 5-7% in the past three months. This is supposed to be the beginning of the spring selling/buying market, yet homes are starting to sit for 80+ days when this time last year they were going under contract in under 35 days. The banks are also not getting it (yet) and holding out for maximum dollar on utter crap boxes. Three-family homes in Worcester are now selling at or above what they were selling for in 2007-2008. Rents are at an all-time high yet wages are stagnant.

What does this mean? If you are an owner-occupant purchasing a three-unit property with the intention of living there, and your mortgage approval is based on the premise you will get 1200 for each of the other 2 units so you can “afford” your 350K mortgage, that is scary indeed. Your mortgage payment will be about 2050 per month. Now, if you can in fact find and KEEP decent tenants willing to pay you 1200 per month, then magically it would appear you can “afford” your mortgage, because supposedly now you will pay nothing out of pocket but your water and sewer, which for this building will be about 1200 per quarter. Probably. But then that is counted as income against you, and you will have to pay taxes on it, and your mortgage interest deduction will be so low that it will not offset the taxes on the income, which is in a different income bracket than your paycheck. Ok, fine you say. I can handle that.

But if things continue the way they are, and you have vacancies, or even worse, deadbeats that refuse to pay, then you are now net-zero AND paying to get rid of them. Which is more likely to happen when the free money dries up and/or people get laid off.

“Retail” tenants are ones that get no government or state assistance to pay their rent. They typically will look for more affordable apartments in the 950-1000 range, but they tend to stay longer, pay on time, and don’t wreck the place.

Tenants on “assistance” don’t care how high the rent is, really. The government allows housing authorities to give its Section 8 voucher holders from between 90 and 110 percent of the fair market value figure. They serve about 22,000 “families” which also includes one-bedroom applicants. A three bedroom in Worcester is capped at $1494 per month. The tenant would be required to pay 30% of that. You do the math. It’s not sustainable, because this all comes from taxpayer money. Many of these folks cannot even afford the 30%.

A lot of landlords I have spoken with talk about the fraud they see from applicants. If you are a voucher holder, you are required to disclose anyone who will live with you, and those people’s income, as it affects how much you get. So if you are living with a non-spouse (or spouse) who has income, you must report it and it can affect how much you get. Applicants will in some cases lie about who else will be living with them or ask the owner to lie and not include another adult who earns income on the lease. This is fraud, straight up. This puts the owner at risk, because good luck eviction someone you never put on the lease, or trying to recoup losses from them in form of damages. And if you try, then you are de facto admitting to fraud. Lose-lose situation.

This is one of many factors going into the housing crisis.

Great post, Realestatepup.

I got out of the landlord business quite awhile back. If you want a losing proposition get a rental property, especially a housing rental property.

Tell that to my son in law. He owns a % of a real estate investment trust started by his grandfather (the grandfather built the buildings and kept them) 60 years ago. 5,0oo rental units in Arlington Va. and another 1,000,000 sq ft of commercial space.

Pup,

Where are you? What type of building is going on in your area? The aughts experienced building out the ass at all income levels. I do not see that anywhere in my area now and not since the aughts. I’m in DC area.

can’t judge by dc area,,as long as govt remains bloated dc is going to be artificially prosperous–

Spot trends.

Refer to the past.

Speculate & make predictions.

But never predicting ‘when’ with much accuracy. That’s the hard part.

Of course, after a blow-up, the rare fortune teller or two who get it right invariably say ‘told ya so’, while the legions who got it wrong rarely admit their failures.

Many see storms a brewing on the horizon. Me included.

The hucksters in that camp usually have an ulterior motive, but, at the very least, they offer an option strategy to consider implementing.

Fear mongering without suggestions for surviving the carnage is a warning without instruction.

Basically, ‘we’re all screwed. Nothing can be done about it.’

Seems diversity with plans is the wisest.

Putting all your eggs in one basket could be disastrous, if the wrong strategy fails when most things go south, and a few others go ballistic.

For this, it’s why comments prove so valuable, from people revealing specifically what they are doing, to prepare.

Those who have offered concrete steps to consider contribute to the action plans and suggested strategies.

So, hat tip to those folks round here. Keep ’em coming.

“The point of all this is that, in the weeks ahead, we will see shockwaves spread out, not only through the car and housing industries, but the economy overall.”

Bwahahabababa

We will eventually have a monster crash . We must have a economic collapse in order for the Luciferian Elites to get their new world Order up and running. It won’t happen until Trump is out of office. All financial / economic collapses are planned. Just watch the first 4 parts of Europa : The Last Battle . You see it all . How the Bankers and others collapse the world right into World War One and Two.They will do it again as soon as they have someone in office who will do as told . Trump is to much of a wild card for their taste.

BB, I’m going to watch Europa tonight.

I hope I’m proven wrong but it seems to me that Trump is their man. When things crash, the “deplorables” will be forever blame-able. What could be more useful to them then to have us as the reason for the crash?

gcp,

You are probably right…check these three out:

1. 5G MILLIWAVES ENABLES SURVEILLANCE OF EVERYTHING AND MAY ALTER BRAIN WAVES

Posted on April 26, 2019 by Don Koenig

2. TRUMP RAMPS UP 5G,6G PUSH

3. INTERNATIONAL APPEAL

STOP 5G ON EARTH AND IN SPACE

https://www.5gspaceappeal.org/the-appeal

Maybe a positive side effect of a ‘COLLASPE’ would be to slow down 5G?

We, the lumpen and great unwashed, shall all know that “sumptins up” when both whiz kids and wizened wizards of Wall Street are jumping out of tall buildings (or being defenestrated) in conjunction with the news that trading on the major exchanges in New York and Chicago have been halted for more than an hour due to unforeseen computer glitches or some shit like that.

The “big boys”, on the other hand, will be cruising comfortably on their 50 meter yachts around Martinique or Bora Bora and won’t be concerned one iota as they themselves have taken protective positions at minimum a couple of weeks before.

How did they do that? Not by watching Bloomberg or that Lenin-looking comedian on CNBC , Kramer, you can be sure.

It is very good to be in the small club.

Donkey ,you won’t regret it. I fear that whites in America are being sit up for some horrible things . If given the chance these Talmudic Jews will kill us. They hate us with a passion. Not all Jews but many of the ones in power. They are doing to America what they did to Germany which gave rise to Hitler. You will also see how Hitler has been so slander .He was the greatest leader the west has ever had. He did not want war . Did everything he could to prevent the war. He was for the Germans .He Loved his people . I wish America had a leader that would get us out of this debt slavery. Hitler sit the Germans free and within 7 years they became a world superpower. You will learn so much .Just try to remain calm.

BB,

My son in law just called me today. My daughter is having ANOTHER WHITE BABY!!!

Praise be to the highest.

Congratulations Donkey!

I just spent 8 day with my 7 year old Grandson…every day was a jewel and a gift from God.

Bring them by we will climb trees and milk goats.

Its coming its coming the sky is falling, falling now for 6 years…..i am still waiting…..eventually these permabears are always 100% accurate