The “forgotten generation,” about 64 million Americans born between 1965 to 1980 and known as Generation X, are unprepared financially for retirement, according to a new study, warning about their “dismal retirement outlook.”

The National Institute on Retirement Security wrote in a report that Generation X was the first generation to enter the labor market following the shift from defined benefit pension plans to 401(k)-style defined contribution accounts.

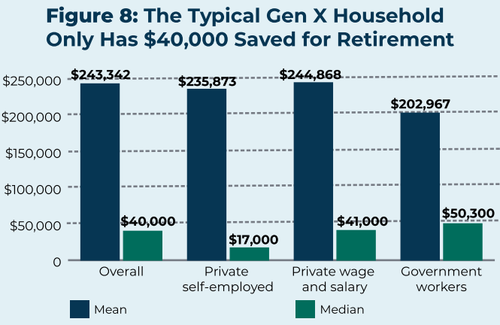

Author of the report and NIRS research director, Tyler Bond, wrote in a statement, “When looking at median retirement savings levels for Generation X, report finds that the bottom half of earners have only a few thousand dollars saved for retirement, and the typical household has only $40,000 in retirement savings.” Shockingly, the study found approximately 40% of the generation have saved not even a single cent towards retirement.

The report relies upon data from the Survey of Income and Program Participation. This nationally representative survey provides income, employment, household composition, and government program participation data. Here are more key findings from the report:

- Slightly more than half (55%) of Gen Xers are participating in an employer-sponsored retirement savings plan.

- Most Gen Xers, regardless of race, gender, marital status, or income, are failing to meet retirement savings targets.

“Most Gen-Xers don’t have a pension plan, they’ve lived through multiple economic crises, wages aren’t keeping up with inflation and costs are rising. The American Dream of retirement is going to be a nightmare for too many Gen-Xers,” NIRS Executive Director Dan Doonan told CBS News.

In June, we cited a separate study that called Generation X, the “Broke Generation,” after a whopping 64% of respondents said they quit saving for retirement not because they didn’t want to but couldn’t afford to.

As for millennials…

Is the American Dream dead? pic.twitter.com/fA8PTCwKos

— Chairman (@WSBChairman) July 16, 2023

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Inflation is taking huge bites from the value of the retirement plan I have right now.

We will all be dumpster divers and be happy!

Whiny ass pussy fucks. It’s not my fault I didn’t save for retirement. Wa wa wa. Piss cry and moan.

Based

Well cruel accountant I suppose your doing well supplying law firms and individuals with statements required by government and banks for a tidy sum GOOD FOR YOU !

You are aware that millions of middle and lower income have been irreparably damaged financially by the inflation and of course the job losses leaving only low paying service and retail jobs !

But Fuckem is your attitude, remember that when you become a victim of either criminal class !

That is the ones on the street and the government class all ready to Jack you up !

I wonder who will WAWAWA POOR ME THEN

A real cheapskate , the dude that vaporizes when it’s his turn to buy a round

I suspect that anyone who is hoping that the IRA, 401k, or 403b will get them through is in for it. these are simply sections of the tax code. The gov’t can change those laws any time they want. And they will, when it is time for stealing those funds.

They already have in other countries, and they certainly have done so to Social Security.

Gen X knew instinctively early on that social security was a ponzi scheme , even without knowing that term. By sheer numbers of Boomers vs. X’ers that was clear. Inflated currency will pay out to some of the last boomers , then it goes tits up. Open borders , replacement workers may fill in some gaps for a time but those illegals burden the system even if they do pay in to SS , and will take any ‘ benefits ‘ up front via food stamps, housing & free medical subsidy.

Absolutely. I have no 401K, and whatever SS funds are there I may not even claim. Haven’t hoped for these things since my 20’s. I’m happier this way and you’ll never hear a complaint about it from this X’er. Thank God the college loan trap only impacted me for a few years. The ongoing plan is just build up a business that I can sell, while spending as little as possible.

The whole economy is a ponzi scheme.

When the industry union scale jobs were raped and murdered by collusion among the “BIG CLUB” members “WALL STREET to K-STREET to CAPITAL STREET” shipping all the assembly and production of goods to cheap child and slave style abusive labor markets eradicating the tax base that destroyed the American Dream !

The pathetic parasitic feral cats in DC protected their own with debt and inflationary money practices as they scurry about covering each other’s shit .

Now here we are 50 years later exclaiming WTF happened , we were systematically FUCKED by a carefully organized criminal cartel masquerading as a government of , for and by the people .

Government workers should not be included in most instances because they are guaranteed a specified amount regardless of their contributions.

Incidentally do not attempt to blame the unions and the wage and benefit demands in contract negotiations for the problems of today !

