Guest Post by Alex Berenson

PART 1: How Marc realized FTX was a grift when (almost) no one else did

(FIRST OF TWO PARTS)

One reason last month’s collapse of the cryptocurrency exchange FTX fascinates me is that cryptocurrencies are the financial world’s version of mRNA vaccines.

Both were promoted as new, superior technologies, gifts of the Information Age.

Both made fortunes for a few lucky people, who insisted they were merely serving humanity as they raked in billions.

Both basked in media hype despite obvious red flags.

And both have had… less than perfect results.

—

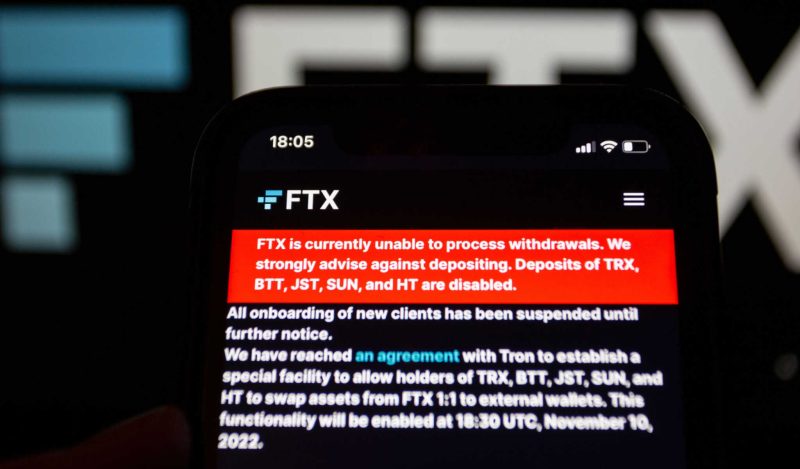

A few months ago, Sam Bankman-Fried, the founder of FTX, was supposedly worth $26 billion. Today he claims to be down to his last $100,000, likely the fastest loss of this level of wealth anyone has ever had.

Shed no tears for Bankman-Fried. Millions of ordinary people who put money in FTX may have lost as much as $8 billion.

(SBF, as he is known, says he wants to make those investors whole. Yet he remains ensconced in the Bahamas, instead of returning to the United States, where he might face arrest.)

Continue reading “An interview with Marc Cohodes, the investor who called the FTX/Sam Bankman-Fried collapse BEFORE it happened”