Asset prices soaring to ridiculous levels, well beyond anything regarding true, intrinsic values creates a bubble. Eventually things come crashing down. Those holding overpriced assets lose a lot of money and the ripple effect can cause economic hardship to many others.

Asset prices soaring to ridiculous levels, well beyond anything regarding true, intrinsic values creates a bubble. Eventually things come crashing down. Those holding overpriced assets lose a lot of money and the ripple effect can cause economic hardship to many others.

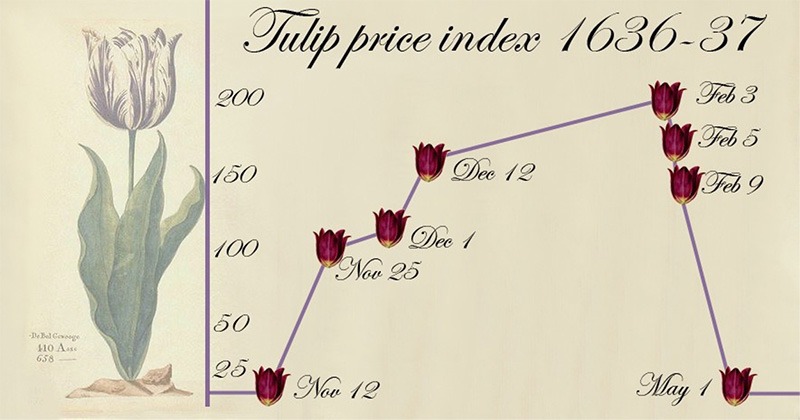

Ozak Durmus tells us about “Tulipmania”:

“Tulipmania was the first major financial bubble. It happened in Holland between 1636-1637. …. The term “tulip mania” is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values.

…. At the peak of tulip mania, in 1637, some single tulip bulbs sold for more than 10 times the annual income of a skilled craftworker. Tulip mania reached its peak during the winter of 1637, when some bulbs were reportedly changing hands ten times in a day.”

Historians ask, “How could people be so stupid?” Many times (dot-com bubble) investors ignore history, tell themselves “This time is different!” and repeat the process.

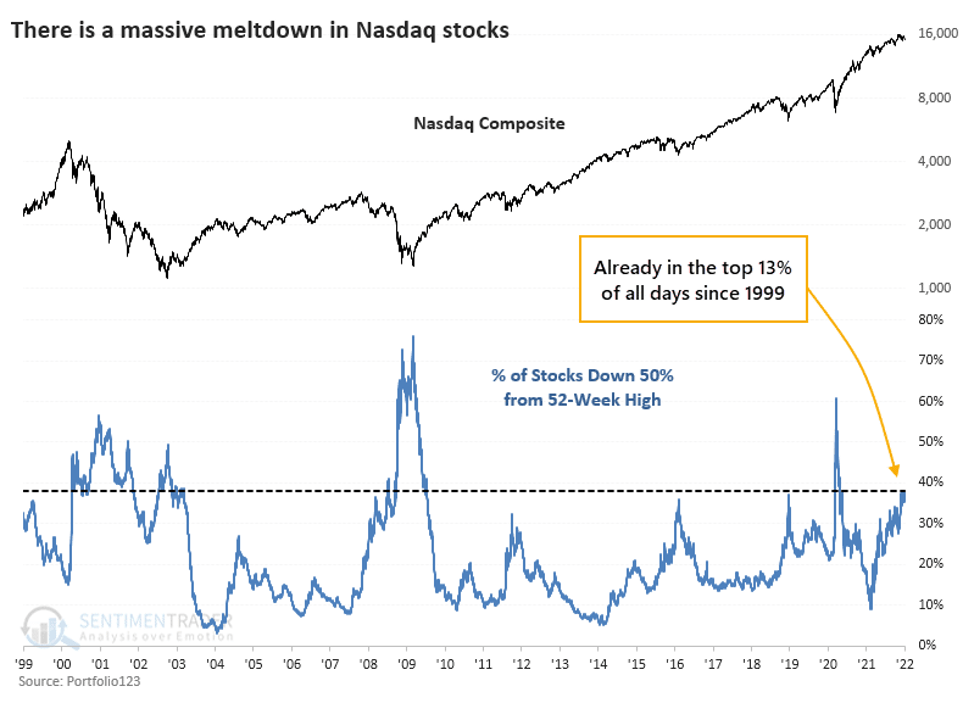

Does the NASDAQ composite index look like the tulip index?

