Ticket There’s been a lot of hoopla about recent Mega-Million jackpots topping $1 billion. It must have been nice for the odds-defying winner.

There’s been a lot of hoopla about recent Mega-Million jackpots topping $1 billion. It must have been nice for the odds-defying winner.

The lottery is the fairest tax of all. It is voluntary, it is not levied; you are not forced to buy a ticket. It is an adult choice. I’ve never heard anyone complain about having to pay their lottery tax.

Winning the lottery is NOT how to accumulate wealth and provide for retirement. Winning is a fantasy dream – for entertainment purposes only!

Fantasy??

Think it’s not a fantasy? Let’s peek behind the curtain. AS.com provides the odds:

“The odds of winning the Powerball jackpot are 1 in 292,201,338, so you’re more likely to win at a slot machine than the grand prize. Could anything be less likely to happen?

Yes, as turns out! The Mega Millions lottery cashes in with even slimmer odds – you’ve got to have some serious four-leaf clover action going on to beat the 302,575,350 to 1 odds there.”

The US Census Bureau tells us:

“In 2020, the U.S. Census Bureau counted 331.4 million people living in the United States; more than three-quarters (77.9%) or 258.3 million were adults, 18 years or older.”

If every adult in the US bought one lottery ticket, 50 million numbers would still remain unsold.

Subscriber Charles C. shared a great analogy, showing how much winning the lottery is pure fantasy.

When Jo and I lived in Austin, TX we enjoyed the University of Texas football games. The Texas Memorial Stadium holds 100,321 people, and it was packed every time we went.

Charles suggested:

“…. Envision everyone in the stadium having one chance at winning the lottery; but you’re not even close – yet. Then imagine 3,000 stadiums packed to the brim, with each person holding one ticket with a different number.

They’re going to pull one winner. Look around. Do you really think you might win!?”

I let my mind wander a bit. For the sake of example, a net worth of $50 million would put you in the ultra-wealthy category. In 2020, there were a total of 89,510 people in the US with a net worth of at least $50 million.

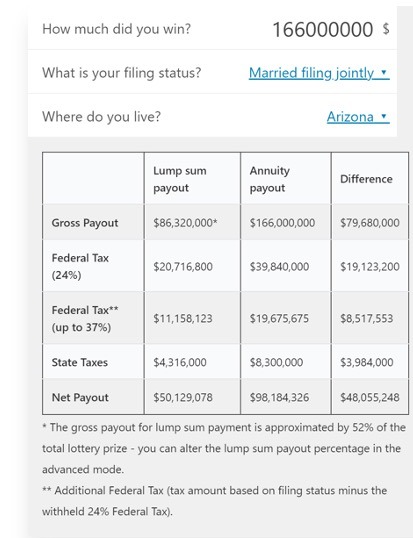

How big a lottery would you have to win to end up with $50 million after taxes? Omni Calculator provides a neat, fun Powerball calculator. It estimates the lump sum payout, then deducts the federal and state taxes based on your filing status and residence. Next time someone asks “How much would you walk away with?” – dazzle them with this!

For us to instantly join the $50 million club, we would have to beat 292 million to 1 odds and win a $166 million Powerball.

If you want to enter the $50 million club, you have an 89,500 better chance of earning the money than you do winning the Powerball.

Back to Reality

For most, earning, and accumulating wealth is not easy, particularly in today’s world. The political class, combined with our educational system, present major obstacles. We will discuss them independently.

| “Vote for me. I’ll use my office to take another American’s money and give it to you.”

— Walter E. Williams |

I abhor politicians who refer to “winning life’s lottery” as the excuse to confiscate our hard-earned money and redistribute it in the name of “fairness”. Nothing fair about it! Being rich or poor is not a game of chance; but rather a result of life choices we make. Ultra-wealthy people can go bankrupt, and those raised in poverty can become ultra-wealthy.

Portraying the poor as “victims” and the wealthy as “lucky” does nothing but help power-hungry politicians get elected. Politicians’ only concern about the poor or wealthy is what the poor and wealthy can do for them. Nothing-new here. The ruling class has been this way for thousands of years.

Our tax system is the tip of the iceberg. It’s the hidden tax, inflation, that is destroying the wealth of the nation, rich and poor alike. Some timely quotes make the point: (Emphasis mine)

“By a continuous process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of its citizens.” — John Maynard Keynes

“Inflation-that’s the price we pay for those government benefits everybody thought were free.” — Ronald Reagan

“We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.” — Alan Greenspan

“The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.” — Alan Greenspan

Mr. Greenspan was a balanced budget, gold standard advocate until he became the Chairman of the Federal Reserve. Once he got the job; he became one of the biggest enablers of deficit spending we have ever seen.

Controlling our own destiny

“Each player must accept the cards life deals him or her: but once they are in hand, he or she alone must decide how to play the cards in order to win the game.” — Voltaire

There is little we can do to control inflation or ridiculous government spending. Those are the cards we’re dealt. However difficult it may seem; we can still play the game and accumulate enough wealth to enjoy life without constantly having to worry about money.

