Authored by Egon von Greyerz via GoldSwitzerland.com,

We are now at the end of an era of economic and moral decadence in a debt infested world built on false values, fake money and abysmal leadership. All hell will break loose.

The consequences will be fatal for the world.

There are eras in history which have produced great leaders and thinkers. But sadly, the current era has produced nothing of that kind. The end of an economic cycle produces no great leadership or statesmanship but only incompetent leaders.

Looking at the Western world, the only notable statesman in the last few decades in my view is Margaret Thatcher, prime minister of the United Kingdom from 1979 to 1990.

But political leaders are of course instruments of their time. Sadly times as the current don’t produce Superior Men.

As Confucius said:

“The Superior Man thinks always of virtue, the common man thinks of comfort.”

It is the buildup of a massive debt mountain which has given the Western world a false comfort based on false values.

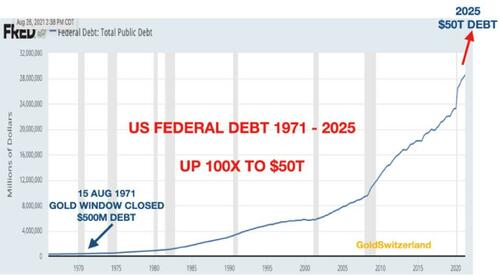

As I have pointed out many times, the US has increased its debt every year since 1930, with a couple of minor exceptions in the 1950s and 1960s. The Clinton surpluses in the late 1990s were fake and in fact deficits.

In history, when there is undue economic pressure, starting wars is popular and often felt necessary. It is convenient to blame the war for the increasing debts.

The Gold Standard was an excellent method for preventing governments to spend money they didn’t have. Since money couldn’t be printed at will, deficits then had to be financed by settling debts in physical gold.

THE GOLD WINDOW HAS BEEN “TEMPORARILY” CLOSED FOR 50 YEARS

As Nixon in the late 1960s had to meet the US debts to France in gold, he decided in 1971 to close the gold window temporarily. He clearly didn’t want to hand all the US gold to de Gaulle. Over 50 years later that gold window is still temporarily closed with fatal consequences for the US and the world.

The chart below shows the exponential growth of US debt since 1971. As we reach the final stages, the debt curve is explosive since 2019.

Creating debts of this magnitude is only possible without the discipline of gold backed currencies.

THE FAT LADY HASN’T SUNG YET

But as I have explained before, the debt explosion is not finished until the fat lady sings. And sadly a lot will happen before she finally sings.

Because like most economic eras, this one will finish with a number of spectacular events, many of which will take place concurrently.

Only a few months ago, Powell and Lagarde were singing from the same hymn sheet about transitory inflation.

But as these Central Bank chiefs prove consistently, they are always wrong. For years they are trying to get inflation to two percent and then, all of a sudden, it is approaching 10% and they don’t understand what has hit them.

They haven’t even understood that Keynesianism was dead before it started.

Even a monkey would understand that if you print $10s of trillions and keep interest rates at zero or negative for years, the end result will be spectacular inflation.

Initially we saw unprecedented asset inflation in stocks, bonds and property but it was always clear that the exponential increase in money supply would eventually reach consumer prices.

THE PERFECT STORM

What is coming next is the inevitable perfect storm.

A perfect storm means that everything that can go wrong will go wrong. And that is not just obvious failures in many parts of society but also totally unforeseen consequences.

Let’s just look at some of the obvious events that will take place in the next few years:

Financial Markets

Stocks have topped worldwide. The correction currently taking place is likely to end very soon in a devastating decline.

Everyone will get slaughtered when hell breaks loose. Whether investors buy the dip or just hold on to their stocks, they won’t understand what has hit them.

Just look at the chart below and the major falls starting in 1973, 1987, 1999, 2007 and 2020. They were all nail biters at the time, but today you can hardly discern many of them on the chart.

For decades every correction has recovered and reached new highs.

But this time WILL BE DIFFERENT, although no one expects it!

Stocks are likely to decline by 75-95% in real terms and not recover for years or maybe decades.

