Last week we reported that something strange was going on at the same time that central banks are injecting $100 billion each month in electronic money to crush volatility and ramp markets: a similar amount in physical currency and precious metals was literally disappearing.

The mystery, in a nutshell, was as follows: while banks are printing more bank notes than ever, these seem to be “disappearing off the face of the earth” and nobody knows where or why, or as the WSJ notes, “central banks don’t know where they have gone, or why, and are playing detective, trying to crack the same mystery.”

And while readers can read up much more on the topic of disappearing hard assets here, a few days after, Fox Business picked up on this thread, writing that almost $1.5 trillion of the world’s physical cash, with $100 dollar bills making up the vast majority, was reportedly unaccounted for.

So what happened to the money?

To get to the bottom of this mystery, this was the question FOX Business anchor Lou Dobbs asked the man who literally signs every single US dollar bill, Treasury Secretary Steven Mnuchin. The response” “Literally, a lot of these $100 bills are sitting in bank vaults all over the world,” Mnuchin said.

Mnuchin pointed to the negative interest rates causing people to turn to American dollars as a solid investment.

The dollar is the reserve currency of the world, and everybody wants to hold dollars,” Mnuchin said on “Lou Dobbs Tonight.” “And the reason why they want to hold dollars is because the U.S. is a safe place to have your money, to invest and to hold your assets.”

Mnuchin said it’s interesting that, in a increasingly digital world, “the demand for U.S. currency continues to go up.” adding that “there’s a lot of Benjamins all over the world.”

Actually, it’s not that interesting: the world’s growing appetite for physical assets such as paper dollars and gold, coupled with the continued interest in cryptocurrencies and other traditional currency alternatives, merely confirms that faith in artificially levitated markets is approaching a tipping point. Meanwhile the world’s “top 0.001%ers” continue to quietly cash out, literally, and put their Benjamins in secret vaults in the middle of somewhere, even as central banks do everything in their power to reduce the amount of physical currency in circulation and replace it with easily trackable digital alternatives.

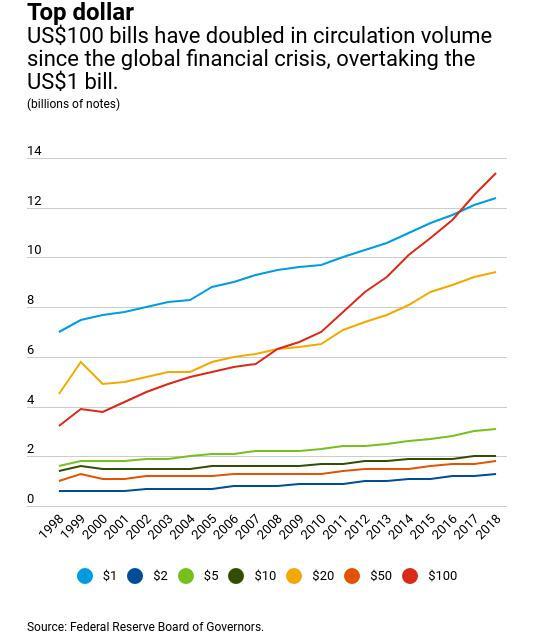

As we reported back in August, there are now more $100 bills in circulation than $1 bills, according to data from the Federal Reserve, which found there are more $100s than any other denomination of U.S. currency. And as an indication of just how much demand there is for physical stores of value, consider this: the number of bills featuring a picture of Benjamin Franklin has about doubled since the start of the recession.

In 2018, the Federal Reserve Bank of Chicago illustrated a correlation between low interest rates and high currency demand, though it also noted outside factors could help explain swelling demand.

The bank estimated that 80% of all $100 bills last year were actually in circulation in foreign countries, and explained that residents in other countries, particularly those with unstable financial systems, often use the notes as a safe haven.

To watch the exchange, click on the image below and fast forward to 7 minutes 30 seconds in.

Historic Trade Victories. @stevenmnuchin1 praises @POTUS for continuing to deliver on all of his trade & economic promises. #MAGA #AmericaFirst #Dobbs pic.twitter.com/K0i9jjzCHH

— Lou Dobbs (@LouDobbs) December 18, 2019

It’s not just US dollar that are disappearing, however.

Few are as perplexed by the fate of the missing cash as the German central bank: according to the Bundesbank more than 150 billion euros are being hoarded in Germany. This has led the European Central Bank, and others, to ask the public for help.

“Everyone says that they are not hoarding cash but the money is clearly somewhere,” said Henk Esselink, head of the issue and circulation section in the ECB’s currency management division.

“People hide their money everywhere,” said Sven Bertelmann, head of the Bundesbank’s National Analysis Centre in Mainz, Germany. Sometimes bank notes are buried in the garden, where they start decomposing, or hidden in attics, where they are used by mice for building nests. “It happens again and again that people keep money in an envelope and then they shred it by mistake,” Bertelmann said. “We pick up the bank notes with tweezers and then start to put them together, like a jigsaw puzzle.”

