Guest Post by Martin Armstrong

Many people are starting to question why this coronavirus has been shipped up into a major panic when the annual flu kills far more people. Perhaps they have enlisted the conspiracy contingents who turn everything into the end of the world and are so eager to paint doom and gloom as a lethal weapon for mass financial destruction. They may not realize that they are being played for fools spitting out various conspiracies such as biological weapons laced with AIDS that will kill 50% of the population without a single shred of proof.

Curiously, the World Health Organisation (WHO), which is a specialized agency of the United Nations established on April 7th, 1948, and is headquartered in Geneva, Switzerland, has advised people to use contactless technology instead of cash as banknotes may be spreading the coronavirus. It is interesting since paper money has long been recognized as a hospitable environment for gross microbes including viruses and bacteria. Both can live on most surfaces for about 48 hours. However, the claim is that suddenly paper money reportedly transports a live flu virus for up to 17 days. The question emerges: If this has always been the case, then suddenly why now warn about using paper money? Is this part of a broader plot to eliminate cash in order for governments to take whatever taxes they need when the entire social structure is collapsing around them?

Sweden has been the leader in eliminating cash. They have suddenly realized that there is a major risk to digital money and have advised citizens to now ‘Stockpile coins and banknotes‘ in case there is a cyber attack on the banking system. Living in Florida, you instinctively have to hoard some cash due to hurricanes. The power went out where my bank was for about a week. Without power, it became a cash-only society very fast if not instantly. There are two risks to digital currency: cyber attacks and power failures.

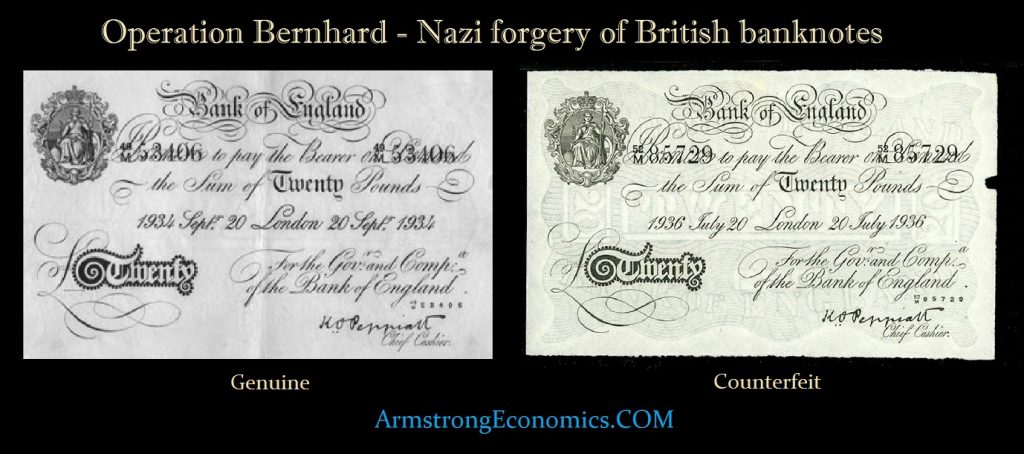

Operation Bernhard was an exercise by Nazi Germany to forge British banknotes. The initial plan was to drop the notes over Britain to bring about a collapse of the British economy during the Second World War. Obviously, undermining the currency of a nation during a war has been a strategy throughout all of time. The question that would certainly arise is if all money is crypto or digital, then an attack on the banking system and/or power grid would undermine the economy of an opponent.

Moving to electronic currency may be a desperate attempt to save socialism, but it would also open the door to sophisticated cyber attacks to undermine that economy.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Getting rid of paper currency (not money) always seems to mean the gov’t has full control of it. That’s not necessarily the outcome but is, I’ll admit, most probable. That’s because whatever the gov’t writes into some bullshit law is what the population just goes along with. Add to that that most people have no idea how currency currently comes into existence and the ignorance keeps the population under control.

Suppose we go back to gold and silver as money (not currency). The Federal Reserve would have no way of conjuring physical metal into existence so they are out of business. The asshat legislators can no longer propose all manner of spending not covered by taxes because the gov’t would have to borrow real money from those that have it to cover any shortfall. That competition in the constrained lending market would cause all manner of GDP harm if they became too large a part of that market. Given that the borrowed money would eventually have to be paid back by taxpayers, the process of borrowing makes no sense in the long run anyway.