Remember that in 1929, the Dow declined by 90% and that it took 25 years before it recovered in nominal terms. And this time the economic circumstances are exponentially worse.

Bonds have gone up for over 40 years and rates reached zero or negative. Rates have now turned up and we are likely to see interest rates reach at least the 1980 levels of 15-20% and probably higher in a hyperinflationary debt collapse. Many bonds will become worthless and more suitable for framing and hanging on the toilet wall as a reminder for future generations.

Credit markets will come under that same pressure as bond markets with defaulting borrowers, neither in a position to service the debt nor repay it.

Property markets have also reached extremes, fueled by cheap or free money and unlimited credit at very high leverage. In Europe mortgage rates are around 1%. These negligible and irresponsible financing costs have driven property prices to ridiculous and unsustainable levels.

My first mortgage was in the UK. In 1973 the rate went up to 21% in a high inflation environment!

Today, few borrowers could afford an increase to 3%, never mind 10% or 20% like in the 1970s.

As rates rise, it is absolutely certain that the residential and commercial property markets bubble will implode, leading to major defaults, very high vacancy rates and homelessness.

Governments will initially subsidise these markets by endless money printing, but in the end that will fail too as money dies.

Derivatives are a major financial nuclear bomb that is likely to be a death knell for financial markets. As I wrote in a recent article “Chaos and the triumph of survival”, LINK global derivatives, primarily OTC (over the counter), are most likely in the $2+ quadrillion range.

Every single financial instrument contains a derivative element with massive leverage.

Due to the current volatility in commodity markets, most large commodity trading firms as well as hedge funds are now exposed to margin calls.

For example, many JP Morgan clients are currently under enormous stress in a massively over leveraged market.

So if JP Morgan clients are under stress, this means that JPM and other banks will also be under pressure.

Remember that this is just the beginning of the crisis with more bad news unravelling on a daily basis.

As the derivatives market blows up with counterparties failing, central banks will have to print quadrillions of worthless dollars, paving the way for massive hyperinflation.

Banks & Financial System will clearly be under tremendous pressure initially and eventually totally or partly fail as the above problems unravel.

Governments and central banks will obviously be powerless in this scenario. The rescue of the system in 2008 was just a temporary stay of execution. Global debt has trebled since early this century from $100 trillion to $300 trillion. But remember this is mostly fake money which has created false asset values standing on a foundation of quicksand.

All this is now about to collapse.

NOT JUST AN ECONOMIC & FINANCIAL STORM, BUT ALSO HUMAN HELL

The coming economic and financial crisis will have devastating effects on the world. Here are a few affected areas:

Commodity inflation is guaranteed. For years it has been clear that the long-term commodity cycle was bottoming and a massive surge in commodity prices would start. The cycle had already started to go up well before the Ukraine crisis, but it is fascinating how events fall into place in order to create the perfect storm. I covered some of this in my previous article “A Global Monetary & Monetary Inferno of Nuclear Proportions”.

Dollar collapse, together with most other currencies, is guaranteed. As money printing and inflation rises in an uncontrolled fashion, the dollar will quickly reach its intrinsic value of ZERO. Most currencies will follow but they will take turns.

Digital money is likely to be launched in coming years. But I don’t think that crypto currencies will play a major role except as a very speculative investment. More important will be CBDC (Central Bank Digital Currency) which will be another form of fiat money, but now digital. As all fiat money, CBDCs will be quickly debased by endless electronic printing.

WEF & Claus Schwab have got more prominence than they deserve. In my view they will lose whatever power they now have as financial asset values and their wealth implode. Thus, I don’t believe that their reset will happen or succeed. Governments might try resets but they will fail. The only real reset will be disorderly and as outlined above.

Unemployment will increase dramatically as world trade declines and the financial system comes under pressure. Many companies will perish.

Pension systems will fail, as the values of pension funds collapse.

Social security systems will not function as the governments run out of real money.

Human Hell breaking loose will sadly be felt by most people on earth as a consequence of the problems outlined above. And that is without a bigger nuclear war, which obviously would be fatal for the world.