If that was the cause and effect of today’s economic plunder POLICE , FIRE , SCHOOL TEACHERS and all other manor of government employees are undeserving of their wage and benefits !

Perhaps congressional retirement, benefits and salaries would be a good place to start cutting ,

$15 bucks an hour and only for 30 hours a week

Yeah give ’em a COLA compensation package:

consequences of looting America

“Now here we are 50 years later exclaiming WTF happened…”

Aug.3 will be 42 years since they killed PATCO. Just sayin…

Nixon & gold standard about 50 years ago

“Great Society” by a despicable, arrogant president from Texas.

Since graduating from college it’s been one non-stop recession/economic crisis never earning enough to live let alone saving for retirement.

At 48 my retirement plan is to work until I’m dead.

Poor baby you should go live in your mommy’s basement.

You, sir, are a complete douchebag.

A Douche bag mouthing of with nothing to back it up . Probably in his mommy’s basement now !

You’re not alone.

Endgame: US Federal Debt Interest Payments About To Hit $1 Trillion

There was a shocking number in today’s latest monthly US Budget Deficit report. No, it wasn’t that US government outlays unexpectedly soared 15% to $646 billion in June, up almost $100 billion from a year ago…

No, the one number that was truly shocking was found all the way on page 9, deep inside Table 3 of the latest Treasury Monthly Statement: the only highlighted below, and which shows that in the 9 months of the current fiscal year, the US has already accumulated a record $652 billion in gross debt interest…

Soaring interest rates, driven by the panicked Fed’s scramble to undo its epic policy failure of 2020 and 2021 when the Fed kept rates at zero for far too long while injecting trillions into various asset bubbles, have been the key driver of the deficit, with the Federal Reserve boosting its benchmark rate by 5% since it began hiking in March last year. Five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt: that’s right – even when the Fed starts cutting rates, due to the delay of rolling over maturing debt, actual interest payments will keep rising for the foreseeable future.

For context, the weighted average interest for total outstanding debt at the end of June was only 2.76%, a level that’s not been surpassed since January 2012, according to the Treasury. That’s up from 1.80% a year before, the department’s data show, and if the Fed indeed keeps rates “higher for longer”, the blended rate on the debt will surpass 4% in one year.

That would be a complete disaster for the US, and it would mean that interest payments on total US debt of $32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

But we don’t even have to wait that long until the exploding interest on US government debt becomes a major talking point ahead of the coming presidential elections. According to the St Louis Fed’s FRED and the BEA, the interest payments by the Federal Government have now surpassed $900 billion for the first time ever, and within a quarter will hit probably rise above $1 trillion, a historic benchmark that will probably begin the countdown to the US Minsky Moment.

See the key to happiness in retirement is to give the Jews control of your assets in a 401 k.

No, it’s the Chinese. Really.

The easiest path to financial destitution is divorce for a man especially having kids later in life coupled to the divorce. I’ve wasted a lot of money and gotten burned by the real estate market as have many. I managed to save through 401K for the last 15 years and am well above the mean and only a couple a handful of years older than Gen X.

Another is using credit to buy crap that depreciates. Haven’t bought a new car in 23 years except for one that I used for work and was reimbursed almost 100% of the expense. Get the jew bankers out of your life and live below your means is all I can say. Every time I see someone driving a brand new SUV or truck and anything for that matter, I wonder how they can afford spending $1K per month on a vehicle.

No cunts no kids no giving a fuck is my motto.

I agree I have never bought a new car ever and never will.

Not to mention the cost of insuring and licensing it.

This Gen X is doing just fine and will retire early comfortably. We don’t drive new cars, have latest technology, go on multiple annual vacations or a live in a McMansion. Instead, we live in a paid for house, our newest vehicle is 8 years old, and we aren’t living in debt up to our eyeballs.

I was raised by my depression-era grandparents and knew early on not to trust anyone to have my best interest in mind. When I landed my 1st real job after college, I paid off my own loans, I started saving in a 401k. 20-something years later the pittance I set aside in that account has grown enough to set me free very soon.

We’ve also been able to put 2 kids through college on a combination of merit scholarship and saving a few $ every week. My kids will not start in the debt hole I had to dig out of.

Living a happy life is about having goals, priorities, and not counting on someone else for your happiness.

I have coworkers in the same job title who never have a car more than 4 years old, constantly upgrade/remodel their home financed by more debt or a new mortgage, send their kids off to college 100% on student loans, and then say they will never afford to retire.

Your coworkers are telling the truth, however they fail to understand that it is their choices that caused the path they are on with their finances.

Very well said. It’s all about the choices we make. Wife and I both retired at least 10 years early and we never made big money. We just made good choices. I would have retired 20 years early had I made a few better choices.