If people deposited their gold and silver metal in a bank and got a debit card to use to spend their metal, the gov’t is out of the currency business and no longer has anything to do with money. Can they muscle their way in, yes, if we let them. Again – the stupidity of the population would probably allow this to happen. One major difference however is that monetary inflation is now a market force, not the product of a cabal of asshat banksters and their co-conspirators in the gov’t.

If prices were in G:S:P (gold weight, silver weight, copper weight) then there would be no need for an artificial entity like a ‘dollar’, ‘euro’, etc. There would be no currency arbitrage between countries because there would be no currencies. You go to the dealership, the supermarket, etc and purchases are made in G:S:P.

A metal standard is the enemy of “the bad guys.” It is deflationary and therefore rewards saving. Money can be lent at no interest with the money paid back being worth more than when it was lent as it is deflationary. Perhaps this is why the Bible and Koran speak against usury or “interest.” Under a metal regimen government has to take what they get as opposed to printing and stealing the value of what’s in your pocket. That’s what printing is. A fraction of your net worth is stolen every time the printing press dilutes the money supply. Politicians would be a lot more concerned with preserving our industry and keeping the Gold and jobs here if balance of payment deficits literally drain a country of its Gold.

How is a metal standard deflationary? I don’t see it.

Miners would add metal to the world’s supply IF it’s worth their investment. The balance between the mining and economic activity would keep prices stable, up a bit today, down a bit tomorrow, but in the long run stable.

Please state your reasoning.

They couldn’t mine it fast enough.

A return to gold would put the mining of asteroids on a fast trck, though.

Regardless of mine output there is less than 1/3 of an ounce of Gold per person above ground at this time. As such, it is a fairly fixed or inelastic supply. An increase of Gold requires investment, energy, human toil etc. You don’t do a few keystrokes at the FED and say “here’s a couple of trillion in electronic digits to bail out X,Y&Z.” Goods and services must compete for a fixed supply of money which is deflationary. I would direct you to a place like mises.org where you might access a lot of the scholarship on Gold and Gold standards. 24hrgold.com is another resource with lots of scholarship and opinion, some good, some not so good.

I believe you will find it very interesting and informative. I would also say in a metal standard you own your own money. It requires no third party promise to pay. There is an old ad recording somewhere many of us have seen and heard in which the Federal Reserve spokesman talks about they print money for us “to use.” It’s their money and they let us use it. They have zero control or ownership of Gold and Silver coins in your pocket or safe. They do not like that.

I put this up on another thread, good 10 minute vid.

https://www.youtube.com/watch?v=r0sxOae3dL4

Sorry, but this guy just want the gov’t to print money without interest instead of the Federal Reserve doing so with interest. That doesn’t solve the problem.

The solution is to get the gov’t out of the money creation business entirely. That can only happen with a commodity they can’t conjure into existence – metals and possibly other hard commodities.

This guy’s lament that there’s fraud ( hypothecation) going on simply means we need to kill the bastards doing it so the lesson gets learned by the next guy. The gov’t encourages the fraud and is why the gov’t should be completely out of the money business.

Counterfeiting is punishable by death according to US law, yet the Treasury and the Fed get a full pass.

Trouble is that the gov’t gets to define what counterfeiting is and, would you believe it, they don’t do it. Imagine that!

Mr. Liberty is right…the problem isn’t doing what the Founders intended, it is the fact the country has been taken over by Luciferian Globalists who in 1913 passed an ill-eagle sick bird law (and many others since) that have turned us all into debt slaves/serfs.

Come on SAO…so you wouldn’t accept the GOOD…because it is not the PERFECT?

I think you might be ‘Solutions are Oblivious’ on this one buddy. (sorry I couldn’t resist that one, you can call me a dog with a hair lip…mark, mark).

THE FEW WORDS ON MONEY IN THE CONSTITUTION SAY MORE THAN WE KNOW

Brian Domitrovic

POLICY

The way United States Constitution of 1789 speaks about money has long puzzled observers. Why does it speak so little about money, people ask, and when it does treat the subject, why the weird specific fashion?