Massive price increases, especially in food and energy combined with shortages, will hit everyone, both developing countries and the industrialised world.

The consequences of food shortages and economic misery, combined with the failure of governments to function properly, will clearly lead to social unrest in many places, even civil war!

THE WAR IS NOT THE CAUSE BUT A VERY GRAVE CATALYST

The current financial and economic crisis was neither caused by Covid, nor by what is happening in Ukraine currently.

The current crisis started with the problems in the banking system and the Repo market in Aug-Sep 2019 and then exacerbated by Covid in early 2020.

The origin of the 2019 banking crisis is obviously the debt bonanza since 1971 and especially since 2006.

Also, the problems in commodity, especially food and energy markets, had already started before the war in Ukraine.

But in a perfect storm, a number of very ugly catalysts will always occur at the worst possible time in order to trigger one worse crisis after the next.

No one knows how this war will end. The Western world is very badly informed about the state of the war since the media is biased pro West and anti Putin. But Putin is not likely to give up easily. Therefore, sadly the war will at best be local and protracted, and at worst lead to consequences which I won’t speculate on at this point.

WEALTH PRESERVATION AND GOLD

For over 20 years I have written about the financial and economic problems that are about to hit the world. Most of the things are happening although I will willingly admit that matters have taken longer than I expected. The financial system was miraculously saved in 2008 which thus was a rehearsal. What will happen next will definitely be for real.

What I have learnt is that we need to be patient since the end of an era and economic cycle doesn’t just happen because you can see all the signs. The process is long and arduous.

Governments and central banks are fighting with all the limited tools they have. But as fiat money has lost 97-99% of its value since 1971, this next time the current monetary system will die like it always has throughout history.

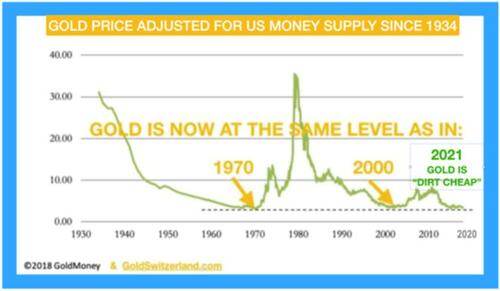

We have invested in and recommended physical gold since early 2002. At the time it was $300. So at $1,920, gold is up 6.4X since then which is better than most asset classes.

But we never bought gold purely for investment purposes, but primarily to preserve wealth. Still, it has been a very good investment for the last 20 years.

As the graph below shows, gold is today is as unloved and undervalued as it was in 1971 at $35 or in 2000 at $290.

Inflation and hyperinflation are likely to destroy most asset values in coming years and currencies will make that final move to ZERO.

The gold price will obviously reflect these moves and will, measured in fiat money, reach levels that no one can imagine. Due to the severity of the current economic and geopolitical situation, gold is likely to do better than just maintain purchasing power.

So preserving wealth in physical gold is today critical. The percentage of financial assets to put into gold is up to everyone to decide for himself. In 2002 I recommended up to 50% and today the risks in the world are exponentially higher.

Finally, what will hit the world in coming years will lead to tremendous suffering as all hell breaks loose, so helping family, friends and others is of extreme importance.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

If this world doesn’t deserve hell, then I don’t know what is.

Let’s be clear about something, the so-called debt is a fabrication, an illusion manifested in a false belief.

No one “owes” anything to anyone. It is a ledger maintained by criminal elements in order to maintain control over the political machine- and by extension the organizations under its control, like the military/intelligence/propaganda/academic organs of The State.

The Federal Reserve is an extortion racket legitimized by politicians over time in order to give them the power of fictitious benevolence to various blocks of influence. It could be zeroed out today by an iron fisted leader with the willpower to do so. Or an overthrow by the common people, or a rejection of the system in totality by a significant minority.

This exactly.

Good luck, when over 70% get their dough from the same elements, why would the 70% overthrow themselves,and lose everything, when their only goal is the love of money.

everything you said is true!

That is why they talk about black slavery, the people do not even understand the slavery they are under now, so they take their minds off of their own slavery.

