Guest Post by Marin Katusa via International Man

We’ve all heard the macroeconomic arguments in favor of owning gold. Today I want to talk about the scientific (chemical) reasons that separate gold from all of the other metals in the periodic table.

First, gold is inert, which means it’s very inactive. It does not react with oxygen like iron does (think rust).

That makes gold an excellent store of value.

If all the elements in the periodic table were characters in a reality TV show, gold would easily be the most boring.

Why? Because gold is inert. It doesn’t hook up with anyone.

Yes, gold is the ultimate celibate element.

Let me explain why this is important—chemically speaking.

The Alchemist’s History of Hard Money

There are 118 elements in the periodic table, of which gold is one.

Take away the 17 gases (gases are of no value for this exercise).

Also remove the six metalloids, which are elements that don’t know whether they are metals or non-metals since they have traits of both (e.g., antimony, arsenic, silicon).

Thus, we end up with ninety-five elemental metal contestants on our Currency Reality Show.

Note: For the chemistry nerds among us, I don’t count Oganesson and antimony as metals—call me old school. There are ninety-five metal elements in the periodic table.

Of the ninety-five metals in the periodic table, eighty-five are “active.” This means they are fun to watch on our reality TV show because they are always hooking up with other elements.

But remember that activity always results in oxidation or corrosion.

If you want a metal for long-term storage value, you don’t want it to change. You want it to hold its own, maintain its integrity, and not degrade.

Iron, for example, has many useful applications, but it oxidizes and then rusts. Iron is active, and it would be fun to watch its decay on a reality TV show for entertainment value.

But it’s bad if you want to use it as a currency. The coinage will rust away. And the last thing you want is a metal that debases itself.

Politicians and central bankers don’t need any help doing that; they do a wonderful job of debasing currency on their own.

The Noble Metals – Gold, Silver, Platinum, Palladium…

So that leaves us with what are known as the “noble” metals. Just like there are noble gases (noble meaning “inert”), these metals are not active.

I want you to think of the noble metals as the royalty of all metals. They don’t interact with the peasants—the other elements on the periodic table that are always “interacting” with others and debasing themselves.

The noble metals in chemistry are the following:

- Copper,

- Silver,

- Gold,

- Platinum,

- Palladium,

- Ruthenium, Rhodium, Osmium, and Iridium.

Historically, copper, silver, and gold have been known as the coinage metals. And scientists deem these three the “real” noble metals because of their electronic structure.

Copper does react with oxygen, which is where the Statue of Liberty got its bluish-green color.

But the result of copper interacting with oxygen is not corrosion, like rust. It’s the exact opposite. The process is called “passivation,” and the bluish-green color is actually a layer of protection that protects the copper from natural debasement.

That is why copper is included in the noble metals. It does “interact,” but it doesn’t corrode. This interaction acts as a protective barrier for the copper but changes its appearance.

Silver is a bit kinky, too. It reacts with sulfide gas in the atmosphere, which causes it to look tarnished.

Removing the tarnish is natural debasement. Every time you polish the silver to get rid of the tarnish, you will be removing some silver, thus debasing it.

The remaining noble metals just aren’t practical for use as a store of value.

Not only are they hard to smelt and difficult to work with, but they are also too scarce in nature to be able to meet the need as a store of value.

And they all look kind of ugly. Think silver, but without the sexiness and brightness.

A blah gray is what the platinum group of noble metals look like.

In fact, all the metals on the periodic table of elements except copper and gold are a variation of gray. Silver is at least a sexy version of gray. The rest are just variations of a dull gray.

So That Leaves Us With Gold…

Gold’s beautiful color is not only unique on the periodic table, but it also will not change. Gold doesn’t mess with the peasant metals or with the other nobles. Gold does not react with any other element.

And ultimately, that is why gold will always be the king of all metals—and the currency of kings.

Everyone loves gold. Nobody dreams of winning a bronze medal at the Olympics. It’s the gold medal they want! There are thousands of analogies engrained in our subconscious, passed down to us through our families and societies, why gold is the king of metals.

