For generations Baby Boomers were told to follow certain rules and, with Social Security, then later Medicare, they were guaranteed a safe, comfortable retirement.

For generations Baby Boomers were told to follow certain rules and, with Social Security, then later Medicare, they were guaranteed a safe, comfortable retirement.

Oops! For many it is not happening; did they fail to read the small print, or understand things?

Dictionary.com defines guarantee, with some examples:

noun

“a promise or assurance, especially one in writing, that something is of specified quality, content, benefit, etc., or that it will perform satisfactorily for a given length of time: a money-back guarantee.

verb (used with object), guar·an·teed, guar·an·tee·ing.

to make oneself answerable for (something) on behalf of someone else who is primarily responsible: to guarantee the fulfillment of a contract.

to undertake to ensure for another, as rights or possessions: The Constitution guarantees freedom of religion.”

Founding Father, Ben Franklin cautioned:

“Our new Constitution is now established, everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.”

Sadly, even Constitutional guarantees seem to be morphing into the level of political promises.

Moneywise reports that members of congress rate just ahead of car salesmen as the most dishonest professions, with low ethical standards.

Nothing new here, been that way since the beginning of time.

Let’s look behind the guarantee curtain….as it relates to retirement planning.

| Death is the only guarantee; it will happen – someday. When planning for retirement, go long. You don’t need to be worrying about running out of money before your judgment day. |

Taxes are guaranteed; however, what is taxed, the tax rate and implications are constantly changing.

If the current tax changes in congress come to pass, retirees will refer to 2020 as “the good old days”.

I’ve read articles concerning proposed tax increases and changes for:

- Individual income tax

- Corporate income tax

- Capital gains tax

- Itemized deductions changes

- Retirement savings changes

- Estate tax

- Gift tax

- Wealth tax

- Vehicle mileage tax

The Charlotte Business Journal tells us:

“In the past few years, we have experienced three major tax and financial changes that we typically only expect once a decade….

This year, we are expecting another major bill (if not multiple) to be signed that may affect how you wish to structure your finances. It is key to remember that no bill has been proposed that is expected to be signed immediately.”

Who knows what will come to pass? The predicted fourth major tax change, which could be retroactive, will impact retirees, savings, income and lifestyle.

Focus on what you can control

I define “Comfortable Retirement” as living a comfortable lifestyle, without constantly worrying about money.

Understanding investments; what is, and is not, guaranteed is the first step. Step two is investing in such a manner that your overall portfolio, plus retirement income, allows you to achieve the “Comfortable Retirement” goal.

Guarantees, promises, assurances and illusion

Retirees must balance four factors:

- Safety of the guarantor

- Income

- Protection of Principal

- Buying power

You can generally get some, but not all from an individual investment.

Don’t assume guarantees or promises that do not exist.

When I retired, my wife Jo and I were heavily invested in FDIC-insured Certificates of deposit. We felt we could count on regular, contractually guaranteed income each month.

When the 2008 bank bailout came, our CDs were called in. We didn’t lose principal; however, what we thought was guaranteed income disappeared.

Is social security really guaranteed? Recently Jo’s family sold the family farm. After taxes, she could not invest the remainder and safely earn anything close to the income the farm provided.

The crowning blow? We got a notice that our social security checks for 2021 would be reduced by approximately $9,000. On paper, our social security benefits were not reduced; however, they raised our Medicare premiums because of the farm sale. In essence, they are means-testing benefits; including those for existing retirees.

Don’t be fooled with the social security inflation rider. Inflationary increases are generally offset with increases in Medicare premiums. You may get an inflationary boost in your benefits, but it is routinely taken back in government medical premiums. If your other bills increase, you are on your own!

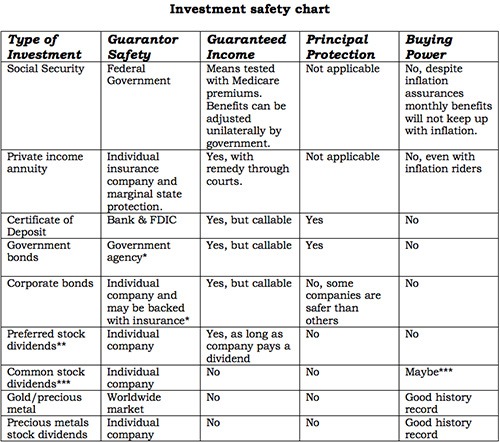

In the following chart, I take some common investments and look at the promises and drawbacks. Let’s start with definitions:

Guarantor safety is the strength of the promise, and the government agency/insurer backing the promise.

If a bank fails, the FDIC insures depositors will not lose their money, up to a certain amount. States have various plans insuring annuity holders from default on the part of the insurance company.

If one party breaks their promise (defaults), is there an insured backup or do investors have to go to court to recover what they can?

Guaranteed Income means the money is guaranteed to arrive as promised for the life of the agreement. Many investments are “callable”, meaning the borrower can end the agreement at will by repaying the principal.

Principal Protection means you will not lose the amount you invested. Many bondholders have found their income came in as promised, but when the bond matured the issuer could not pay them back. They end up in the court system and can lose a lot of money. How safe is the principal?