As I stood up at a township meeting and said a man in debt is so far a slave, they were forcing me to do labor, and make monthly payments, I told the engineering firm and the atty., they are not following the 13th amendment of the constitution, slavery nor involuntary servitude is allowed amongst the land unless you commit a criminal act, but these same two republicans were profiting from it.

There is always somebody on the other side of the ledger, if you agree to sell me all your livestock, with 10% down the rest due within one year, and I don’t pay you, you just lost the replacement cost and all the grief.

any comment HSF?

I get a good vibe from Egon, that he is a good person at heart. Aside from his financial advice, he often emphasizes that the best things in life are free and are to be cherished: music, art, family, nature, time.

Speaking of time: I just finished reading a classic of German literature to our children: “Momo” by Michael Ende. It is a fictional tale of time thieves that are represented by heartless grey men who steal time from humans under the guise of keeping it safe for them in a time bank and returning it later with interest. In reality, they use the time for themselves. Momo, a poor orphan with unlimited time and a pure heart is the only one that can save the world and return all of the time to the people, its rightful owners. I recommend it to children and adults alike and found a lot of wisdom within.

I thought about this movie too as I read her comment.

Never heard about the movie. We just don’t do screens, just books.

Movie is not for your kids. It’s for adults.

Arch, yes I thought “In Time” was a great flic!

Many of us have been examining ourselves to try to detect where we’ve been programmed. We all have to some extant it’s insidious.

I think Financial ‘news’ etc. is one that’s gone under the radar for a long time, a real echo chamber. For most people it is only a place where your 401k is or a hobby, if involved at all.

Even those who know it’s all fake and corrupt still talk like it’s a real.

My motto is what if they threw a stock market crash and nobody came? Write THAT article. What if there was a bank crash and we declared all debt null and void- they failed, we didn’t.

That’s not likely of course and the alt media is to blame also for perpetuating the myths with no pushback besides SAYING it’s corrupt then playing along. Because they like it. Just like people, especially Christians, promoting Bitcoin etc. while knowing it’s the entryway to a truly cashless society and slavery. I’ve felt the pull.

PS. This is why there will most likely never be an internet crash that lasts very long. They (and other cabals) need it. Of course there may be once they’ve sucked the last drop of blood.

I’m with you about Bitcoin. I have never understood why people are for it…knowing what it leads to.

Bitcoin = finite supply of nothing

Kind of like gold. A creation of lies = to finite supply of nothing.

Binary numbers(BIT) do not fit the definition of Money-period

80% of the sheep will follow, right to the digital dollar, they have to no choice, they made themselves slaves for the love of money, that is not money, talk about psychological, warfare.

Block chain monies will quite likely be the method the antichrist will use to control the population. I dropped out of the 401K, stocks, bonds and. other financial instruments 25 years ago. When they dump the system my pension and SS will be gone. I planned on it disappearing when I retired 20 years ago so it will not be a surprise, just an inconvience. Last I read 36% of current retirees have only SS to live on and 64% SS is the largest share of their income. I will likely join that group in 2023 as my pension has not increased in 20 years. I know that the Lord will take care of me in some manner that will be fine, so bring it on you elite idiots.

Along these lines you have probably been hearing people (like Corbett) talking about building communities.

https://www.activistpost.com/2022/03/building-resilient-communities-that-are-immune-to-the-whims-of-the-political-class.html

I’m not against this but if you’re thinking about building a blog niche for yourself you could specialize in one that gives advice on how to make it work concerning the human factor. You know leadership, problems, problems, problems, how to pick people. Lots of stuff.

I get the feeling these a bit too utopian right now. Seems like they’ve never been a boss or served on a board, etc.

New business opportunity.

When all hell breaks loose as the article proclaims, gold will be utterly worthless. Your means of self defense and food supply will be the only thing worth a damn. That and the knowledge of how to create, build, service what you have and so on. These fucked up financial advisors probably haven’t built a damn thing in there entire lives. This whole house of cards has always operated on the size of ones bank account. There is coming a day when your bank account won’t mean shit and your ability to be useful to those around you will be what all men will be judged by. Mark it down. Agree or disagree. I’m past giving a crap what people think. In a SHTF scenario most people are a waste of oxygen.

