Authored by Simon Black via SovereignMan.com,

By the mid-6th century BC, Darius the Great was ‘King of Kings’, ruling over the vast Achaemenid Empire.

By that time, gold and silver had already been in use by earlier civilizations for thousands of years.

There are cuneiform tablets that are nearly 4,000 years old from ancient Sumeria which record commercial transactions made in gold and silver.

And subsequent civilizations – the Babylonians, Egyptians, Lydians, etc. all used gold or silver in commerce.

But Darius had a unique idea.

He borrowed the idea of minting gold and silver coins from the Lydians… but then established a fixed exchange rate between the two metals.

Darius decreed that one gold “daric” was worth 13.5 silver coins– one of the first examples in history of a fixed, bimetallic standard.

His idea caught on. And for thousands of years afterward, later civilizations established a fixed gold/silver ratio.

In ancient Greece during the age of Pericles, gold was valued at 14x silver. In ancient Rome, Julius Caesar valued gold at 12x silver.

It remained this way for centuries.

Even in the earliest days of the United States, eighteen centuries after Caesar, The Coinage Act of 1792 established a ratio of 15:1.

(According to the law, one US dollar is supposed to be 24.1 grams of silver, or 1.6 grams of gold. So those pieces of paper in your wallet are not dollars– they are technically “Federal Reserve Notes”.)

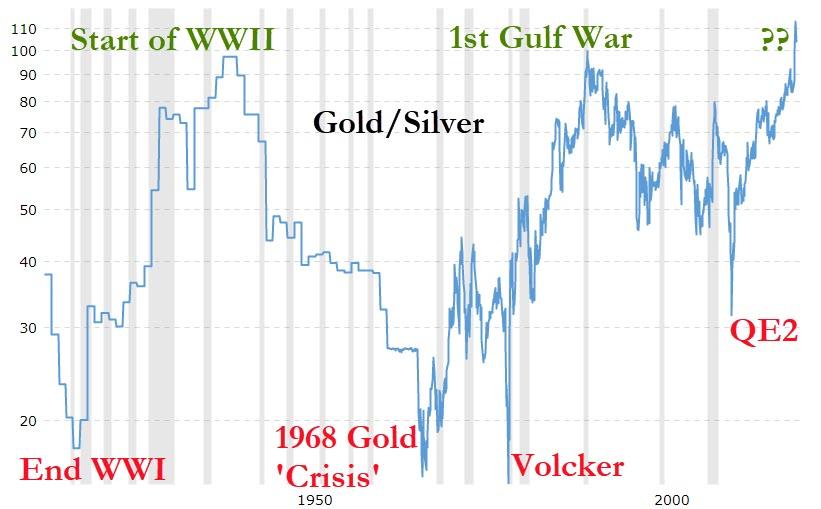

In modern times there is no longer a fixed ratio between gold and silver, though its long-term average over the last several decades has been between 50:1 and 80:1.

This is a lot higher than in ancient times… but the circumstances are obviously different.

Today, gold is still widely used as a reserve by central banks and governments around the world. And investors still buy gold as a hedge against inflation and uncertainty.

Silver, on the other hand, has countless industrial applications; it’s a critical component in everything from mobile phones to automobiles to solar panels.

Like gold, silver is also a hedge against inflation and uncertainty.

But silver’s demand fundamentals are more heavily influenced by overall economic health. If the economy is in recession, silver prices can fall because there’s less demand from industry.

Gold, on the other hand, doesn’t follow that pattern. In 5 out of the last 6 recessions, in fact, gold has increased in price.

That’s why recessions, and extreme turmoil, can lead to a massive spike in the gold/silver ratio. Gold goes up, and silver stays flat (or falls).

- Just prior to World War II as Hitler launched his invasion of Poland, the ratio spiked to 98:1.

- In 1991 as the first Gulf War began, the ratio again reached 100:1.

- Today we’re back again in that territory; as of this morning, the ratio is 110:1, and it’s been as high as 120 or more in recent weeks.

Now, there are very few things about this pandemic that we can be certain about.

Things that were unthinkable even a month ago are now part of our daily lives. And so as I’ve written over and over again, EVERY possible scenario is on the table right now.

But one thing that does seem very clear is that central banks around the world are going to print an extraordinary amount of money.

Many of them already have.

The Federal Reserve in the US, for example, has already expanded its balance sheet to SIX TRILLION DOLLARS.

That’s a nearly 50% increase from last month. And they’re just getting started.

Why does something so mundane as a central bank balance sheet even matter?

Because a rising balance sheet means they’re conjuring trillions of dollars out of thin air to bail everyone out.

This is the way they solve problems: they print money and debase the currency, something that policymakers have been doing for thousands of years.

But you can only get away with doing that a limited number of times before the currency starts to lose value.

And whenever that happens, gold and silver tend to rise as a result.

There’s a lot we don’t know about this pandemic.

We don’t know how long it will last, how much destruction it will cause, or what the world will look like once this is over.

But we can be pretty sure that central banks are going to print a ridiculous amount of money, and that governments will go into a ridiculous amount of debt.

They’ve told us this much. And they’ve already started to do it. So this seems pretty obvious.

