What is money? Baby boomers worry about retirement, workers never seem to have enough while politicians spend other people’s money recklessly to buy votes.

What is money? Baby boomers worry about retirement, workers never seem to have enough while politicians spend other people’s money recklessly to buy votes.

Richard Maybury writes a terrific publication which I highly recommend. His recent issue grabbed my attention: (Emphasis mine)

“Ever since President Nixon bamboozled the whole world by sabotaging the gold standard in 1971, there has been no such thing as money.

The most important function of money is to be a dependable store of value, and there is no longer anything like that anywhere in the world.

Everything that passes for money is just another commodity…(value) fluctuates, sometimes wildly, as the floods of fake currency pumped out by governments slosh from one fad to another….”

What is real money? J.P. Morgan said, “Gold is money and everything else is credit.”

The US dollar used to be redeemable for gold. When Nixon took the US dollar off the gold standard the world soon followed. Paper currency may be a medium of exchange, but it is not “a dependable store of value.”

Why is gold different?

Throughout history gold (and silver) has been considered the ultimate source of wealth, hoarded by kings, governments, and the wealthy.

- Gold is easily recognized, and many coins are accepted, without question, throughout the world.

- The price of coins and other forms of gold are widely published, easily valued, and exchanged.

- Gold is divisible; smaller or larger units are proportional in value.

- Gold and silver coins can be easily transported.

- Gold is durable and has stood the test of time. Approximately 90% of the gold ever mined in human history is still in circulation today.

- And most important, the supply is FINITE. Unlike paper money, it cannot be created out of thin air.

- Gold (and silver) is the only form of money that is not a debt instrument.

When the dollar was backed by gold, government spending was limited by the amount of gold in their treasury and what could be borrowed in the open, free market. Without those restrictions, governments spend trillions without offsetting taxes to pay the bills.

Across the top of US currency it says, “Federal Reserve Note”, a debt instrument. All world currencies are nothing more than “politicians promise.”

What is inflation?

Unlike gold, which has a FINITE supply, paper money can be created out of thin air. As the supply increases, the value of each unit decreases.

Unlike gold, which has a FINITE supply, paper money can be created out of thin air. As the supply increases, the value of each unit decreases.

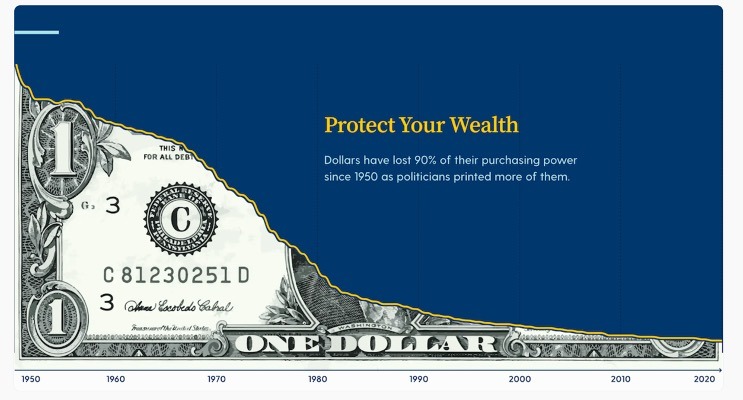

While inflation is generally defined as an increase in the price of goods and services, it’s really the value of the currency decreasing in value. This website provides a great graphic:

Inflation is a hidden tax that NO ONE voted for. Every time someone pays an increased price for what they want they are paying this hidden inflation tax.

Since the 2008 bank bailouts, inflation has been on steroids.

- The Fed creates trillions out of thin air, bailing out the banking system.

- The Fed buys government and private debt in the open market, suppressing interest rates, driving them to historic lows. The Fed’s balance sheet grows to dramatic proportions. It increased from less than $1 trillion to over $9 trillion:

- The government spends recklessly, while the Fed creates much of the money out of thin air. Government debt has quadrupled since 2008, recently topping $32 trillion.

Inflation skyrockets. John Williams at Shadowstats.com compares the current government reported inflation rate with the 1980 calculation method.

Inflation skyrockets. John Williams at Shadowstats.com compares the current government reported inflation rate with the 1980 calculation method.

The BLS gerrymanders the numbers for the benefit of the government. If the calculation method remained consistent, the Social Security COLA adjustment would be double what was recently announced.

The BLS gerrymanders the numbers for the benefit of the government. If the calculation method remained consistent, the Social Security COLA adjustment would be double what was recently announced.

Bill Bonner’s article “A Multi-Stage Disaster” discusses what used to be normal:

“…. Anyone younger than 60 has no adult recollection of any financial world other than the one we’ve had since 1980. They think that was normal. And after this hissy fit is over, and the Fed turns around, they believe things will go back to the ‘normal’ they have known.

But there was nothing normal about the 1980-2020 period.

Is it normal for:

- Stock prices to multiply 36 times – as the Dow did between 1982 and 2021?

- Real bond yields to drop from the high teens down to under zero?

- The Fed to “print” more new money in 18 months than it had in nearly 100 years.

- The federal government to multiply its debt by 30 times…even as its’ carrying cost (interest payments) went down?

…. You’ve got to go back before the ’80s…and you’ve got to look at it in terms of real money – gold – to see what ‘normal’ really looks like.”

What would it take to get back to normal as baby boomers define it?

The Glass-Steagall act prohibited investment banks from merging with commercial banks. Since it was repealed, taxpayers have been bailing out casino banks for their investment mistakes. Today, when casino banks earn big profit, they keep it. Their losses are passed on to the taxpayers. The Fed (owned by the banks) is the agent that continues to bail them out. That must stop!