I have NP going down in Flames, I wont intentionally do it, but if it’s for the better of our nation, so be it.

Pardon my ignorance, but what is NP?

No one ever answers really what gold will buy and how to use it in the world of transactions. Gold is a commodity just like any other metal. To buy a loaf of bread you need a transfer of gold to some currency or the seller willing to accept the coin or bullion. Where is it going to stored? Who is going to keep it safe? No, gold is for currency backing and reliable transaction through some middleman (government) to some other currency. What happens if the government then outlaws’ gold holding by individuals like FDR did in WW II? Transactions in gold were illegal. We are going to a digital society where all is controlled by the government. Gold will be confiscated. Do you really believe they will allow you to transact gold or even silver? If so let me know I hear that the Brooklyn bridge is for sale, and I own it!

it will come, gold stands the test of time, those who do not know gold, will learn that dishonest men hate gold, and honest men like gold.

psss.. gold can be .01 cents if you desire it to be, it can be as clear as glass when that small of a denomination, hmmm where did I hear roads paved of gold as clear as glass

People have to demand it,I talked to the amish they dont get it yet, but they will

And broke loose is less to be preferred than snowpack-snowpack-snowpack? (Ever felt the heat of cold? Saw a docu about a doomed Everest expedition that depicted a guy trapped on a ledge in a storm. He was freezing but felt like he was burning up. Stripped off all his clothes. Then slipped off the ledge.)

Alpine dynamiters keep the pack from devouring wholesale.

But the equivalent & analogous markets explosives have been devoured.

So pack-pack-pack it is.

Them that’s upset the balancing mechanism, & them that’s gone along to get along, deserve the avalanche. And Yet(i), since being swept away & buried alive is SNAFU, what’s deserved & what’s wanted are pretty much abominable snow/edman synonymous.

Mountainfolk are pretty good/right stuff – Chuck Yeager & altitude just seem to go together, same as prehistoric-looking mudcats & holes beneath sumps seem more bosamy. The flats & valleys throngs, like those clogging the 70 West on w/e’s, for example, are mostly much more like camp of the saints refugees.

Haven’t read this one yet:

https://www.goodreads.com/book/show/30652243-no-friends-but-the-mountains

Haven’t acquired this one yet (there’s a vid clip below, in the comments section):

https://mises.org/library/art-not-being-governed

And here’s something:

“Those who first imagined the penitentiary saw the stone cell & the prison sentence of silence as penance, a prescribed time to both suffer & be cleansed, much like that endured by the penitents in Dante’s Purgatory. In the Divine Comedy, the souls in Heaven & Hell aren’t subject to time. Paolo & Francesca, the famed couple condemned to one of the first circles of Hell, will be eternally buffeted by the wind, eternally without volition: “Hither, thither, downward, upward it drives them. No hope of less pain, not to say of rest, ever comforts them.” But Purgatory (if not Purgatory, CO) is different. To prepare for his ascent up Mount Purgatory, Dante – as with Charles Williams (two years, for b&e, theft) before his blindfolded walk to his cell – undergoes ablutions. Cato, the guardian of Purgatory (& Koch bros the master of Cato), instructs Dante’s guide Virgil: “Go, then, & see that you gird him with a smooth rush, & that you bathe his face so that you remove all defilement from it.” And the penitential souls Dante encounters in Purgatory are still governed by time. Things will change for them. They are looking upward & forward even as they are goaded: “When lo, the venerable old man, crying, ‘What is this, you laggard spirits? What negligence, what stay is this? Haste to the mountain to strip off the slough that lets not God be manifest to you.’” They anticipate their future cleansed of sin as they begin to circle the mount, their own prayers & the prayers of others lifting them higher & spurring them on.” ~ Silence: A Social History of One of the Least Understood Elements of Our Lives, Jane Brox

So how long will the truth of consequences be remembered & should forgetters be penitence-sequestered to a walled-in NM?