The price of gold is up significantly over the last several months, and since the start of this crisis.

But the price of silver has declined… leading to a record-high gold/silver ratio.

This ratio may stay elevated for a while, or even go higher.

But in the past, the ratio has always returned to more traditional levels. Always. Even when the world was facing Adolf Hitler or the Great Depression.

So it stands to reason that, if they keep printing money (which they already are), and the ratio eventually returns to its historical range, the price of silver could really skyrocket.

We’ll spend some time this week talking about some interesting ways to take advantage of this.

And to continue learning how to ensure you thrive no matter what happens next in the world, I encourage you to download our free Perfect Plan B Guide.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I have no doubt…..SLV will go through the roof higher……as soon as my calls expire worthless

PHYSICAL silver will go through the roof.

Spot and physical silver decoupled on 3/15/2020, been that way since.

Mining company CEO’s have said (in the past 8 months) physical silver to gold ratio is about 4:1; and silver is much rarer than is realized. Today’s spot it’s 110:1.

When more paper metal is traded on a daily basis than has been mined in the history of the world there’s a problem.

(deleted)

Noticed that also– as silver briefly dipped under $13 and oz, the largest bullion dealers were completely “out of stock”… now I don’t know if they just stopped taking orders with the fear of losing too much below their purchase price, but silver on ebay and other BIN sites were selling at $25 an ounce faster than they could re-list more items.

There is at least a 40% difference right now in paper traded silver “spot” as opposed to physical delivery per ounce price….

“SLV will go through the roof”

don’t you mean the roof will fall down?

Silver could go up, up and away!!

Way way way up!….

But it won’t….cuz manipulation….

Another way exists for the ratio of gold to silver prices to get back to a historical balance. That is, TPTB declare the value of gold to be $256/oz. and require all citizens to cash in their gold for that new price, just like Roosevelt did. Presto, the gold/silver ratio is back to 16 to 1.

But somehow I’m not sure people today are as complaint as they were in the 30s. We’ll see.

Silver? Wouldn’t it be less painful to just eat broken glass? Why not buy Tesla? Up 45% this week, and almost 13% today.

What price did you buy Tesla?

Did not buy ten cents worth. Stocks are not what I keep my money in. But for plenty of people, that’s the only investing they know. And if they bought Tesla last week, they are happy today. Real happy

Do you think they’ll be real happy six months from now?

If they take their profits and don’t get greedy, yes. You could put stops on it now, if it keeps going up, just bump up your stops with it

What advice do you give to the dude who bought at $968 on February 19?

Right, he should have bought stock in that girl with the black panties stuck up her ass instead. I’m sure her stock went up with this lockdown. LOL

Put a pistol in your mouth. Darwin has no use for you. I believe in buying low and selling high, not the other way around. Look at the after hours, so far. Up another 26 bucks, or 4% more. Today was a good day for some people.

Just so you understand, the fact that I like Tesla as a company, is coincidental to the plays that I see with their stock. If I bet on the Dolphins, it would have nothing to do with whether I was rooting for that team. Just looking for free money

The gold to silver ratio may decrease, but why not just buy gold as protection against a devalued dollar? The article states that central banks and governments buy gold, so just buy gold and forget about it.

you can not escape, you can not bargain your way out, you can not buy your way out, we own everything, we control the markets, we control the horizontal, and the vertical, we will print time and space, if you let us.

Please let us print your reality, we only take a small percentage, just enough to wet our beak.

(the international ***)

Look at the price of physical silver compared to the paper price. Market is calling bullshit on the shenanigans going on.

Will the “price” of silver, in U$ dollars, increase, or will the value of U$ dollars decrease in terms of silver? Which is the measuring stick, and which is being measured?

In my opinion, you cannot change silver. A .999 fine try oz. is the same composition regardless of how many dollars you trade for it. On the other hand, a dollar is anything that the seller and buyer agree on. You used to be able to get a Big Mac Meal for a dollar, now they are 6 dollars. Same happy meal. The dollar is what changed.

Don’t buy silver because you think it will be worth more dollars. Buy silver for when the dollar is not worth anything.

“On the other hand, a dollar is anything that the seller and buyer agree on”

well that’s true for silver too. and gold. and, well, anything.

gman, No, I don’t think so and neither (faced with physical presence) do you. A piece of paper with green ink on it is useless for anything but trading at whatever rate you can trade it at. Silver or gold can be used, actually used, for a lot of different things. That green paper can be declared worthless and becomes worthless. That silver or gold will always retain it’s quality as silver, regardless of decree.

You may not always be able to trade dollars for silver but you will always find someone willing to trade you dollars for your silver. Remember that Greshams’s Law has not been repealed.

“No, I don’t think so”

… well good luck with that.

above ground gold: about 4.5 billion ounces

above ground silver: about 1 billion ounces

if silver goes down with reduced industrial activity, why is it going to go up during a general economic drawdown/depression?

It will be nice to have something that might be worth $200 an ounce versus its current $15. Unfortunately, bread will be $25 a loaf. Without the non-stop price suppression, its value would likely have been high when I might have REALLY been able to benefit.