Australia’s central bank says its best guess is that only around a quarter of the bank notes in circulation are used for everyday transactions. Up to 8% of cash is used in the shadow economy—tax avoidance or illegal payments—while as much as 10% could have been lost. That is $7.6 billion Australian dollars ($5.2 billion) missing at the beach or in couch cushions… Or simply lost in a “boating accident” to avoid the taxman until the rainy days arrive.

The biggest use of cash is as a store of wealth “in safes, under beds and at the back of cupboards, both here in Australia and elsewhere around the world,” Mr. Lowe, the RBA governor, said.

Swiss National Bank officials likewise found that hoarding of Swiss francs jumped around the year 2000, likely motivated by fear of the Y2K bug infecting computer systems, the bursting of the dot-com bubble, the September 11 terrorist attacks and introduction of the euro. The financial crisis that began in 2007 encouraged people to stash even more.

Meanwhile, with a financial crisis looming – and getting closer by the day – for some countries, such as New Zealand, making money disappear is becoming a national pastime. Around a third of New Zealand’s new bank notes headed overseas in 2017, up from 6% four years earlier. That happened around the time that tourism overtook dairy as the country’s main export money-spinner, leading officials to speculate on the role played by currency exchanges, especially in Asia.

The trail mostly ran cold after that. The bank could only identify the whereabouts of around 25% of New Zealand’s cash. The rest, of about 75%, has disappeared.

“Our sense is that we’re in the same boat as a lot of other central banks out there,” said Christian Hawkesby, assistant governor at the RBNZ. “We can’t fully explain why holdings of cash are rising and where they are going.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

If (when) the global economic reset, or default, or catastrophe, or whatever occurs, why would the powers-that-be allow hoarded cash to flow in, perhaps upsetting the macro plans? It is one thing for Joe Lunchbucket to have 3-4 months salary under the mattress, it is another for a paper wealthy man to have millions in cash. All the Treasury would have to do is either outlaw cash or issue a new bill with some provision for limited deposit or exchange without question) and the hoarded cash goes to zero in value, just that fast.

Not so with gold, but that is a different set of concerns. Gold is a durable store of value that the govt. really has to look hard for to find, but cash can be made into plain paper in one second. If anyone has some real money they want to keep, cash is not the way to do it.

Cash is good til they outlaw it….until that time I must admit that it was me, yes, it was me, I have all the 1.4 trillion hundred dollar bills. I put them in the attic for safekeeping after I originally found them in the couch cushions of an old sofa I bought at Goodwill. I’m holding them until the original owners can be found….If you were the original owner of the sofa then get in touch with me at http://www.hahahfat-chance.com

Yes they could and probably will outlaw cash but they will also outlaw gold. They did it before, they will do it again.

Things are only outlawable (is that a word?) in the legal marketplace. In the black market (something that will clearly be far bigger than the so-called legal market, should the SHTF), gold, ammo, food, sexual favors, etc. will all be readily accepted currency.

Then like drugs or any other contraband, those trading in a black market risk getting caught by statists posing a participants in the black market when in reality they are part of the citizen tattle tale squads in sting operations, probably with a rewards program. I personally wouldn’t trust it, but maybe there are some who trust others more than me. I mean even today, it’s amazing how many ‘submit a tip’ lines, i.e. rat lines are in just about every government agency in operation, from the IRS to your local sheriffs office. It’s already just like Nazi Germany. Think of how this would increase by authoritarian statists participating believing they are being good citizens. They do it already.

Saw it myself on the public information channel on cable TV years ago when I lived in Northern VA. The message encouraged citizens of Fairfax County to call a tip line to rat out people driving without proper registration and inspection stickers. The county depended on these stickers as revenue.

I won’t be relying on paper as a means of exchange should an economic event occur. It’s rice, beans, PMs, and copper-jacketed lead. Exchange as needed.

if the dollar fails and a full-on barter culture develops, as paper wears out people will still try to use coinage ….

This is why older “junk” silver and fractional value bullion coins will be an excellent means of exchange. Many of our older PM coins are silver and gold alloys so a nice reference manual is needed. I rely on a 2020 Red Book for numismatic info.

no I mean the post-64 stuff.

If you live in the EU, they are now passing negative interest onto ordinary citizens, previously it only affected those with muti-millions. So it seems rather obvious, if the bank wants money from you, to store your savings, you would take you business elsewhere. If the euro you are storing in your basement, is being depreciated more rapidly than the dollar, you will convert your shitty euros to dollars.

the implications are that the globalists, and their plans for EU, are failing, Brexit is happening, more people will now push back against un-elected bureaucrats, who’s plans are to push green agenda down their throats.

Germany screwed the pooch when the went all in for green energy, they had to bring coal plants back on line, now they pay more, and pollute more, because they bought the illusion of green/climate change bullshit.

“the implications are that the globalists, and their plans for EU, are failing”

actually it looks like they’re succeeding – not much left to steal.

I figure the dollar is worth little. Maybe it was all used as toilet paper.

And then these sheeps will use it as toilet paper because they have no silver. I will refuse to take paper in shtf scenario. Gold, silver or real items of need is all i will deal in…..and if i get a knock on the door within a 7 day period the last 3 persons i traded with will have to deal with other pissed off family to their demise…..trust nobody.