Guest Post by Nick Giambruno

As told in the movie The Big Short, a group of hedge fund managers who saw the housing crash coming used Credit Default Swaps (CDS) to make a fortune.

These exotic financial instruments conveyed information crucial to seeing the 2008 financial crisis in advance. That knowledge allowed astute speculators to get positioned for massive profits as the crisis unfolded.

In the coming crisis—which has already started—I expect CDS will again play a key role in telegraphing important information shrewd speculators can use to their advantage.

A CDS is a contract between two parties. Think of it like an insurance policy against a borrower—typically a large company or a government—defaulting. One party underwrites the insurance policy, and another buys it. If the borrower defaults, the CDS issuer pays out the CDS buyer.

CDS trade in the open market and reflect investor expectations of the default probability of a particular borrower. The more likely the underlying entity is to default, the more expensive the insurance (CDS) will cost.

The seller of the CDS collects a premium and bets that the underlying entity will not default. Conversely, the buyer of the CDS is betting that the underlying entity will default or become more distressed so that he can sell the insurance policy in the market for a higher price than he paid it for.

For example, in 2006, a CDS to insure $10 million of Lehman Brothers debt against default cost around $9,000. That CDS contract exploded in value to over $6 million in September 2008 as Lehman went bankrupt.

In short, that is how CDS work. They can deliver enormous profits, and their prices provide crucial market information.

Greg Foss is a 35-year veteran of the credit markets. He is an accomplished risk analyst with some of Canada’s most prominent financial institutions. Greg is also a passionate Bitcoiner and has said:

“Bitcoin is the best asymmetric trade I have ever seen.”

Greg has devised a simple—yet clever—way to value Bitcoin using the CDS market. It reveals critical information about Bitcoin and the entire fiat currency monetary system.

The CDS market—and the information it conveyed—was crucial for making fortunes during the last crisis, and I suspect it will be for the next crisis as well. Likewise, I believe the information in Greg’s valuation model is key to getting positioned for big profits in the months ahead.

Bitcoin Is a Cheap CDS on the Entire Fiat System

Greg Foss thinks Bitcoin should be considered default insurance on the entire global fiat currency system—like a CDS on the US dollar, Canadian dollar, British pound, euro, yen, yuan, and all the rest of the government currencies.

Why?

Because Bitcoin is an alternative and superior form of money compared to government confetti.

Think of Bitcoin’s superior monetary properties—namely its total resistance to debasement—like a black hole sucking in capital and monetary energy from other forms of money. The bigger the Bitcoin monetary network gets, the more powerful its gravitational pull becomes. I think this process will continue and accelerate exponentially in the years ahead.

Some proponents believe the endgame for Bitcoin is to eventually emerge as the world’s dominant form of money. It’s a process called “hyperbitcoinization”—or what I like to call The Bitcoin Supremacy.

In short, as the risk to fiat currency continues to rise, so does Bitcoin’s value proposition. As a result, it will benefit similar to a CDS as the fiat currency system defaults.

Legendary value investor Bill Miller has called Bitcoin “an insurance policy against financial disaster.” He’s correct.

Consider the example of Lebanon, which recently experienced hyperinflation, bank failures, and capital controls as its fiat system collapsed.

For over 20 years, the Lebanese government pegged the local currency, the lira, to the US dollar at a rate of 1,500.

That all began to change in the middle of October 2019, and many Lebanese would soon find themselves financially ruined.

As the banking system became insolvent, Lebanon imposed capital controls, preventing most people from sending their funds abroad.

The lira’s artificial peg to the dollar became untenable, and a thriving underground market developed and revealed the real exchange rate. Recently, this free market is trading the lira at around 64,000 to the dollar.

In other words, the Lebanese lira has lost over 97% of its value since October 2019.

Now, let’s look at how Bitcoin could have served as insurance against a collapse in the fiat system in Lebanon.

Imagine there was an astute Lebanese individual, let’s call him Marwan, who saw the writing on the wall and knew trouble was imminent.

After all, similar banking and currency crises had occurred previously in Argentina, Greece, Cyprus, and other countries in recent years. So it didn’t take much imagination to understand that Lebanese bank deposits and the lira could soon lose most or all of their value.

Suppose Marwan had the equivalent of $100,000 USD in his lira savings account at a Lebanese bank in October 2019 and decided to convert half of it—the equivalent of $50,000—into Bitcoin when the price was about $8,333 per BTC.

Marwan would then have around 6 Bitcoins that he could use to send and bring with him anywhere in the world without depending on the whims or permissions of any bank, central bank, government, or third party.

Fast forward to today.

The other $50,000 Marwan left in his Lebanese lira bank account is now worth about $1,200.

Marwan’s 6 Bitcoins are now worth around $142,500 today, nearly triple his $50,000 investment and more than his $100,000 in total savings at the start of the crisis.

Had he not converted half of his money into Bitcoin, his $100,000 in total savings would have collapsed over 97% to just $2,400. Instead, he has $143,700 thanks to Bitcoin.

That’s how Bitcoin could have served as insurance against the collapse of the fiat system in Lebanon.

Undoubtedly, Bitcoin saved many people in Lebanon—I know several of them.

But Bitcoin is not just like default insurance against the fiat system in Lebanon. It’s like a CDS on the entire global fiat currency system. As this system falters in many countries, the value of such insurance could become mind-bending.

However, Bitcoin is even better than a CDS.

That’s because Bitcoin has no counterparty risk, and it never expires.

Typically, a CDS expires after five years and has significant counterparty risk.