Lived below our income potential, bought a modest home , invested frugally paid to educate our children and last year made a choice put a new comfy trailer on our lot in a seasonal beach community or give up the lot and put a new deck and windows for the home . The trailer won and are there regularly enjoying it with our family & friends . Life is what we do while making other plans . Our adult children all have Gate passes and keys because like we did they are now WORKING THEIR ASSES OFF for their future but they have that free beach get away so they can invest wisely and still kick back when possible ! All they needed to do was work hard in school their mom & I paid all the bills for them and they thank us now in ways money cannot measure .

Honor & Integrity by doing the correct thing even when nobodies looking !

Something in short supply especially in Government

“…the typical household has only $40,000 in retirement savings.”

THEIR RETIREMENT SAVINGS IS IN THEIR HOMES.

A house is neither retirement savings or an investment.

Unless it’s investment property.

There’s a lag time to everything.

Hyperinflation is still going to come at some point in time.

In the meantime, enjoy recession or depression with a second plandemic thrown in the middle for good measure. Government will borrow/“print” in response. As more of the world de-dollarizes, it’s the govt spending that hasn’t happened yet that will trigger the hyperinflationary collapse needed for the new system. Digital ID and global health passports etc, etc will be rolled out piecemeal along the way.

You will own nothing and eat ze bugs.

Anal mouse blames his problems on other people.

I don’t worry about it I’m just gonna eat long pig and take the assets of accountants.

When you go to use the “BANK CARD” and the screen at the Drive Thru just displays this 🖕 You will know that it’s on and why regardless of what any woke POS or government pathetic parasites babble on about its time to exercise your second amendment !

Obviously the use of your first amendment as already been shot full of holes . Invest in usable hard goods now while you can because the BIG THEY already proved they do not give a fuck about you AT ALL

Thank goodness they stocked up on all those un-opened star war figures.

One of my favorite commercials, ever. It’s a truth bomb. “Somebody help me”

Oh look anal mouse is famous!

It was called a dream…cause you had to be asleep to believe it.

One thing that is coming, but rarely mentioned, is the retirement plans for the feminist and modern whamen group. These women have literally f-k’d around through their twenties and thirties, and now simply cannot bond with men. They will be desperate to marry, but will not find anyone who wants them, and will be destined to live their old age alone. They also have no retirement, and many have no careers. They have spent their money on make-up, shoes, clothing, and stuff for themselves. Their jobs are dead-end, they have neither husband nor children to help them, and their gonna end up eating out of the same dish as their cats.

10-20 years from now, we’ll have Frontline TV specials about the massive number of homeless women on the streets. And if you look closely at these ladies, you’ll see tatoos, piercing scars, and onlyfans accounts in their past.

Agree

A lot of stupid ex-wives thought mugging their husband and becoming playgirls would work out for them wound up blowing everything they had and moving in with their daughter later.

Yeah.

Back then. ‘OK, Gen-X, you’ve finished college – but we’re hiring incompetent people from China and India instead of you for those entry level jobs you’re qualified for.’

Years later. ‘You have no experience in your field, so we’ll just hire more third world incompetents.’

Now. ‘Why didn’t you save more money for retirement from those jobs we refused to hire you for?’

Well, I hope your Haitian rest-home nurses torture you to death for fun.

If you are a White male, they hired blacks and women instead of you.

Prior to the year 1900 only royalty was fat. There where no 401ks or pensions. You relied on family when you got old or you starved to death.

Now just about everyone is fat. Especially the Free Shit Army. Everyone believes they deserve a luxurious retirement better than kings.

Even the poorest of poor now live better than royalty back then.

Americans are so rich even their poor people are fat.

I am not in the top 10 % by the way. I live a stress free and debt life in a house that cost less than the median. I drive a 17 year old car. When I have drinks i invite my buds over with the drinks I provide.

Bars are stupid and over priced I try to avoid them. I should know I paid for college as a bartender.

Well said. Many of us have done the same, and we are living a good spiritual debt free life.

Nobody gives a shit.

I’m GenX and so are all my close friends. We’ve been the quiet achievers in this world, working hard all our lives to pay for the excesses of the generations on either side. We have invested in real estate and cash-flow generating businesses and have always been self reliant. Most of us are going well financially, have never expected to get anything but bills from government and have always been prepared for the inevitable regular downturns. So bring it on. We are not victims, we are prepared.

City slickers always made a lot more money than me, and they ridicule us rednecks and hard work; but they are the dumb ones because they don’t appreciate the benefits of hard Rural work and the compound “interest” of animal reproduction (and profligate liberal government inflation). A White Christian man is in a constantly battle with the Leftist Governments, Society and Feminism (Divorce esp) and he will take constant beat downs, but he has above average intelligence, abilities and willpower: the Bible says we never see a Righteous Man begging because Cream Rises to the Top.