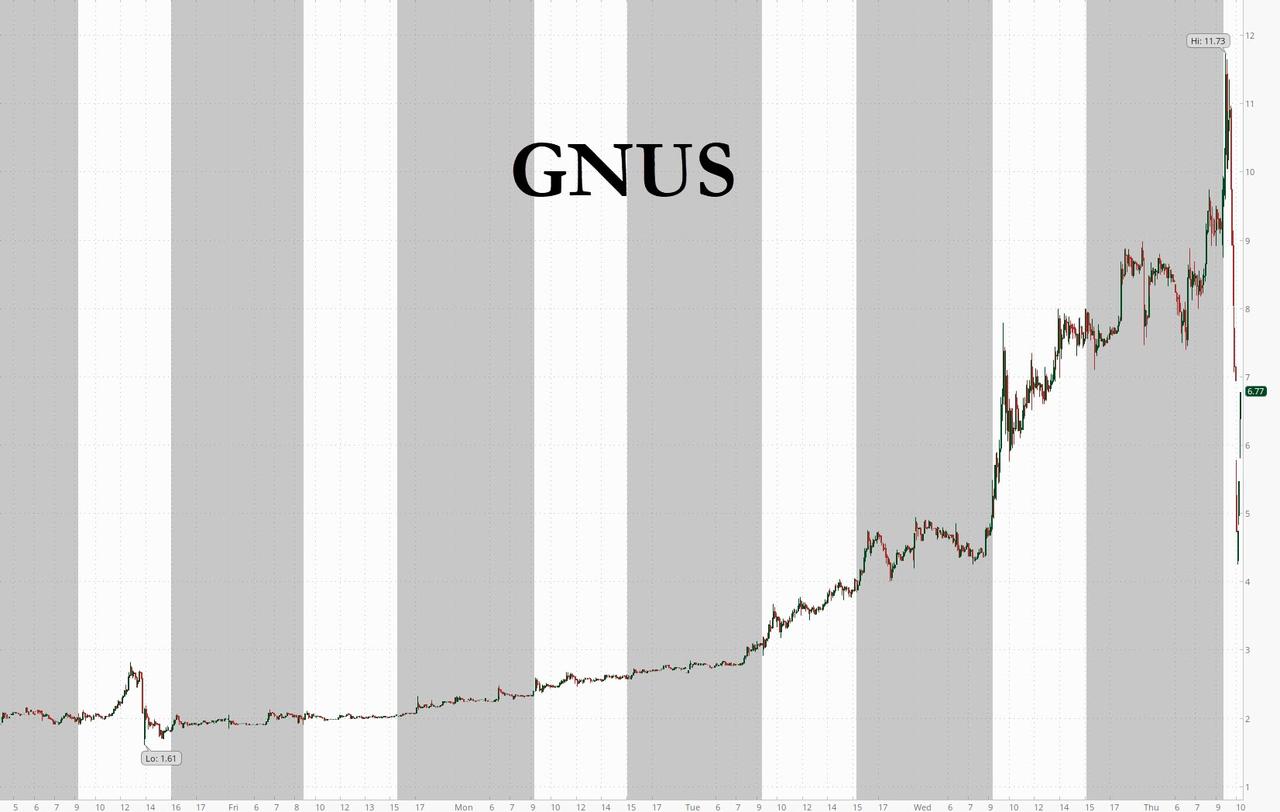

With retail investors taking over the extremely illiquid market, resulting in crazy intraday swings where the horde of robinhood retail traders alone can send a stock soaring (and tumbling)…

