First Republic Bank’s stock crashed in premarket trading in New York following a statement issued on Sunday night that sought to ease investor worries about its liquidity situation in the wake of the failures of Silicon Valley Bank and Signature Bank.

Shares of the regional bank are down 60% in the premarket. The lender said in a statement late Sunday that it had more than $70 billion in unused liquidity to fund operations from agreements that included the Federal Reserve and JPMorgan Chase & Co.

“The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies, and further strengthens First Republic’s existing liquidity profile,” the bank said, adding that more liquidity is available through the Fed’s new lending facility.

“The plunge in its shares is classic market psychology at work, with investors starting to question the credentials of any lender that may be remotely in the same category of Silicon Valley Bank,” Bloomberg’s Ven Ram wrote.

We pointed out over the weekend, “as a result of the SVB failure – one look at what is already taking place at some smaller, vulnerable banks such as this First Republic Branch in Brentwood should be sufficient to see what comes tomorrow if the Fed makes the wrong decision today.”

I’ve never seen a bank run in Brentwood Los Angeles in over 40 years — this is at first republic bank branch. People standing in rain pic.twitter.com/k31PqqpyO3

— pjb.eth (@Dr_PhillipB) March 11, 2023

Despite the emergency lending program announced by the Fed and Treasury on Sunday to increase the availability of funds to meet bank withdrawals and prevent runs on other banks, fears have not been alleviated as other regional banks continue to experience significant pressure.

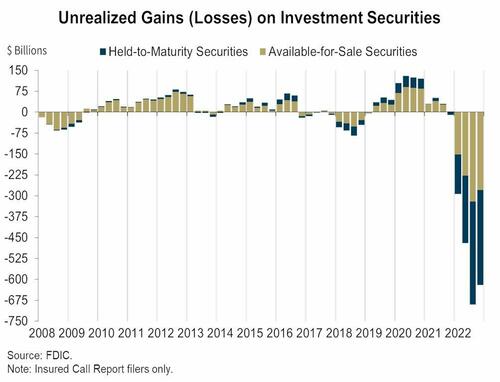

And why would that be? Well, as we outlined, “banks which are sitting on some $620 billion in unrealized losses on all securities (both Available for Sale and Held to Maturity) at the end of last year, according to the Federal Deposit Insurance Corp.”

If the Fed’s goal was to shore up wavering confidence in the banking system by announcing the alphabet soup of bailout facilities, the BTFP lending program — well, it hasn’t worked yet this morning:

- PacWest Bancorp’s stock tumbled 27%

- Western Alliance Bancorp’s shares slid 17%

- Charles Schwab’s shares lost 6.7%

- Bank of America’s stock fell 4.4%

- Citizens Financial Group’s stock declined 2.7%

- Wells Fargo’s stock slid 2.3%

$25BN? They think $25BN will stop this bank run???

"With approval of the Treasury Secretary, the Department of the Treasury will make available up to $25 billion from the Exchange Stabilization Fund as a backstop for the BTFP."

— zerohedge (@zerohedge) March 12, 2023

The current question on everyone’s mind is whether the measures taken by the Fed are sufficient in preventing further depositor panic at other regional banks.

Then there’s this: “There’s no doubt in my mind: There’s going to be more. How many more? I don’t know,” William Isaac, the former chairman of the Federal Deposit Insurance Corporation, told Politico on Sunday. “Seems to me to be a lot like the 1980s,” he added.

ETA until market realizes $25BN is nowhere near enough and futs react appropriately?

— zerohedge (@zerohedge) March 12, 2023

… and Cramer strikes again.

FRC is new focus… very good bank

— Jim Cramer (@jimcramer) March 10, 2023

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

A large stone is not broke with one blow of the hammer. The crash in late October and into November of 1929 started earlier in March of that year. The hammer blows fell again in May and then again in September and early October. If this is the start I suspect there will be several strikes before this stone shatters.

On 22 February 2008, HMG nationalised Northern Rock UK, a mortgage lender which a few years earlier had taken advantage of ‘deregulation’ to transform its status from building society to bank. Yes it was the ‘regulators’ wot done it – same today; asleep at the wheel. More than 100,000 investors – many of them pensioners – saw the value of their holdings completely wiped out when Northern Rock was nationalised following the first run on a British bank since 1866.

AND they said it was all under control – nothing to worry about but we now know it was just the start. Today, depositors will be bailed-out but creditors will be bailed-in and shareholders can go whistle. Meet the new boss, same as the old boss.

No worries,the brain dead potato(not fetterman!) will be addressing the bank issue at 9 a.m. so the markets can relax,every thing is fine.

Buy the rumor, sell the news.

Guess someone didn’t make bank today…Lol

Hint: Buy low then sell high…..

Some mood music while you wait.

Turn it up.

He’s a crazy fucker!

For years now the only thing ZH has been good for is reporting on credit markets/events.

That first graph clearly shows that a decision was made here. This was no accident.

DONT BELIEVE THE LIES!!! THE BANKING SYSTEM IS SAFE !!!

Solid as a rock.

I have some of these. Looks like they may be worth something against the US dollar pretty soon.

Joe Robinette Hoover

Just pointing out Ag up 5%! Wow!

Avg. price of a dozen eggs is up to $4.82 -St. Louis Fed.

$21.50/$4.82 = 4.4 Dozen eggs per ounce.

Carton of Eggs per ounce is crashing towards 1:1.

I wonder what the private equity guy (Thomas Lee) who killed himself in his NYC office two weeks ago knew?

Apparently he had info that would lead to Hillary’s arrest.

From Wiki Rumor…

“Lee was an avid art collector and a friend of Bill Clinton and Hillary Clinton. In June 2008, at the conclusion of Hillary’s unsuccessful presidential run, she and Bill were reported to have stayed at his East Hampton, New York, beach-front home for a few days for the period when she was out of the public eye”.

All we need now is Jim Cramer’s vote of confidence, followed by an announcement by Trump that he’d personally solve the banking crisis in 24 hours.

Kek. Top comment of the day.

That’s what the masks are for: to contain the banking contagion.

Plus the cloth masks help a lot with wet, stale fart gas.

I remember from the old westerns on TV that the bank robbers always wore masks over their lower face.

Buy the dip… but not yet.

Current Trading Halts

https://nasdaqtrader.com/trader.aspx?id=tradehalts

Most likely this will be a controlled demolition. Don’t be disappointed if we don’t see the big crash everyone is anticipating. The fed can inject trillions with no accountability. Dow +400 today is my prediction.

Ignorance is bliss with a cup of Folgers.

“The best part of waking up,

is learning Banks have Failed!”

flash,

is that you in the pic?

you look so distinguished —

Ahhh Mike Adams Today!! I want my non-Bailout, Bail-out Money!

I was wondering this morning. What if they say they had to bail out Non-bailout styles the banks because of misinformation spread by alt media and right wing terrorists?

This misinformation threatened our Banking System. See it is sooooo dangerous. We need to make an online ID for access to the internet. “These Domestic Terrorists almost brought our banking sector to its knees and is a National Security Threat…….” This was a Digital J6.

I would hate to be a bank that Cramer says is sound.

“Over the last 96 hours we have seen:

1) The 2nd & 3rd largest bank failures in US history.

2) 110+ banks halted by the NYSE

3) $620Billion in unrealized losses for banks

4) 100s of billions of customers funds in purgatory

5) At least 10 other banks of the edge of collapse”

Anybody have ‘Credit Suisse’ for tomorrow?