“I am not a product of my circumstances. I am a product of my decisions.” — Stephen Covey

Our individual choices are what impact our ability to accumulate wealth. The wealthy people I know didn’t leave their future to chance; they know better.

Many times, I’m asked what I feel is the single most important aspect in building a good nest egg. It’s pretty simple, get out of debt and stay that way.

“Gold is the money of kings; silver is the money of gentlemen; barter is the money of peasants; but debt is the money of slaves.” — Norm Franz

Debt is slavery, plain and simple.

To accumulate wealth, earn more than you spend, get out of debt, and invest what’s left in assets that compound and grow.

Accumulating wealth isn’t winning the lottery; happening overnight and by chance. It requires hard work, mental discipline and continuous financial education.

The Educators Failed

Let’s start with student loans and the implied lessons for young people. “Borrow now, go into debt and don’t worry about it.”

When they finally get out of college, many are in debt up to their eyeballs and it takes them decades to get to any kind of positive net worth. Government bailouts just make things worse.

What happened to real Economics? The US Debt Clock provides the sad reality:

- Total US Debt, tops $31 trillion, over $94,000 per taxpayer

- Total unfunded US liabilities – $173 trillion, $519,000 per citizen

- Debt to GDP ratio increased from 59.56% in 2000 to 121.50% today

Young people are taught, deficits don’t matter! The hell they don’t! Their generation is on the hook.

If our education system did its job, the public would be revolting over public debt and the free-spending politicos would have been sent packing long ago.

I recall a distant family member, married with a couple of kids, who went back to college full-time. They were living off the government. They milked the system: two cars, Starbucks, iPhones, tattoos and all. I asked about getting a part-time job. With a hateful glare, they responded, “Oh no, working and going to school would be too stressful.”

So much for educators preparing young folks for dealing with the realities of the adult world.

Perspective

Dare to be different. Regardless of your age or finances, you can learn to live below your means and get out of debt. Charles C. shared another quote:

“What you thought before has led to every choice you have made, and this adds up to you at this moment. If you want to change who you are physically, mentally, spiritually, you will have to change what you think.” — author unknown

The slave masters have trained much of society to think in terms of “monthly payments.” Change your thinking, when something is paid off, don’t go buy something else because there’s a little money left over. You don’t need a new iPhone just because you paid one off.

The slave masters look to “Monthly payments” as income. That is what wealth, invested wisely can provide.

I used $50 million as an easy example. One does not need to win a huge lottery to become wealthy. Zippia.com tells us:

- There are about 22 million millionaires in the U.S.

- 8.8 % of U.S. adults are millionaires.

The odds of accumulating enough wealth to retire comfortably are not insurmountable, for those willing to live below their means and invest wisely.

I write a lot about investing, however, the first step is changing your mindset, daring to be different…getting out of debt and accumulating capital to invest for true financial freedom.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Do you all still think the game is not rigged. The computer is picking the numbers based on what is sold. The deception is right up there with the last two election cycles.

It doesn’t need to be rigged.

Imagine the stadium above filled to capacity.

Your chances of winning a huge Powerball drawing

are the same as picking the correct hair on the head

of one of the people in that stadium.

Your chance of winning is the same whether you play or not…

If you don’t play, you have no chance. If you do play you have two chances, a fat chance and a slim chance. If you work and use your brain, you have a 100% chance of winning to some degree. Even when you don’t make money, you will be rewarded.

To the 10 people who downvoted me for saying buy Tesla. It has doubled in the last 35 days. Sit on my nuts

“You’re gonna love My Nuts! We’re gonna make America skinny again one Slap at a Time.”

-Vince Offer

Tesla will crater right after Elon dies in a “mysterious” accident.

That guy is pissing off way to many people that can make that happen.

Be completely honest with yourself and concentrate on what you can do WITHOUT and adjust your life accordingly.

It’s not that hard.

Excellent advice for everyone. Those who are always broke because they have massive credit card debt need to learn to live without all the junk they really don’t need, but believe they do. They would be better off. If they keep living without the junk that created the debt, they could start paying off their debt. Eventually the debt will be zero. Then they can start saving for retirement instead of renewing more debt spending on junk they don’t need.

Those who cry about how they can’t live on Socialist Security refuse to understand that Socialist Security was intended as a retirement supplement, not a lifestyle. As someone who saved and is retired but not collecting Socialist Security, I have zero sympathies for those economic illiterates. They have nobody to blame but themselves for being too stupid to do the math when they were younger.

Currency destruction, offshoring of jobs, illegal immigration, taxes, licensure, regs, EEOC racial/sexual quotas, easy divorce, feminism, the Pill, and every wealth-wrecking .gov program, have all made it nearly impossible for Joe Sixpack to make it, economic literacy or ignorance notwithstanding.

A lot of what is stated here is basic common sense, but its easier said than done, especially if raising a family. Not mentioned is the need for effective tax planning in addition to strategies to supplement – not your income (it’s taxed on a curve!) – but your skill sets and creativity. Also not mentioned is the other side of the debt coin.