For example, consider the lucrative CDS on Lehman Brothers debt I discussed earlier. These insurance contracts became incredibly valuable as Lehman Brothers became more distressed and sank into bankruptcy.

Owning a CDS on Lehman Brothers in 2008 was a winning trade… except for one big problem: counterparty risk.

The sellers of the CDS contracts on Lehman Brothers found themselves in big trouble as they had to pay them out as Lehman went bust. As a result, many, including Bear Stearns, became distressed, which brought into question whether they could fulfill the contracts.

Counterparty risk is a big problem with the fiat currency financial system in general and with CDS in particular.

Even if you get the trade right, your counterparty could default, which means you’d pay the insurance premium for the CDS but not get the payout.

That’s why Bitcoin is even better than a CDS.

It provides insurance against the failure of the entire worldwide fiat currency system, has no counterparty risk, and doesn’t expire.

Bitcoin is about as close to perfect financial collapse insurance as you can get.

Valuing Bitcoin Using the CDS Market

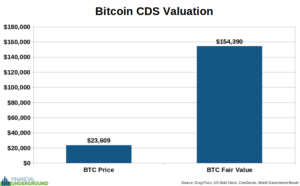

Greg Foss says that if Bitcoin is like a CDS on the entire fiat currency system, then we can use the data in the CDS market to create a fair price valuation for Bitcoin.

Here is how Greg’s valuation model works in five simple steps…

Step 1: Calculate Total Obligations Needing To Be Insured

The US federal government has over $31.5 trillion in debt and about $181 trillion in unfunded liabilities.

That’s around $212 trillion in total obligations that default insurance would need to insure.

Step 2: Obtain US Five-Year CDS Costs

In the open market, US five-year CDS are trading at 35.02 basis points, which means it costs $35,020 to insure $10 million worth of US federal government obligations. It’s essential to remember that this number is constantly changing depending on market conditions.

Step 3: Estimate 20-Year CDS Cost

The obligations of the US federal government do not occur only over five years. Greg thinks a 20-year period is more appropriate.

Since there is no such thing as a 20-year CDS, the best Greg can do is make a calculation to estimate what the price would be using the market data of the five-year CDS. He does this by dividing the cost of the five-year CDS by five and then multiplying it by 20.

Therefore, the estimated cost of a 20-year CDS for the US is 140 basis points—or $140,000—to insure $10 million worth of US federal government obligations.

Step 4: Calculate the Cost To Insure All US Federal Obligations

There is $212 trillion worth of US federal government obligations.

Therefore the estimated cost to insure all US federal government obligations against default is $212 trillion x 140 basis points or about $2.98 trillion.

Step 5: Implied Bitcoin Valuation

If Bitcoin is like a CDS on the global fiat currency system, the fair value of all outstanding Bitcoin should be at least $2.98 trillion or $154,390 per BTC at the current supply.

And that is a conservative estimate because we are just calculating the value of default insurance on the US, not the rest of the fiat currencies.

Bitcoin’s current market cap is around $455 billion, and the price is about $23,609 per BTC.

That means, at current prices, we are getting default insurance on the US at an 85% discount while at the same time getting protection against the failure of all the rest of the fiat currencies for free.

In other words, with Bitcoin, we are getting perfect financial collapse insurance at an 85% discount to fair value at current prices.

That doesn’t mean Bitcoin can’t go higher than $154,390. That is only the model’s fair value valuation at today’s CDS prices.

As the fiat currency system in the US and other countries becomes more distressed, it’s obvious the cost to insure their obligations will increase. That means higher CDS prices and a higher fair value for Bitcoin.

With all the chaos going on right now—which will likely only get worse—it seems prudent to buy Bitcoin to obtain some financial disaster insurance, especially since it is so cheap.

As the fiat currency system falters in the months ahead, buying Bitcoin now could be an even better trade than buying a counterparty-free CDS on Lehman Brothers in 2006.

Now you know why Greg Foss said:

“Bitcoin is the best asymmetric trade I have ever seen.”

I agree.

Here’s the bottom line.

The collapse of the fiat system—which is already well underway—could be an enormous catalyst for Bitcoin.

That’s why I just released an urgent PDF report.

It details how it could all unfold soon… and what you can do about it. Click here to download the PDF now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Don’t believe it.

That is all.

So, Marwan bought 6 Bitcoins. And stored them w/ SFX. Hey, Marwan, how’ya doin’ bro?

In that case, Marwan=Moron. Always use a private wallet.

Or just buy gold/silver. Bitcoin stinks to high heaven of a 3 letter agency liquidity trap.

Bitcoin has utility till the lights go out.

Porter Stansberry and Doug Casey said silver to the moon when I bought a gob of it in 2011.

Exhausted yet?

Lol, the timing is just off. No one thought the scammers could scam as long is the have. It’s unraveling as we speak….whether that is by design or not is the sinister question.

As far as the lights going out being BTCs downside, I see much worse. It’s a pilot program, for CBDCs, it soaks up extra liquidity in the market, warms the public up to the idea of CBDCs and will be shut down when TBTSB decide so.

Thought about it for awhile, then decided to go with a couple pallets of canned Spam. When SHTF people will get hungry, very hungry. Fuck financial leverage and derivatives.

I have put many cans of spam into the garbage when they spoiled. Best get seeds and a garden with a tall fence and a gun turret.

Spam should last a decade if the can isn’t opened up.

Bought some bird seed, but have yet to raise a single one. 😉

CDS denominated in fiat currency will go worthless too.

Now Tulipcoins denominated in fiat currency however…

/s

I vote for diversification. Gold, silver, platinum, dividend paying stocks, Bitcoin, productive farmland or ranch with no debt, for example.