And it’s the only metal that serves its purpose as the best store of value.

Gold Market Update

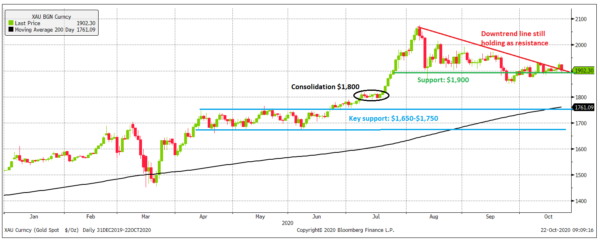

As I have written several times over the past few months, I did not expect gold to be a one-way trip.

Gold has risen 47 percent, or $600 per ounce, in fewer than two years. Taking some time to consolidate before moving higher is important.

In Katusa’s Resource Opportunities, we’ve highlighted three resistance points above $1,900 per ounce that gold needed to hold above, which it failed to do so.

In addition, $1,900 per ounce was a line in the sand, which gold has broken below.

In the graph below, you can see that the red trendline remains intact and has acted as resistance since August.

So what’s going on?

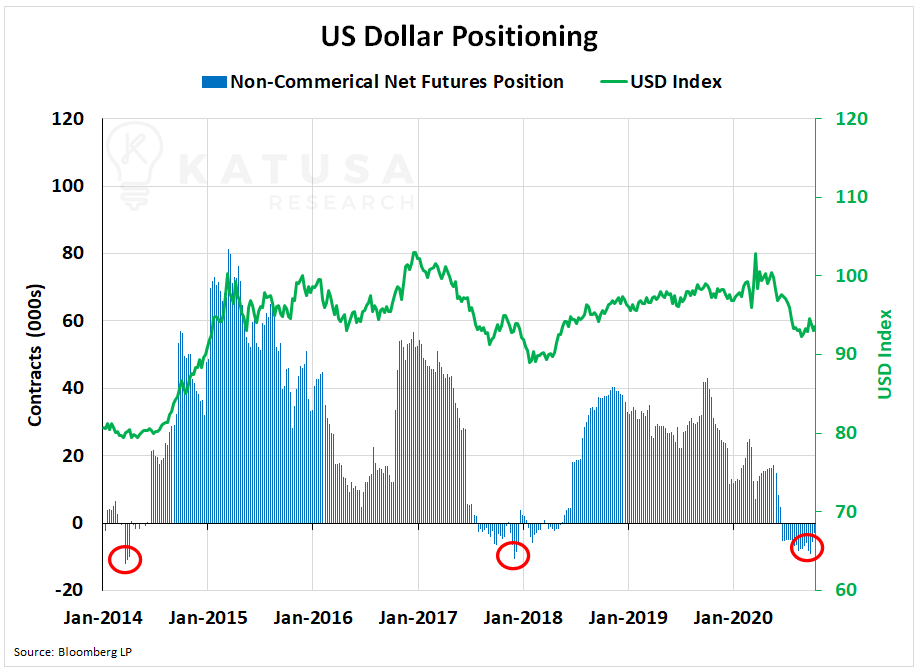

The USD continues to play its role in the price of gold.

On the heels of enormous stimulus packages, the USD has faced high-short sales pressures. The graph below shows the current USD positioning.

According to the CFTC, over 9,000 contracts are currently short the USD.

This has only happened two other times since 2014. Both times, the USD has subsequently experienced a sharp rally.

A rally in the USD would be a headwind for short-term gold prices.

Regardless, I expect the gold market to remain volatile over the coming weeks.

Make no mistake; you can use this volatility to your advantage.

If the USD rallies and takes the wind out of the supercharged gold and silver markets, are you prepared?

Back in Q2 of this year, there were screaming bargains in some of the best companies in the resource world.

Subscribers and I were prepared, picking up world-class companies and stocks in price swings that a junior or small-cap company normally sees.

