Guest Post by Alex Berenson

Cohodes explains why the media failed to cover FTX properly – and why SBF is STILL talking

(SECOND OF TWO PARTS)

Is FTX founder Sam Bankman-Fried a sociopath?

Marc Cohodes thinks so.

FTX is the cryptocurrency exchange that collapsed last month, costing investors billions. Bankman-Fried – sometimes called SBF – is the chubby 30-year-old who briefly had a fortune estimated at $26 billion and is now holed up in the Bahamas, where FTX was based.

Cohodes is a veteran Wall Street investor who was one of the few people to predict FTX’s failure.

Cohodes and I have known each other since the 1990s, so I asked him to explain FTX to Unreported Truths. In Part 1, he explained why he was so sure FTX was a fraud. Now he talks about the media’s failure on the story – and why Bankman-Fried still won’t shut up.

—

(Come for the Covid, stay for the crypto!)

—

FTX’s collapse was so sudden and complete that no one knows how much the company might owe its clients, lenders, and others, much less how much money it has.

In a scathing court filing on November 17, John J. Ray III, who is overseeing the FTX bankruptcy and who also supervised Enron’s bankruptcy, wrote that he had never “seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

Yet even now Sam Bankman-Fried is engaging in a public tour to downplay his responsibility for the FTX collapse. In interviews this week, he has minimized his relationship with Alameda Research, a hedge fund affiliated with FTX that appears to have looted FTX’s customer deposits.

This defense would be more compelling if Bankman-Fried did not OWN 90 percent of Alameda – and if it had not lent him $1 billion, as the bankruptcy filing revealed.

To Cohodes, Bankman-Fried is simply proving to the world what Cohodes has known all along. SBF is a sociopath and a compulsive liar.

Throughout, italics are Cohodes’s own words:

All these fraudsters that I’ve dealt with over the years, they all have this sociopathic bent, where they can look at you straight in the face and lie their asses off, and you think they’re telling the truth… All these guys, the guy on top has the same sociopathic view…

You are Alameda… You are on the board where you made these investments and the whole thing, so that is you, how can you say you didn’t know…

Why is SBF talking at all?

Cohodes argues he realizes he has no viable legal defense and so is simply trying to make his case (and bias potential jurors) in interviews where he is not under oath.

He’s trying to play a game in the court of the public opinion, and trying to get ahead of it… This is the court of public opinion… This guy talks in circles without saying anything… “I didn’t knowingly commit fraud.” That is like, I’m accidentally pregnant…

—

Cohodes says Bankman-Fried’s behavior is particularly reprehensible because FTX targeted retail investors in the United States and around the world.

In 2020 and 2021, as central banks pumped money into the financial system to cushion the effects of Covid lockdowns, the prices of financial assets like cryptocurrencies soared. Developers of and early investors in new cryptocurrencies could make fortunes overnight.

These were mostly men under 40, often under 30. A free-spending culture developed around crypto that put Wall Street in the 1980s to shame. Gluttony for its own sake became a form of competition.

—

With fortunes apparently available for the taking, unsophisticated investors who had little understanding of crypto or its risks began to invest too. Crypto companies encouraged them, explicitly marketing leveraged currency trading – among the riskiest forms of speculation, essentially gambling on borrowed money – as an investment appropriate for average people.

FTX was among the most aggressive advertisers, running a Super Bowl spot featuring the comedian Larry David, with the tagline “Don’t Miss Out.”

As inappropriate as that ad was, another featuring quarterback Tom Brady and supermodel Gisele Bundchen, who at the time were still married, was worse.

It featured nearly a dozen people – including one who was supposed to be Brady’s plumber – doing little more than saying “I’m in” as Brady and Bundchen supposedly explained the wonders of cryptocurrency investing. In retrospect, the ad looks like nothing more than marketing for a Ponzi scheme on a massive scale.

Cohodes: It was a giant Ponzi scheme to try to use customer money to control an agenda… Crypto was a hook to get Tom Brady to induce the fish…

—

In an April 2022 interview with Bloomberg, Bankman-Fried hinted as much, describing cryptocurrency tokens as “magic” and a “a pretty cool box” that would make be profitable as long as everyone continued to invest in them. “And then it goes to infinity. And then everyone makes money,” he said.

In response, Bloomberg reporter Matt Levine said that Bankman-Fried had described a Ponzi scheme. “You’re just like, well, I’m in the Ponzi business and it’s pretty good,” he said.