Buying Power. Will payments increase with inflation? My parents bought CDs during the Carter years. When they matured, they got their money back but lost around 25% in buying power.

*Bonds are rated for safety by private rating agencies. Theoretically, bonds with a higher default risk pay higher interest. If an investor is worrying about losing their money, they should seek other alternatives. The rating agencies are not always accurate. Let the buyer beware!

**Preferred stock dividends are a higher level of contractual promise than common stock. The company promises they will not cut the dividend and they will continue to pay them as long as they pay any stock dividends. Some are cumulative, meaning if dividends are suspended, they are contractually obligated to “catch up” for preferred shareholders.

***Common stock dividends are not guaranteed. The dividend is generally announced each quarter. Common stock dividends can be raised which helps to offset inflation. Many investors have held common stock shares for years and their dividend income is in double digits when compared to their original investment.

What does this mean?

Guarantees are nothing more than promises or assurances, including those from the government. There is no one, set it, forget it and go enjoy retirement investment.

Guarantees are nothing more than promises or assurances, including those from the government. There is no one, set it, forget it and go enjoy retirement investment.

CDs and quality bonds don’t pay enough interest to beat inflation, particularly if they are held in a taxable account.

The stock market has made a lot of people rich. Today the market is at an all time high and can make a lot of people poor overnight.

| Each investment outlined can be excellent. A good, balanced portfolio will include most all types. |

How do you do it?

When friend Chuck Butler and I preach diversification, we mean accumulating a group of investments together to take advantage of the positives, while offsetting the negatives (counter-balance) with other types of investments.

Many retirees love the contractually guaranteed lifetime income annuities. They must counter-balance and provide for the lack of inflation protection by holding investments that hedge against inflation.

When there is a major stock market correction, even the best companies will see their share prices drop – and they could take years to return to their previous highs.

Dividend expert Tim Plaehn sorts through thousands of candidates finding solid companies that will thrive through tough times and continue to reward investors with solid, safe and many times growing dividends.

While their dividends are not guaranteed, Tim seeks out companies with a good, proven history record and great business. He recommends buying small amounts regularly so your costs even out. That beats fee-based mutual funds specializing in dividend-paying stocks.

Ben Franklin said, the only guarantees are death and taxes. I expect our 2020 tax rates will be the lowest I will see for the rest of my life; nothing I can do about that.

The best guarantee in life is the one you give yourself and your family.

No one cares more about your money than you do. The investment world is constantly changing. Investing in continuing education and resources gives Baby Boomers the best chance to control their own destiny for the duration; without worrying about how to pay their bills, including taxes; now and in the future.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

I had a broker who repeated the diversify mantra, unfortunately it was just stocks or bonds. Then he started recommending putting it all into a annuity. So much for diversity, a market crash and the single company guaranteeing my annuity goes away. New broker time.

Get some camping gear and something paid for. Like a boat or a shed or an RV to live in. imagine everything you take for granted right now, not being there in the future. Also, think about everything as taxable.

Just got my annual retirement fund statement from Wells Fargo. 1.5 Billion underfunded, and I’m still at least 10 years from being eligible to draw anything. Fuckers still go home every year with a bonus though. Boomer politicians passed the laws to enable the raiding and looting of anything of value over the past 50+ years and the Gen-Xr’s are nothing but cuckold, go-along-to-get-along cowards. Suck it up buttercups, we’re all slaves now.

Hi,

Sad commentary. GE was in the same boat and borrowed millions to buy back their stock when it was at an all time high, but did nothing to bring their pension fund up to speed.

Best regards,

Dennis Miller

Are any of the big union pension funds in trouble? LOL… asking for a friend.

Seriously, every year my husband gets a letter from the IAM Pension Fund (he retired “early” at 15 years in 2012) assuring him that the shortfalls and reductions in benefits will not effect those who have already retired. Eventually, shortfalls almost certainly have to impact his benefits, but fortunately, we planned for that.

Who thought the unions were going to protect your retirement monies any better than Congresscritters?

When I worked in the logging industry and then in a wood mill we had to have International Woodworkers Assoc. (IWA) membership. Paid in for nearly 10 years before injuries forced me out for good.

Got a nice letter from the IWA… In a nutshell it stated that those working in the industry between 1990 and 2000 will not get a pension because the union made some unfortunate investments that went bye bye… Heres $200 for your troubles…

So yeah I’m not a big fan of unions before this happened and especially after this happened. Unions are parasites just like every other big corporation and government.

Well for vets the CBO proposed taxing VA disability benefits and eliminating them for vets with a 30% or less disability rating.

That is huge, subwo… do you have a source or link?

I read it in a MOAA magazine. Went to the site and tried to logon but couldn’t so I did a search there under cbo va and found this link. Look at Mandatory Spending and Revenues. It hasn’t been made law. Just proposed.

https://www.moaa.org/content/publications-and-media/news-articles/2020-news-articles/advocacy/budget-cutting-options-in-this-new-report-could-cost-you-thousands-of-dollars/

CBO is always trying to screw vets, but it’s never popular in congress.

I can take a dump in a box and mark it guaranteed. I have spare time.

When the final Ka-Boom happens folks will watch those paper assets disappear like cotton candy in a kids mouth.