In both cases, asset prices increased almost ten-fold into a huge bubble.

Looking behind the curtain

The NASDAQ chart is an illusion; not reflective of what is happening. Lance Roberts at Real Investment Advice explains that the top-ten stocks are what is supporting the indexes:

Their weekly letter is very clear:

“…. According to SentimenTrader, nearly 40% of the Nasdaq index have lost 50% of their value from respective 52-week highs. To wit:

‘Valuations are at historical highs, companies are raising billions based on fairy dust, and the Fed is signaling a tightening cycle. All of these are scaring investors that we’re on the cusp of a repeat of 1999-2000.

After Wednesday’s post-FOMC selloff, more than 38% of stocks trading on the Nasdaq are now down 50% from their 52-week highs. ….

At no other point since at least 1999 have so many stocks been cut in half while the Nasdaq Composite index was so close to its peak. When at least 35% of stocks are down by half, the Composite has been down by an average of 47% (!).’

The last sentence is critical. There is no precedent for when so many stocks were in a bear market, and the index wasn’t.”

The last sentence is critical. There is no precedent for when so many stocks were in a bear market, and the index wasn’t.”

Hoisington Investment Management recent Quarterly Review and Outlook explains: (Emphasis mine)

“…. Lower real yields carry an alternative implication that is far more negative for economic growth. A negative real yield points to the fact that investors or entrepreneurs cannot earn a real return sufficient to cover risks. Accordingly, the funds for physical investment will fall and productivity gains will erode which undermines growth.

Attempting to counter this fact, central banks expand liquidity but the inability of firms to profitably invest causes the velocity of money to fall but the additional liquidity boosts financial assets. Financial investment, however, does not raise the standard of living.

While the timing is uncertain, real forward financial asset returns must eventually move into alignment with the already present negative long-term real Treasury interest rates. This implied reduction in future investment will impair economic growth.”

Friend Chuck Butler published a Twitter post by Marc-Andre Fongern that sums things up well:

“What the Fed has achieved so far:

1) Intensified inequality

2) Made the rich even richer

3) Boosted inflation alarmingly

4) Inflated stocks massively

5) Engaged in insider trading”

The Fed has not raised the standard of living of Main Street.

Birch Gold reports:

“After printing trillions of dollars over the last two years, the Federal Reserve wants to rein things in. It’s woken up to the threat of the U.S. dollar losing its status, or its value altogether, and aims to address it with a series of rate hikes.

[Geoffrey Smith, Investing.com] points out that hawkish Fed policy (in other words, raising interest rates) requires a strong economy. The U.S. economy, at the moment, simply isn’t strong.”

Since the 2008 bailout with negative interest rates, the stock market soared, and corporations borrow to the hilt. Most corporate borrowing didn’t go into building factories or equipment. There was no real growing demand for their products. Instead, they borrowed money to buy back their stock, increase dividends…and pay themselves huge bonuses. The rich get richer!

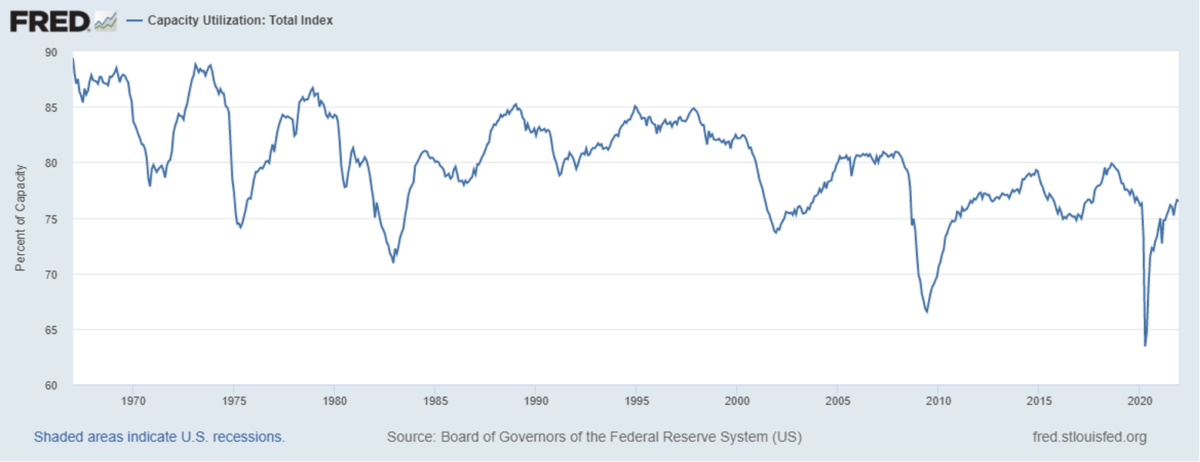

When the Fed raises rates it’s normally to slow a hot economy and curb inflation. The Capacity Utilization Index shows no reason for expansion, there is plenty of unused capacity; much different from what we saw in the 1970s when Paul Volcker raised interest rates.