Even more stunning, Bankman-Fried did not disagree with Levine’s interpretation.

“I think that’s a pretty reasonable response, but let me play around with this a little bit,” he said. “Because that’s one framing of this. And I think there’s like a sort of depressing amount of validity…” before concluding that the reality would not matter as long as investors continued to put in money:

“If the world never decides that we are wrong about this in like a coordinated way, right? Like you’re kind of the guy calling and saying, no, this thing’s actually worthless, but in what sense are you right?”

—

Yet at the same time, SBF pitched himself as the friend of small investors, a crypto executive who wanted to establish an exchange that would be fair for all.

He regularly traveled to Washington to lobby regulators, and he donated more than $40 million to Democratic politicians in 2022 – and one point suggested he might donate as much as $1 billion to Democrats in 2024 race. (He has now claimed he secretly donated $40 million to Republicans in 2022 as well, but he has provided no public evidence for that claim.) He donated millions to left-leaning media sites such as Vox.

FTX even brought Bill Clinton and Tony Blair to a conference in the Bahamas in April, where SBF moderated a panel on cryptocurrency with them. “Crypto’s strange new respectability,” Politico headlined an article about the conference. Clinton called crypto “obviously serious” and said “you want to do right by it in the regulatory space,” Politico reported.

But Bankman-Fried wasn’t content to be known as a voice for fairness in cryptocurrency. He claimed to see himself as the 21st century’s savior, pretending that he only wanted to make money… to give it away.

In interviews, he called himself a believer in “effective altruism,” a theory that basically claims that very smart people should try to get as rich as possible to become hyper-charitable. A doctor might save 100 lives. A Wall Street billionaire gives away his fortune to build a medical school in Africa to train physicians can save 100,000.

That’s the idea, anyway.

So far effective altruism appears to be mainly a way for Silicon Valley billionaires to feel less guilty about how rich they are. But none of the new mega-rich became more closely associated with the mantra than Sam Bankman-Fried, who bragged driving a Toyota Corolla (but rarely discussed his $40 million penthouse).

—

None of this sat well with Marc Cohodes:

You’re supposed to trust him because he dresses like a schlep and drives a Corolla…

When he looked at SBF, Cohodes didn’t see a genius, just an chubby, sloppily dressed geek who played a lot of video games and needed a haircut:

If you’re a mover and shaker under 30, there’s something special about you… There was nothing special about this guy, nothing, there was nothing about this guy that makes you say wow…

But Bankman-Fried’s friends in the media did not agree.

By the summer, Cohodes believed he had garnered enough evidence to interest mainstream media outlets. On July 3rd, he approached the cryptocurrencies team at Bloomberg, the financial news service. Bloomberg was not interested:

I have a real problem with the mainstream media… I think this whole thing’s been covered up and I think they’ve failed people bad… Bloomberg said if we go to him with these questions, we’ll lose access, and then they said it’s bad for business…