Glass-Steagall must be reinstated and the casino banks, like all other businesses, should sink or swim on their own.

Reining in the corrupt banks is only part of the solution; reckless government spending must be stopped also.

West Virginia Congressman, Alex X. Mooney introduces a bill titled, “The Gold Standard Restoration Act.”

“The legislation calls for the U.S. Treasury and the Federal Reserve to publicly disclose all gold holdings and gold transactions within 30 months, after which time the Federal Reserve note ‘dollar’ would be pegged to a fixed weight of gold at its then-market price. Federal Reserve notes would become fully redeemable for and exchangeable with gold at the new fixed price, with the U.S. Treasury and its gold reserves backstopping Federal Reserve Banks as guarantor.

The gold standard would protect against Washington’s irresponsible spending habits and the creation of money out of thin air. ‘Prices would be shaped by economics rather than the instincts of bureaucrats. No longer would our economy be at the mercy of the Federal Reserve and reckless Washington spenders.'”

This proposed legislation is much more than it appears on the surface. The government has suppressed the gold price for years. This article Peter Warburton, written in 2001, tells us:

“What we see…is a battle between the central banks and the collapse of the financial system fought on two fronts.

1. The central banks preside over the creation of additional liquidity for the financial system to hold back the tide of debt defaults that would otherwise occur.

2. They incite investment banks and other willing parties to bet against a rise in the prices of gold, oil, base metals, soft commodities, or anything else that might be deemed an indicator of inherent value.

Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value, not only of the US dollar, but of all fiat currencies. Equally, they seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.” (Emphasis mine)

Chris Powell, speaking at the New Orleans Investment Conference, provided a Gold Market Manipulation Update:”

“…. What a year has passed since we last gathered here.

- The money supply in the United States and throughout the world exploded and inflation soared here and abroad.

- Central banks steadily announced their purchases of gold and turned from net sellers to net buyers.

- War in Ukraine pitted the United States and its NATO allies against Russia and upended the energy and food markets.

- Russia began threatening to use nuclear weapons in that war.

(In each case) The price of gold in U.S. dollars continued to fall.

A month ago, the world began sinking into economic recession and still the gold price in U.S. dollars went down — until about a week ago, when it began to stabilize.”

He adds some scary data:

“In June, Wall Street on Parade reported that JPMorgan and Citibank hold 90% of all gold and other monetary metals derivatives held by U.S. banks.

As far as I can tell, no respectable financial journalist or market analyst has wondered aloud why such a concentrated position in a sensitive financial market would be allowed if it was not actually a U.S. government position, with the two banks functioning as the government’s brokers.” (Emphasis mine)

He concludes:

“Gold price suppression is no ‘conspiracy theory’ but long standing government policy. That is, gold price suppression is ‘conspiracy fact! ‘ Indeed, whenever government operates in secret to develop and implement a course of action, as it often does, government is conspiracy itself.”

When Herman Cain (an advocate of the gold standard) was a candidate to head the Federal Reserve, Congresswoman Elizabeth Warren called him “radical.” Perhaps it is the politicos who are radical….

In the meantime, they are trumpeting an 8.7% Cost Of Living Adjustment (COLA) in Social Security. While no one will turn it down, keep it in perspective. Retirees may get a raise, but their true living costs are raised even more.

I doubt we will see many politicos campaigning for a return to the gold standard, it is not in their best interest. We can always hope for some fiscal sanity and a ballot box revolution.

I’m not selling any of my gold holdings….

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

And buy my latest book on How Not to Sell Your Gold…

My great grandmother used to give my mother a quarter in the late 1940s to go to the deli in Brooklyn NY.That quarter would buy a bottle of pop a loaf of bread a lb of potato salad and a half pound of bologna. A quarter today will get you a quarter can of green giant vegetables lol. That quarter was also 90 percent silver to buy it today it costs you 6 dollars at a local coin shop.

Yep…check this out on PMs Iggy…just 7 minutes.

https://www.youtube.com/watch?v=TOV0DmHPqAc

Yeah once the suppression of prices ends it will get real interesting.

What’s going to make the suppression stop?

Donkey,

The same thing that has happened to every fiat currancy in history…REALITY.

Kinda like bankruptcy…slowly…(like now) then all at once…like sooner rather than later…

HOLD THAT HI HO SILVER! It will give you the ride of your life!

Remember, I’m the guy that cashed in a 401k in 1999, at 49…and went into PMs.

This an’t my first PM rodeo…

“The US dollar used to be redeemable for gold.”

When de Gaulle forced the US off the gold standard, only foreign central banks could redeem dollars for gold.

I note that the dollar is defined as a silver coin.

They took the silver out of the money years before, in 1965. That is when American citizens lost the ability to exchange their paper dollars for precious metal coinage at any bank.

The gold was taken away all the way back in 1933. I’m not old enough to remember that, but the people who raised me never forgot.

You guys have not lived through a change in currency. I still have some old Deutsche Mark coins, which evoke fond memories of buying ice cream and such as a child with them. Granted, that was a controlled demolition of a currency, we shall see what an uncontrolled one feels like.

I still cannot understand the concept of a gold standard as a feasible method of monetary policy. If the population of a country doubles and its gold supply stays fixed, isn’t everyone poorer (except the original owners of gold)?

Why do you assume gold supply and gold value would be fixed?

Banking crisis — the Great Unwind – Research – Goldmoney

“This downturn in the cycle of bank credit boom and bust will prove difficult enough for the central banks to manage. But they themselves have balance sheet issues, which can only be resolved, one way or another, by the rapid expansion of base money. *And that risks undermining all public credibility in fiat currencies.*”

https://www.goldmoney.com/research/banking-crisis-the-great-unwind?