My situation might be real world proof of the merit of the debt-free philosophy , but not proof that its the best or only way. I have never had any debt whatsoever – never, not for any amount at any time, including any mortgage. I have lived below my means and have invested (at least somewhat) wisely. I have everything I need, more or less, and while still under the age of 60, I now have: 1) a small multiple 7 figure net worth, 2) a 3000 square foot house owned outright, 3) the means to navigate any serious downturn 4) the ability to work another 10 years, or more, should I chose to, and 5) A wide variety of valuable and tangible skills that can be deployed should the SHTF.

BUT

In hindsight, I could have really used debt, as a tool. I could have used more investments in real estate, as a tool. I could have leveraged my knowledge of both of the above to come out much further ahead than I am now, but wasn’t willing to take enough risk. I played it safe, but too safe. Make no mistake – I have no regrets, and hindsight is always 20/20, and given the current interest rate situation I’m quite happy to be debt-free. But there are two types of debt – debt taken to acquire consumer “things” that only depreciate in value over time, and debt taken to invest in real assets that appreciate in value over time, and for which interest on said debt is tax deductible. Miller makes no distinction between the two. You should understand that significant difference, especially if you are amongst the younger ones on TBP.

You are spot on, this is the elephant in the room that Dave Ramsey ignores too.

I’ve watched a young friend build a manufacturing business over the last four years starting with about $100,000 in debt. He just moved into his brand new 10,000 square foot shop in a much larger building that he had built. The rental income alone from his other commercial space being leased out essentially covers the note.

He just hired a 3rd guy to work for him full time. Before his building was completed, he had multiple offers to purchase the property and could have walked away something close to a cool half million in profit but he is playing the long game.

If you have the brains and the ability to leverage other people’s money, the only thing in your way is yourself and that feeling of risk in your gut.

Now if only I really believed the last part of what I just wrote.

If you do meaningful work that delights you and have people in your life who you love and who love you, you already won life’s lottery.

Couldn’t be more truer than that

…”meaningful work that delights you”…if I had a dollar for every time I heard that.

No disrespect, but honestly, how many people make a living and pay their bills, doing something they love?

It is a true statement for some, I can testify. I would estimate easily less than 15% of the people working could ever say this as a truth.

She said, “If.”

You don’t have to do fun things all day long and your job doesn’t have to be the meaningful work. The job can be the means of paying the bills and then you could spend an hour a day riding your horses and mucking their stalls and THAT could be your meaningful work. For some people, it will be their job, if they are lucky. In my case, I chose to do something that I love, but it doesn’t pay. I am grateful for being able to choose that. You make your choices and live with the consequences.

As an answer to the above statements about making do with less: My “no buy year 2023” is going great. I am buying nothing but food. Had to hold myself back a few times when I wanted to make purchases, but, overall, I haven’t missed anything.

Beautifully said. The Viaragi adepts live by these five tenets.

Be thankful for every gift, no matter how small.

Love what you do.

Do what you love.

Love the gift of life.

Know that God is love

Svarga. From the above list, you are most of the way there. Another one for kids to aspire to.

downvote me all you want but there staring you in the face is the reason the border is wide open —

“In 2020, the U.S. Census Bureau counted 331.4 million people living in the United States; more than three-quarters (77.9%) or 258.3 million were adults, 18 years or older.”

Being born into the modern West IS a lottery win – even now, in its decay.

I consider myself supremely lucky – I’ve been rich and I’ve been poor, and am just as happy either way

I also learned the lesson that happiness has nothing to do with wealth. It has more to do with health. I believe it is our attitude and choices that make us happy or sad.

I don’t think it even has to do with health, but definitely with an attitude, you are right about that.

Andrea Bocelli, when a soccer ball turned off his vision forever before he was a teenager, could have easily fallen into despair. I often play his songs at breakfast and tell my children that he might not have become the voice that sounds like a male angel if his sight had distracted him from the melody. God had a plan for him and triumph came from tragedy, with the right attitude.

I know a lot of people with perfect vision and health who are miserable.

What I was really trying to say was with money you can have a more healthy stress free lifestyle. You can afford good food and activities you may enjoy. Love your story. Attitude is number one, and yes God has a wonderful plan for us all.

What was God’s plan for the 20,000 dead in Turkey?

The vast majority were not Christian so I guess no plan for them.

I could go on and on and on ………………….

The plan was they would get to experience another life somewhere in his kingdom. There is a place in Gods kingdom for every soul.

Anyone who says “money can’t buy happiness”, has never done blow off the breast of a $5k/day hooker at 35K feet in a G5 heading for Monaco to watch the vintage F1 races.

Anybody who thinks that is happiness, I guarantee you is a miserable person deep down inside.

Hunter Biden comes to mind.

Anyone who can’t find joy in that? I guarantee you is a miserable person deep down inside.

I did the above and was able to retire at 55, and my wife at 52. Discipline, good decisions, and staying healthy did it as we never made more than average income. Dennis is spot on with this article.

The lottery is exactly like the poke n croak.

You can’t lose if you don’t play.