Guest Post by Jeffrey A. Tucker

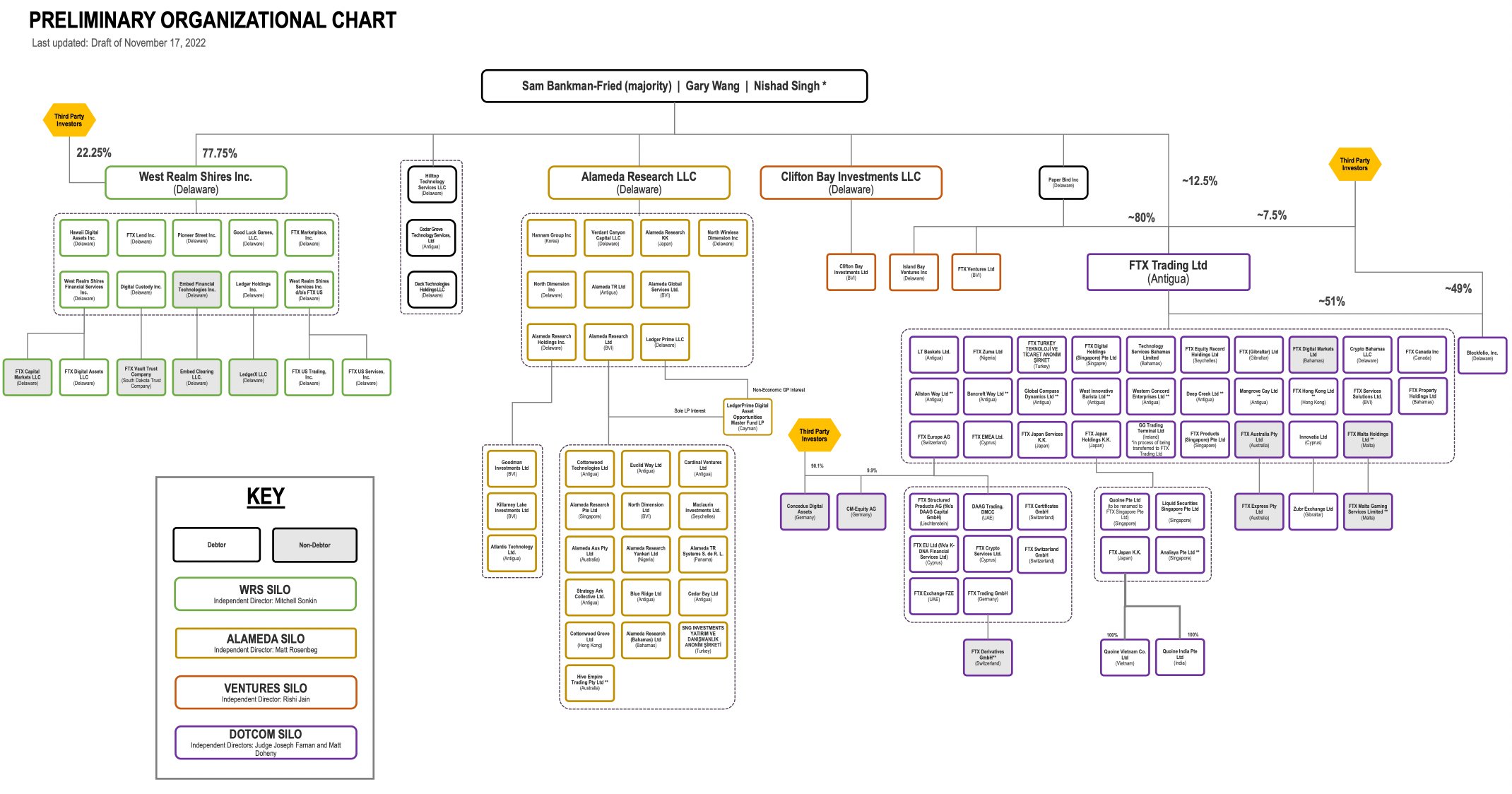

The complexities of the FTX scandal with Sam Bankman-Fried at the helm boggles the mind. Unlike the Madoff scandal, which was incredibly simple, the funding, influence, and political networks sounding the $32 billion collapse of FTX is byzantine by design.

Just have a look at the org chart of the company to get a sense. It’s all the better for avoiding oversight.

What we really need in the months or even years in which it will take to sort all of this out is some kind of key to the major players. What follows is a list which we’ve put together in order of network importance for easy reference. This small effort is made necessary because there seems to be very little attention being given to the entire SBF empire, both in terms of the players with whom he worked and where the money ended up. Continue reading “The SBF Scandal: The Players and the Money”