Authored by John Rubino via DollarCollapse.com,

US stocks are behaving amazingly well given the political and economic near-chaos of the past few months. This is probably the first recession that inflated rather than popped financial asset bubbles.

Why? Because panicked governments and central banks are dumping trillions of play-money dollars into the system, a big part of which flow directly into the brokerage accounts of the 1%.

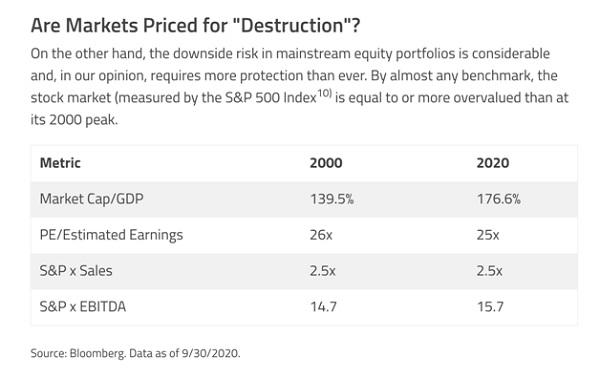

The result is a stock market that looks very familiar to financial historians. But not in a good way. Here’s a table from money manager Lawrence Lepard comparing today’s S&P 500 to its predecessor at the peak of the 1990s tech stock bubble.

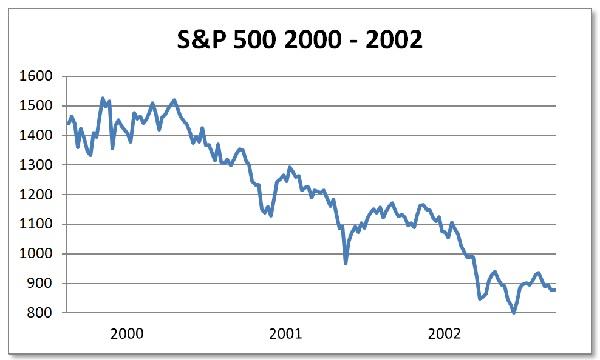

And here’s what the S&P 500 did following that 2000 valuation peak:

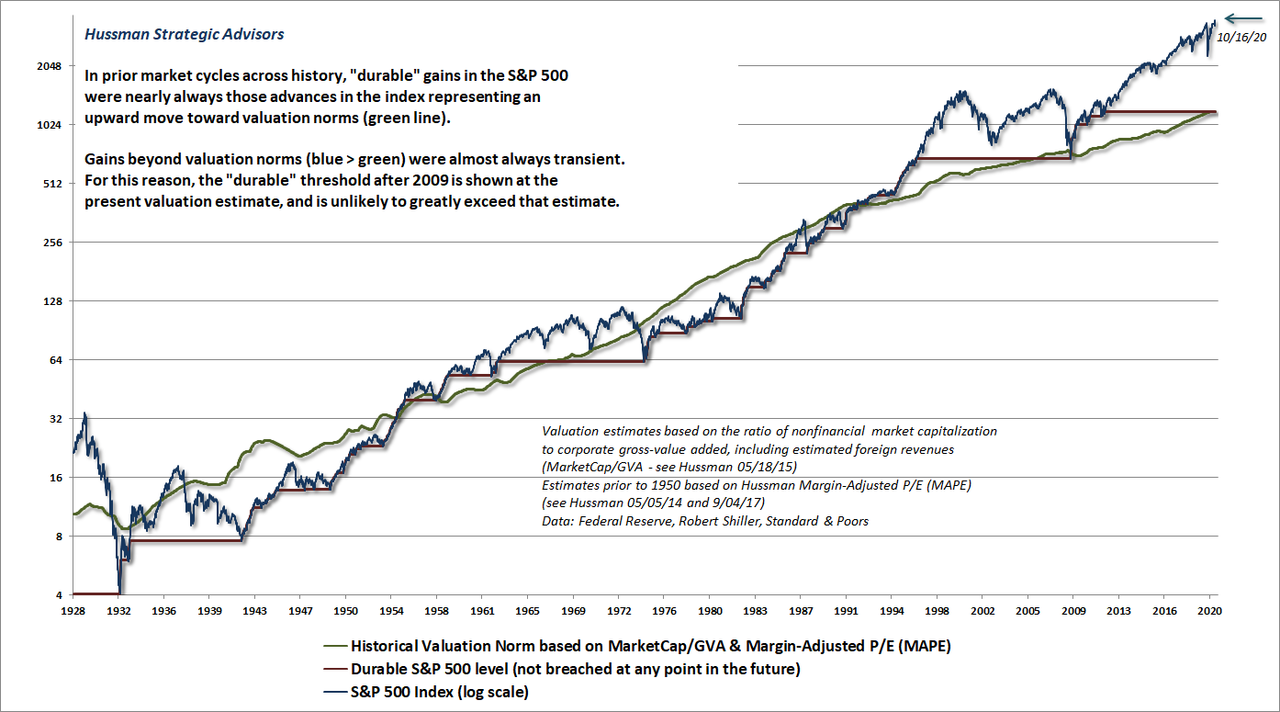

Next is a chart from Hussman Funds (always a good source of terrifying stock market visuals) showing the S&P 500’s behavior as it fluctuates around Hussman’s favorite market valuation measure. Their explanation:

The chart below is a reminder of where the S&P 500 stands relative to levels that we would consider “durable.” The blue line shows the S&P 500, the green line shows our best estimate of historical valuation norms at each point in time, and the red line shows “durable” levels in the S&P 500 that were never again breached in later cycles. Notice in particular that market advances toward valuation norms (that is, blue line below green line) tend to be durable. In contrast, market advances far beyond valuation norms (blue line above green line) tend to be transient, and are often wiped out over the completion of the market cycle, or even the following market cycle, as was the case in 2009.

This pattern points to an imminent give-back of the past few years’ overexuberant gains.

And last but not least, zombies

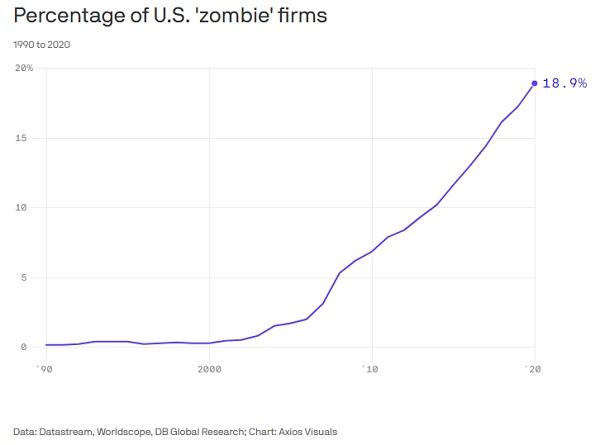

Another effect of long equity bull markets is a growing population of companies that are only viable in the easiest of easy money environments.

“Zombie” companies, for instance, have debt service costs that exceed their profits, so they can’t survive without continuous infusions of new capital. They are, not surprisingly, the first to go when financial conditions become even slightly less easy. And there are now more of them than ever before. Chart courtesy of Real Investment Advice.

Clearly, this is another of those “peak insanity” markets that emerge during credit bubbles. Here’s why it matters so much today: This level of financial fragility and equity overvaluation gives the financial markets veto power over government policy. If future administrations and/or central banks even think about tightening fiscal or monetary conditions, the air pockets under stock prices will act as a deterrent, leaving governments around the world with no choice but to stay their current course. That means zero-to-negative interest rates and massive ongoing credit creation basically forever.

So the question becomes, what unintended consequences will flow from emergency levels of monetary ease becoming permanent? This, at least, is easy to answer: Inflation, extreme volatility, currency crisis, and soaring gold and silver.

An ugly world, in other words, but one full of opportunities.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

John, been a big fan for a long time, as to your question of permanence.

We, and this is pretty much all of humanity have been trapped in the zero bound for over a decade, especially the real.

The lever pullers have tried like 3 times to lift the rate lever and….no. There is nothing new today, except perhaps the extremity, they will never get it back.

Jim Willie, as obnoxious as he can be, called this spot on in 10 or 11, they will never get above zero.

So in this sense we have permanence to answer your question, permanently zero bound.

Growing zombification requiring ever more debt infusion producing ever more zombies.

Obviously it cannot go on like this forever, so in this sense permanece will be decidedly short lived.

Monopoly money life support for the US Stock Market. What a fine way for the Fed Reserve to build credibility in the US economy. Our 401Ks go up with debt piled on future generations, all so we are comfortable in the here and now with our cars and boats and houses. Immoral.

The ‘cash’ the Fed has created has to go somewhere, right? The cash that former savers have that is now getting .1% interest has to go somewhere, right? Hence the inflation of stock valuations.

The only thing that would pop the stock market would be an increase in interest rates that reduces easy money liquidity.

Why does everything have to be an advertisement for precious metal dealers?