Here is all the Constitution says about the money power of the government. From Article I, Section 8, there is “Congress shall have Power…to coin Money, regulate the Value thereof, and of foreign Coin.” And from Section 10, “no state…shall make any Thing but gold and silver Coin a Tender in Payment of Debts.”

That’s 27 words, some of them offbeat or capitalized like in German, pertaining to monetary policy in the founding document of the government of the United States.

Is there a problem? It is not clear there should be.

As for the first clause, Congress could set up a mint. That is about all it says. Congress can coin money and specify what its denomination is. This is what “regulate” means and is an ordinary task of any mint. If you strike a coin you put a denomination on it, an identifier, this little gold one is ten, that bigger in silver is one. After that quotidian task, the Congressional mint can also post a list of prices of the coin in foreign exchange. Any mint, any business at all, does the same thing: post its prices.

As for the second clause, one of the main reasons the Constitutional Convention of 1787 prepared the document was so that the federal government could assume the massive state debts. The federal government did not want to have to bail out the states over and over again, just this one time. By forcing the states to accept only gold or silver coin as payments, states had a decent chance of staying solvent. Their revenues would always be good.

This all sounds brisk and efficient. What is the problem?

One criticism, a modern one, is that “monetary policy” is obviously such a core function of government, things could be clearer and more expansive on this front. Another is that “coin” is too specific. Of course they must have meant make paper money too. One more is that surely states can accept something other than gold or silver coin. By the way, every time states collect our taxes today (never in gold or silver coin), they violate the Constitution clear as day.

The Constitution is a dead document. It was written by the oligarchs of their day. Yes, there were some reasonable provisions, but it certainly hasn’t done it’s most important work which is to restrict the Fed Gov from becoming an ogre.

What I won’t accept is the ridiculous proposition that gov’t should have anything to do with money. Gov’t should be begging for money and making their reasoning clear for all to see. If they have complete control, the deficit and inflation would rocket to the moon in short order.

Sorry, but the idea that gov’t should print money out of nothing is a conjurers trick and I’m not falling for it.

How about we bring the Constitution back to life?

Then go for the good…that is already in it, then maybe…over time the perfect?

Oh yea, and while we are white boarding let’s throw in Term Limits.

mark, mark (dog with a hair lip barking back at you)

I assume this whole thing is basically a medical version of 9-11. A relatively small number of people will profit from it handsomely and more freedoms will be taken away from the general public in the name of safety. Cash has already been demonized for a long time and this will be the final excuse to get rid of it for good.

A few months from now expect to see a new wave of virus billionaire celebrities who knew how to play the 1,000 point swings we see day after day in the markets. Who will be the new Kyle Bass?

Of paranoid fears, my fear of a cashless society is greatest.

A cashless society IS THE purpose of the Mark of the Beast in Revelation 13:16-17. What the actaul physical and spiritual mark is is almost irrelevant. When “all people, great and small, rich and poor, free and slave”…”(can)not buy or sell unless they ha(ve) the mark,” then whatever the mark is (tattoo, microchip, smartphone app, a black X written with a Sharpie, etc.) will enable or disable anyone to buy or sell at the whim of government, and will therefore BE the Mark of the Beast.

Whether this virus becomes the impetus, the Globalist Elite will not rest until they ultimately have a global cashless society.

Ya, cannot buy or sell if you don’t get the CV19 vaccine full of programmable nano bots and monkey guts and egg embryos and thimerisol. There’s your mark of the beast. And geuss what, Israel is weeks away from a vaccine. Go fucking figure.

Much hand-wringing and Bible-thumping going on over CV19.

I have ugly business in Massachusetts and have to visit horrid Boston and Quincy (Chinatown South) regularly.

Now, God bless the Federal Reserve. Israel is really getting more like $380B/yr not $38B and it’s coming together nicely brick by brick, despite all the human tragedy and criminal behavior. Zion is a warm, fuzzy place.

BAN CASH

Please God, if you’re listening, torch all those overseas $100 bills and give Trump, Don Jr., and the Federal Reserve the wisdom to press ctrl+alt+delete.

Solutions, We will go back to a gold or bimetal system, and it will be great! For your grandchildren. Before we get there, we are going to go through a Hell of a mess. Whether it will be some crypto mess, or UN SDR, or some other skullduggery, it does not matter much to us low lifes. The whole world s bankrupt, and this is what we get.