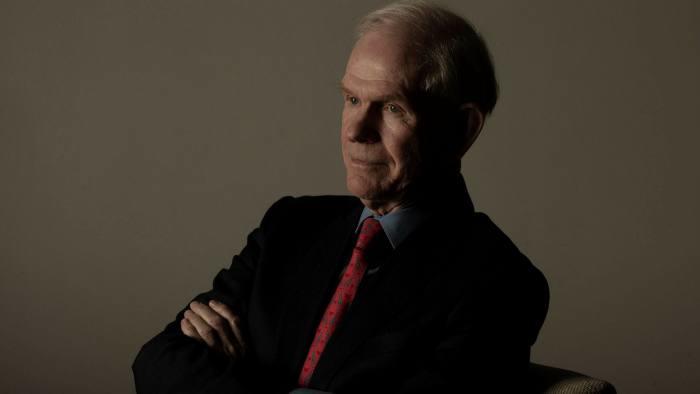

… many veteran investors are throwing in the towel on what is emerging as the most furiously ridiculous rally in history in what is now better known as “Jay’s market” (with 73% of Wall Street claiming that the market is only up due to the artificial gimmick of the Fed’s balance sheet explosion and not due to fundamental factors). And with one after another investing legend such as Warren Buffett, Stanley Druckenmiller, David Tepper boycotting the artificial rally, and either selling or pulling out, today GMO’s Jeremy Grantham became the latest to bail on what Bank of America recently called a “fake market.”

In a letter to GMO investors, Grantham writes that “we have never lived in a period where the future was so uncertain” and yet “the market is 10% below its previous high in January when, superficially at least, everything seemed fine in economics and finance. And if not “fine,” well, good enough. The future paths include many that could change corporate profitability, growth, and many aspects of capitalism, society, and the global political scene.”

In short, the veteran value investor known for calling several of the biggest market turns of recent decades admits he has lost his faith in an upside case – unlike the retail daytrading army – and his sense of direction in a world of record uncertainty “which in some ways seems the highest in my experience” and as a result “in terms of risk and return – particularly of the worst possible outcomes compared to the best – the current market seems lost in one-sided optimism when prudence and patience seem much more appropriate.”

Grantham also highlights the obvious: that the market and the economy have never been more disconnected, and points out that while “the current P/E on the U.S. market is in the top 10% of its history… the U.S. economy in contrast is in its worst 10%, perhaps even the worst 1%…. This is apparently one of the most impressive mismatches in history.”

As a result of this total loss of coherence driven by trillions in central bank liquidity that have propelled a massive wedge between fundamentals and stock prices, GMO, the Boston fund manager Mr Grantham co-founded in 1977, cut its net exposure to global equities in its biggest fund from 55% to just 25%, near the lowest levels it reported during the global financial crisis, according to a separate update from GMO’s head of asset allocation, Ben Inker.

That decision, according to the FT, slashed GMO’s Benchmark-Free Allocation Fund exposure to US equities from a net 3-4% to a net short position worth about 5% of the $7.5bn portfolio, said Inker, perhaps the first time the fund has turned net short US stocks since the crisis. This, after GMO loaded up on stocks during the sell-off but has since cut offloaded its exposure to the US market following the unprecedented 40% rally in the past 2 months.

“The Covid-19 pandemic “should have generated enhanced respect for risk and it hasn’t. It has caused quite the reverse,” Grantham told the Financial Times. He noted that trailing price-earnings multiples in the US stock market were “in the top 10 per cent of its history” while the US economy “is in its worst 10 per cent, perhaps even the worst 1 per cent”, echoing what he said in his quarterly letter.

And while markets seem to be taking all the negative news in stride, Grantham is worried that the wave of devastation that is coming is unlike anything experienced before:

At GMO we dealt with three major events prior to this crisis, and rightly or wrongly, we felt “nearly certain” that sooner or later we would be right. We exited Japan 100% in 1987 at 45x and watched it go to 65x (for a second, bigger than the U.S.) before a downward readjustment of 30 years and counting. In early 1998 we fought the Tech bubble from 21x (equal to the previous record high in 1929) to 35x before a 50% decline, losing many clients and then regaining even more on the round trip. In 2007 we led our clients relatively painlessly through the housing bust. In all three we felt we were nearly certain to be right. Japan, the Tech bubbles, and 1929, which sadly I missed, were not new types of events. They were merely extreme cases akin to South Sea Bubble investor euphoria and madness. The 2008 event also was easier if you focused on the U.S. housing euphoria, which was a 3-sigma, 100-year event or, simply, unique. We calculated that a return trip to the old price trend and a typical overrun in those extreme house prices would remove $10 trillion of perceived wealth from U.S. consumers and guarantee the worst recession for decades.All these events echoed historical precedents. And from these precedents we drew confidence.

But this event is unlike all those. It is totally new and there can be no near certainties, merely strong possibilities. This is why Ben Inker, our Head of Asset Allocation, is nervous and this is why you are nervous, or should be.