What’s different this time?

I’m not an economist, I needed help from our Fed Expert, Chuck Butler.

DENNIS: Chuck, I have always associated the Fed raising rates to cool an overheated economy. Since the first 2008 bailout, we haven’t really seen a strong economy. Isn’t this different from what we have seen in the past? What can they do?

CHUCK: Central Banks used a very hot-running economy as a time to raise rates when inflation becomes a problem. Historically they raised rates to calm inflation.

This time it is different, Dennis, because of the kind of inflation we are experiencing. Some used to call it Stagflation, but I’ll just refer to it as just inflation… Real wages haven’t really increased by much for the last 40 years, so it’s not wage inflation… It’s simply inflation that has been caused by the Fed and its currency printing…

And as far as an overheated economy… Well, that’s not the case. The U.S. has averaged 2.1% GDP since the Great Recession of 2008… At least 3% growth would have helped, but we never got there… So, there’s no economic growth to speak of, and the Fed needs to raise rates in this environment… To me, being a student of economics, this is not going to work out for you, me, and the guy down the street…

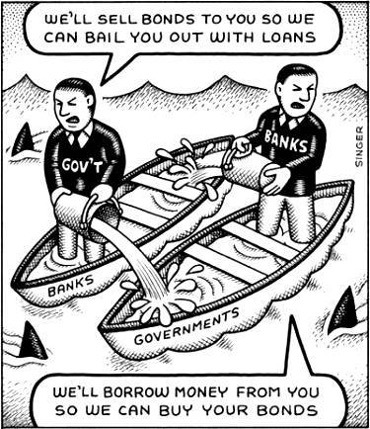

The Fed printed currency to keep bond yields down… How do they do that? A Fed Head named Ben Bernanke, decided that Quantitative Easing was needed. QE was simply bond-buying by the Fed. The Fed has no money, so they printed dollars to pay for the bonds, and this continued up until recently.

The Fed printed currency to keep bond yields down… How do they do that? A Fed Head named Ben Bernanke, decided that Quantitative Easing was needed. QE was simply bond-buying by the Fed. The Fed has no money, so they printed dollars to pay for the bonds, and this continued up until recently.

The Fed also needed to print currency to pay for the Gov’t’s deficit spending, which ties back to buying Gov’t bonds that are issued to finance our deficit spending…

Unless the Gov’t is ready to go cold turkey on deficit spending, including stimmy checks, and the Fed agrees to stop creating trillions in funny money going forward… I don’t see how the Fed’s 25 BPS rate hikes, even if they do 4 of them this year, bringing rates to 1%, is going to combat double-digit inflation…

DENNIS: What must happen for the Fed to stop creating money? You need to fix the cause if you are going to solve the problem. Is it possible to reinstate Glass-Steagall? Dodd-Frank was supposed to add back some restrictions, but the bill was watered down and basically ignored.

CHUCK: Since Glass Steagall was defeated as a law, the Banks and Brokerage Houses merged, creating the “casino banks”.

And when the Brokerage Houses that create, trade and own Billions of dollars’ worth of derivatives, need cash infusions, they don’t have to go with their hat in their hand to the Bank and ask for a loan… They can just belly up to the Fed’s repo bar and take as much money as they need….and, in some cases, this is hidden from the public.

Reinstating Glass-Steagall would be a step in the right direction… But I doubt we would ever see that happen given the lack of courage and strength to do what’s right in our lawmakers. Dodd-Frank was supposed to keep a lot of what’s going on in the derivative world from happening again, has fallen on its face. Things are worse today, regarding derivatives, than in 2007, when Lehman Brothers folded…

So, barring either of those two things gaining teeth to bite into deficit spending and currency printing to save the casino banks, I see nothing but dark days ahead of us, financially speaking…

The Fed needs to stop printing currency, period… The Gov’t needs to stop spending money on things we don’t have the money to pay for… When those pigs begin to fly, only then will we begin to see inflation cool down, and… a return to sound money policies….

| “You can choose to ignore reality; but you cannot ignore the consequences of ignoring reality.”