In markets exactly like you see today, it’s important that you know which stocks you’re holding are liquid – and which ones are illiquid.

We are not even halfway through the share-printing spree that resource companies (explorers and developers) went on. These companies are giving central bankers a run for their money (printing).

Editor’s Note: A small amount of money put into mining stocks right now could give you life-changing rewards.

For a limited time, Marin is revealing how you can get positioned alongside him as the bull market kicks off in earnest. Click here to get the details now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

First off, gold does tarnish in the presence of sulfur. It reacts with chlorine and cyanide solutions in the presence of oxygen. It can form the following compounds:

gold chloride

gold bromide

gold cyanide

gold hydroxide

gold oxide

gold potassium chloride

gold potassium cyanide

gold potassium iodide

gold sodium thiosulfate

gold thioglucose

and quite a few more. To top it all off, there are no stable isotopes of gold, although the half lives are so long that isn’t much of a concern. The point is that technically every gold atom will eventually decay to other elements.

Although it is true that polishing silver will cause the removal of some of the metal, there are chemical means to remove tarnish that does not remove any metal and releases the sulfur harmlessly.

Put your tarnished silver in a Pyrex baking dish lined with aluminum foil such that every piece is touching the foil. Sprinkle two tablespoons of table salt and two tablespoons of baking soda over the silver and pour boiling water to completely cover the silver. Watch (and smell) the bubbles of H2S form all over the silver. Hydrogen sulfide (rotten egg odor) is toxic, but the quantities released in this reaction are so small that it’s not a concern. If you are worried, do it outdoors. If the reaction slows down, add some more baking soda. If you have a lot of silver or it is heavily tarnished, you’ll discover that the aluminum foil will disintegrate. No metal is removed from your silver AND there is no effort like there is when you polish it.

My question is: why do all of the authors from International Man come off as know-it-alls? I know this same thing has been commented on here in the past.

I certainly DON’T know it all, but I don’t like the feeling that an author is talking down to me, particularly when they write an article as a teaser to get me to sign up for a subscription.

Open pit cyanide leaching is used at the Cripple Creek/Victor Gold Mining Company in Colorado to perform the first stage of processing gold ore.

Gold may be “noble “, but brass, lead and copper are `”KING”, especially at high velocities…and will be worth more than their weight in gold in days to come….

another minor item in addition to the bigger posts on chemical details below, the greenish color of patina on copper and copper alloys, is from reaction with sulfur, not oxygen. oxidized copper is an extremely dark dark black, actually one of the _most_ light absorbent surfaces one can make.

at room temperature copper barely reacts with oxygen but at temps above several hundred degrees the reaction speeds up considerably. the metal gets slightly more brittle if its soaked with oxygen, which is also why small amounts of phosphorus are added to thin copper constructions expected to be exposed to a lot of heat, namely plumbing fittings and pipe. this makes the copper work-harden a lot more, but protects against most of the oxidization.

greenish colors are copper sulphate.

and yes both reacted forms of copper do form a somewhat protective layer on the metal’s surface.

none of this detracts from gold’s uniqueness, though merely fixating on its inertness ignores many further factors which make it an excellent money (even physical properties, like its very high density which makes it a lot harder to fake, like its extreme malleability and ductility which also help authenticating it, and make it easy to form into convenient objects like coins, its ability to readily allow with small amounts of especially other noble metals to be even more practical in those daily applications… and its very _wide_ distribution in the earth’s crust. if gold were only found in one

or two deposits anywhere on earth, its likely that the resulting monopolization of supply that would have held for long ages, would have detracted from its appeal as a money. instead, gold is found in _small_ quantities all over the place (certainly before the modern age systematically mined out every last deposit near the surface) which meant that even from the beginning nobody really had a strong monopoly on the stuff.. thats important for its use in markets.

now of course theres so much above ground that that doesnt matter much anymore.

Gold, if people know you have it they will kill you for it. I can only imagine the misery and death associated with it.