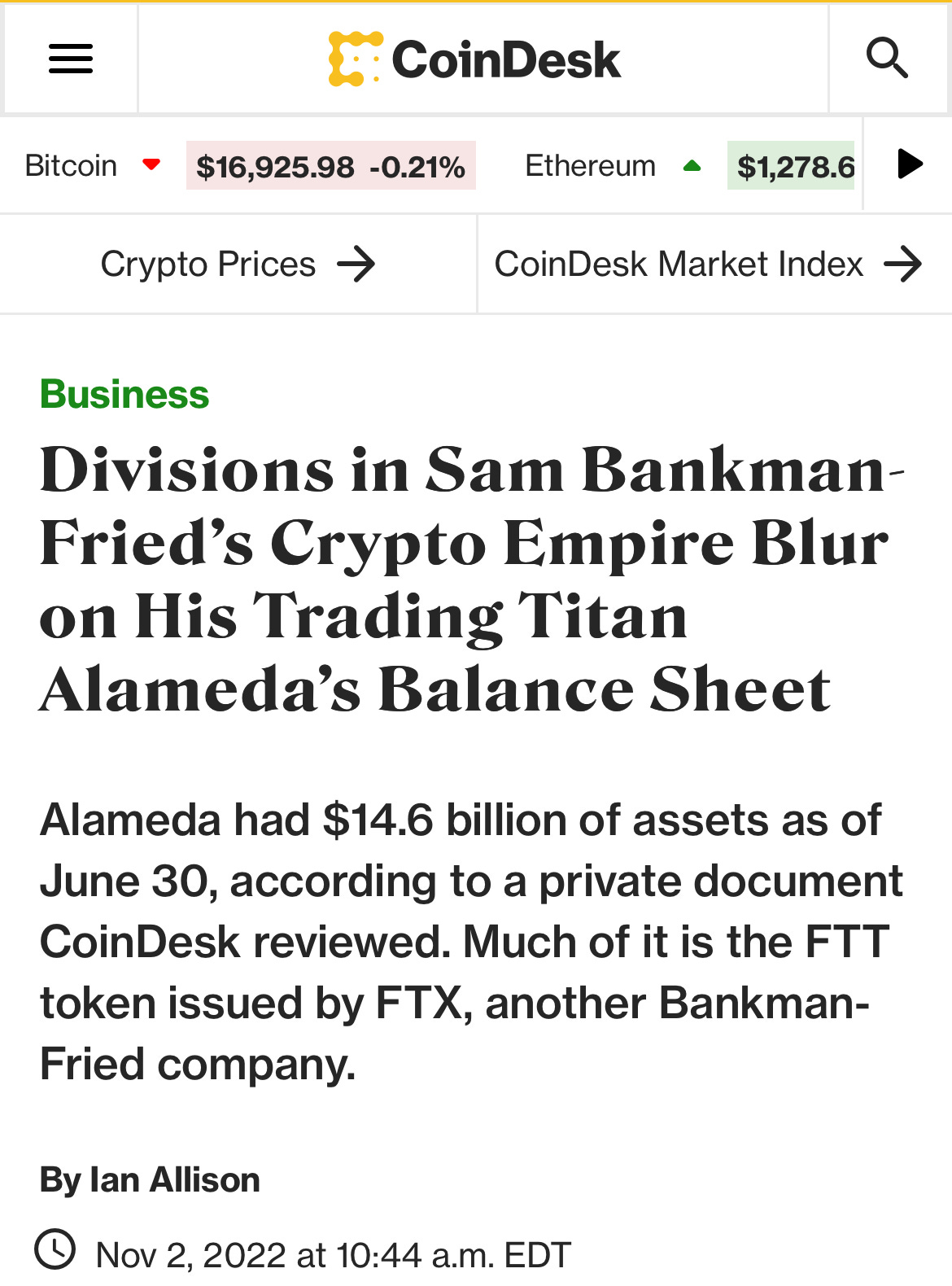

And so Bankman-Fried’s ride continued – until November 2, when a cryptocurrency-focused news site called Coindesk.com published Alameda’s leaked balance sheet, showing it owed $7.4 billion in loans, while relying heavily on FTX’s FTT tokens for assets.

Considering that Alameda hugely influenced the price of the FTT tokens, this would be a bit like Citibank simply declaring it had enough “Citidollars” in its accounts to pay off loans to other banks. The Coindesk.com report laid bare how much trouble FTX and Alameda were in, and a run on FTX began immediately as clients tried to pull their deposits. But they couldn’t, because FTX had transferred billions of dollars to Alameda.

FTX collapsed within days. But Sam Bankman-Fried remains free, in the Bahamas, still claiming that he didn’t do anything illegal.

Cohodes’s last words:

He had the Wall Street machine, and he had the mass media… Between the New York Times, which has been puffing this guy, Bloomberg, which has been puffing this guy, CNBC… They let this shit get carried away and they idolize people without trying to check facts… There’s a huge, huge huge debacle here… It was all out there and everyone failed everyone huge.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Sam Bankman-Fried a sociopath and a compulsive liar? Never!..

Wouldn’t hurt if he were hung from a light pole and castrated.

also, he is disgustingly man-titted

FTX part, start it at around 33:00 mark.

I sometimes read Kitco articles.

This one about SBF being a “useful idiot” and pawn directed by larger interests merits some attention, especially for people suspicious of government-driven digital bank currencies.

https://www.kitco.com/news/2022-12-02/SBF-is-a-pawn-and-useful-idiot-in-an-effort-to-take-down-the-Crypto-and-DeFi-industry-Mark-Yusko.html

Can you say politically backed money laundering operation with insider connections all the way up to the SEC, involving family, friends, Bill Clinton, and by proxy, the DNC along with a Ukrainian tie-in?

It’s no coincidence, it’s the usual suspects all over again.