— Ayn Rand |

Dennis here. Things are different, at least in our lifetime. Historically the Fed raised rates to cool an overheated economy and inflation. This time around we DO NOT have a strong economy but DO have double-digit inflation. If the Fed pays lip service to inflation as Chuck suggested, inflation will continue to destroy the economy along with much of the wealth of the nation.

If they make a real effort to raise rates and tame inflation, the economy will also suffer; however, it will likely recover more quickly, while the banks are screaming….

We soon will know what the Fed intends to do. It’s probably going to take something as dramatic as the Great Depression to get our government to do what is right and reign in the banks.

Unfortunately, it always seems to come back to the same thing. Not everyone owned tulips or dot-com stocks when the bubble burst. Prudent investors held assets like gold that offset the loss of buying power of the currency.

How much longer will the public tolerate double-digit inflation before they DEMAND Congress enact meaningful reform? Glass-Steagall worked well.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Longagoandfaraway…

So how high will rates go?

Sorry but gold will not protect your wealth this time. We need to end fractional reserve banking and base currency on production and labor. That is all we need to do and the ship will right itself. Getting rid of the kleptocrats in the government would be good too.

yeah, ok, well you let me know how much progress is made in those endeavors.

Worthy aspirations? Sure. Achievable? No way in hell.

Meantime, inflation –> hyperinflation –> $USD buying power is swirling around

the white porcelain bowl.

Some pre-’64 junk might be a pretty good coin to use if you can find any sellers willing

to satisfy your needs. If not, you better have some valuable stuff to offer as barter.

And the money of kings has been around for thousands of years and has always held it’s value. Time will tell how this clusterf*&k pans out, with survivors and early victims.

Further to the USD purchasing power…..

JM Bullion has pre 65 junk still but not small amounts.

I have to disagree with the “gold will not protect your wealth this time” statement.

Gold IS “wealth”. It has innate value and is universally recognized, although it isn’t a universal currency in these modern times. If, or when, the paper currency is de-valued and possibly worthless, gold or silver could serve as insurance to salvage your lost financial savings. I have a hard time believing gold or silver will become illegal to own, incapable of being exchanged for any future currency replacing the paper dollar.

It would be wise to own some. Even if PMs become “illegal”, they will always have exchange value on black markets.

Silver would be impossible to confiscate door to door because of volume alone. They can make it illegal but as you say, there is always a black market.

I tend to agree. So long as the banking cartels are not swinging from ropes, they can control all prices on international trade and commodities, and securities as well. There are no markets. In case you are too stupid to understand that in regular font, I will repeat it in bold: THERE ARE NO MARKETS

I agree that that is what we need to do. I don’t agree that this ship will right itself. This Titanic has only one way to go from here.

Sorry to bust your tulip.

Listen and learn, unless you’re already in the know.

Current review of the”Stock Market MANIA” by Mr. Hussman.

MacKays famous book had as its first example as the “Tulip Bulb Mania.”

The book is over 400 pages long, but here is the one line operative phrase I grabbed.

I have had business cards printer with this phrase on them, 250 for $10.

Now on the *second batch* of giving them away as a public service announcement everywhere I go, as the explanation for the mass hysteria created to sell and push the jab and the useless masks, to the poor sheeples.

“MEN, IT HAS BEEN WELL SAID, THINK IN HERDS; IT WILL BE SEEN THAT THEY GO MAD IN HERDS, WHILE THEY ONLY RECOVER THEIR SENSES SLOWLY, ONE BY ONE.” ― CHARLES MACKAY, Excerpt from book, “EXTRAORDINARY POPULAR DELUSIONS AND THE MADNESS OF CROWDS” — 160 years ago in 1841

I am thinking about getting season passes for the local ski hill. You can buy them for 2022/23 and ski free all of March 2022.

I think it’s a win-win-win:

If inflation picks up more, then prices will surely be lower now than in November.

If major conflict breaks out domestically, skiing will be the last thing on our mind. Or, we could “train for biathlon” wink wink.

If “climate change” actually materializes, maybe this will be the last season of our lives. Better make it worth it.

Mostly, I like this place because they do not make you pre purchase or reserve a ticket, never enforced a mask mandate, prefer cash over credit card payments, allow you to bring your own food into the lodge, and do not require vaccination for indoor dining (most ski areas in the Northeast don’t allow the non-jabbed in their restaurants).