While the uncertainties are indeed large, one can triangulate a sufficiently material dose of “certainty” about what is coming, and as Grantham explains further, it is not pretty, especially with the US economy already on the back foot heading into the crisis:

We had U.S. and global problems looming before the virus: an increasingly disturbed climate causing global floods, droughts, and farming problems; slowing population growth, in the developed world, soon to be negative; and steadily slowing productivity gains, especially in the developed world, and therefore a slowing GDP trend. In the U.S., our 3%+ a year trend is down to, at best, 1.5% in my opinion. It is closer to a 1% maximum in Europe. We had, as mentioned, top 10% historical P/Es in the U.S. and much the highest debt level ever in the U.S. for both corporations and peacetime government. So, after a 10-year economic recovery, this would have been a perfectly normal time historically for a setback.

And then the virus hit.

Simultaneously, it is causing supply and demand shocks unlike anything before. Ever. It is generating a much faster economic contraction than that of the Great Depression. And unlike 1989 Japan, 2000 Tech (U.S.), and 2008 (U.S. and Europe), it is truly global. The drop in GDP and rise in unemployment in four weeks have equaled what took one to four years to reach in the Great Depression and were never reached in the other events. Rogoff & Reinhart, Harvard Professors who wrote the definitive analysis of the 2008 bust, agree that this event is indeed completely different and suggest it will take at least 5 years to regain 2019 levels of activity. But this is a guess. We really don’t know how long it will take. Nearly certain is that a V-shaped recovery looks like a lost hope. The best possible outcome would be that there will be, almost miraculously, billions of doses of effective vaccine by year-end. But most viruses have never had a useful vaccine and most useful vaccines have taken well over five years to develop and when developed have been only partially successful. Yes, this time there will be an enormous effort with unprecedented spending. But still, a leading vaccine expert says quick success would be like “drawing successfully to several inside straights in a row.” And even if all works out well with a vaccine there will remain deep economic wounds.

Meanwhile, as the world waits for a vaccine, and buys stocks confident one is imminent, the “bankruptcies have already started (Hertz on May 22nd) and by year-end thousands of them will arrive into a peak of already existing corporate debt. It will need spectacular management, which it may get. But it may not. Throwing money – paper and electronic impulses – at the problem can help psychology and, particularly, the stock market, where extra stimulus money can end up but does not necessarily put people back to work; there will be up to 20% unemployment for at least a moment.”

In response to this historic economic collapse, central banks’ unprecedented stimulus efforts have “temporarily overwhelmed” underlying economic realities but “it’s hard to believe that will continue.”

And when it stops, watch out below: Grantham told the FT in an interview that after seeing markets price in “total recovery” over recent weeks, “my confidence that this will end badly is increasing.”

Speaking as protests against police brutality and racism filled the streets of US cities, Grantham said previous outbreaks of social instability had had few lasting effects on the US economy, but “there are more things going wrong than normal“.

However, the value investing legend’s most dire prediction was that “if you look back in two to three years and this market turns around and drops 50%, the history books will say ‘That looked like one of the great warnings of all time. It was pretty obvious it was destined to end badly,” Grantham said, adding: “If it does end badly the history books are going to be very unkind to the bulls.” For the sake of an entire generation of Robinhooders who will lose everything if there is a 50% crash, one hopes Grantham is wrong.

Finally, Grantham also chimed in on the “most important question in finance right now”, revealing that he was proud of not having “made a fuss about inflation” in 20 years of writing his widely followed letters, but said that record amounts of monetary easing from central banks had now created the possibility of inflationary pressures.

“With a generous stimulus program in many countries you can just about daydream about inflation for the first time in 30 years.”

To this, all we can add is that in the very near future that daydream will become a nightmare.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

HMMMM.

https://wbbm780.radio.com/articles/mayor-lightfoot-pleads-with-walmart-to-not-abandon-chicago

Well…..I bet the feel pretty silly this morning!

Fuque all these experts. As of today I am right about where I was at the all time peaks again with a couple of thousand points to go to retake the DJIA all time high. Not too shabby.

As I wrote previously, those who sold out paid fees, capital gains, perhaps penalties and lost the revenue stream from investments. It not being anywhere near my first rodeo, I did nothing, except for selling a couple of shitty performing stocks that reached 52 week highs incredibly during the madness. “go on, take the money and run.”

The investment world is a different breed of cat.